After today, Trump will become the most powerful president since Roosevelt, and it was during Roosevelt's tenure that Fort Knox became the United States' strategic gold reserve base, and Trump has also announced that he will make BTC the federal reserve of the United States.

In this U.S. election, Trump defeated Harris in the popular vote, and as long as the electors are loyal to the will of the voters, Trump has already won more than half of the 538 electoral votes. Barring any surprises, 'Trumpy' can return to his loyal White House on January 6, 2025.

Furthermore, the Republican Party has already occupied 51 seats in the Senate, and the two parties in the House of Representatives are expected to form a balance of power. Even if the Republicans cannot control it, the gap between the two parties is within single digits, and thanks to Trumpy's multiple nominations of Supreme Court justices during his first term, the current ratio of conservative to liberal justices on the Supreme Court is stable at 6:3, which even surpasses that of President Roosevelt, as he did not fully control the Supreme Court.

The last time a miracle of two non-consecutive elections occurred was 132 years ago during the Cleveland era, and after November 5th, Wikipedia's page will need to be modified, as Trump's achievement of being the second-greatest president in history has been realized.

Looking back on the history of Rome, the Republican Party is already Trump's party, and the first-time unification of the three powers has also given him a power base that previous U.S. presidents did not have. The last time, Roosevelt established the dollar-gold alliance, until the Bretton Woods system collapsed, and this time, will BTC also initiate this historical process?

The Web3 institutionalization process begins

Institutionalization means stability in the Eastern powers, but in the eyes of Western powers like Trump and Musk, the System and the Deep State represent the corrupt interest groups that need to be destroyed. Therefore, Musk has personally joined the fray, hoping to become the helmsman of the Department of Government Efficiency (D.O.G.E.), adding new catfish and vitality to the existing political correction mechanism.

This is not a new idea. The birth of the FBI, the emergence of the IRS, and the establishment of the CIA were all new variables that could not be sustained by the existing route. Therefore, there is no need to believe that cryptocurrencies and BTC will truly change America, and the only thing we need to care about is how the dollar and gold are "Americanized", which is the so-called institutionalization, that is, the new rebellious forces are absorbed into the existing ruling order.

The end of the free dollar

The issuance of the dollar has gone through three stages: the Continental currency of the Revolutionary War era to the establishment of the Federal Reserve in 1913, the gold standard from 1879 to 1944, and the credit currency era after the 1970s.

As early as the American Revolutionary War, the Continental Army began issuing dollars, but at that time the dollar was more of a war bond, if you bet that the Continental Army would win, you would hoard dollars, and later during the Civil War, the federal government issued a large number of "greenbacks", which also had the characteristics of war bonds, while the Confederate government issued cotton bonds, and the industrialized dollar ultimately defeated the plantation owner's cotton.

Then came the Bretton Woods system of World War II, with the dollar pegged to gold and other countries' currencies pegged to the dollar, a dual peg mechanism that was effectively a gold standard. But after Nixon announced that gold would no longer be convertible to dollars, the system formally collapsed.

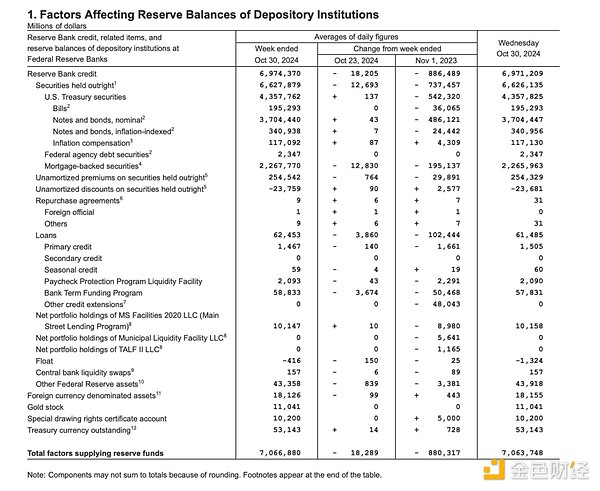

The above is the history of the dollar that we are familiar with, and the dollar today is actually a coupon for the redemption of U.S. Treasury bonds, with the Treasury Department issuing bonds and the Federal Reserve purchasing them as reserve funds for dollar issuance. The Luna-UST dual currency mechanism is nothing more than a clumsy imitation.

The free banking era between the 1820s and the Civil War, when greenbacks were issued, and the current prosperity of cryptocurrencies are no different, with many banks able to issue their own banknotes, essentially a kind of sight draft, and even if the face value of the banknotes issued by different banks was the same, there was still a lack of interoperability. At the most crazy time, there were more than 70,000 different "dollars" on the market.

To a considerable extent, the chaos of the dollar system was also one of the causes of the Civil War.

This chaos in the issuing entities naturally cannot continue to exist, just as the current regulatory thinking on cryptocurrencies, if not managed, even gold will be sold at prices ranging from the moon to the underworld, and the economic system will remain in a Brownian motion.

Accordingly, the U.S. enacted the National Banking Act in 1863, establishing a number of national banks and the Office of the Comptroller of the Currency (OCC). However, it should be noted here that the U.S. government did not deny the qualification of other banks to issue banknotes, but rather conducted "audits" and supervision in a targeted manner, just as the SEC is examining the "securities issuance" qualifications of various cryptocurrencies, not denying your cryptocurrency issuance qualifications. The characteristics of U.S. management are hidden in history.

At this point, the U.S. government began to intervene in the dollar on a large scale, until the economic crisis of 1907, when J.P. Morgan played the role of savior, and thus gained the hard power to collaborate with the U.S. government. In 1913, the Federal Reserve Act was enacted, and the Federal Reserve (Fed) was born, and the free dollar was completely ended.

After BTC lands

Zhang Hua got into Peking University, Li Ping got into a technical secondary school, and I'm a salesperson at a department store, we all have a bright future.

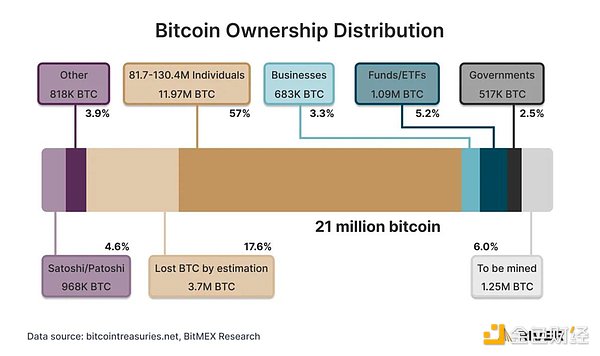

There are only two types of cryptocurrencies in the world, BTC and others. In Trump's view, the dollar needs a new anchor, and BTC will be a better anchor than U.S. Treasuries, at least as good as gold as a supporting asset. The only problem is that BTC's price cannot accommodate tens of trillions of liquidity, and if each BTC is worth a million dollars, it is more likely that the dollar will depreciate.

Let's do a simple math problem. The current U.S. debt is $35 trillion, and the current BTC circulating supply is around 19.1 million. Doing a simple division, to solve the U.S. debt crisis, the price of a single BTC needs to reach $1,832,460, so the current $75,000 is just an appetizer, with another 24-fold increase to go.

A more rational choice is that BTC does not need to become a reserve asset for the dollar like gold, it only needs to solve the interest on U.S. debt. According to the calculations, the current U.S. debt interest is around $1 trillion, which is about half the value of the cryptocurrency market or equivalent to the BTC market value. But this still requires the U.S. government to control all or most of the BTC, and regardless of whether the U.S. government can do this, an asset without liquidity has no value.

Currently, the U.S. government's BTC holdings are around 1%, but like J.P. Morgan to the Federal Reserve, most of the BTC ETFs are U.S.-backed, and if you add their 5.2% share and Satoshi Nakamoto's passive lockup of 4.6%, the U.S. government theoretically has the ability to control or influence around 10% of the BTC price, which is already a super whale.

By 2034, there will be about $10 trillion in U.S. debt interest. Considering that Trump's term is only 4 years, if BTC can truly serve as a reserve for the dollar, then only about $5 trillion in interest needs to be solved, and the price of a single BTC only needs to reach $261,780, about 3 times the current price, which is possible to achieve, as long as we adopt the attitude of "after I'm gone, let the flood come".

And the entire Web3 will also enter the American era, the last time the Internet dividend bore the fruits of Silicon Valley, and this time, who knows how it will proceed.