Author: 0Alice0

This is not the last time Ethereum will face attacks.

Compared to the clamor surrounding Solana, Ethereum's autumn has been rather unsightly: poor Layer2 performance, lack of innovation in the ecosystem, and a sluggish price trend.

Even the discussion about Vitalik's love life has become a hot topic in the Chinese crypto community:

"Did V God dump the foundation's coins to support his girlfriend?"

For a long time, Ethereum has been the innovation center of the blockchain industry, with developers gathering the latest creative ideas on this chain and presenting them to users, and Ethereum's strong community foundation has also given these projects a chance to emerge - the rise of DeFi, the explosion of Non-Fungible Tokens, and the social practice of DAOs, all of which have proven this point.

However, almost all the hotspots of the current bull market are no longer on Ethereum, but have shifted to the Bitcoin ecosystem and new ecosystems like Solana and Sui.

Plagued by internal and external troubles, Ethereum has also entered its own midfield battle.

The "mother" drained by Layer2s

It is no exaggeration to say that the Layer2 strategy has brought a golden age of peace to Ethereum - Layer2s are responsible for solving the technical and market share expansion issues, replacing the mother chain to deal with the "Ethereum killers" that keep appearing; Ethereum itself, through the technology and influence accumulated over the years, provides various forms of assistance to the exploration of different directions of Layer2.

The emergence of projects like Arbitrum and Optimism has successfully solved the long-standing problem of high gas fees on the mother chain, providing a lower-cost and more efficient transaction experience, and also blocking the steps of public chains like Avalanche and Near from invading the Ethereum ecosystem.

However, the fate of more Layer2s is obscure - the Layer2s recorded by L2beat have reached 112 so far, and the names of most public chains are not well known, nor are they like the early Layer2s that placed the DA (data availability) layer on Ethereum, with almost zero TVL and interaction volume.

In the cruel Layer2 war, the winner-takes-all has become the only truth.

The Layer2 TVLs at the bottom are almost 0

The definition of Layer2 is also becoming increasingly blurred.

Although the Ethereum Foundation and Vitalik himself have provided "guiding opinions" on the definition of Layer2 through Twitter and blogs, they still cannot prevent this concept from being abused.

New public chain projects are launching under the banner of "Layer2", using Ethereum's momentum to attract investors and users, without the need to redesign their technical features or architectural design, just pressing a one-click button to launch a chain, coupled with a beautiful PPT and grand project expectations, they can find a group of crazy investors.

Vitalik himself has also written in his blog about his dilemma: "...some currently independent Layer1 projects are seeking to get closer to the Ethereum ecosystem and may become Layer2. These projects are likely to want a gradual transition - an immediate full transition would lead to a drop in availability, as the technology is not yet ready to put everything on Rollups. While a future one-time transition could sacrifice momentum and come too late to be meaningful..."

But at least at the time of writing this text, Vitalik still appears to be very optimistic about the prospects of Ethereum's Layer2 system: the EVM Rollup ecosystem represented by Arbitrum, Optimism and Taiko is developing rapidly; Polygon is also building its own Rollup; independent Layer1s like Celo are starting to turn to Ethereum; and there are new attempts like Linea, Zeth, and Starknet.

At least at this time, to say "all heroes are in my net" is not an exaggeration for Vitalik.

However, the development of events has not gone as expected.

The overvalued Layer2 tokens plunged on the first day of listing on the exchange, with the VCs and airdrop hunters who profited quickly dumping their holdings - and of course, the so-called "rat race".

At the same time, the prosperity of the various Layer2 ecosystems is far from enough to support the expectations of the market, with developers wandering among various hackathons but not actually building complete projects on the sponsored public chains, following the strategy of "shearing and leaving".

The TVLs that came at the sound of the wind also scattered after the airdrop distribution: the airdrop rewards that far exceeded the traditional Defi yields made the whales "flee from one dark forest to another".

The old-school ecosystem projects are also "harboring ulterior motives": just last month, Uniswap, the most classic DEX project in the Ethereum ecosystem, announced the launch of UniChain, which is being built based on the Op Stack.

And like all the OP chains that have joined the Superchain (Base, Zora, etc.), UniChain will contribute 2.5% of the chain's profits or 15% of the chain's revenue (whichever is higher) back to the Optimism collective. The situation of "knowing OP but not knowing ETH" is unfolding - although the "parent-child relationship" between Optimism and Ethereum remains unbreakable, the emergence of the modular narrative still leaves the possibility of division within the Ethereum ecosystem.

Ethereum's internal troubles are also manifesting: the Foundation's "non-intervention" and over-emphasis on the pressure from competitors have led them to take a more "sink or swim" attitude towards the development of projects in the ecosystem - the old projects occupy the high ground, and developers can only seek alternative chains for survival. Meanwhile, the Layer2 foundations are using their deep pockets to exert financial tactics on the developers, providing various services from incubation to promotion, and ultimately becoming the de facto new Layer1 in the growth process.

The market's attitude towards Layer2 has gradually shifted from excitement to fatigue, with the new meme coins listed on Binance seeing their prices plummet, while Ethereum itself is teetering from constant blood-letting.

"Why buy meme on ETH"

The market's earliest impression of Solana came from SBF's classic line "go sell all your Sol to me" - after the FTX collapse, this high-performance public chain had once fallen into an abyss of no return.

But the early accumulation has given Solana the capital to rise again. The successful implementation of the Hacker House Series, the early introduction of USDT/C that was already in place during the SBF era, the early influence of projects like STEPN, and the Foundation's strong support for ecosystem projects have helped Solana weather the most difficult times and ultimately see an explosion in its ecosystem.

The development of Ethereum's ecosystem is more like a planned economy: the Ethereum Foundation and Vitalik first propose the direction, and then the various Layer2s respond, with the developers ultimately following. But this strategy also means giving up the possibility of another direction - no one wants to lose the so-called orthodoxy, so no one wants to take the lead in falling behind.

Solana does not have the burden of orthodoxy.

Unlike the idealistic developer environment of the Ethereum and Bitcoin ecosystems, Solana's atmosphere is more akin to the "backstabbing" of the BSC chain - the Degen culture that Western players can more easily understand has been present in this public chain from the beginning, with less harmony and more PVP. Users also find that they don't have to pay dozens of dollars in gas fees and then sit and wait for the chain congestion to clear, with transactions completed in just a few seconds.

The instant and smooth feedback brought by high TPS, as well as the complete infrastructure, have made the thrill of "on-chain gambling" stronger than ever, with the emergence of meme coins like PEPE and BOME creating a wealth effect while also siphoning users from other ecosystems.

And then Pump.fun was born.

Pump.fun, which has solved the "last mile" of meme coins, has completely plunged the market into frenzy - the traditional crypto narrative requires painstaking search, a year of brewing, and half a year of explosion, finally reaching its peak in the reports of outsiders. But in Pump.fun, from famous singers to billionaires to nobodies, anyone can create their own narrative at any time, with expectation, rise, shilling, and dumping becoming the only four things to worry about.

The Ethereum ecosystem also has its own casino in this round - the odds on Polymarket about the US election have once become an important indicator for judging the final winner. But compared to the simple and brutal on-chain slot machine of Pump.fun, the feedback experience of betting is still a bit cumbersome, and also loses more excitement for the bettors.

Slot machines can be found not only in Macau or Las Vegas, but on any touchscreen you can access, and the rewards are higher than any machine you've ever encountered - this is the most intuitive experience brought by Pump.fun, after all, most of the players in the crypto world are still harboring the dream of getting rich overnight.

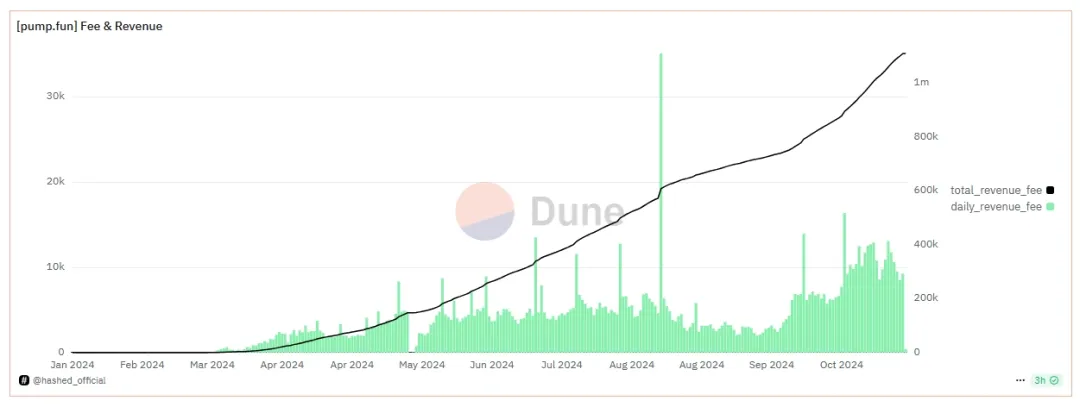

The other side of the coin is madness. As of the editorial deadline, the number of token projects deployed on Pump.fun has approached 2.95 million, and the total revenue of the projects has exceeded 1.1 million SOL (about $160 million), with an average daily revenue of 10,000 SOL.

Pump.fun's total revenue and daily average revenue are both growing continuously.

Small circles and inertia

The convention of "To Vitalik" startups has a long history - due to the non-profit nature of the Ethereum Foundation and Vitalik's own influence, seeking Vitalik's support and "clinging to his leg" to get better investment and attention for their projects has been the only thing some entrepreneurs have had to worry about for a long time.

And the early financial success has also gradually distanced Vitalik from the community, which he sees as having a strong copper smell, and he has built a small group based on his own ideas. With a call and response, Vitalik's barriers to the outside world have become increasingly serious: he refused a request for a photo in Montenegro with "No Chinese", discussed cognitive sovereignty and irrationality with members, and was worried that his photos would be used for hype, but he never hesitated to cheer on the members of the small group - whether the project parties were sincere or just flattering him.

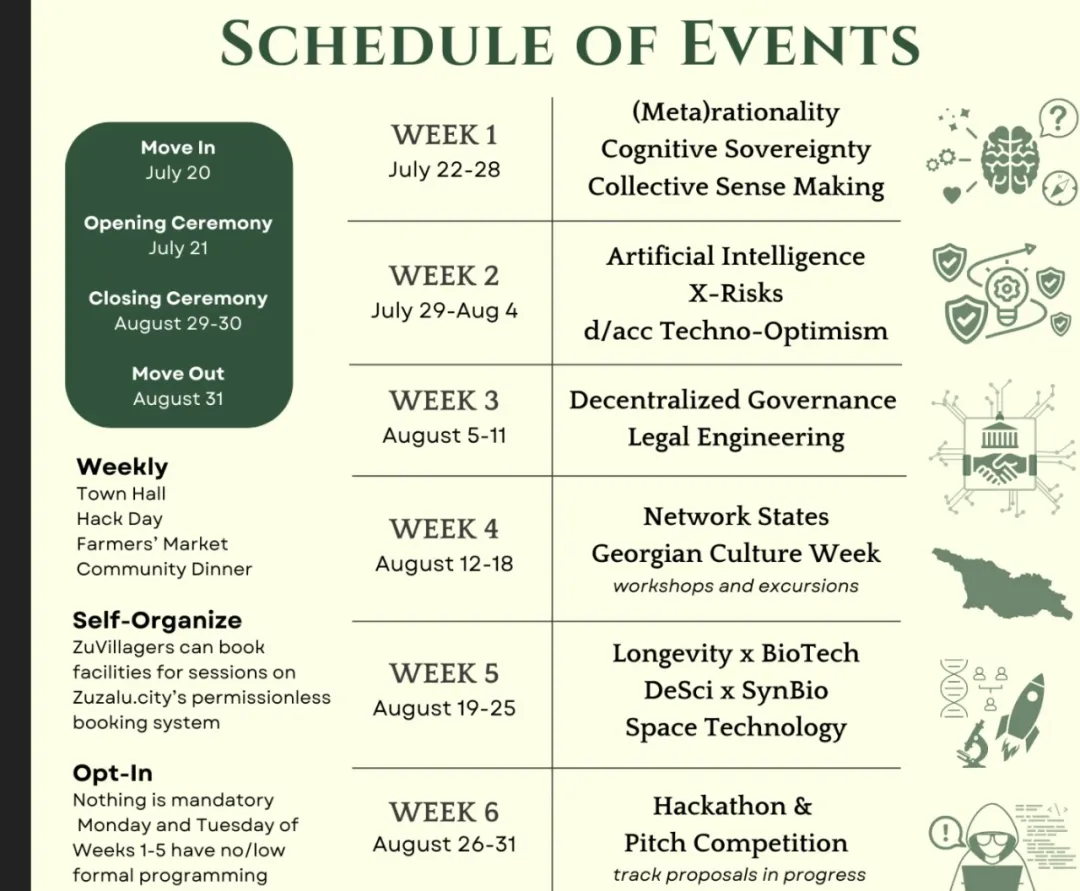

List of topics discussed at zuzalu.

The researchers at the Ethereum Foundation, on the other hand, are living a different life, with the technicians quietly driving technological innovation, but what they can get is far less than what they have obtained, which is why projects like Eigenlayer can take advantage of the situation - the researchers exchange their almost costless endorsement for the project's Tokens, forming another kind of interest collusion.

But objectively speaking, Vitalik and the Ethereum Foundation have never taken the responsibility of making the ecosystem profitable on themselves: the former has always played the role of pushing technology and research, while the specific commercialization has been the responsibility of companies closely related to the Ethereum ecosystem, such as Wanxiang and ConsenSys, in the previous cycles. But the huge commercial success has also made these companies lose interest in further commercializing the Ethereum ecosystem, and they have turned to seek other more profitable tracks.

And the crypto VCs that have sprung up like mushrooms after the rain have not played a role sufficient to take on the burden of commercialization.

The most convincing example is the priority list on the official website when applying for Grants: financial, NFT and pre-coin projects are "valuable, but not eligible for funding" - this inertia has continued from the day Ethereum was established to the present, ensuring the Ethereum Foundation's absolute neutrality in financial investment.

But the Ethereum Foundation cannot stop individual likes and dislikes.

Epilogue

Navar tweeted this text: "Most crypto projects will fail because the founding team gets rich too early, and this problem cannot be solved by hiring new talent."

Will Ethereum ultimately fail? Or are all the problems mentioned above just the growing pains, and a slight adjustment can put it back on track? We don't know yet.

But this is not the first time nor the last time Ethereum has faced criticism - this experiment born in 2015 has gone through 9 long years, experienced big and small storms, and has also received countless praises and criticisms, whether love or hate, it is an indispensable part of blockchain history.

But after the fierce competition period, Ethereum is finally facing the inevitable problem of middle age.

Without the exciting market share battles, the blood-boiling ICO and atmosphere, the long-term ecosystem building looks more boring and flat, but this is also what Ethereum must do to survive.