BTC was very weak over the past weekend, with the lowest point reaching $67,450 late last night, a new low in nearly 7 days. In addition to the failure of the financial reports of the seven tech giants last week to gain investor support, the market may also have been a major factor in the decline, with investors choosing to exit the market before the election to avoid potential volatility.

However, after a brief dip, BTC has seen a relatively strong rebound, reaching a high of $69,350 this (4th) morning, up 2.7% in 6 hours. As of the time of writing, it has fallen back to $68,637. What major events this week might affect the currency price? Let's take a quick look.

US Presidential Election

The US presidential election will officially arrive on November 5th local time, with the earliest polling stations closing in Indiana and parts of Kentucky at 7am Taiwan time on November 6th, and the latest in Alaska at 2pm Taiwan time on the 6th.

Overall, if a new US president can be elected with a decisive margin on the same day, that would likely be the best bullish news for the stock market.

However, if the race in the swing states remains deadlocked, the loser questions the results and triggers a lengthy legal process, or if Trump declares victory prematurely and sparks unrest, that could put pressure on global risk investment markets and cryptocurrencies, so investors should be cautious.

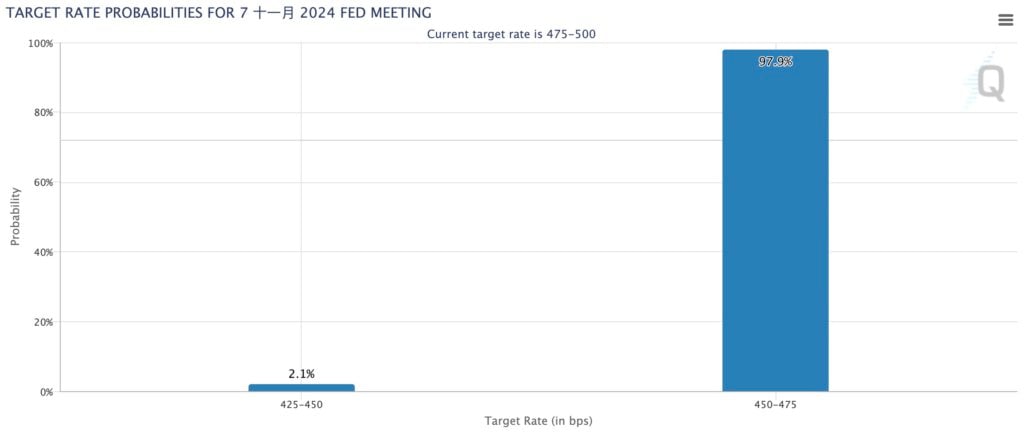

The probability of a 1-point rate cut by the Fed has reached 98%

Another important news next week is that the Federal Reserve will hold its November interest rate decision meeting, which is expected to be announced at dawn on the 8th Taiwan time, which could also bring major volatility to global markets.

According to the CME Group's Fed Watch tool, the market currently believes the probability of a 1-point rate cut this month is 97.9%, and the probability of a 2-point rate cut is 2.1%, with no one believing the Fed will keep rates unchanged.

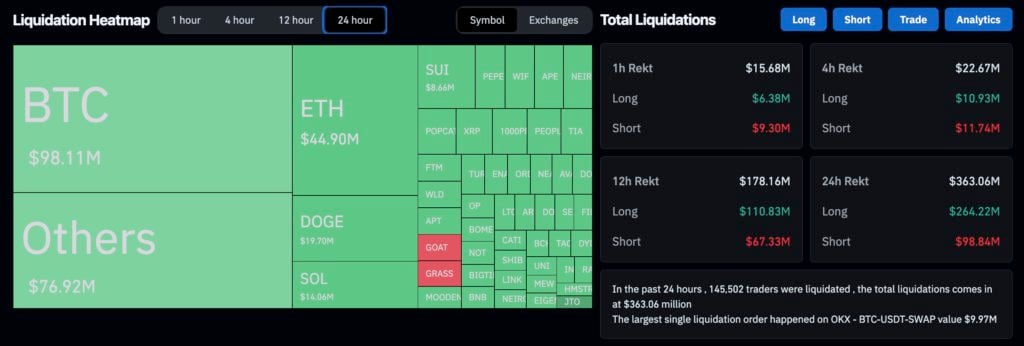

Over the past 24 hours, the entire network has been liquidated for $363 million

In the volatile BTC market, according to data from Coinglass, over the past 24 hours, the total amount of cryptocurrency liquidations across the network exceeded $363 million (long positions accounted for $260 million), with over 145,000 people being liquidated.