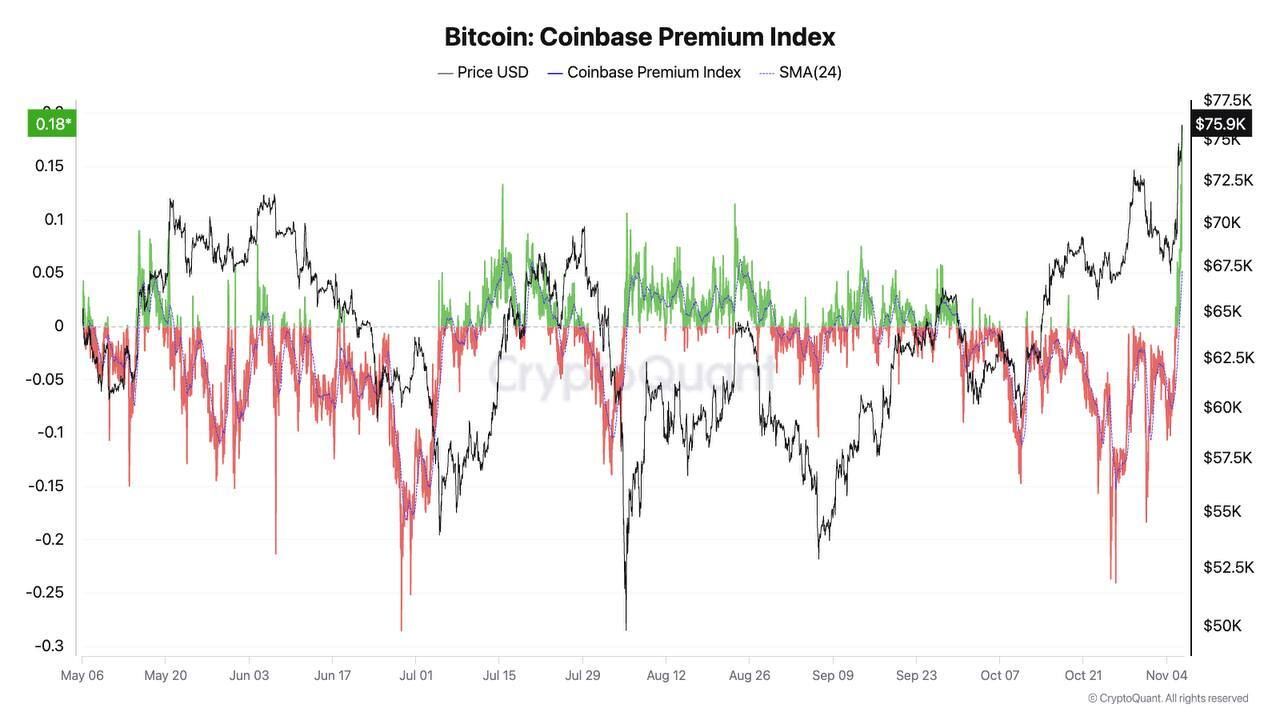

The price of Bitcoin (BTC) has recently reached a new all-time high after Donald Trump was elected as the President of the United States. This surge in demand appears to be driven by renewed interest from US investors, as evidenced by a significant increase in the Coinbase Bitcoin price premium.

Historically, a positive Coinbase premium has been associated with a sustainable rise in Bitcoin prices. This suggests that US-based traders are becoming more optimistic. The current uptrend is gaining momentum, and there are expectations that BTC may soon test even higher price levels.

BTC Coinbase Premium Index Hits New All-Time High

One of the most notable developments is the resurgence of Bitcoin demand from US-based investors and traders. This is closely linked to the election of Donald Trump as the new President of the United States.

This increased interest is clearly reflected in the Coinbase Bitcoin price premium, which has soared back into positive territory for the first time since October 18th.

Read more: What is a Bitcoin ETF?

Notably, it has surged to its highest level since May, as indicated by the green line.

"Historically, a positive Coinbase premium has coincided with a sustainable rise in Bitcoin prices," said Julio Moreno, the Head of Research at CryptoQuant.

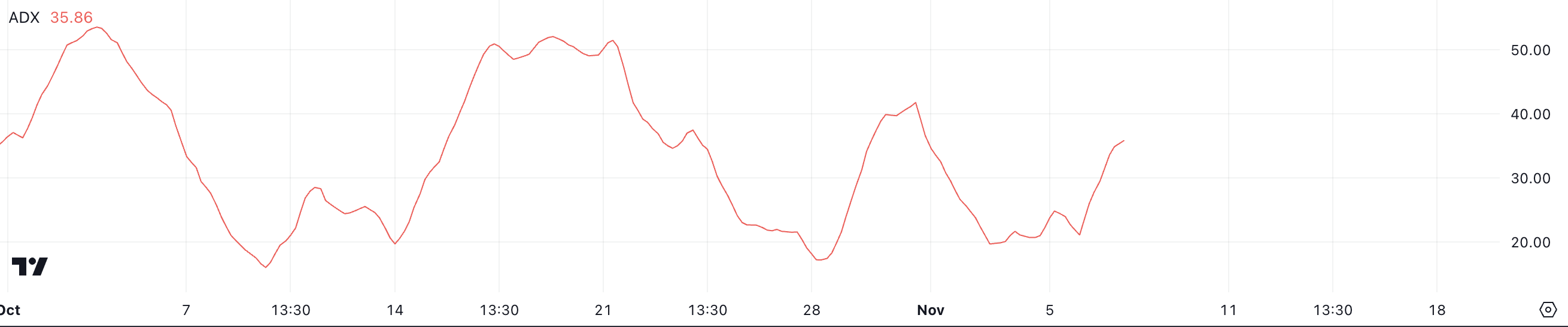

BTC's ADX Indicator Signals Strong Uptrend

Bitcoin's ADX currently stands at 35.86, a significant increase from the previous day's 20.98, indicating that the trend is strengthening. The ADX, or Average Directional Index, is used to measure the strength of a trend.

A sharp rise in ADX suggests that the momentum of the current trend has increased substantially.

The ADX helps traders determine whether the market is trending or ranging. Generally, an ADX below 20 indicates a weak or non-existent trend. An ADX between 20 and 40 suggests a trend of medium to strong strength.

An ADX above 40 indicates a very strong trend. With Bitcoin's ADX currently at 35.86, it signifies a robust uptrend and the potential for new all-time highs.

BTC Price Forecast: Likelihood of Consecutive New Highs Increases

Bitcoin's moving average (EMA) lines are currently in a positive position. After reaching new all-time highs, the price has retraced slightly but remains bullish.

The EMA, or Exponential Moving Average, helps smooth out price movements and identify trends. In this case, the positioning of these lines suggests ongoing optimism.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Bitcoin's price is well above the EMA lines. All the short-term EMA lines are above the longer-term ones, indicating a strong uptrend. If this momentum is sustained, Bitcoin could continue its upward rally and set new all-time highs, potentially targeting the $76,000 area.

However, after reaching new peaks, investors may take profits or consider investing in other coins, leading to some price correction. If the trend reverses, Bitcoin could test strong support levels at $65,500 and $62,000.