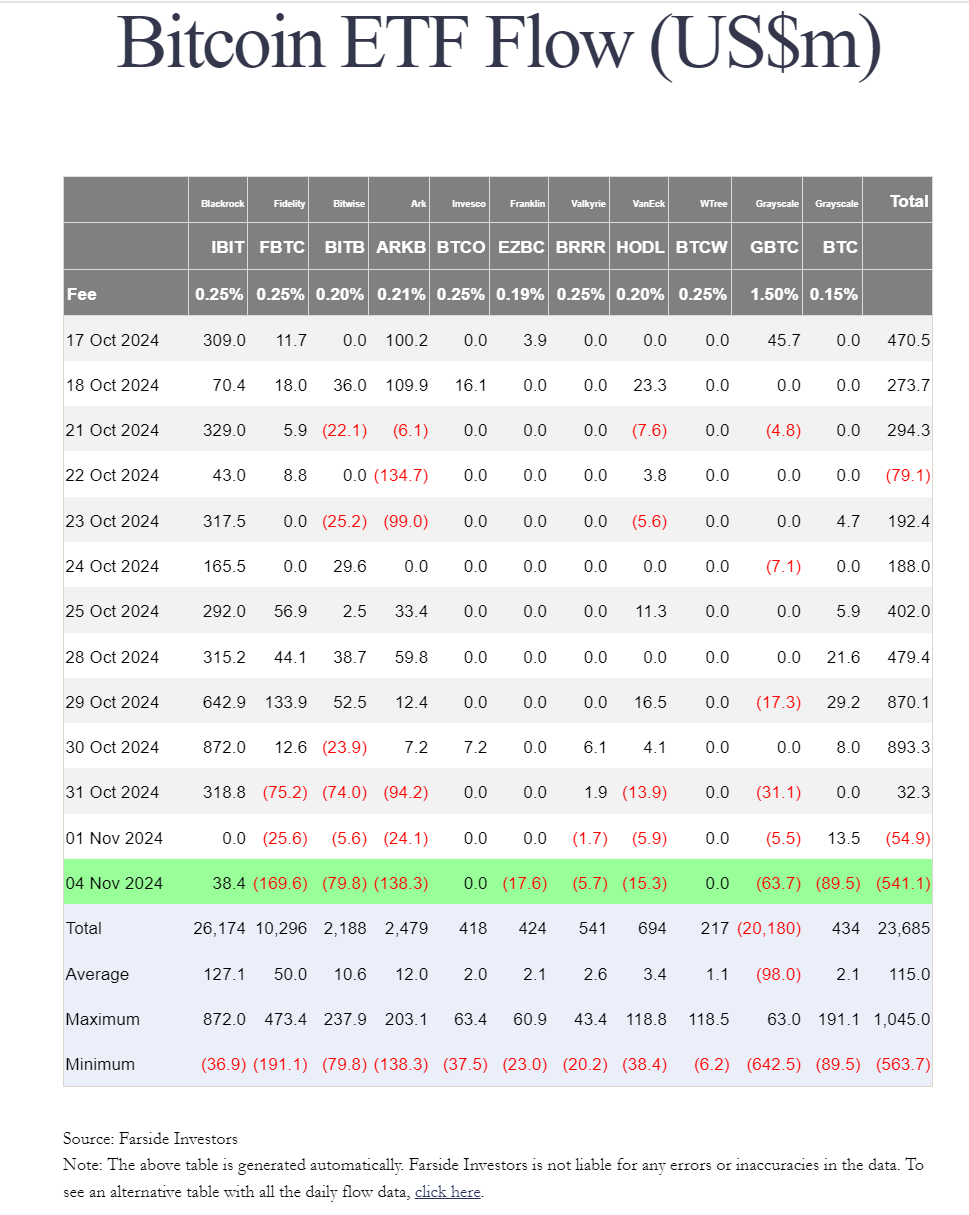

On November 5, 2024, the Bitcoin ETF set the second largest net outflow record in history - $541 million in funds disappeared instantly. This phenomenon seems to remind us that the "gold alternative" path of Bitcoin is far from smooth sailing as expected. Although the craze for digital currencies continues to heat up, this large-scale capital outflow and the decline in the Altcoin index may have poured a bucket of cold water on those investors who are eager to view cryptocurrencies as a new generation of safe-haven assets. At the same time, gold ETFs, as representatives of traditional safe-haven assets, have weathered nearly 20 years of ups and downs and still steadily attract the favor of investors.

Can the Bitcoin ETF truly break the "king's position" of gold and become the new darling of the financial market, becoming an important part of global asset allocation? As the 2024 US presidential election approaches and the uncertainty in the market becomes increasingly complex, this question becomes particularly urgent. Over the past few months, the Bitcoin ETF has attracted capital inflows at a surprising speed, seemingly indicating that it will gradually replace gold and become the new "digital gold".However, when politics, finance and market dynamics are intertwined, can the future of digital gold be firmly established? The answer may lie in the review of history, especially the market dynamics when the gold ETF was launched in 2004.

The 2004 US Presidential Election and the Background of the Launch of the Gold ETF

Gold price trend after the launch of the gold ETF in 2004-2008

The 2004 US presidential election was an important milestone in global economic history, coinciding with the launch of the gold ETF.In 2004, George W. Bush was successfully re-elected, marking the continuation of US domestic and foreign policies, but Bush's re-election also reflected voters' concerns about the aftermath of the terrorist attacks, the Iraq war, and global energy price fluctuations.These external uncertainties led investors to seek safe-haven assets, further verifying gold's status as the "king of safe havens".

In that year, the global market faced multiple pressures: turmoil in the Middle East, weak global economic recovery, and frequent changes in monetary policies of the Federal Reserve and other countries. Against this backdrop, the launch of the gold ETF perfectly met the market's strong demand for traditional safe-haven assets. The gold ETF provided investors with a convenient way to invest in gold, avoiding the inconvenience and risks of holding physical gold. The 2004 US presidential election also became an important catalyst for the rise in gold demand. Although Bush's re-election did not change the direction of US's dominant policies, the political uncertainty during the election campaign caused investors' concerns about the economic outlook to peak, which in turn boosted gold prices.

Now and Then

Comparing the 2004 US presidential election with the 2024 US presidential election can not only help understand the underlying logic behind the inflow of gold ETFs at that time, but also reveal the sentiment in the current Bitcoin ETF market. The 2024 US presidential election has attracted the attention of the global financial market, and the huge differences in personality and governance philosophy between the two candidates, Trump and Harris, will inevitably have different impacts on investor sentiment.

Trump, as the former president, represents the policy propositions of the conservative camp. Trump's governance style is known for its toughness and anti-globalization, especially in foreign policy and domestic economic reforms, advocating tax cuts, strengthening state-owned enterprises, and promoting the "America First" policy. He usually has a relatively loose attitude towards the financial market, believing that stimulating economic growth can be achieved through lowering corporate tax rates and reducing regulation. Trump's policy inclination often makes the financial market volatile during his late term, and when the election result is uncertain, investors may be more inclined to turn to traditional safe-haven assets such as gold to hedge against potential market turmoil.

Compared to Trump's "strong" policies, Harris represents a relatively moderate liberal ideology, emphasizing social justice, environmental protection policies and global cooperation. Her policy orientation is more focused on social welfare, climate change and innovation in the digital economy. Although this policy orientation may help boost the performance of emerging markets such as green energy and tech stocks, during the sensitive period of political change, Harris's governance may make the market feel uncertain, especially if she is likely to strengthen the regulation of tech giants and the policy control of cryptocurrencies, which may to some extent inhibit digital assets such as Bitcoin.

Market response: For Trump's supporters, the financial market may tend to seek safe-haven assets such as gold when political uncertainty intensifies; while Harris may be more inclined to promote investment in green energy and tech industries, and her policy attitude towards cryptocurrencies such as Bitcoin may be more cautious. Different policy backgrounds and different leadership styles will, through subtle changes in investor psychology, affect the capital flow of the Bitcoin ETF and the performance of the gold ETF.

The Relationship between the 2004 Gold ETF and Global Tech Stocks

The performance of tech stocks also experienced considerable volatility in 2004. At that time, the Nasdaq index in the US began to recover, especially after the bursting of the Internet bubble, tech stocks had experienced a long period of stagnation. However, the rise in gold did not have a significant impact on tech stocks as it did during the bursting of the Internet bubble, on the contrary, gold and tech stocks showed a certain "inverse relationship". In the context of increased economic uncertainty, the rise in gold was often accompanied by the sell-off of risk assets (such as tech stocks).

However, the launch of the gold ETF provided a new driving force for the gold price, and also provided investors with a convenient way to hedge risks. From 2004 to 2008, the performance of tech stocks and gold also tended to move in tandem, with gold gradually rising from $400 per ounce to $800 per ounce, while the Nasdaq index also rose by 20%.

Bitcoin ETF Today: Similarities and Differences with Gold ETF

Comparing the historical background when the gold ETF was launched with the current situation of the Bitcoin ETF can reveal the similarities and differences between the two. First, we can see that the launch of the Bitcoin ETF and the launch of the gold ETF occurred in a time of high global economic uncertainty. Today, from the perspective of 2024, Bitcoin seems to be facing a similar "safe-haven" demand as gold did back then.

However, the differences between the Bitcoin ETF and the gold ETF are also very obvious. The launch of the gold ETF was a response to global economic uncertainty and political risks, catering to investors' demand for stable assets. In contrast, the launch of the Bitcoin ETF, while also driven by uncertainty, is more influenced by the digital currency revolution, with Bitcoin being seen as a tool to challenge the traditional financial system.

The launch of the Bitcoin ETF means that digital currencies are gradually being integrated into the traditional investment market, and although its volatility is much higher than gold, due to its limited supply and relatively less connection with the traditional market, investors' "speculative" investment in it is more intense. Therefore, the capital flow of the Bitcoin ETF is different from that of the gold ETF - Bitcoin investors are often more concerned about its potential for price surges, while gold is more for risk aversion.

The Rapid Growth of the Bitcoin ETF and the Comparison with the Gold ETF: A Historical Mirror

The inflow of the Bitcoin ETF is from farside

The rapid rise of Bitcoin ETFs has attracted market attention. Since its launch in January 2024, the Bitcoin spot ETF has attracted funds at an extremely fast pace, accumulating $23.89 billion, with total net assets of $70 billion, nearly half the total assets of the gold ETF. In contrast, the gold ETF has existed for 20 years since its launch, with current total net assets of $137.3 billion. In other words, in just 10 months, the Bitcoin ETF has attracted more than 50% of the asset size of the gold ETF, which is astonishing. The speed of fund inflows is equally shocking. The fund inflows of the Bitcoin ETF range from $192 million to $893 million, setting a historical record. Ryan McMillin, Chief Investment Officer of the cryptocurrency fund management company Merkle Tree Capital, said: "The Bitcoin ETF has been warmly welcomed, breaking all fund inflow records." This rapid growth reflects the increasing maturity of the digital asset market and the growing interest of mainstream investors in Bitcoin. Comparison of Bitcoin and Gold Market Capitalization As of the time of writing, the market capitalization of Bitcoin is about $1.4 trillion, which is still negligible compared to gold. According to the World Gold Council (WGC), the total market value of the global gold market has already reached nearly $20 trillion. This gap shows that gold has become the "cornerstone" of the global financial market after decades of accumulation. The liquidity of gold is relatively stable, and although new gold mines are being exploited every year, the total supply of gold is growing very slowly, further highlighting its scarcity. Due to the historical perception of gold as a "store of value", it has firmly maintained its position as the most traditional and stable safe-haven asset globally. If we go back to 2004, the market capitalization of gold was less than $3 trillion, equivalent to the total market capitalization of all cryptocurrencies at their peak 21 years ago. This market capitalization gap may mean that Bitcoin can replicate the development trajectory of the gold ETF. In fact, many market analysts believe that Bitcoin is in a similar early stage as the gold ETF was in 2004. In the years following the launch of the gold ETF, the price of gold experienced relatively stable growth and gradually transformed from a traditional safe-haven asset to an indispensable component of investment portfolios. With the promotion of the Bitcoin ETF and the deepening market recognition of digital gold, Bitcoin may also follow the path of the gold ETF, becoming an important member of asset allocation, gradually stabilizing and forming a "complementary" relationship with gold. Especially in an environment of increasing political and economic uncertainty, Bitcoin, as a limited-supply asset, seems to have certain "gold-like" properties. As market participants' recognition of the Bitcoin ETF gradually strengthens, Bitcoin is expected to follow the path of stable growth of the gold ETF, and ultimately become an important asset for global investors to allocate.