This week, there are important cryptocurrency news events such as the US election and interest rate decisions. These events can affect the overall market sentiment, but other developers are focusing on specific ecosystems.

This week, cryptocurrency market news may cause volatility.

US Presidential Election and Interest Rate Decision

According to BeInCrypto, the US election this week and the Federal Open Market Committee (FOMC)'s interest rate decision are major macroeconomic events. The showdown between Donald Trump and Kamala Harris will reach its climax on Tuesday, November 5. Meanwhile, the FOMC is scheduled to meet between Wednesday and Thursday to decide on the next interest rate cut.

Read more: How to Protect Yourself from Inflation Using Cryptocurrency

These two events will have a significant impact on Bitcoin and the overall cryptocurrency market, both in the short and long term. For example, the US election result could determine cryptocurrency regulation during the next presidential term. Meanwhile, the Federal Reserve's preferred interest rate cut will

"Expect extreme volatility in Bitcoin over the next few days! With the US election and FOMC meeting coming up, we can expect big moves, but wait until the post-election trend is established. The CME gap below 67,000 and the liquidity below the range lows seem unlikely to escape the volatility this week. After that, the election result and FOMC will drive the next trend," said Mark Cullen, an analyst at AlphaBTC, said.

Polygon Community Grant Program

The second season of the Polygon Community Grants Program (CGP) will start in November, providing funding for all projects built on the Polygon network. The specific tracks have not yet been announced, but the first season ended on November 1, with grants awarded to up to 120 projects.

"The first season of the Polygon Community Grants Program facilitated innovation in the ecosystem by receiving over 1,200 applications and awarding 17.5 million POL tokens to 120 projects," the announcement read.

The CGP aims to drive the growth of Polygon's ecosystem by supporting developers and founders, and encouraging the building of innovative solutions on the platform.

Trader Joe, Pump.Fun Spinoff Token Mill

LFJ, previously known as Trader Joe's, is set to launch Token Mill, a version of Pump.fun's token generator on Solana. The full release, including the whitepaper, is scheduled for November 7.

This launch is considered a step towards LFJ's comprehensive on-chain exchange vision. It now consists of three core components: the Liquidity Book, Token Mill, and the Central Limit Order Book (CLOB). The CLOB is a transparent matching system that prioritizes customer orders based on price and time, improving the efficiency of order execution.

"The Liquidity Book and Token Mill are for long-term assets, while the CLOB is for major assets. As a trinity of a decentralized exchange, they become a collective that binds them all together," a co-founder of LFJ pointed out.

Trader Joe's announced its rebrand to LFJ in September, revealing plans for a collective, loyalty program, portfolio system, and new protocol launches. Token Mill is one of the products, along with the Central Limit Order Book.

Astar Network Async Support

The Astar Network has announced a major upgrade that includes asynchronous (Async) support, which was successfully implemented on the Shiden Network. The same upgrade is expected to be applied to Astar and Shiden. The Async support upgrade will take place on Monday, November 4, but it will not affect vesting, dApp staking, or other time-based mechanisms. These processes will automatically adjust to the new block time.

"Expect asynchronous support on Shiden starting November 4," the Astar Network mentioned in October.

Notably, the Astar Network (ASTR) is one of the most preferred smart contract platforms in Japan, supporting both the Ethereum Virtual Machine (EVM) and WebAssembly (Wasm) environments, while using a unique cross-virtual machine to ensure interoperability between the two environments.

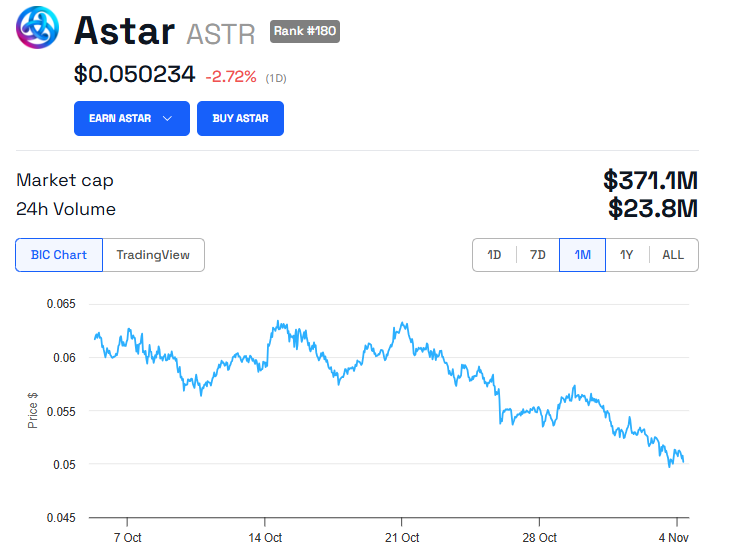

Despite the upgrade news, the ASTR token fell nearly 3% after the Monday session opened. At the time of writing, it is trading at $0.0502.

zkSync $40 Million Incentive Program Vote

The zkSync network will start voting on a new $40 million ecosystem incentive program on Tuesday, November 5. This follows a proposal to deploy a program that allocates 325 million ZK tokens over the past 9 months to build a DeFi liquidity hub on the ZKsync Era.

The program aims to increase the total value locked in DeFi and improve liquidity across all interoperable ZK chains ("Resilient Chains"). Token holders must finalize their delegation on the proposal before the voting session starts.

"The total voting power will be calculated when the voting period starts," ZK Nation announced.

Celestia Ginger Upgrade on Testnet

Celestia's Ginger upgrade is scheduled for November 5, doubling the network's data throughput and preparing the system for future scalability, paving the way for the mainnet beta launch in December.

Meanwhile, analysts are optimistic about TIA, saying it is well-positioned for a potential recovery after recently entering an oversold state."Doubled data processing capacity (Block time reduced to 6 seconds), the community can expand the Block size up to 8MB/6 seconds, faster transaction finality and improved UX, as well as the author's written Blob, stable gas costs, and more efficient data flow through BBR, are the innovations," Celestia recently announced.

SKY Rebranding Governance Vote

As reported by BeInCrypto, the Sky ecosystem is considering a return to the original brand of MakerDAO and the MKR Token. This was discussed after community feedback and the success of USDS. Specifically, the community is concerned about the confusion between Sky and SKY on both the platform and governance token.Read more: Top 11 DeFi Protocols to Watch in 2024 Against this backdrop, the community plans to hold a governance vote on Monday, November 4th, to decide whether the rebranding will take place. Traders and investors can adjust their trading strategies in line with these major cryptocurrency news, or they may suffer losses as part of the exit liquidity."The cause of the confusion is that Maker and Sky exist simultaneously in the market," a community member expressed their opinion.