Author:Zaddycoin

Compiled by: TechFlow

Please do your own research, this is just a personal opinion and does not constitute financial advice.

If, according to market rules, Trump is reported by @AP, @Foxnews and @NBCNews to have lost the election, I predict that the US presidential election market on @Polymarket will experience two "disputes", and retail traders may suffer losses by chasing the possibility of the market result being reversed.

In other words, if the market determines that Trump lost, the market may experience two disputes, and retail traders may go all-in, hoping that the market will overturn the disputed result. Please refer tohere.

But remember, you're not Tom Brady... If Trump loses, those who believe in TRUMPYES may not give up easily, and may even be more tenacious than the supporters of HARRISYES. However, rules are rules, and @Polymarket reminds everyone of the consequences if this happens.

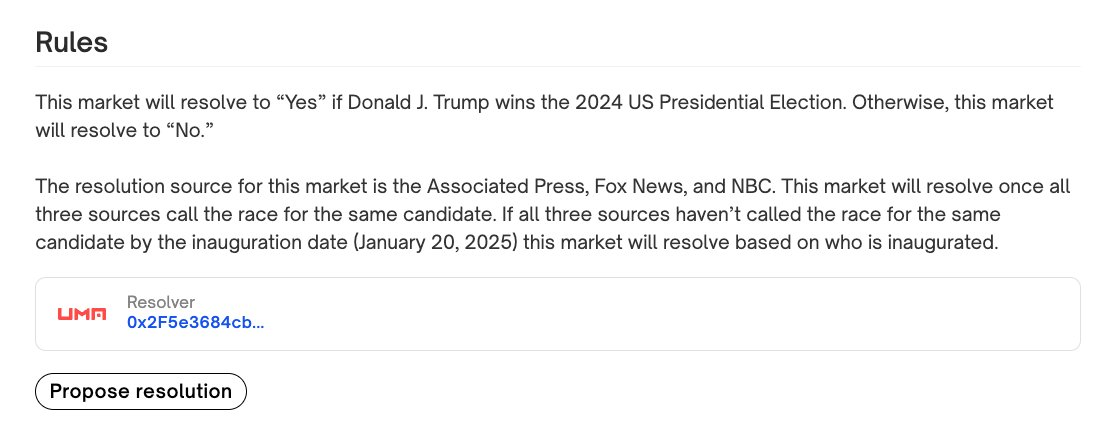

Market Rules

Polymarket 2024 Presidential Election Winner

Let me explain.

Dispute Mechanism

Anyone can dispute the market within about a day after the market resolution by staking $750 on the @UMAprotocol. This is a small amount for the platform's liquidity. Traders can dispute the market twice before it is fully resolved.

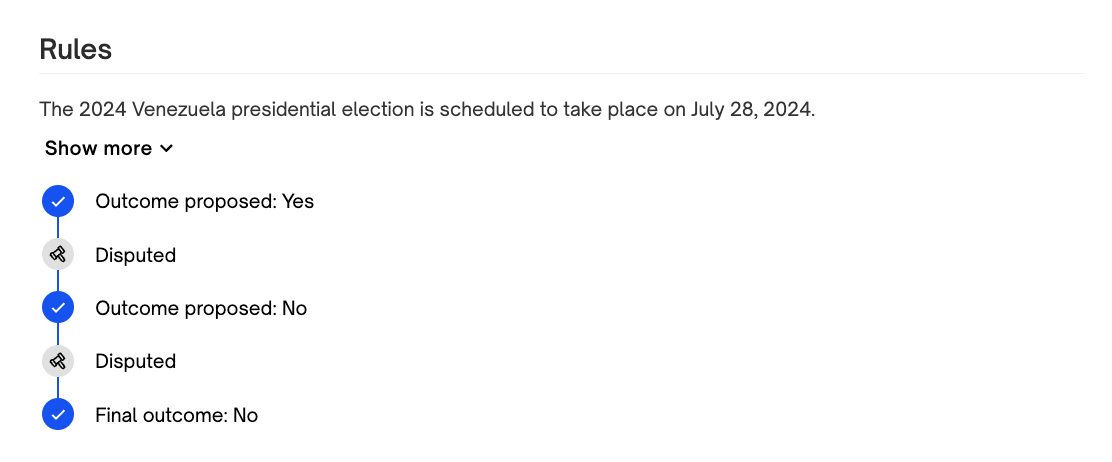

This is an example of a reversed double dispute. (These examples show what a disputed market looks like).

Due to the rule requiring all these news agencies to confirm, and based on the precedents of past disputed markets on Polymarket, I expect the market to enter a double dispute stage, and the $UMA token holders (UMA voters) will ultimately determine the result as "Trump lost".

Potential Arbitrage Opportunities

During this period, I predict some arbitrage opportunities will arise, targeting those investors who want to try to reverse the market outcome and get a 100x return (betting 1% on TRUMPYES, hoping to profit 100x if the market reverses). During the dispute period, the market will initially price TRUMPYES at 1% and TRUMPNO at 99%, and as more people try to put money in to get the 100x gain, the market volatility may increase (creating arbitrage opportunities).

Honestly, these are like slot machines in the prediction market.

Some may say "there's a 100x chance, I'll put in a little", while others may confidently put in large amounts. Sigh...

I won't go for that 100x chance, but will put my money on the 99% possibility, because after the dispute period, the market should judge it as "Trump lost".

Note: The arbitrage opportunities may be small, as the "100x bettors" cannot single-handedly drive the market change.

In the RFK market, the market fell to 96% YES after resolution on Friday. During the dispute period, those savvy investors (OGs) who understand Polymarket's stance on disputes can utilize the market rules to get a 6% free arbitrage gain.

How to Gauge the Timing?

If @AP, @Foxnews and @NBCNews announce that Trump has lost the election, my prediction may come true.

Imagine if @FoxNews, out of support for Trump, does not announce the winner. That would be very interesting.

I'm not sure if there has been a precedent for this before, but if it does happen, it would be fascinating.

I sympathize with @Polymarket, because if any of these hypothetical outcomes come to pass, it could lead to a very complex situation involving a large amount of funds. Again, these are just some thought-provoking hypothetical ideas based on a combination of various variables, so please consider them as such. At the same time, I'd also like to hear the thoughts of @Domahhhh, @hosseeb and others.

Let the game begin.