The Top 15 Venture Capital Firms and Their Key Crypto Projects (Part 2)

What are the focus areas of venture capital firms in the crypto space?

Venture capital firms have diverse focus areas, investing across a range of domains from infrastructure and decentralized finance (DeFi) protocols, to GameFi, NFTs, and emerging trends like DePIN and AI.

Key Highlights

- Leading venture capital firms like a16z are deploying billions of dollars into crypto investments, demonstrating strong long-term confidence in the industry.

- Beyond capital infusion, venture capital firms provide strategic support to their portfolio projects through technical guidance, network resources, and other support to help them grow.

- The key venture capital firms covered in this article include Paradigm, a16z, 1kx network, Multicoin Capital, Animoca Brands, Spartan Capital, and Mechanism Capital.

In the second part of our series exploring the top venture capital firms shaping the crypto and blockchain landscape in 2024, we delve deeper into the innovative strategies and impactful investments of more leading firms. These venture capital firms are not only driving the evolution of Web 3, decentralized finance (DeFi), and blockchain technology, but are also playing a crucial role in defining the future of digital assets.

From Paradigm's research-driven approach, to a16z's expansive crypto funds, 1kx Network's focus on tokenized projects, and Animoca Brands' pioneering efforts in blockchain gaming, each firm brings a unique perspective and expertise. We'll also explore Spartan Capital's strategic investments, the rising prominence of Mechanism Capital, and the innovative projects supported by Multicoin Capital.

If you haven't read it yet, check out the first part of the article. The venture capital firms listed here are not in any particular order.

9. Paradigm

Paradigm, founded in 2018 by Coinbase co-founders Fred Ehrsam and Matt Huang, is headquartered in San Francisco, California. The firm focuses on investing in innovative companies and protocols in the cryptocurrency and blockchain space. In evaluating startups, they take a more research-driven and operationally-focused approach, providing guidance on mechanism design, smart contract security, and engineering technology.

Some of their notable investments include:

- Chainalysis: A blockchain analytics company that provides data, software, services, and research to government agencies, exchanges, and financial institutions.

- Matrixport: A crypto financial services platform offering digital asset custody, trading, lending, and other services.

- Dapper Labs: A blockchain gaming and collectibles platform company behind popular projects like CryptoKitties and NBA Top Shot.

- Fireblocks: A digital asset custody and transfer solution provider, offering secure infrastructure to move, store, and issue digital assets.

Paradigm's recent investment focus has primarily centered around blockchain infrastructure, staking, and smart contract platforms. For instance, they recently led a $7.5 million seed round for Sorella, a crypto startup working to address Ethereum's MEV problem.

Sorella is currently developing two tools, Brontes and Angstrom, aimed at combating MEV behavior. Brontes is a blockchain operating system tool that processes ETH blocks and identifies MEV through pattern matching analysis algorithms, while Angstrom serves as a Uniswap V4 hook to prevent certain forms of arbitrage in decentralized exchanges.

To reach out to Paradigm, you can connect with their team through their website: https://www.paradigm.xyz/tea

10. a16z

Andreessen Horowitz (a16z) is a venture capital firm that has been investing in cryptocurrency and Web3 startups since 2013. To date, a16z has launched four crypto funds, the latest being a $4.5 billion fund announced in May 2022, making it the largest crypto venture fund ever. Their crypto investments are led by Chris Dixon.

a16z is considered a Tier-1 investor and has recently launched a new product called a16z Games, an early-stage accelerator aimed at supporting startups at the intersection of technology and gaming, many of which are Web3 companies. They invest $750,000 per company and plan to run the SR004 program in the first half of 2025. The application link is available on their website.

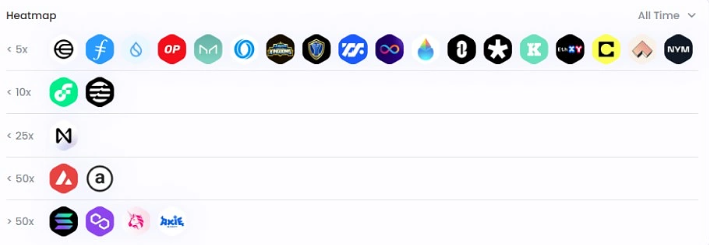

Image source: ChainBroker

a16z has invested in many projects that have shaped the Web3 landscape today, including Solana, Polygon, Uniswap, and others. Recent investments include protocols like Moku, T1 Protocol, Blocksense Network, Pin AI, and Balance, all of which occurred in September 2023!

You may also remember the popular Farcaster protocol that went viral on Twitter earlier this year, successfully raising $150 million in a round led by a16z, Paradigm, Union Square Ventures, Variant, and Standard Crypto.

To reach out to a16z, you can consider applying for their various programs on their website. (a16z also has a wealth of high-quality Web3 research that you can check out: https://a16zcrypto.com/research/)

11. 1kx Network

1kx Network is an early-stage venture capital firm founded in 2017, primarily focused on investing in tokenized projects in the cryptocurrency and blockchain space. Based in the US, 1kx positions itself as a crypto-native fund, aiming to support exceptional founders in launching their token networks.

The firm was co-founded by Lasse Clausen and Christopher Heymann, both of whom have technical founder backgrounds. 1kx's team includes various professionals, such as analysts and researchers, who provide support for the firm's investment strategy and portfolio management. 1kx is known for its founder-friendly approach, emphasizing hands-on support and guidance to help entrepreneurs develop and scale their projects.

Some of their notable investments include:

- Kiln: A provider of enterprise-grade staking solutions, which has completed a Series A round.

- Fxhash: An NFT platform that allows users to create and trade generative art.

- Pudgy Penguins: A prominent NFT collection and Web3 intellectual property company, in which 1kx led a $9 million seed round.

Recently, 1kx Network has also invested in several seed-stage companies, such as:

- Astria: In July 2024, 1kx led Astria's Series A round, raising $12.5 million. This investment aims to enhance decentralized application development and improve transaction processing in the blockchain ecosystem.

- Lagrange: In May 2024, Lagrange Labs raised $13.2 million in a seed round, with 1kx among the investors. The funding will support the company's expansion of blockchain computing through its zero-knowledge co-processing technology.

- Botto: In March 2024, Botto completed a $1.67 million seed round, demonstrating investors' continued confidence in decentralized technology projects.

- FuzzLand: On February 9, 2024, FuzzLand raised $3 million in a seed round led by 1kx. The company focuses on Web3 security and analytics, and the funding will help advance its automated smart contract analysis solutions.

To learn more, you can visit their Twitter page or directly reach out to them for investment inquiries: https://x.com/1kxnetwork

12. Multicoin Capital

Multicoin Capital is a venture capital firm focused on investing in the cryptocurrency and blockchain space. Founded by Kyle Samani and Tushar Jain, the firm takes a thesis-driven approach, focusing on innovative startups that are using blockchain technology to disrupt major markets.

True to its name, Multicoin Capital tends to make concentrated, non-consensus investments in emerging projects. This contrarian strategy has yielded impressive returns, with an internal rate of return (IRR) of 33.8% from 2020 to 2021, one of the highest in the industry. The firm believes in the importance of deploying capital proactively, investing in projects that are seen as "early," such as Solana, Helium, and The Graph.

Multicoin Capital's investment thesis is based on the "attention economy theory", which believes that the way the market prices crypto assets has changed. This theory holds that the driving factors of asset prices are the community's investment of time, effort, and money, rather than traditional financial valuation models (such as the DCF discounted cash flow model).

Consumer interest is the key to the success of most Web3 projects, so their investments often focus on projects around two functionalities:

- The ability to quickly create new assets

- The ability to trade these assets on any trading venue

This strategy is reflected in their recent investments in early-stage and late-stage startups. For example, they co-led the $225 million funding round for the popular cross-chain interoperability platform Wormhole.

In terms of early-stage investments, this year they have invested in:

- zkMe: a solution that allows users to verify their credentials without revealing any personal information to anyone. zkMe aims to provide compliant solutions for Web 3 developers, especially in the context of increasing regulatory scrutiny. It allows users to generate anonymous credential proofs and automatically verify and link them with the blockchain ecosystem of their choice. Service providers can request access to these verified claims without the user sharing private data. This is achieved through an identity oracle, using zero-knowledge proofs and multi-party computation.

- CrunchDAO: a collective intelligence protocol that transforms models into sustainable revenue. They achieve this through a three-step process where companies upload anonymized data to the platform, Crunch hosts and makes the data available, and then builds new models using this data.

- El Dorado: a super app (fintech service) that is redefining the way you exchange, store, and send funds. El Dorado allows you to swap between assets, deposit yields, and access fiat on/off ramps.

- Baxus: a global marketplace focused on the world's most collectible spirits. Essentially, it is a secure P2P marketplace that allows people to buy and sell high-end spirits.

If you would like to contact Multicoin Capital for investment consultation, you can submit an application directly to them here: https://multicoin.capital/contact/. Due to the large number of investment proposals they receive, it is recommended to seek a warm introduction.

13.Animoca Brands

Animoca Brands is a digital entertainment and blockchain gaming company co-founded by Yat Siu and David Kim in 2014, headquartered in Hong Kong. The company initially focused on mobile game development but pivoted towards blockchain games and Non-Fungible Tokens (NFTs) around 2018.

For example, Animoca Brands created Mocaverse, which contains 8,888 unique NFTs called Mocas, aimed at building a comprehensive Web3 ecosystem. It is both a consumer network and an identity and reputation management platform, integrating various elements of gaming, culture, and digital assets.

This transformation has made Animoca a key player in the rapidly growing Web3 space, aiming to promote digital property rights and contribute to the open metaverse. Animoca's strategy is reflected in its investments in startups and well-known companies, such as Axie Infinity, OpenSea, Dapper Labs (NBA Top Shot), and Yield Guild Games.

Notably, Animoca adopts a hybrid model, generating revenue not only from token/equity investments but also from game sales, in-game purchases, and trading fees. With its rapid growth and innovation, they were recognized by the Financial Times in 2023.

Animoca Brands often not only makes investments but also establishes strategic partnerships with projects, with recent investments including:

- hi: Animoca Brands announced a strategic partnership with the Web3 financial super app hi and committed to investing $30 million. This collaboration aims to enhance the utility of fungible tokens and Non-Fungible Tokens (NFTs) within the Web3 ecosystem.

- Bondex: the company received a strategic investment in the Web3 recruitment platform Bondex, further expanding its portfolio in the blockchain space. Bondex is also the first economically-aligned talent marketplace for recruiters, talent, and companies.

- CROSS THE AGES: Animoca led a $3.5 million equity funding round for CROSS THE AGES, a project focused on creating innovative gaming experiences.

To stay up-to-date on Animoca Brands' latest news and investments, you can check their media coverage: https://www.animocabrands.com/coverage

14.Spartan Capital

Spartan Capital is a fund operated by the Spartan Group, established in 2017 and headquartered in Singapore and Hong Kong. Spartan Group has a strong reputation in the venture capital space for its unique combination of traditional finance practices and innovative approaches in the Web3 domain, supporting leading companies and networks in the crypto space.

The group has a significant influence in mergers and acquisitions (M&A) and capital raising, leveraging its extensive network and expertise to co-create value with innovative founders and provide advisory services for its investments.

Some of its earlier and more prominent investments include:

- Merit Circle: a DAO dedicated to the "play-to-earn" gaming ecosystem, helping players earn resources and opportunities through blockchain games.

- Maple: a decentralized finance platform designed for institutional lending, allowing users to access liquidity through a decentralized pool network and providing attractive returns for lenders.

- Pendle: a protocol that tokenizes yield-generating assets, enabling users to trade future yield streams and enhancing liquidity in the DeFi space.

In 2024, Spartan Group is inclined to invest in GameFi and blockchain/data service startups, with 38 investments already this year. Some of the more recent investment projects include:

- Redacted: developing an integrated platform that combines blockchain and AI, allowing users to engage in gaming, trading, and content viewing.

- RedStone: a modular oracle providing efficient data to support DeFi and EVM. Redstone broadcasts signed data packets to the DDL and archives to Arweave, enabling users to utilize data streams in pull, push, and X models.

- Essential: building intent-based infrastructure and tools to drive the transition from value extraction to intent fulfillment. Deploying an Optimistic Rollup on Ethereum, creating an intent-centric Layer 2 blockchain.

- Chaos Labs: an automated on-chain economic security system that helps crypto protocols optimize risk management and capital efficiency while protecting user funds.

If you would like to contact the Spartan Group for investment consultation, you can reach them at [email protected]

15.Mechanism Capital

Mechanism Capital is an emerging investment firm founded in 2020, primarily focused on decentralized finance (DeFi). Recently, Mechanism Capital launched a $100 million fund called "Mechanism Play" specifically dedicated to investing in the play-to-earn gaming space, reflecting the firm's commitment to exploring innovative investment opportunities in the rapidly growing gaming industry. One of Mechanism Capital's co-founders is the well-known Crypto Twitter personality Andrew Kang.

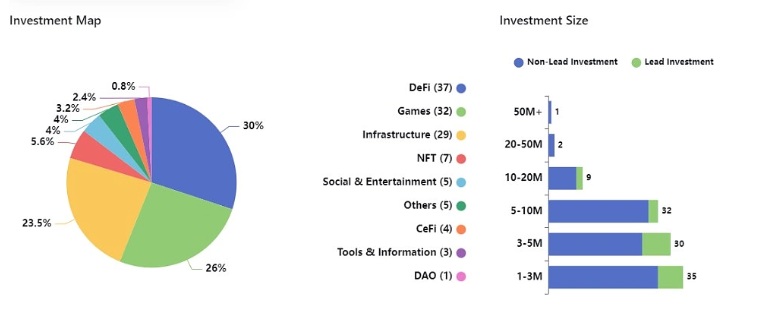

Image source: RootData

Mechanism Capital typically follows investment trends and has already invested in several prominent projects, including:

- Star Atlas: a large-scale strategy game set in a future metaverse, where players explore space, engage in territorial battles, and participate in a dynamic economy powered by blockchain technology. The game features three factions vying for dominance, and players can build and pilot their own spaceships, as well as trade assets through Non-Fungible Tokens (NFTs).

- Humanity Protocol: a project dedicated to enhancing trust and transparency in humanitarian work through decentralized solutions.

- Frax Finance: a stablecoin protocol that issues innovative decentralized stablecoins and includes multiple sub-protocols to support them. The Frax protocol currently issues three stablecoins: FRAX, FPI, and frxETH.

Recently, Mechanism Capital has started investing in artificial intelligence protocols, such as Nectar AI, a decentralized platform that aims to make users' dream girls and fantasies a reality in just seconds. They have also invested in Mira, a decentralized infrastructure that aims to democratize AI, allowing companies to build advanced AI systems using features like knowledge graphs, user insight systems, and evaluator networks.

For those friends who enjoy high-risk investments, you will be pleased to know that Mechanism Capital recently also participated in a $12 million funding round for Shiba Inu.

To contact Mechanism Capital, you can visit their Twitter page: https://twitter.com/mechanismcap.

Conclusion

In 2024, the cryptocurrency and blockchain space is being profoundly influenced by a diverse group of venture capital (VC) firms, each bringing unique strategies and areas of focus. From established firms like Andreessen Horowitz (a16z) and Paradigm, to emerging players like Mechanism Capital, these companies are driving innovation across various segments of the crypto ecosystem.

Here are some key highlights from the overview:

- Massive Capital Deployment: Firms like a16z have raised billions of dollars in dedicated crypto funds, demonstrating strong confidence in the industry's future.

- Diversified Areas of Focus: Investment areas span from infrastructure and decentralized finance (DeFi) protocols, to emerging technologies like GameFi, Non-Fungible Tokens (NFTs), and blockchain-integrated artificial intelligence.

- Strategic Support: Beyond just capital, many firms provide technical expertise, networking opportunities, and strategic guidance to their portfolio companies.

- Global Reach: While many firms are based in traditional tech hubs like San Francisco, their investments and influence are global, reflecting the decentralized nature of the crypto industry.

- Evolving Strategies: Firms adapt their strategies based on evolving needs, with some specializing in specific areas like Animoca Brands in blockchain gaming, while others like Multicoin Capital focus on emerging trends.

As the crypto industry matures, these venture capital firms play a crucial role in funding innovation, supporting founders, and helping to bridge the gap between traditional finance and the decentralized future of Web3. Their investments and strategies are likely to continue shaping the direction and growth of the cryptocurrency and blockchain space.