Arthur Hayes' Investment Guide: Navigating Elections and the Future Investment Portfolio

Arthur Hayes says that elections are just a distraction factor. He is betting that the liquidity that global central banks are about to release will ignite the next bull market in the crypto market.

Here is the investment portfolio strategy he has pre-positioned.

Ladies and gentlemen, get your popcorn ready because Arthur Hayes is back.

In a recent appearance on the "Unchained" podcast, Hayes shared his "gold mine" perspective. Let's dive deeper into his latest thoughts.

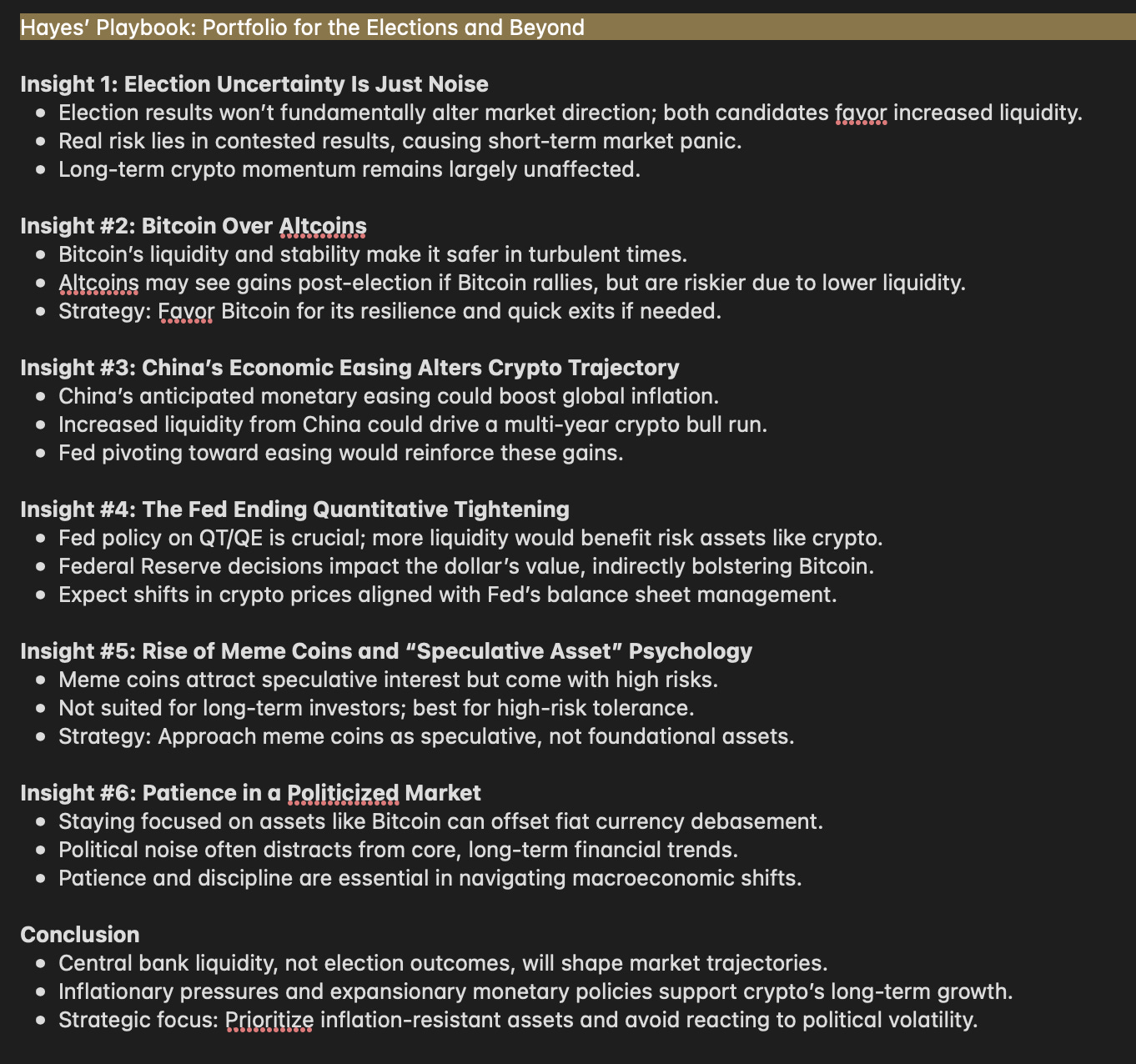

Insight 1: Election Uncertainty is Just Noise

Hayes dismantles the view that election results will impact market volatility, arguing that regardless of which candidate wins, the basic strategy will be to inject liquidity into the economy. Whether it's Trump or Harris, Hayes believes politicians will continue to inflate the economy through cheap money, a strategy that has existed since the Reagan economics of the 1980s. In his view, the US election ultimately boils down to a competition over who will control the next stage of capital allocation, with the ultimate goal of satisfying their political support base.

However, Hayes offers a cautious warning: the real risk lies in the election results being contested, which could plunge the markets into chaos in the short term as the issue of legitimacy erupts on the streets and in the courts. If the losing side refuses to accept the results, the markets may experience a violent reaction due to a temporary shaking of investor confidence. But Hayes reminds us that this is just a minor deviation, not a serious obstacle to the long-term trajectory of cryptocurrencies.

Insight 2: Bitcoin Over Altcoins

Hayes is not just randomly backing Bitcoin - he argues that it is the least volatile choice in an increasingly turbulent world. Betting on lesser-known Altcoins may seem attractive, especially when high-risk assets perform well in a bull market, but Hayes advises caution. Bitcoin's liquidity provides a safeguard, ensuring that investors are less likely to face significant losses when trying to exit in low-liquidity conditions if their election predictions do not materialize.

While Altcoins may have profit potential, Hayes is not willing to put his money on these assets, especially during the volatility triggered by elections. In his view, Altcoin performance will only thrive when Bitcoin dominates the market. If Bitcoin rebounds after the election, he expects to then shift towards Altcoins, but emphasizes the importance of maintaining flexibility and choosing assets that allow for a quick exit.

Insight 3: China's Monetary Easing Shifts the Crypto Trajectory

Amid the din of US election coverage, Hayes points to a crucial macroeconomic factor that may reshape the trajectory of cryptocurrencies more profoundly than any election outcome: China's inevitable monetary easing. China's economic powerhouse status has been built on massive lending to the real estate industry, and as this bubble shows signs of fatigue, Hayes believes the People's Bank of China will intervene with liquidity injections, similar to the Federal Reserve's rescue actions after 2008.

This impending liquidity surge could provide the tailwind that Bitcoin and other scarce assets need to reach new highs. By injecting liquidity into the markets, China may drive global inflation higher, especially as its loose monetary flows into risk assets. Combined with the Federal Reserve potentially also turning dovish, Hayes suggests that cryptocurrencies may experience a multi-year bull market fueled by the debasement of fiat currencies.

Insight 4: The Federal Reserve Ends Quantitative Tightening

Hayes draws our attention to another key factor: the Federal Reserve's balance sheet management. As the US government's deficit continues to grow, the national economy's reliance on short-term financing makes the Fed's role in maintaining liquidity crucial. If the Fed tapers Quantitative Tightening (QT) or resumes Quantitative Easing (QE) when bank system reserves decline, risk assets may benefit. Crypto markets are typically highly sensitive to changes in monetary policy, so significant growth could be on the horizon.

This is a crucial insight for crypto investors: the Fed's policies, more than political rhetoric, shape the liquidity environment for risk assets. If QT ends and QE resumes, the resulting liquidity will sweep across financial markets, driving Bitcoin and other scarce assets higher as investors seek hedges against a depreciating US dollar.

Insight 5: The Rise of Meme Coins and the "Speculative Asset Class" Mindset

In the realm of highly speculative areas, Hayes acknowledges the rise of meme coins (such as Goat) and points to their appeal in a financial ecosystem that is susceptible to viral trends. However, he warns against chasing the fleeting gains of meme coins, viewing their value proposition as more entertainment-driven than sustainable. For those who understand the psychology behind meme coins, their high volatility can be manageable, but in Hayes' view, these assets represent high-risk gambling, more suitable for those who can withstand significant losses.

Insight 6: Maintaining Patience in a Politicized Market

Hayes' strategy calls for patience and caution, whether you're a newcomer or a seasoned crypto enthusiast, in the inevitable era of fiat debasement. He encourages us not to be swayed by the hype of electoral speculation, but to remain steadfast in our long-term investment philosophy centered on hard assets like Bitcoin. His perspective suggests that while the political landscape may shift, the fundamental drivers of monetary expansion and devaluation remain unchanged.

As the crypto market continues to mature, Hayes' views emphasize the importance of maintaining a clear focus amidst the distractions. By filtering out the noise, we can better navigate the complex interplay between politics, macroeconomic trends, and digital assets, always poised to seize the next opportunity.

Conclusion

Arthur Hayes has once again sparked discussion, this time by shifting his gaze beyond the election frenzy. His insights provide a timely reminder for anyone in the crypto or financial realm: while politics may trigger short-term volatility, the factors truly driving the markets run much deeper. Hayes sees liquidity as the king - whether from the Federal Reserve, China, or other central banks, he believes the big picture is shaped by monetary expansion and inflationary pressures, not by the winners or losers of political contests. For crypto enthusiasts, this message is crucial: stay calm, focus on macrotrends, and don't let election anxieties blur the long-term objectives.