If the Avalanche price turns the $31 key resistance level into support, it could be on the verge of a 56% bull marketMore information Crypto Dumplings

The price of Avalanche has rebounded in the past three days and is trying to break through the 50-day moving average. The trading price of the 12th-ranked cryptocurrency AVAX is $27.22, higher than the $22.75 low this week. Traders now hope that further gains can push it up 56% to the critical resistance level of $42.

Potential Catalysts for AVAX Surge

In the short term, multiple factors may drive up the price of Avalanche. Avalanche announced on Thursday that it has acquired 1.9 million AVAX tokens from the collapsed Luna Foundation Guard. These tokens were initially worth $45 million and are now worth $53 million.

At the same time, the Federal Reserve may decide to cut interest rates at its November meeting. A rate cut the day after Trump's election victory could trigger further gains in risk assets, including cryptocurrencies.

Network data shows that the Avalanche blockchain is performing well, with the number of active addresses rising to 94,154, the highest level in two weeks.

Avalanche Active Addresses

Additionally, Avalanche has made several high-profile collaborations in the past few months. Recently, it was selected to participate in a project by the largest US bank, JPMorgan, called Kinexys. This collaboration will explore privacy and identity solutions for large institutions.

Further analysis of some on-chain indicators reveals that whale activity has increased by 49% and trading volume has increased by 14% at the time of writing.

This suggests that larger market participants and active traders are actively engaged in AVAX, potentially indicating a positive sentiment.

Will Avalanche Price Retest $42?

The technical analysis indicates that the Avalanche price may see a rebound, potentially rising to the important resistance level of $42, the May 22 high.

The likelihood of this rebound has increased after the currency found strength on the uptrend line connecting the higher lows since August 7. It is also trying to break through the 50-day and 100-day exponential moving averages (EMAs), indicating that the bulls are about to regain control.

Additionally, the Avalanche price oscillator has started pointing upwards, and the relative strength index (RSI) has crossed above the neutral 50 level. The MACD indicator's two lines have also turned upwards and are about to cross the zero line.

Therefore, with support from trading volume, a breakout of the $31 resistance level could lead to further gains up to $42. Such a rebound would mean a 56% rally from the current level.

Avalanche Price Chart

On the other hand, a break below the uptrend line would invalidate the bullish outlook and suggest more bearishness in the market. In such a case, the AVAX token would drop to the next critical support level of $17.27, the August low. Avalanche may continue to perform well in the coming weeks as long as its price remains between $22 and $26, which could lead to a bullish breakout.

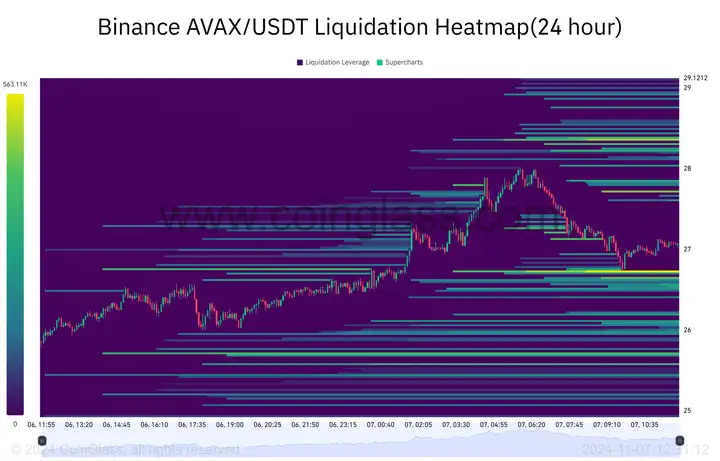

It's worth noting that research on Coinglass data shows that at the $26.73 level, the liquidation pool value for AVAX is as high as 563K, indicating the potential for a short-term pullback.

This level can act as support or resistance, depending on the market's reaction and the extent of whale-driven and trading activity.

In the case of Avalanche, large traders are flooding the market, as evidenced by the increase in the number of large transactions.

After the next liquidation is utilized, AVAX may face a brief pullback before the expected rebound.

What's Next for AVAX?

If the support level holds and becomes the new resistance, the bullish momentum of the Altcoin may continue, leading to further gains. Although it has several catalysts, such as the Federal Reserve's decision and the buyback of Luna Guard tokens, the market may see a short-term pullback if the $28.16 resistance level holds, and it needs to break the $31 key resistance level to confirm the bullish trend.