Introduction

Immutable, an Ethereum gaming company, recently disclosed that the U.S. Securities and Exchange Commission (SEC) has issued a Wells notice to the company, indicating that the company may face legal action. Immutable, through its spokesperson, stated that the SEC is focusing on the compliance of the IMX token sale, and this regulatory action is similar to the regulatory scrutiny faced by other cryptocurrency companies. The Immutable spokesperson emphasized that the SEC has misunderstood the nature and use of IMX, claiming that IMX is not a security and that the SEC's regulatory actions are "ultra vires." This event reveals new risks facing the compliance challenges of crypto gaming companies, marking the SEC's extension of its regulatory reach into the emerging crypto gaming sector.

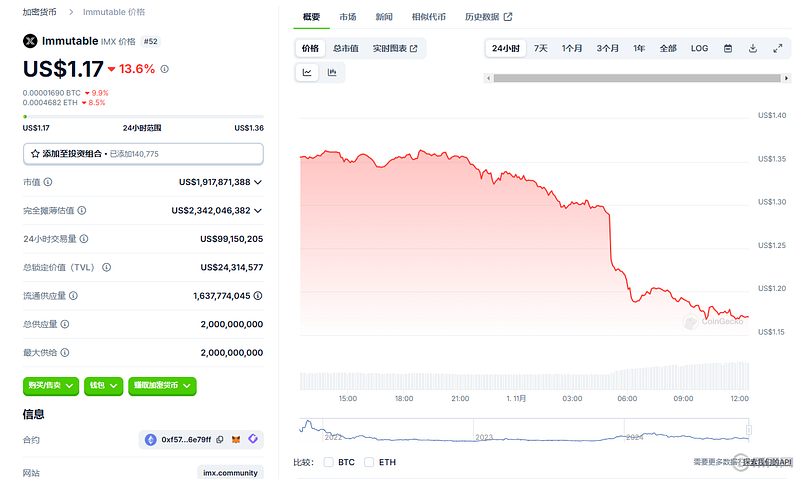

IMX token latest price performance

SEC's Wells Notice: Crypto Gaming Companies Become New Targets

Immutable revealed that the SEC issued a Wells notice to the company last month, threatening enforcement action, and sent letters to Immutable's CEO, James Ferguson, and its partner, the Digital Worlds Foundation. This notice questioned the compliance of the IMX token sale, specifically targeting the 2021 token offering. In 2021, Immutable successfully raised $12.5 million through the CoinList platform, which allowed investors to purchase IMX before it was listed on official exchanges. However, the SEC claims that Immutable may have violated securities laws in this token sale process, alleging that the company made false statements to the public and provided unfulfilled promises.

Immutable has objected to the SEC's allegations, emphasizing that the purpose of the IMX token is clearly defined within the game and platform ecosystem, and it does not possess the attributes of a security. Immutable's spokesperson pointed out that the SEC's notice did not clearly specify the basis for the allegations, only citing statutory provisions, making it difficult for Immutable to understand the SEC's exact demands. The spokesperson further stated that the design and use of the IMX token are fully consistent with the characteristics of cryptocurrencies and blockchain technology, and it differs significantly from traditional securities. Immutable believes that the SEC's approach of treating the entire cryptocurrency field as the securities market is biased, and it has requested the SEC to make a more reasonable determination on the classification of the IMX token.

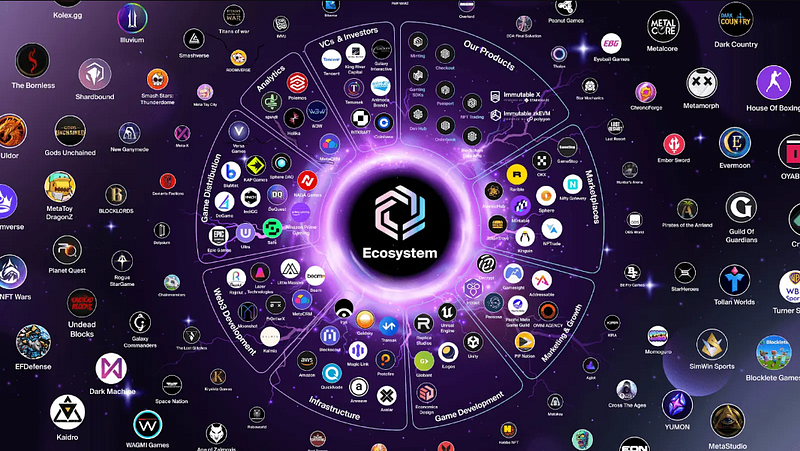

The Utility of IMX Token and the Expansion of the ImmutableX Platform

The IMX token is an essential component of the Immutable ecosystem. According to the Immutable website, IMX can be used for specific transactions on the company's Ethereum scaling network, including the ImmutableX and Immutable zkEVM platforms. Additionally, IMX tokens can be used for staking and platform governance, allowing holders to participate in various proposals provided by Immutable, such as funding and rewarding game developers. As an ERC-20 standard Ethereum token, IMX supports decentralized trading, staking, and incentive mechanisms on the Immutable platform, making it widely applicable both within and outside the ecosystem.

Immutable hosts several well-known crypto games on its platform, including Gods Unchained and Guild of Guardians, and has established partnerships with major gaming companies and brands to drive the mainstream adoption of blockchain technology. For example, Immutable previously collaborated with the retailer GameStop to provide support for its blockchain games, although GameStop closed its Non-Fungible Token (NFT) market in early 2023. Immutable has also partnered with the globally renowned game developer Ubisoft to develop blockchain games, demonstrating its deep involvement in the crypto gaming market. As the market capitalization of IMX continues to grow, the token has become one of the highest-valued gaming tokens on CoinGecko, with a current total value of approximately $2.1 billion.

SEC's Expanding Regulation of the Cryptocurrency Market and Its Impact

The SEC's latest actions indicate that its regulatory scope has extended to the crypto gaming sector. Since the collapse of the FTX exchange in 2022, which garnered widespread attention, the SEC has intensified its scrutiny of cryptocurrency trading and issuance, gradually expanding its enforcement efforts. Last year, the SEC issued Wells notices to major cryptocurrency exchanges such as Coinbase and Binance. This year, trading platforms like Robinhood, Non-Fungible Token (NFT) marketplaces like OpenSea, and decentralized exchanges like Uniswap have also received similar notices. The SEC's series of actions reflects its attempt to protect investors through stricter regulation and mitigate potential risks in the crypto market. However, Immutable's spokesperson suggested that the SEC's notice to Immutable may be related to the upcoming U.S. presidential election, indicating that the SEC may be rushing to demonstrate its regulatory achievements before the election.

Immutable pointed out that the SEC's notice was brief and did not provide detailed explanations of the alleged violations, making it difficult for the company to clearly address this potential legal challenge. Immutable stated that the SEC had indicated it would issue the Wells notice within a week of their initial interaction, suggesting the SEC's intention to expedite this enforcement action. Immutable also noted that the current regulatory framework's blanket treatment of cryptocurrency companies as securities issuers is unreasonable, especially for crypto assets like IMX with clear utility.

Immutable's Response Strategy and Financial Strength

Immutable stated that the company is prepared to face the potential litigation and has sufficient financial resources to support its defense. Immutable's spokesperson revealed that the company has raised over $300 million in equity financing and has the backing of top cryptocurrency investment firms, including Coinbase Ventures and Animoca Brands. Immutable currently has ample financial reserves, with "nine-figure" cash and equivalents, enabling it to withstand a prolonged legal battle. Immutable emphasized that the design and application of IMX strictly adhere to the decentralized principles and technological attributes of cryptocurrencies, and the company will actively engage in dialogue with the SEC to protect the company's interests and the legitimate rights of token holders.

Potential Regulatory Risks Facing the IMX Token

Whether the sale of the IMX token complies with securities regulations and whether Immutable needs to comply with the securities regulatory framework are the core issues of the dispute. The SEC's previous enforcement focus on cryptocurrency companies has been on reviewing whether there are unregistered securities offerings. Immutable stated that the issuance of the IMX token does not constitute a securities offering because the token's primary use is for platform transactions, staking, and governance, and it does not possess the traditional rights of securities. The allegations in the SEC's notice include Immutable's false statements about the token's support, particularly the pre-listing investment arrangements, but Immutable believes these allegations lack evidence and that the notice lacks specific details.

Immutable's spokesperson emphasized that the launch of IMX was carefully designed and considered, with the token's functions within the ecosystem being clear and distinct from traditional securities. Immutable believes that the SEC's regulatory classification of IMX may be misguided and that it has not fully recognized the innovation and uniqueness of IMX in decentralized application scenarios. Immutable's response demonstrates the company's confidence in the compliance of the IMX token and its desire to publicly discuss the token's true purpose and design logic.

Conclusion

The legal dispute between Immutable and the SEC reflects the regulatory challenges in the cryptocurrency field and introduces uncertainty to the future development of the crypto gaming market. The application positioning of the IMX token differs from the definition of traditional securities, and Immutable believes that IMX should not be treated as a security, questioning the SEC's regulatory approach to emerging crypto assets. The SEC's actions indicate that the crypto gaming market will be subject to increasingly strict regulatory scrutiny, and the challenges faced by Immutable will be shared by the entire crypto industry.

As regulatory authorities gradually clarify the regulatory framework for crypto assets, the development space of and similar decentralized tokens in the US market may be further affected. Immutable's response attitude indicates that the company hopes to find a balance between compliance and innovation, bringing more value to token holders and platform users. This event not only concerns Immutable's future, but also provides important experience and inspiration for the entire cryptocurrency industry. Whether Immutable can successfully respond to the SEC's allegations will have far-reaching significance for other cryptocurrency gaming companies to address regulatory challenges.