With Trump winning the US election the other day, the Federal Reserve will cut the benchmark interest rate by 25 basis points to 4.50%-4.75% today (November 8th) (the second consecutive rate cut this year, in line with market expectations), and the market sentiment has also remained bullish, with Bitcoin continuously breaking through historical highs to reach $76,990.

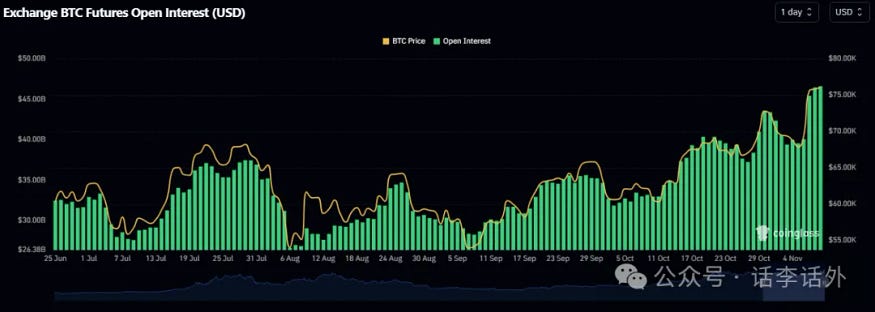

Although the outcome of the US election will have a long-term impact on the crypto market, we should not ignore the short-term volatility risk. In the fluctuating and rising market of Bitcoin this week, in the past 24 hours alone, the total amount of liquidations in the crypto market has exceeded $348 million, with over 96,000 people being liquidated. At the same time, the open interest in Bitcoin on exchanges has reached a historical high of $46.6 billion, which usually suggests that there may be greater volatility or that the short-term peak has been reached, so please do not FOMO and try to stay away from leverage as much as possible.

In our previous article (November 5th), we mentioned that the crypto market has never lacked hot spots, and a new important event becomes the focus of attention and discussion almost every now and then. Now, with the US election in November and the second rate cut by the Federal Reserve expected to materialize, it is estimated that people will soon start looking for or focusing on the next new event.

From a short-term perspective: The current breakthrough of Bitcoin's price to a new high is mainly due to the sentiment impact of Trump's victory in the US election, which we have already elaborated on in our previous article. At this stage, the leverage ratio in the crypto market has risen significantly, so we cannot rule out the possibility of a short-term adjustment.

From a medium to long-term perspective: As we have foreseen in our previous articles, with the breakthrough of Bitcoin, a new bull market has arrived. Although there may be some adjustments in the short term, this is normal, as the market cannot rise in a straight line, and there will always be some adjustments along the way. But if you are still in a wait-and-see mode at this stage, still hoping to buy the dips at below $40,000, then you will likely continue to miss this bull market.

So, how high can the price of Bitcoin reach in this bull market?

In fact, we have been thinking and guessing about this question in our articles since 2022, although from a personal psychological perspective, I am not willing to talk too much about any market forecasts or price predictions. But as a blogger, I know that many people (especially newcomers) like to see this kind of content, so I will occasionally do some market analysis or price predictions (guesses).

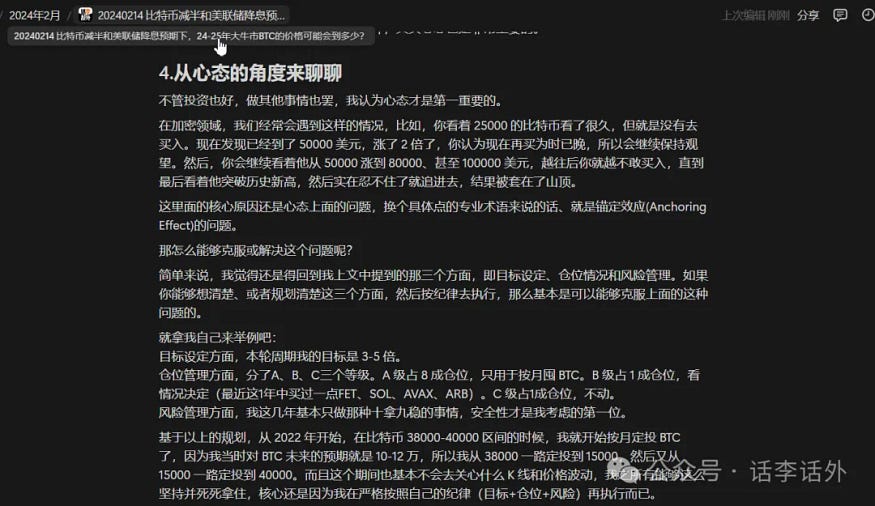

As for the price of Bitcoin, for example, in our article on February 14, 2024, we had made some simple thoughts on the market trend from 4 different dimensions, and at that time we further made a subjective prediction on the price of BTC, and the bullish price tendency was in the range of $100,000-$120,000, and this range would also be the range where I would start to consider batch selling. As shown in the figure below.

Of course, we still stick to the old saying that the market is unpredictable, and all so-called predictions are merely guesses based on historical experience and data by different people. The logic here should not be to look at what others say, because everyone's risk preference, position situation, personal experience, etc. are not the same, you should make a reasonable plan and strategy based on your own situation.

Currently, we maintain our personal expectation (guess) that Bitcoin will reach a price of $100,000-$120,000 in this cycle, but with Trump's victory leading to a rapid breakthrough of Bitcoin's price to a new high, coupled with the expected positive measures that Trump may take towards the crypto market (e.g., making BTC a strategic reserve asset for the US) and the continued rate cuts by the Federal Reserve, we even believe that Bitcoin may reach as high as $150,000 next year (2025).

So, how high can the price of Ethereum reach in this bull market?

As mentioned above, if Bitcoin really can rise to over $150,000 next year, then in an optimistic guess, ETH has a good chance of reaching $12,000, and SOL also has a chance of exceeding $450, and some Altcoins theoretically also have 5-10 times room. And if we guess based on the $100,000-$120,000 range for Bitcoin as we did before, then the possible price for ETH would be $8,000-$10,000, and the possible price for SOL would be $300-$400. Of course, this is also just a personal guess based on the Bitcoin foundation, and not as any investment advice.

At the same time, we will also see some other positive influencing factors, such as:

- The rise of Coinbase stock

With Trump's victory, the suppressed demand seems to have been quite clearly manifested, and although off-chain traditional capital may not consider direct participation in the crypto market for some reasons at the moment, the recent rise in Coinbase stock can also indicate some issues. As shown in the figure below.

In addition to the performance of Coinbase stock, another point we need to further consider is that Coinbase (including Base chain) and its derivatives (such as staking, DeFi) are fundamentally closely linked to Ethereum, so in terms of price expectations, although the price of ETH is currently lagging behind the performance of Coinbase, it is likely to gradually narrow this gap in the near future.

And don't forget that ETH is still the only tool other than BTC that has an ETF product. At this stage, Bitcoin is continuously setting new highs, and Solana also broke its historical high market cap today (November 8th), so ETH is also worth looking forward to.

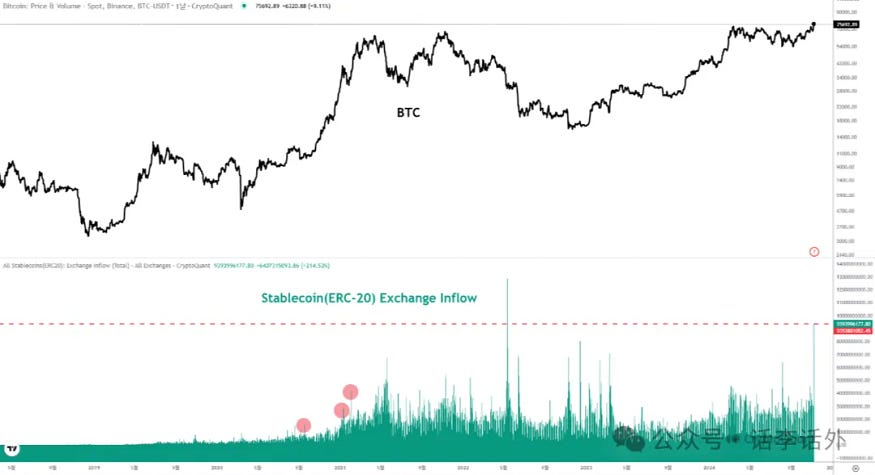

- CEXs are experiencing a large influx of stablecoins

The day after the US election, the inflow of stablecoins to exchanges like Binance and Coinbase reached a cumulative high of $9.3 billion, which is the second largest influx since the birth of ERC-20 stablecoins. Usually, this is a very positive signal, as a large portion of this capital may be used to buy BTC or Altcoins. As shown in the figure below.

And historically, the large-scale capital inflow from September 2020 to February 2021 and the subsequent upward trend occurred simultaneously with the bull market rebound. If history repeats itself, the current large influx may also trigger a similar upward trend, and the crypto market may experience another round of bullish rebound.

In addition, we also have to mention the issue of MEME coins again. In our previous article, we have mentioned that the trend of MEME coins seems to be at a stage-wise peak, and perhaps we will soon see the possibility of a rapid rotation of some Altcoin narratives.

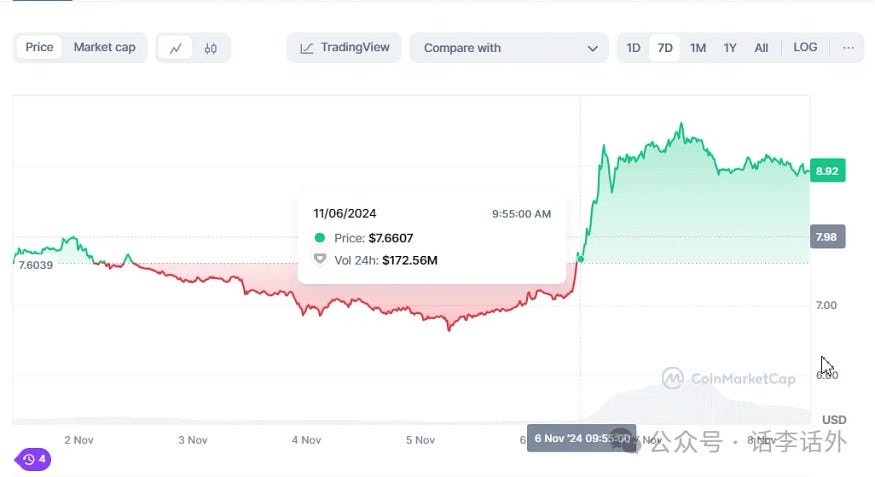

And with Bitcoin continuing to break new highs this week, I found that the rebounds of some projects in the DeFi category, such as UNI and AAVE, have indeed been very good. As shown in the figure below.

Previously, due to some regulatory pressure from the SEC, it seems that many Altcoins other than BTC were considered to be securities, which also made it impossible for many Altcoins to be normally traded in the US market. But with the inauguration of Trump, perhaps these issues may see some new changes.

We expect that before the first or second quarter of 2025, some Altcoins may be re-focused and traded by capital, and then the liquidity of some MEME may flow back to the Altcoin narrative. But in this process, due to the special nature of the MEME narrative in this cycle, we may continue to see the emergence of a few MEME get-rich stories (i.e., a few MEME will continue to rise), but the probability of a large-scale MEME cycle surge will be greatly reduced.

In the medium and long term, we remain optimistic about the overall development of the market. In any case, we firmly believe that Bitcoin will eventually reach over $100,000. But you also need to pay attention to short-term volatility, as the market may see sideways consolidation or a short-term decline this week or in the next few weeks with the election and rate cut expectations.

The bull market may seem like everyone can make money, but many people often lose money in the middle and late stages of the bull market. You must make your own plan and position management. If it's a short-term operation, be sure to do a good job of setting stop-loss and take-profit. And if you're still on the sidelines and want to catch the last opportunity of this bull market, then you need to seriously think about and adjust your strategy, because the bull market won't last forever.