Author: Alex Tapscott, CoinDesk; Compiled by Tong Deng, Jinse Finance

Bitcoin has been soaring recently, and the possibility of Trump winning the US presidential election this week has also been soaring, at least according to prediction markets like PredictIt and Polymarket.

Bitcoin has recently broken through $73,000, almost reaching its previous all-time high, and on the same day, Trump's chances of winning the election on the Polymarket betting market reached 69%, the highest level since the failed assassination attempt on the former president in June.

Many experts believe that Bitcoin's recent strength indicates that investors are preparing for a potential Trump victory. Others go even further, believing that the recent strength of the US stock market and even the US dollar has been driven by bets on Trump, as investors expect tax cuts to boost corporate profits and protectionist trade policies to strengthen the dollar. This is known as the "Trump trade", and if you read newspapers and many sell-side reports, you'll find this trade is very popular!

This is a concise narrative (though unsettling), but is it really true?

To find the answer, we looked at the data.

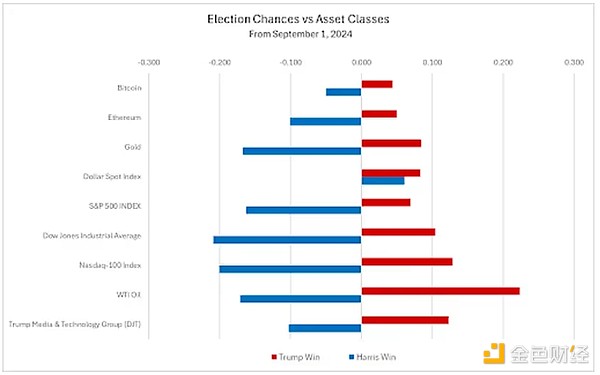

Prediction markets are a good starting point. Polymarket and PredictIt allow bettors to bet on who will win the election. Until recently, the two candidates were in a stalemate, but recently, Trump's chances of winning have started to rise. So we took the odds from the two prediction markets over the past two months, averaged them, and then did a correlation analysis with other asset classes, securities, and indices.

1 means 100% correlated, 0 means not correlated at all. -1 means the two things are 100% negatively correlated.

Here's what we found:

Unsurprisingly, as Trump's chances of winning increase, the owner of Truth Social, the Trump Media and Technology Group (DJT), is more likely to do better. The stock market has a 10% positive correlation with Trump's chances. Bitcoin has almost no correlation with either.

So the Trump trade does show up in the data, but it's quite mild and may have been greatly exaggerated.

It's important to note that prediction markets are just one data point. Fortune magazine recently reported that a third of the activity on Polymarket is wash trading, aimed at making it look more popular than it actually is, or as some critics say, to "prop up" Trump's chances. Not everyone prices based on prediction market data, and given the novelty of this data, many may discount it. Nevertheless, as Bloomberg recently reported, Wall Street is closely watching, and we must as well.

The weak correlation and exaggerated narrative should provide some comfort, relieving us of the concern that the election is a huge market catalyst.

My personal view is that regardless of the outcome, this election is negative in the short term but very positive in the long term. In the short term, given the price is close to the all-time high, a Trump victory could be a "buy the rumor... sell the news" event, while a Harris victory could lead to a knee-jerk reaction, as some traders simply think she would be worse for asset classes. In the long run, regardless of who becomes president, as the digitization of finance and other industries accelerates, the adoption of Web3 is accelerating, and deficit spending will continue to create demand for stores of value like Bitcoin.

Who is better for cryptocurrencies - Harris or Trump?

I generally believe that people exaggerate the influence of leaders. This is not to say that governments do not affect new industries and markets.

In fact, a new administration can do a lot, such as:

Encouraging Congress to pass industry-friendly legislation, such as a stablecoin bill

Clearing the path for more issuers to list on US exchanges

Resetting the relationship between the SEC and the Web3 industry

Reforming financial services regulation to create more room for innovation

Opening up energy markets to encourage Bitcoin miners to move their operations onshore.

I think this is largely wise, and even long overdue.

But I still doubt that Donald Trump can be a true, proactive champion for this space. He has historically lacked the patience, and even the sustained interest, to tackle many priorities, and he is notorious for changing his mind when he is no longer politically useful.

His economic plans could also have counterproductive effects on many businesses and industries, including cryptocurrencies. Business leaders may welcome cutting the corporate tax rate from 21% to 15%, but as the right-leaning Cato Institute has said, his economic plan will exacerbate the deficit and lead to a resurgence of inflation.

Some believe that this chaos is the key to the problem. Mark Cuban, the outspoken billionaire investor who supports Harris, believes that venture capitalists and tech people support Trump because they think his tax cuts, deficit spending plans, and tariffs will lead to inflation, causing Bitcoin to soar.

This feels a bit cynical. The president simply doesn't have that much influence. Additionally, in a failed world, businesses cannot succeed (although Bitcoin perhaps can).

Those who have worked closely with him often tell us how easily Trump can be swayed on issues.

Recent reports suggest that Trump's main interest is using cryptocurrencies to make money, as evidenced by the launch of his own DeFi project, World Liberty Financial (WLF). Even Trump supporters are uneasy about WLF, as they have reason to fear it will undermine confidence in the industry and make Trump's recent pivot seem insincere.

Trump's stance on cryptocurrencies is a modern interpretation of the old adage that "what's good for General Motors is good for America." Replace "General Motors" with "Trump Inc." and your view of the government's role is not far from his.

Will Trump's interest in cryptocurrencies wane when they no longer suit him? This is a question that many crypto-supporting voters should carefully consider before voting.