Table of Contents

ToggleBit coin and related concept stocks continue to rise

Despite the end of the US election, Bit coin continued to rise after the US stock market opened, pushing its historical high to $76,400 this morning, while Ethereum also started to recover, standing at $2,800.

At the same time, the stock prices of many Bit coin miners, including Cipher Mining and Riot Platforms, have also risen by more than 20%. The trading volume on the Robinhood platform even set a record, with the three most actively traded stocks being crypto concept stocks: Coinbase, MicroStrategy and IBIT.

Bit coin ETF surges in volume

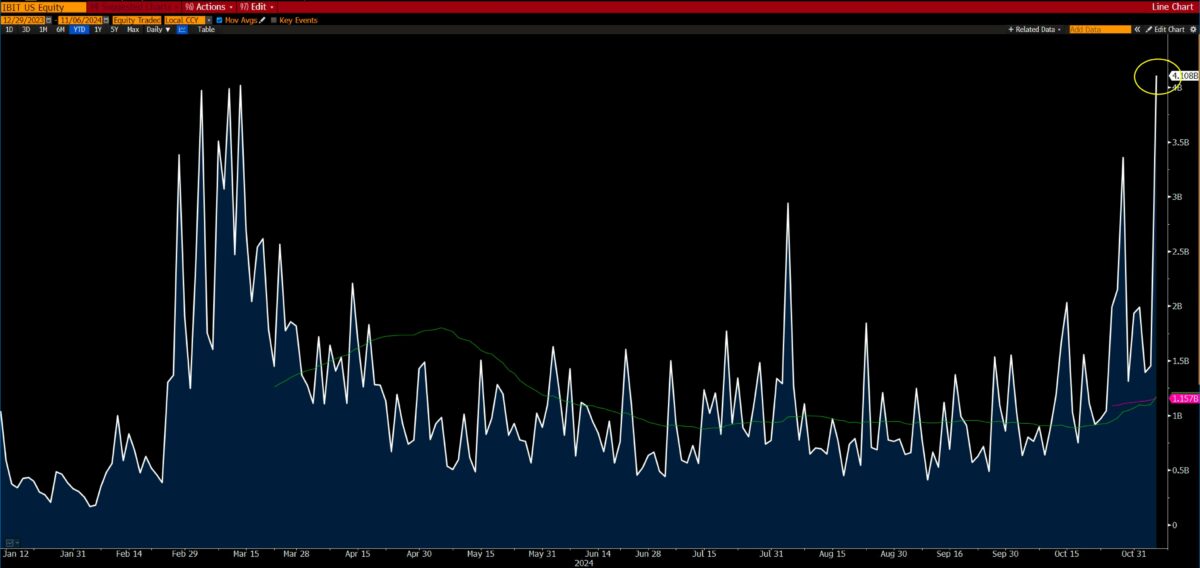

On the other hand, according to information shared by ETF analyst Eric Balchunas, the BlackRock Bit coin Spot ETF IBIT set a record for the highest trading volume ever last night, with a trading volume of $410 million, and recorded the second best single-day gain (10%) since its launch.

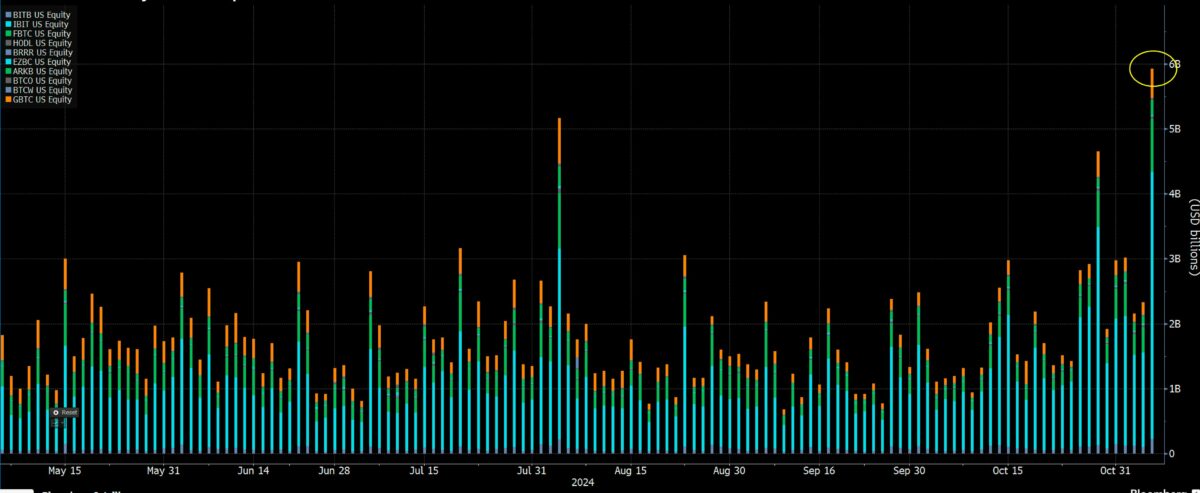

The total trading volume of all Bit coin ETFs reached $6 billion last night, setting a new all-time high.

The data so far shows that the net inflow of Bit coin ETFs yesterday exceeded $690 million, and it should be noted that this figure does not include the highest trading volume of IBIT.

How analysts see it

Regarding the subsequent market trend, QCP Capital issued a statement last night, stating that since its appearance in 2009, BTC has experienced three election cycles, and there has been a price rebound after each election, and the price has never fallen back to the pre-election level. Analysts expect that as the market enters 2025, this bull market momentum will remain strong.

On the other hand, Geoff Kendrick, the global head of digital asset research at Standard Chartered Bank, also stated in a briefing on Wednesday that after Trump's victory, the price of Bit coin will reach $125,000 by the end of this year, and will reach $200,000 by the end of 2025.

This forecast is consistent with the earlier estimate made by analysts at the research and brokerage firm Bernstein this month. Standard Chartered Bank also made a similar forecast in October.

Kendrick believes that many of Trump's pro-crypto currency promises, such as firing the chairman of the US Securities and Exchange Commission Gary Gensler, establishing a national strategic Bit coin reserve, and reshaping the US as a "Bit coin superpower", will drive up the price of Bit coin. In addition, from the Bit coin options trading, Standard Chartered Bank found that many investors are interested in the price around $80,000, indicating that Bit coin will reach this level "within the next one or two weeks".