Author: Matt Hougan, Chief Investment Officer of Bitwise; Compiled by 0xjs@Jinse Finance

There is nothing more to say about the election on November 5.

If you missed my previous comments, my predictions are as follows:

In the short term, a Trump victory is better than a Harris victory.

In the long run, whether Biden or Trump wins, Bitcoin, Ethereum and stablecoins will thrive.

Under a Harris administration, Altcoins face greater regulatory risks than under a Trump administration.

The only "bad" outcome for cryptocurrencies is a Democratic sweep, as this will embolden the fringe elements within the Democratic Party who are openly opposed to cryptocurrencies.

But even in that case, I would buy the dip.

Because if there's one thing the past four years have taught me, it's this: Washington can't stop cryptocurrencies. It can change the trajectory. It can accelerate or slow the process. It can bring more chaos or new clarity.

But it can't stop it.

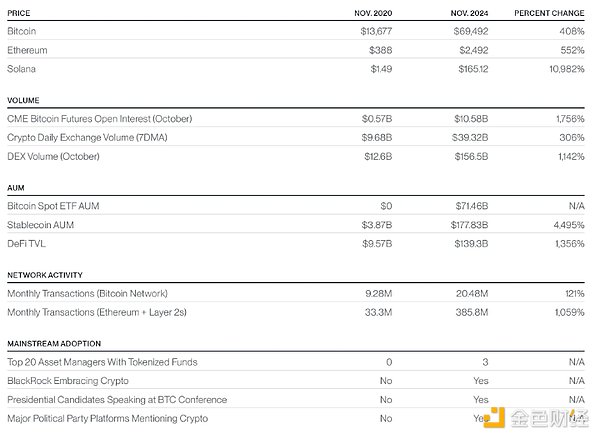

The State of Cryptocurrencies: November 2020 vs. November 2024

One of the things I enjoy about presidential elections is that they give you a chance to look back on what's happened over the past four years.

Has the situation improved or deteriorated compared to the last time you voted?

When you do this in the cryptocurrency space, the results are overwhelming. Despite a hostile regulatory environment - think Operation Chokepoint 2.0, countless SEC lawsuits, and a slew of conflicting or ambiguous statements - the progress we've made is astounding.

Choose any statistic you want, and it's true.

Cryptocurrency Progress: 2020 vs. 2024

Data source: Bitcoin, Ethereum and Solana prices as of November 2, 2020 and November 2, 2024, provided by Bitwise Asset Management. CME Bitcoin futures open interest, DEX trading volume and monthly trading volume (Bitcoin network) from The Block, using full-month values for October 2020 and October 2024. Cryptocurrency daily trading volume (7DMA) as of November 6, 2020 and November 3, 2024, provided by The Block. Bitcoin spot ETF AUM and stablecoin AUM as of November 2, 2020 and November 2, 2024, provided by The Block. DeFi TVL as of November 4, 2020 and November 2, 2024, provided by The Block. Monthly trading volume (Ethereum + Layer 2) as of October 2020 and October 2024, provided by The Block and GrowThePie. Top 20 asset managers with tokenized funds as of 11/2/24, provided by RWA.XYZ. All other data as of 11/4/24 from Bitwise Asset Management.

In the cryptocurrency space, we are often too focused on the immediate price fluctuations that we often overlook the long-term trends. The presidential election provides a good opportunity for us to look back and see how far we've come.

Will These Trends Continue?

When you look at the statistics above, you should ask yourself a question: will these trends continue? In my view, the answer is yes.

Our view is that regardless of who wins the election on November 5:

Inflows into cryptocurrency spot ETFs will continue

Stablecoins will continue to grow rapidly

Institutions will continue to "get off zero" and increase their allocations to cryptocurrencies

Wall Street will continue to embrace tokenization and real-world assets

Blockchains will become faster and cheaper

Real-world applications like Polymarket will continue to break through and gain mainstream adoption

Undoubtedly, the outcome of the November 5 election is important, especially in the short term. But in my view, in the long run, the outcome of the November 5 election will be somewhere between a speed bump and a strong wind.

Neither can stop this train from moving forward.