1) On the economic and inflationary situation. Powell said in his opening remarks that the economy is expanding steadily and consumption is strong; if there are no storms and strikes, the number of hires will be "slightly higher", the labor market is not the source of inflationary pressure, and the labor market situation is more relaxed than before the pandemic; core inflation remains at a relatively high level, while inflation expectations remain stable.

2) On the decision to cut interest rates this time. A reporter asked, given the positive economic data, why are you still cutting interest rates? Powell said that strong economic data is a good thing; the current policy is still restrictive, although the degree of restriction is uncertain; the job market does not need additional cooling to achieve the inflation target; the Fed started cutting interest rates in September, and today's decision is another step. Later, another reporter asked why not pause the interest rate cuts given the resilience of the job market and the stickiness of core inflation? Powell said that looking at the core inflation level of around 2.3% over the past 2-3 months (lower than the latest 2.6%); the Fed fully understands the volatility of inflation, just like core inflation was very low in the second half of last year. In addition, he discussed in detail the various components of inflation, believing that non-residential services have basically returned to pre-pandemic levels; residential services inflation is currently high, but mainly reflecting a "catch-up" effect, reflecting past inflationary pressures rather than current ones; insurance prices are high, but may also be due to a similar catch-up logic. He then concluded that he is confident that inflation will continue to move towards 2%, although it is not yet time to declare victory.

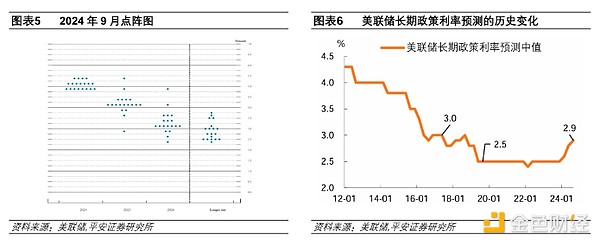

3) On the decisions in December and next year. In his opening remarks, Powell emphasized the "two-way risks" going forward, saying that if the economy remains strong but the inflation rate cannot sustainably move towards 2%, the Fed can reduce policy constraints more slowly; if the labor market unexpectedly weakens or the pace of inflation decline is faster than expected, it can act more quickly. When asked whether the current expectations and the September dot plot are still consistent, Powell said that overall, the Fed feels good about economic activity; the latest inflation is not terrible, but a bit higher than expected; by December, the Fed will have more data, another employment report and two inflation reports and many other data, and will then make a decision in December. He emphasized that the Fed is trying to strike a balance between acting too quickly and acting too slowly. When asked about the room for rate cuts in 2025, Powell stressed that he did not make any forecasts this time and avoided discussing his personal views.

4) On the neutral interest rate and two-way risks. In response to a question mentioning the neutral interest rate, Powell said that nothing makes him feel the need to rush towards the neutral rate. A reporter asked what the specific uncertainties are going forward? Powell first mentioned the risk of "moving too quickly", and then emphasized the risk of moving too slowly. In addition, he stressed that the Fed is trying to stay "in the middle", and as the policy rate moves closer to the neutral rate, the level of the neutral rate will become more uncertain, so they may be more cautious.

5) On the election and fiscal policy. The first reporter's question touched on the election, and multiple questions addressed how the results of the election and the new government's tax cuts and other policies would affect the Fed's decisions. Powell remained cautious in the face of most questions, trying to avoid excessive commentary on politics and fiscal policy. However, he also mentioned some key information. For example, he explained how the Fed's "models" take into account fiscal policy, emphasizing that in the short term, the election will not affect monetary policy; in principle, any government's policies or policies enacted by Congress could have economic impacts over time; these economic impacts will be incorporated into our economic models and considered, along with countless other factors; but the specific policies and their potential impacts are not yet clear, so the Fed cannot quantify them with models. In addition, in discussing fiscal and financial stability, Powell stressed that the US fiscal policy is on an unsustainable path, with debt levels not inappropriate relative to the economy; in the context of very large deficits, you are in a state of full employment, and this situation is expected to continue; so addressing this problem is important, as it will ultimately pose a threat to the economy.

6) On whether Powell will continue to serve. A reporter asked that if Trump asked Powell to resign, would he leave? Powell said: NO. Later, another reporter asked whether the president has the power to dismiss or demote the Fed chair? Powell said such actions "are not legally permitted".

3. Policy Logic: Why Insist on Rate Cuts?

Based on Powell's remarks this time and the economic and market situation in the US, we believe that the Fed's insistence on a 25BP rate cut can be understood from three aspects:

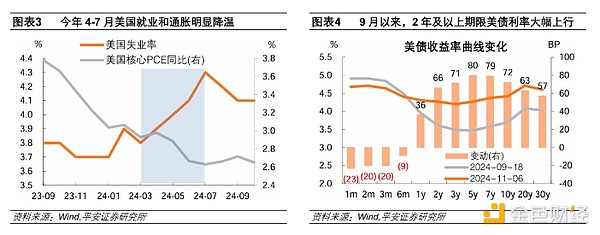

First, although the employment and inflation data released after the September meeting have strengthened, they have not offset the progress made in cooling earlier. The Fed's "compensatory" 50BP rate cut in September was not out of the blue, but the result of the continued cooling of employment and inflation in April-July this year. Moreover, the "excess savings" of US residents turned negative for the first time in May, which is basically in line with the "turning point" of employment and inflation. So although the US economic data rebounded in September, it may not have reversed the cooling trend of employment and inflation over the past half year. Overreacting to monthly data has never been a wise move.

Second, the Fed subjectively hopes to maintain policy inertia as much as possible. The saying "there is no turning back once you start" applies here - the Fed made a large rate cut in September, and then the economic and inflation data immediately rebounded, which has been criticized for being overly data-dependent and lacking foresight. In his remarks this time, Powell said that this rate cut can be seen as "another step".

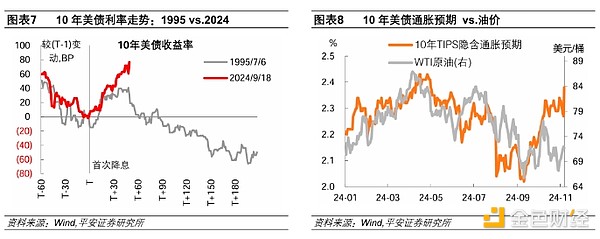

Third, the recent rise in market interest rates has further given the Fed room to cut rates. Since the September 18 meeting, against the backdrop of strong economic data and the "Trump trade" (boosting medium-term economic and inflation expectations), 2-year and longer-term US Treasury yields have risen sharply, with the 10-year US Treasury yield reaching its highest level since early July as of November 6. The self-driven rise in market interest rates may put downward pressure on the economic and inflationary outlook for the next period, and is also a reflection of the Fed's weakened ability to control market interest rates. Therefore, the Fed's insistence on cutting rates this time may also be out of a consideration to curb the overly rapid rise in market interest rates.

4. Market Outlook: Downward Trend in Interest Rates Remains the Main Direction

In the short term, due to the resilience of the US economy and inflation, coupled with the market's close attention to the inflationary pressures caused by Trump's new policies, US Treasury yields may remain at a relatively high level; US stock investors may tend to believe that the US economy can "digest" high interest rates, and thus maintain a relatively strong risk appetite; high interest rates and a strong economy may also provide support for the US dollar exchange rate.

However, looking ahead to the next half year to a year, the direction of policy and market interest rates is still downward. Moreover, if the economic and inflationary data cools further in the next few months, the market's view on the future interest rate path may be adjusted in a timely manner.

First, the impact of Trump's new policies on the economy and inflation will not be immediate. The core provisions of the 2017 Trump tax reform law will not expire until December 31, 2025, and although the expectation of tax policy adjustments may have a certain impact on current resident consumption behavior, it should not be overestimated; on the tariff front, the final implementation and effectiveness of the policies still require time, and their impact on inflation remains to be observed.

TRON must be translated into TRON.

HT must be translated into HT.

AR must be translated into AR.

RON must be translated into RON.

ONG must be translated into ONG.

Secondly, the Fed still has ample room to move from a restrictive interest rate to a neutral interest rate. The Fed's forecast of the long-term policy interest rate has remained around 2.5% from June 2019 to December 2023, and around 3% in 2016-2018; as of September 2024, the Fed's latest forecast is 2.9%, which has risen somewhat from the pre-pandemic level. Even so, the current policy interest rate level (4.50-4.75%) is still significantly higher than the long-term policy interest rate, indicating that the Fed has ample room for rate cuts this round. In addition, there is currently a lack of substantial evidence that the potential growth rate or long-term neutral interest rate in the United States will be revised significantly upward. Since 2008, the United States and major developed economies have been in a low-growth, low-inflation, low-interest rate ("three lows") pattern, the reasons for which are extremely complex, some of which, such as long-term insufficient demand, the development of international trade, and the slow progress of technological advancement and innovation, may undergo changes in the post-pandemic era due to changes in fiscal logic, increased emphasis on economic security, and the development of new technologies such as AI. However, problems such as population aging, global savings surplus, and the need for more time for the application of AI in the economy and society, do not seem to have undergone significant changes.

Finally, the risk of short-term overshooting of US bond yields is relatively high. On the one hand, the trend of US bond yields has been stronger than in 1995, with the increase in 10-year US bond yields since the first rate cut this round exceeding 70BP, significantly higher than the 40BP in 1995; but it is worth noting that in 1995, US bond yields began to decline about a month and a half after the first rate cut. On the other hand, the recent inflation expectations in the US bond market have clearly exceeded its correlation with oil prices for most of this year. This may reflect investors' concerns about the inflation outlook in the United States after Trump's election, but there are signs of excessive concern.