The US presidential election is scheduled to take place on the 5th local time, and the Democratic candidate, current Vice President Kamala Harris, and the Republican candidate, former President Trump, are in a deadlock in the main polls in 7 swing states.

According to the pro-Democratic and Siena College, which were released yesterday (3rd), the presidential election polls in 7 swing states. The results show that Harris has a slight lead in Nevada (49% vs. 46%), North Carolina (48% vs. 46%), Wisconsin (49% vs. 47%) and Georgia (48% vs. 47%).

In Michigan and Pennsylvania, the two are evenly supported; while Trump is leading in Arizona by 49% to 45%. This result shows that Harris has a slight advantage.

Extended reading: The presidential election race between Trump and Harris is at a deadlock》Polymarket whale bets $5 million on Kamala Harris, Trump's lead is less than 10%

Stock market forecast predicts Kamala Harris will win

Against the backdrop of such a deadlock between the two sides, according to , the S&P 500 index may provide a clue as to who will be the next US president. According to the report, according to data from independent brokerage LPL Financial, in the past 24 (1928-2020) US presidential elections, the S&P 500 index accurately predicted 20 times, with an accuracy rate of 83.3%

On this, LPL Financial's Chief Technical Strategist Adam Turnquis also gave an explanation for the S&P 500 index forecast:

The S&P 500 index can effectively predict the outcome of the US presidential election. The index tracks the stock performance of the largest listed companies in the US, and past data shows that if the index rises in the three months before the election, the candidate of the incumbent party usually wins; if the index falls, the incumbent party usually loses power.

Based on the current data, the S&P 500 index has shown an upward trend compared to 3 months ago, and if the S&P 500 index does not show a sharp downward trend today, according to the past indicator forecast, Kamala Harris is very likely to win the election.

Wall Street analysts: This time is different

However, many Wall Street practitioners are skeptical of the predictive power of the S&P 500 index, with Monica Guerra, head of US policy at Morgan Stanley, telling Politico:

The stock market is not a "crystal ball", and the growth of the S&P 500 index is more driven by a few tech giants or the Fed's anti-inflation policies, rather than directly reflecting the election situation.

In addition, Reena Aggarwal, a finance professor at Georgetown University, also expressed doubts about the predictive power of the S&P 500 index:

Today's stock market is more inclined to be driven by the growth of Silicon Valley companies, and is no longer as representative of the overall economy as it used to be. Nowadays, many large companies are not listed on the stock market, and the proportion of industrial and energy giants in the index has decreased significantly. Nowadays, the market and the economy have become disconnected.

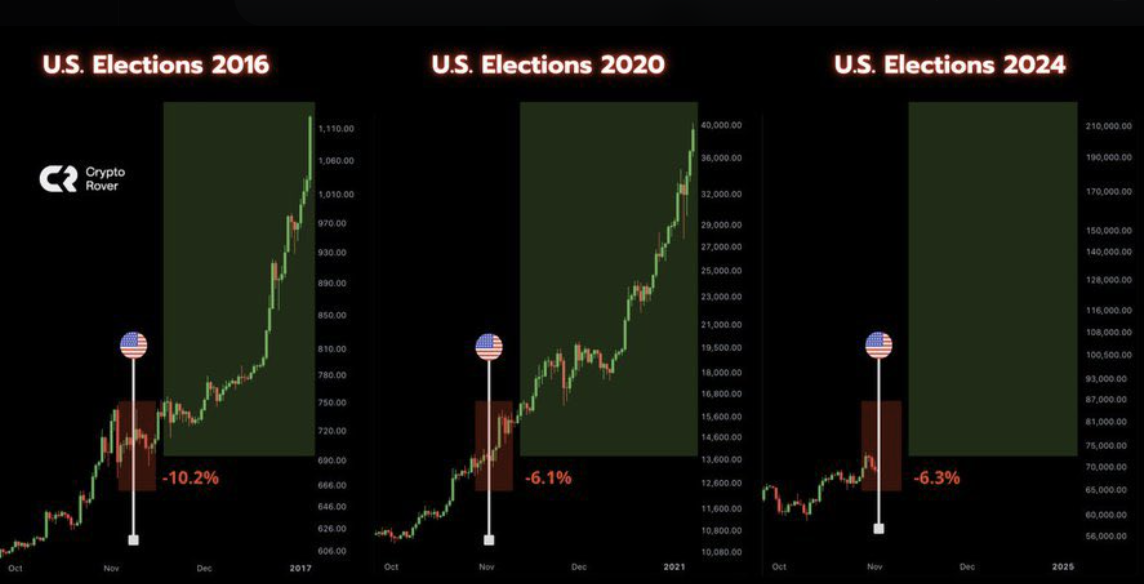

Bitcoin trend after the election

On the other hand, crypto analyst Crypto Rover tweeted yesterday (3rd) that in the past two US presidential elections, Bitcoin has seen a crazy upward trend. Whether Bitcoin will repeat a similar trend after this US election is worth our continued attention.