Author: Chandler, Foresight News

With Trump winning 19 electoral votes in Pennsylvania, the 2024 US presidential election is basically over.

On November 6, FoxBusiness reporter Eleanor Terrett reported that the first "crypto president" is now likely to be Trump.

The crypto market responded to this result first. On November 6, Bitcoin reached a high of 75656 USDT during the session, breaking the high of 73775.9 USDT set in March this year, and continued to hit a new high. The capital market was the same, with the US dollar index rising by nearly 1.5%, and the S&P 500 and Nasdaq 100 index futures rising by more than 1.1%.

As the election enters the final stage, investors' focus is beginning to shift to the impact of the new president's inauguration on the market.

The "Bitcoin" Declaration in July

Let's first review Trump's commitments to crypto when he attended the Bitcoin conference in the US in July this year:

"On the first day, I will fire Gary Gensler and appoint a new SEC chairman. If elected, I will establish a strategic national Bitcoin reserve for the US government. The US government will retain 100% of its Bitcoin. Bitcoin will fly to the moon. Do not sell your Bitcoin."

"Bitcoin may one day exceed the market value of gold. I reaffirm my commitment to reducing Ross Ulbricht's sentence."

"There will never be a CBDC during my presidency as President of the United States."

"If elected president, Bitcoin and cryptocurrencies will soar in a way never seen before."

"Bitcoin does not threaten the dollar, the current US government threatens the dollar. The US will become the global capital of cryptocurrencies and the world's Bitcoin superpower."

"Bitcoin represents freedom, sovereignty and independence from government coercion and control. I assure the Bitcoin community that on the day I take office, Joe Biden and Kamala Harris's anti-cryptocurrency campaign will end."

How will the US election results affect the crypto market

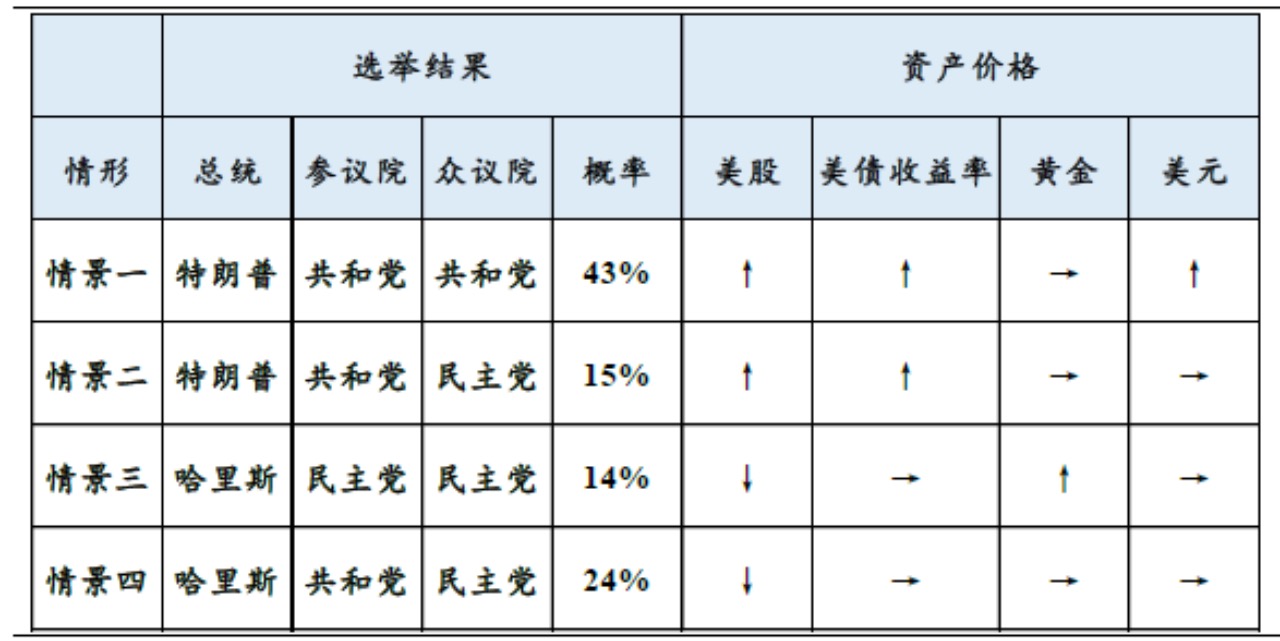

Soochow Securities previously sorted out four scenarios based on the betting odds (one is more sensitive and the other is more indicative), according to the party affiliation of the president, and deduced their impact on asset prices, in which if the Republicans sweep (43%), US stocks > US dollar > gold > US bonds. It pointed out that whether the US president's policies can be smoothly promoted, implemented and implemented, and whether they can obtain the support of Congress are particularly important.

On the one hand, in this scenario, Trump will be able to more smoothly implement and implement his policy propositions, significantly reduce taxes on domestic companies and relax regulations, which will provide strong impetus to the US stock market; on the other hand, policy resonance (increased tariffs + tightened immigration) will increase the pressure of re-inflation in the US, which will be beneficial to the US dollar from a potential impact perspective, while the long-end of the US bond market will face selling pressure.

Trump's tax cuts and relaxed regulatory policies, if implemented, will generate strong attractiveness to the capital market, and the crypto market may see a wave of short-term capital inflows as a result. Tax cuts reduce the tax burden on businesses and individuals, increasing the funds available for investment, and crypto assets may become one of the important channels for these funds to flow in. Relaxed regulation also reduces the compliance burden of crypto companies, encourages innovation, and enhances the capital's confidence in the crypto market. For mainstream assets like Bitcoin and some Altcoins with strong meme properties (such as Doge), the increase in market funds may push up their prices and to some extent increase the market activity of these assets.

From a long-term perspective, if Trump's policies are further promoted, in the low interest rate and expansionary fiscal environment, the market often prefers high-yield and high-liquidity investments, and crypto assets gradually meet this preference. At the same time, if the regulatory cost of the crypto market is relatively low, the willingness of institutional investors to participate will also increase, which will help the scale and application of the crypto market to gradually expand.

In addition, regardless of the election result, the change in the control of the White House and Congress may have a significant impact on the regulatory environment and future development of crypto assets. The control of the Senate is particularly critical for the crypto industry, as it plays a decisive role in confirming the leadership of key regulatory agencies (such as the chairman of the SEC and CFTC).

Apart from this, if Trump can return to the White House, whether his campaign promises on crypto policies can be effectively implemented will also have an important impact on the future development of the crypto asset industry.

Implementation of Crypto Policies

Trump clearly stated in his campaign that he supports crypto asset innovation and plans to promote industry growth through deregulation. At the same time, he will also propose a plan to make Bitcoin a strategic reserve asset for the United States.

Republican Senator Cynthia Lummis has also introduced the "Bitcoin Reserve Act" and submitted it to Congress and the Senate Banking Committee for review. The bill aims to establish a strategic Bitcoin reserve and other projects to ensure transparent management of the federal government's Bitcoin holdings, utilize certain resources of the Federal Reserve System to offset costs, and other purposes. The bill will subsequently be reviewed by the Senate, House of Representatives, and the President to decide whether to pass it into law.

If Bitcoin is listed as a strategic reserve asset for the United States, it will have significant symbolic significance and practical impact. On the one hand, this will mark the transformation of Bitcoin from a niche asset to a state-recognized reserve asset, greatly enhancing its legitimacy and recognition. This policy change will give Bitcoin a new status, significantly enhancing the market's confidence in its long-term value.

On the other hand, as a strategic reserve asset, Bitcoin will, together with traditional reserve assets such as gold and foreign exchange reserves, provide economic stability and financial security for the country. This recognition can further consolidate Bitcoin's position in the global financial system and prompt more central banks and governments around the world to re-evaluate their stance on Bitcoin and digital assets. Especially in the context of seeking to hedge against US dollar volatility and economic uncertainty, this policy change will have a demonstrative effect, prompting more countries to include Bitcoin in their reserve assets to achieve diversification of reserve assets and risk management, thereby further expanding the global market demand and adoption rate of Bitcoin.

However, it should be noted that in the policy formulation and implementation of the US president, the traditional process and the complex political environment in reality are inseparable. The policy commitments of the president, from the blueprint during the election campaign, often need to go through a meticulous policy operation process before they can enter the actual governance stage. Overall, the implementation of the new president's policies is closely related to the interaction between multiple powers such as Congress, the judiciary, and administrative agencies. After the new president takes office, whether his policies can be fulfilled ultimately depends on several key factors: party distribution, the application of executive orders, legislative support from Congress, and the broader social opinion base.

The Fate of Gary Gensler

After the 2024 US presidential election, the days of Gary Gensler as the chairman of the US Securities and Exchange Commission (SEC) will be numbered. Gensler's term will expire in January 2026, but traditionally, when the new president is from the opposing party, the SEC chairman often resigns. Therefore, when Trump is elected, the pressure on Gensler will be doubled, especially as his confrontational stance towards the crypto asset industry becomes increasingly apparent. Trump has explicitly stated on multiple occasions that if he is elected, he will fire Gensler, which means his resignation is almost a foregone conclusion.

Since taking office as SEC chairman in 2021, Gensler has taken a tough stance on the crypto asset industry, emphasizing that existing securities laws are sufficient to regulate crypto assets, and has been regulating through enforcement actions.

According to data from the Blockchain Association, since Gary Gensler took over as chairman of the U.S. Securities and Exchange Commission (SEC), the U.S. crypto industry has spent over $400 million to deal with the agency's enforcement actions. During this period, the U.S. SEC has sued some major crypto companies, including Coinbase and Kraken. The Blockchain Association said that $400 million is just "a small part of the industry" as this is based on a sample survey of its association members. Trump's confirmation of his election victory will make Gensler's future a focus of attention. While he may continue to serve at the SEC, according to convention and the current political climate, his resignation is almost a foregone conclusion. Overall, the price of Bitcoin has risen today, clearly reflecting the market's expectation of a more relaxed policy following Trump's election victory. Capital is hedging against this potential risk, factoring the expected positive impact into the market price in advance. If U.S. policies can balance compliance and innovation, it will further enhance the widespread adoption and legitimacy of crypto assets, especially the hedging attributes and stable growth potential of assets like Bitcoin. In the long run, the price trend of crypto assets will still be closely related to their market acceptance, the strength of policy support, and global capital flows. The clarity and sustainability of policies will be a key factor for investors to regain confidence in the next period.