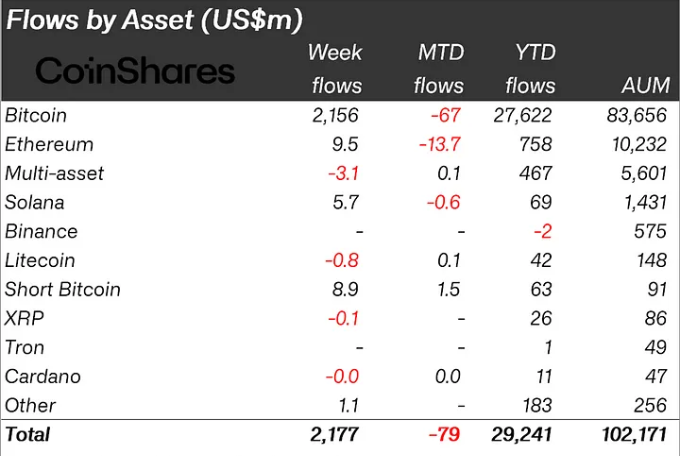

Last week, the inflow of cryptocurrency investment was $2.17 billion, a sharp increase. The annual inflow is $29.2 billion. This inflow has increased the total assets under management (AUM) of global digital asset-related products to over $100 billion, the level it reached last June.

The surge in inflows is due to the renewed interest in Bit. This activity accounted for 35% of Bit trading volume on trusted exchanges.

Digital Asset Investment Product Inflows Reach $2.2 Billion

A recent CoinShares report attributes the recent cryptocurrency inflows to the upcoming U.S. election on November 5. The possibility of a Republican victory could make the outlook for digital asset regulation more favorable, generating interest.

"The expectation of a Republican victory was the main driver of inflows earlier in the week, and with sentiment shifting, there was a slight outflow on Friday. This shows how sensitive Bit is to the U.S. election at the moment," the report stated.

Read more: How to Buy Bit (BTC) and Everything You Need to Know

Bit, which accounted for the majority of last week's inflows at $2.15 billion, reflected investors' confidence. $89 million also flowed into Bit Short products as a hedge against Bit's strength.

Meanwhile, Ether saw relatively modest inflows of $95 million. Solana received $57 million, while other altcoins including Polygon and Arbitrum received $6.7 million and $2 million, respectively.

Given the significant increase in interest in digital assets in the run-up to the U.S. election, this situation is not surprising. BeInCrypto has reported that the digital asset-linked product sector saw positive inflows of $2.2 billion in the 4th week of October and $901 million in the 5th week of October. Inflows in the first week of October were $470 million.

During this period, CoinShares' James Butterfill attributed the positive inflows to the possibility that a Republican victory could favor a more favorable regulatory policy for digital assets.

The Fate of Cryptocurrency Investment Inflows After the U.S. Election

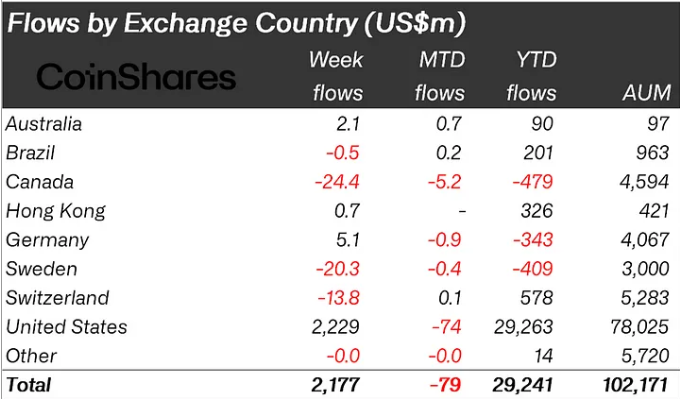

The record inflows coincide with a surge in U.S.-based cryptocurrency investment, with U.S. investors accounting for the majority of the $29.2 billion inflow this year. Meanwhile, Germany saw a slight decrease in new investment to $51 million, reflecting the more conservative attitude towards cryptocurrency in Europe amid regulatory uncertainty.

While Bit remains the primary beneficiary of these investments, the U.S. election could further amplify the volatility in the cryptocurrency market this week. Investors are closely watching key battleground states where recent polls have shown a shift in favor of the Republicans. This suggests that a change in Congress could bring a more favorable stance towards cryptocurrency.

Political analysts believe that GOP control of Congress could ease regulatory pressure on digital assets, strengthening investor confidence and potentially leading to additional inflows into Bit and other cryptocurrencies after the election. However, others like Coinbase CEO Brian Armstrong expect a "more crypto-friendly Congress" regardless of the election outcome.

The election results will signal the short-term direction of cryptocurrency investment. A Republican victory could increase inflows and potentially trigger a new Bit rally, while a Democratic victory could dampen expectations if stricter regulation is anticipated.

Read more: What is Polymarket? A Guide to the Popular Prediction Market

As the election day approaches, the cryptocurrency market is expected to remain volatile. Bit and other digital assets will react to changes in poll data and policy outlooks.

"It's going to be an exciting week ahead. That's for sure. Be careful with leverage, it's best to avoid it altogether this week. The chances of just losing are too high," cryptocurrency analyst Daan Crypto warned.