Author: OurNetwork

Compiled by: TechFlow

This week has been exceptionally noteworthy both on-chain and off-chain, primarily due to the US presidential election. In this process, crypto-backed prediction markets played a crucial role in tracking the final election results. Particularly, Polymarket, with trading volumes reaching billions of dollars, has gained significant attention in political circles, as it had predicted the election outcome before it was reported in mainstream media.

Therefore, before we dive into our regular Bit reporting, we have a special report on prediction markets prepared for you. As always, on-chain data and the top-notch analysis team of OurNetwork have presented us with a unique story.

Prediction Markets + Bit Ecosystem

Polymarket | Ostium | Bit ETF | Rootstock | BOB

Polymarket

Polymarket Prediction Market Surpasses $3.11 Billion in Trading Volume in 30 Days

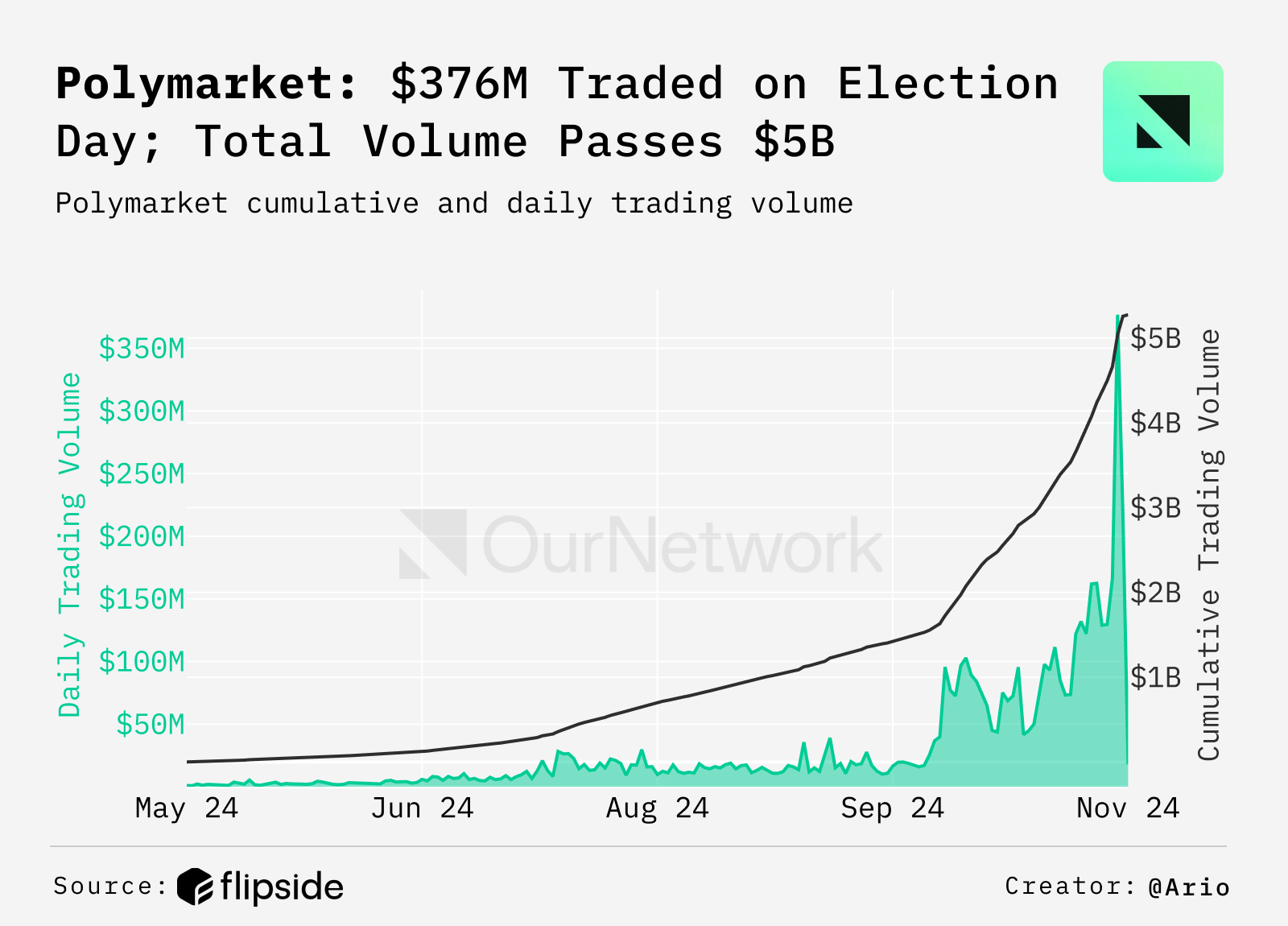

The decentralized prediction market platform Polymarket was highly active during the 2024 US presidential election. Users placed bets on the platform for various outcomes, with the trading volume exceeding $3.11 billion in the past 30 days. Since late September, Polymarket's trading volume has surged dramatically, initially at around $17 million per day, and then skyrocketing to over $376 million on November 5th (Election Day), a 22-fold increase.

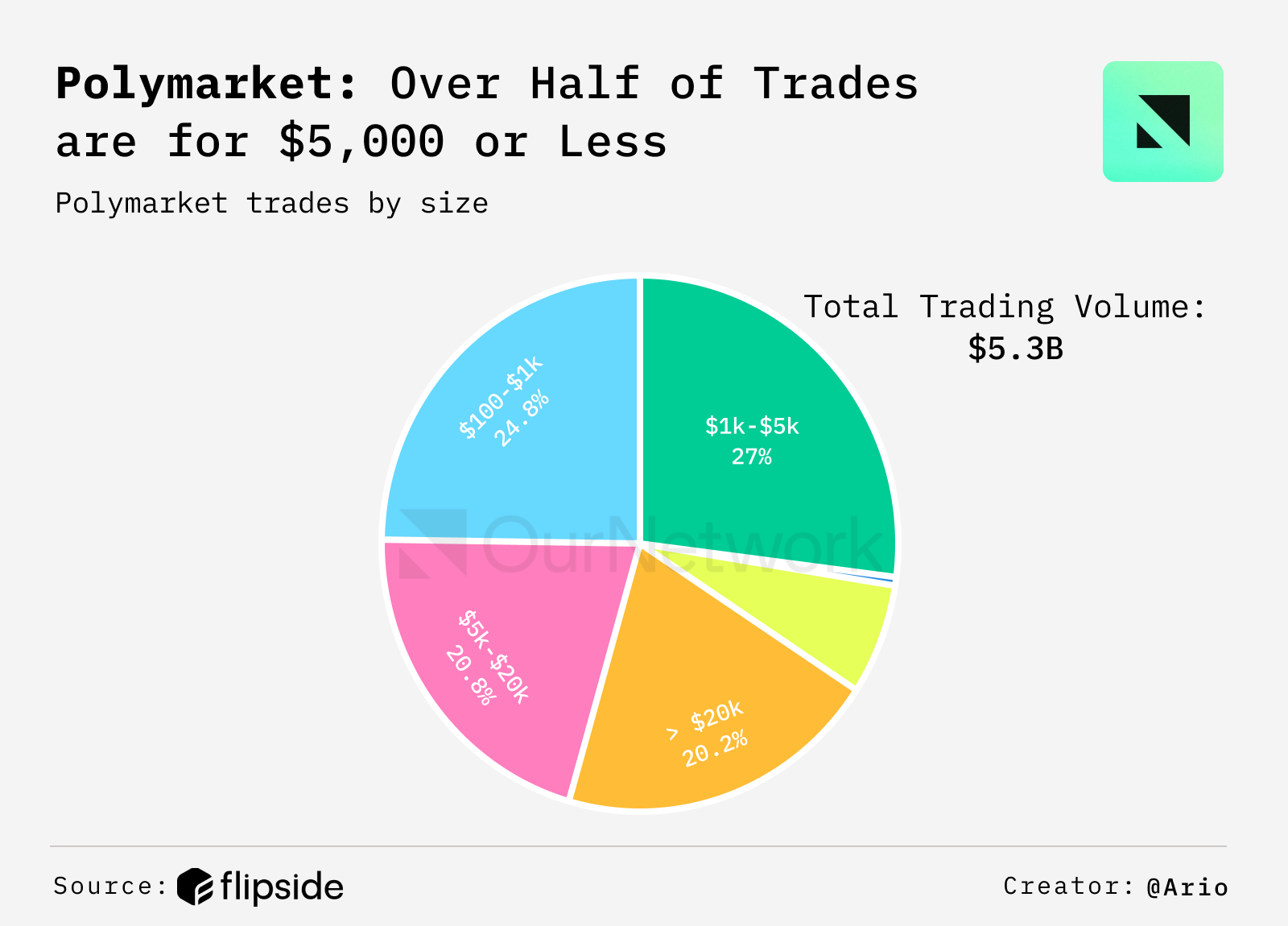

The trading volume analysis shows that 27% of the trading volume was between $1,000 and $5,000, and another 25% was between $100 and $1,000, indicating a high level of retail user participation. Additionally, over 20% of the total trading volume came from transactions exceeding $20,000, demonstrating the significant impact of major market participants.

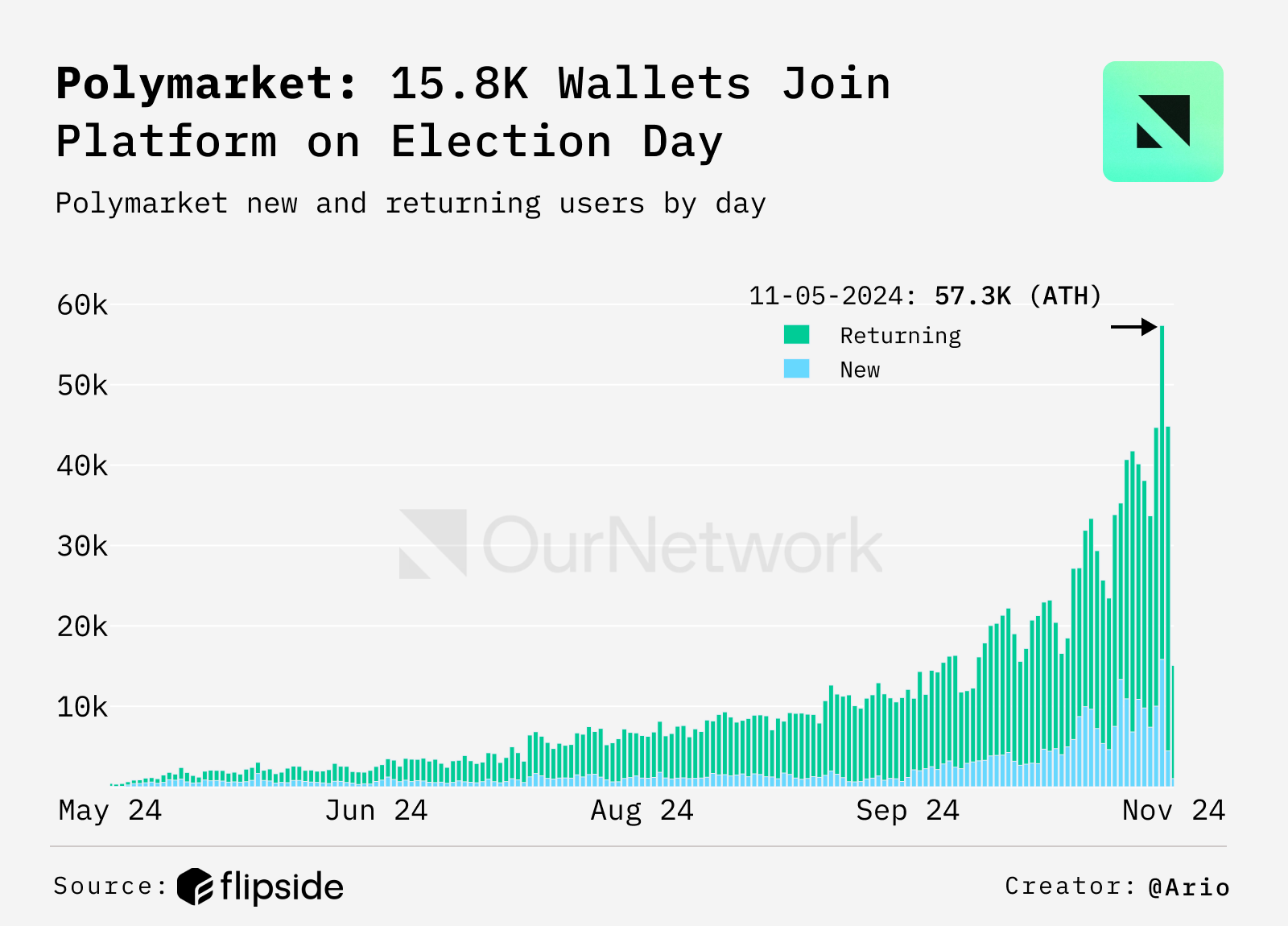

Polymarket's daily active users reached a new high of 57,300 on November 5th, a significant increase from less than 400 in early May. This growth, combined with a high user retention rate, indicates strong user engagement. On November 5th, there was a record 15,800 new wallets joining the platform.

Ostium

Kaledora Kiernan-Linn | Website | Dashboard

Ostium Trading Volume Surpasses $50 Million

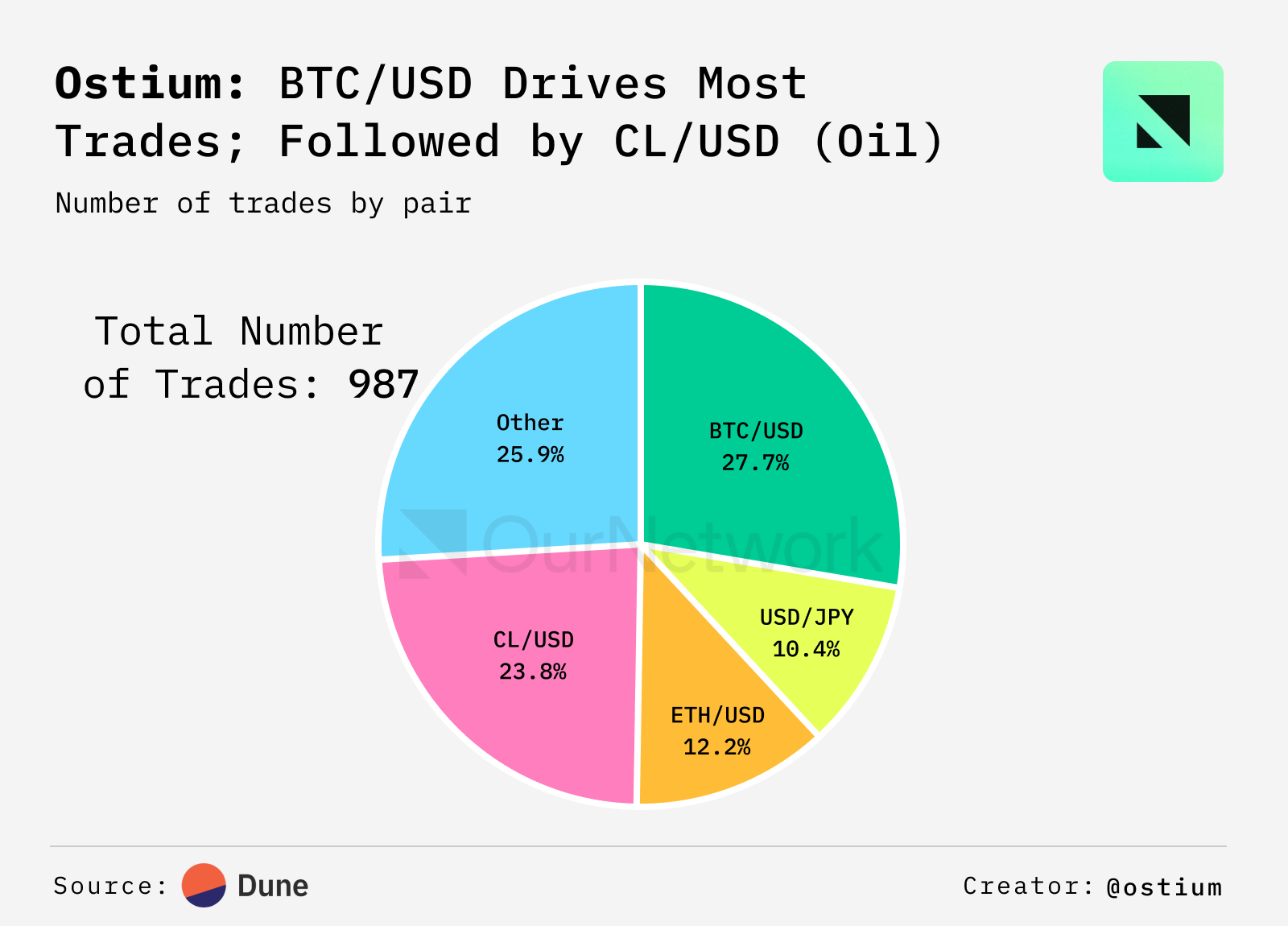

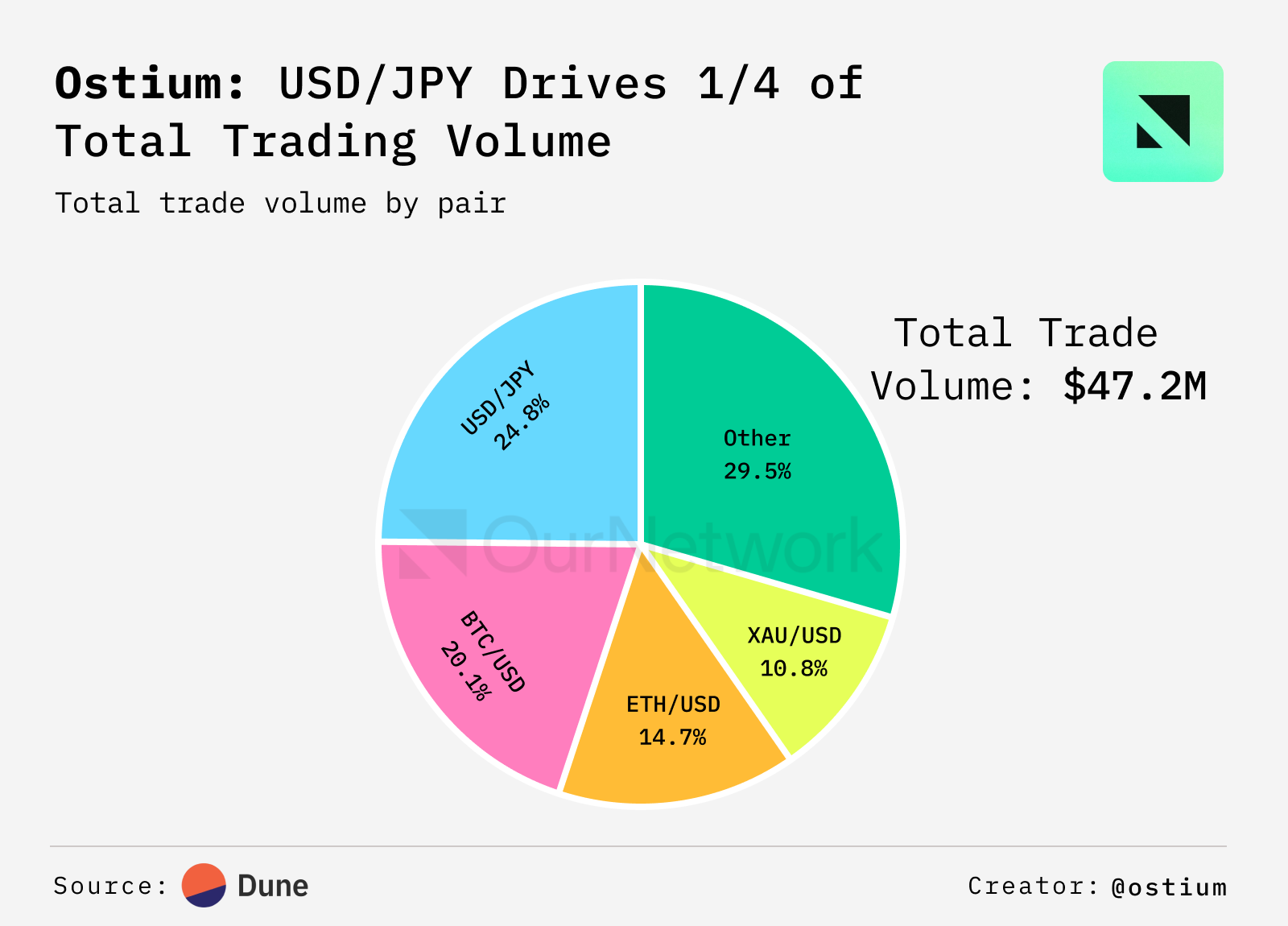

Ostium is making macroeconomics tradable. Users only need a wallet and 10 USDC to long or short a variety of assets, from forex, commodities, to crypto and stock indices. Over 65% of Ostium's cumulative trading volume comes from real assets, with USD/JPY accounting for the majority of recent trading volume due to the impact of JPY volatility and the Bank of Japan's rate decision. While the trading volume of CL/USD (oil) is relatively small, its independent trade count ranks second, accounting for over 20% of the platform's total trades.

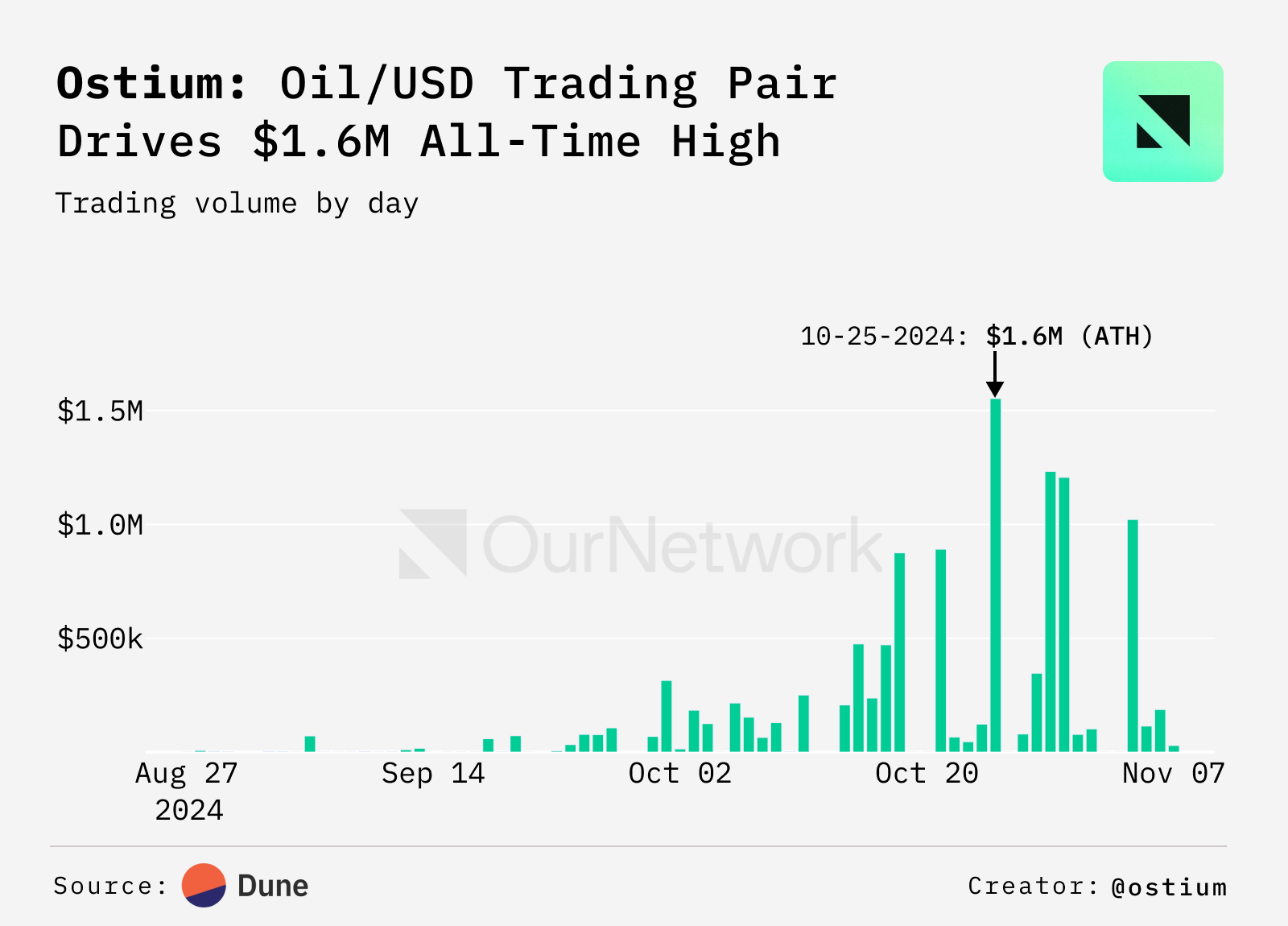

Trading volume closely follows macroeconomic events related to each asset. In the commodity markets (primarily oil), on October 25th, the day Israel launched a retaliatory attack on Iran, trading volume reached a historical high, as the market was concerned about potential damage to Iranian oil fields and its impact on prices.

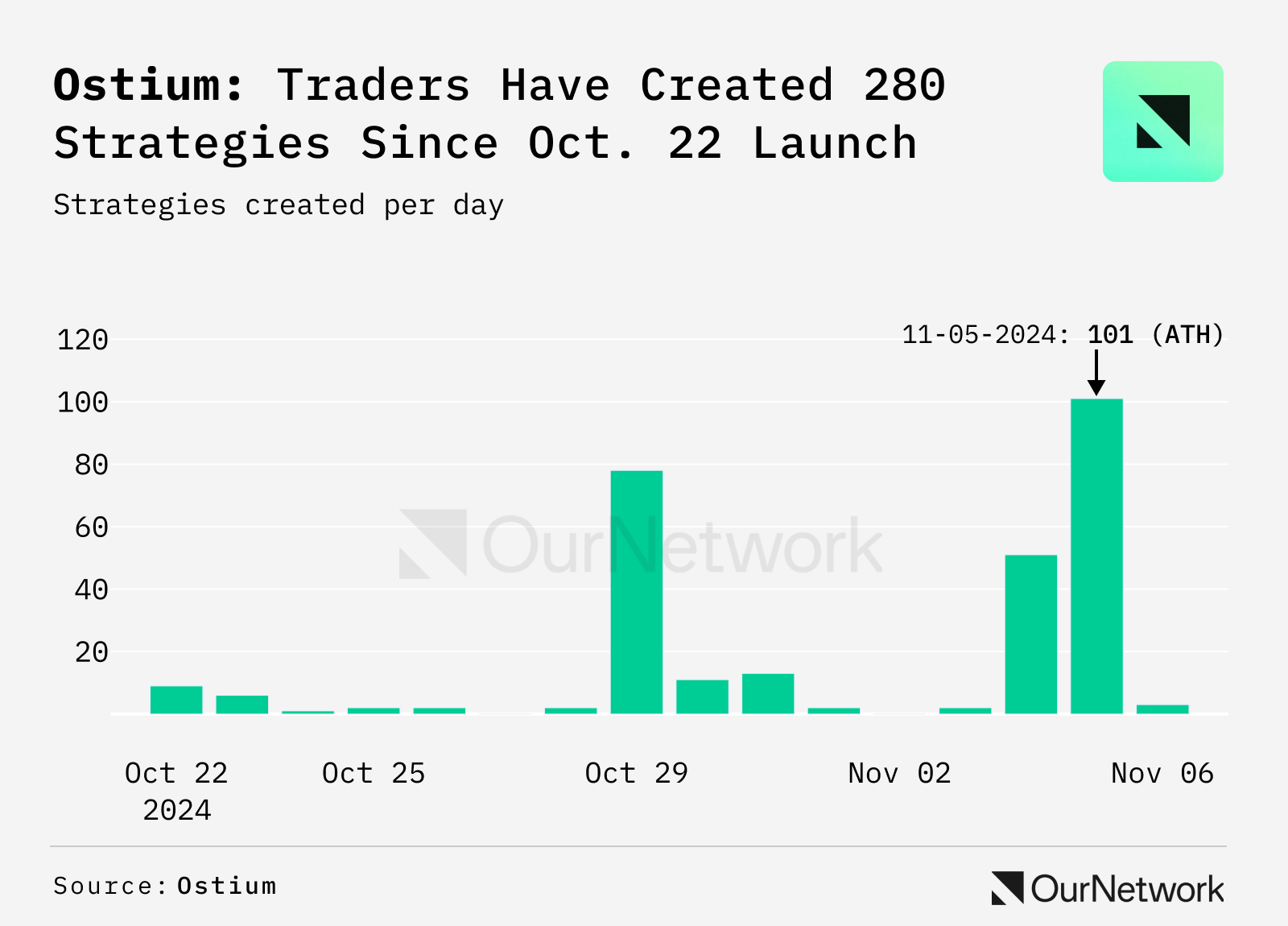

Ostium recently launched the "Strategies" feature, a product based on its trading engine that allows traders to automate trading strategies based on prediction market data, such as "long gold if the probability of TrumpWin exceeds 70%". In the 10 days leading up to the election, traders created over 280 strategies on Ostium, with over 100 created on election night alone.

Ostium (internal)

Bit ETFs

ETF Issuers Accumulate 1 Million Bit in 10 Months, Accounting for Over 5% of Bit Circulating Supply

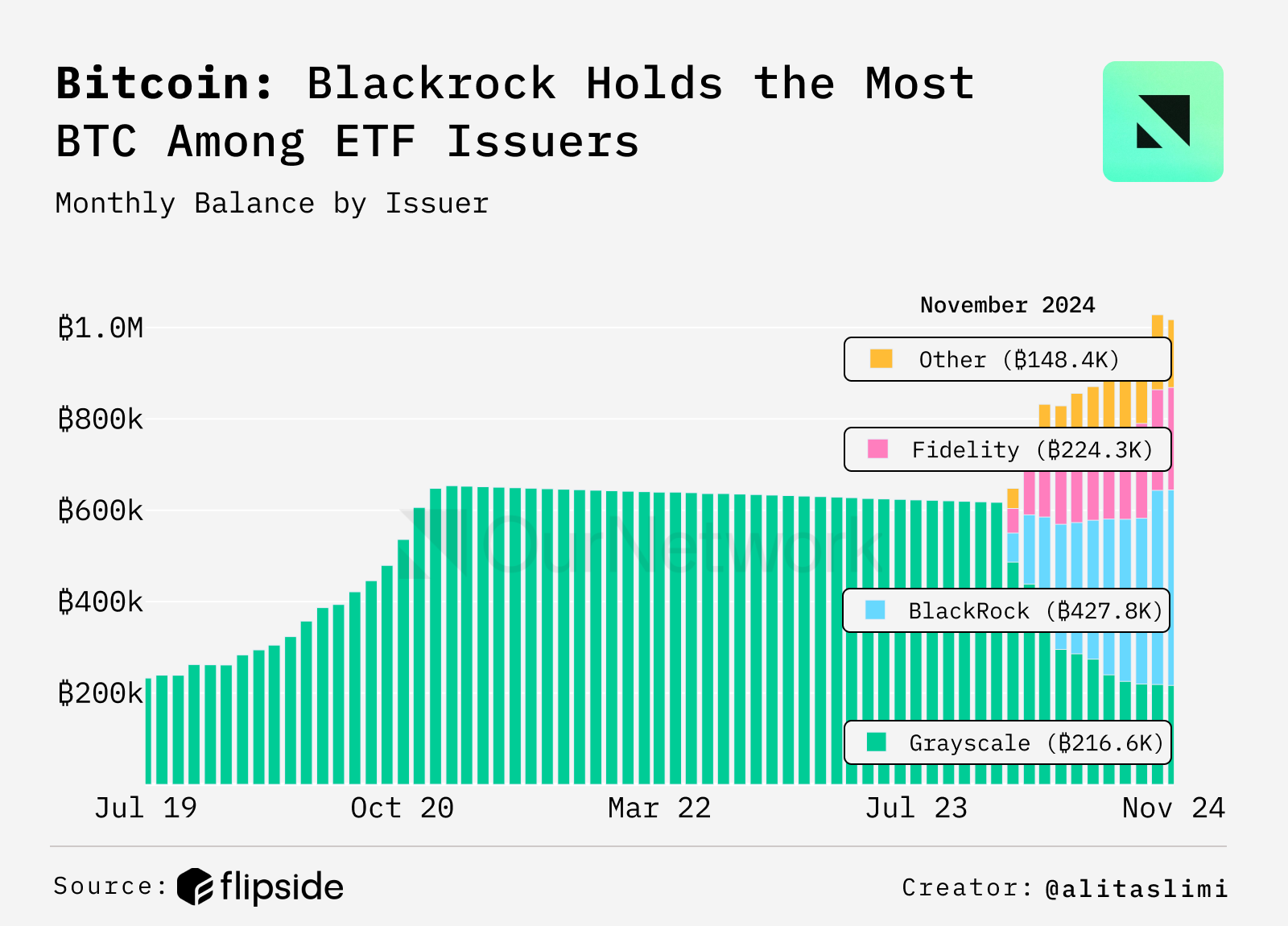

Grayscale was once the largest Bit ETF holder, but due to ongoing monthly redemptions, BlackRock has taken over. In just 10 months, the Bit holdings of ETF issuers have grown from 600,000 to over 1 million Bit, accounting for over 5% of the Bit circulating supply. This sustained buying pressure has driven Bit prices to new highs, indicating strong institutional interest in Bit.

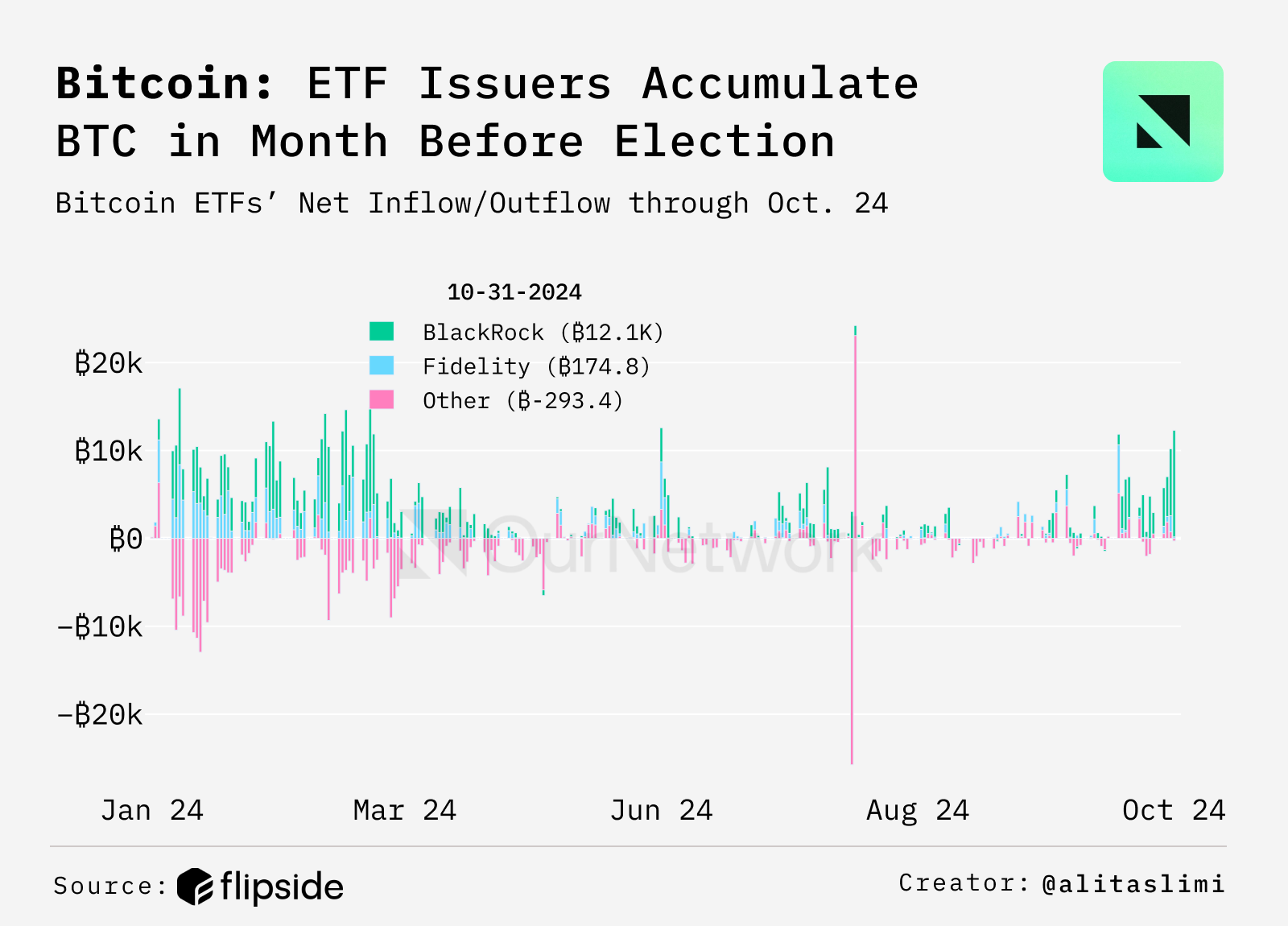

Daily Bit net inflow data shows that issuers actively bought Bit in the 30 days leading up to the US election. While Ark/21Shares and Bitwise have seen increased selling pressure recently, and post-election token prices have generally risen, BlackRock and Fidelity have emerged as the biggest beneficiaries.

Despite price volatility since the beginning of the year, the proportion of Bit held by issuers has steadily increased. Bit ETFs have driven Bit price appreciation, and issuers continue to accumulate Bit, suggesting these institutions may be implementing a long-term investment strategy.

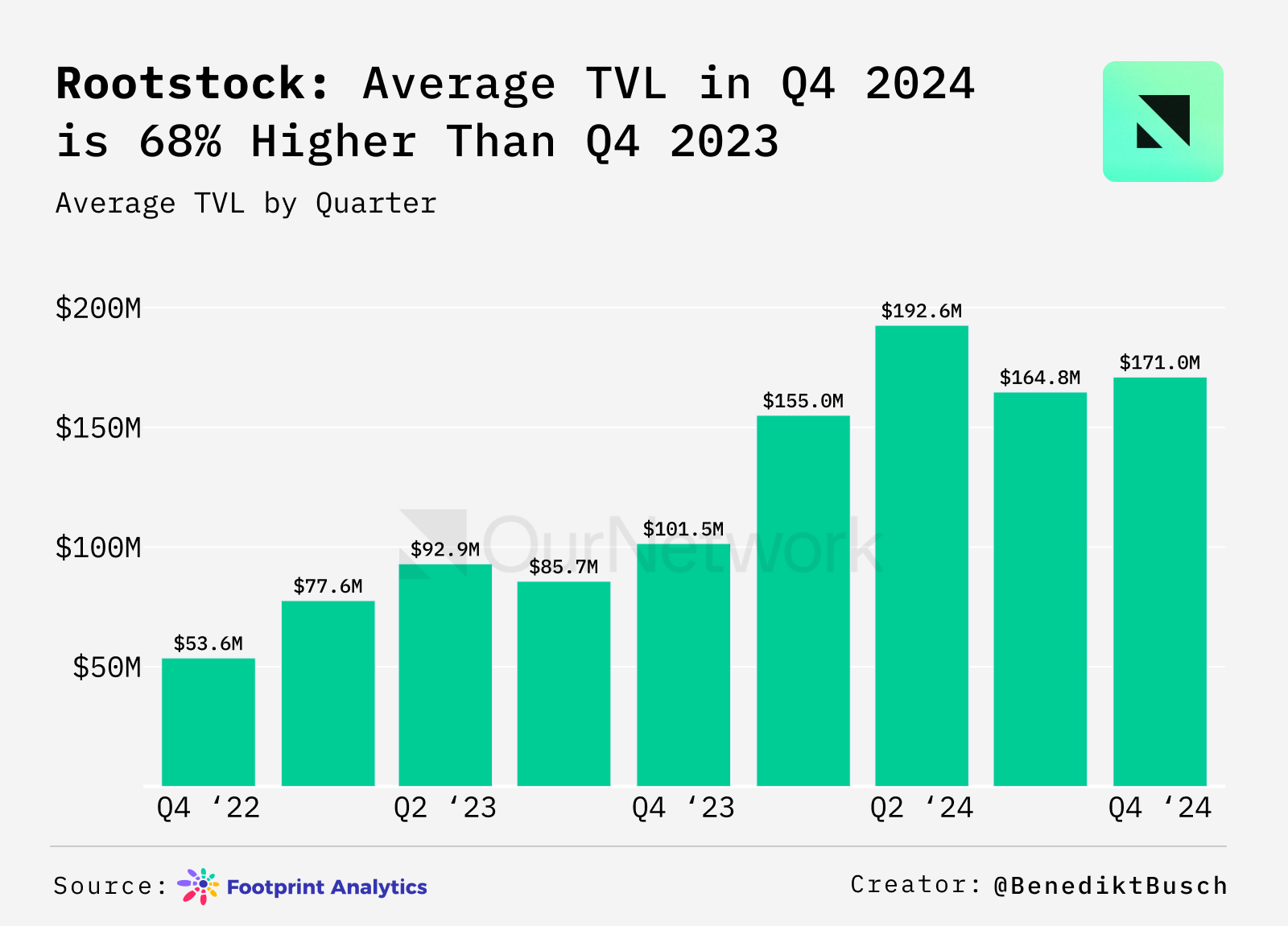

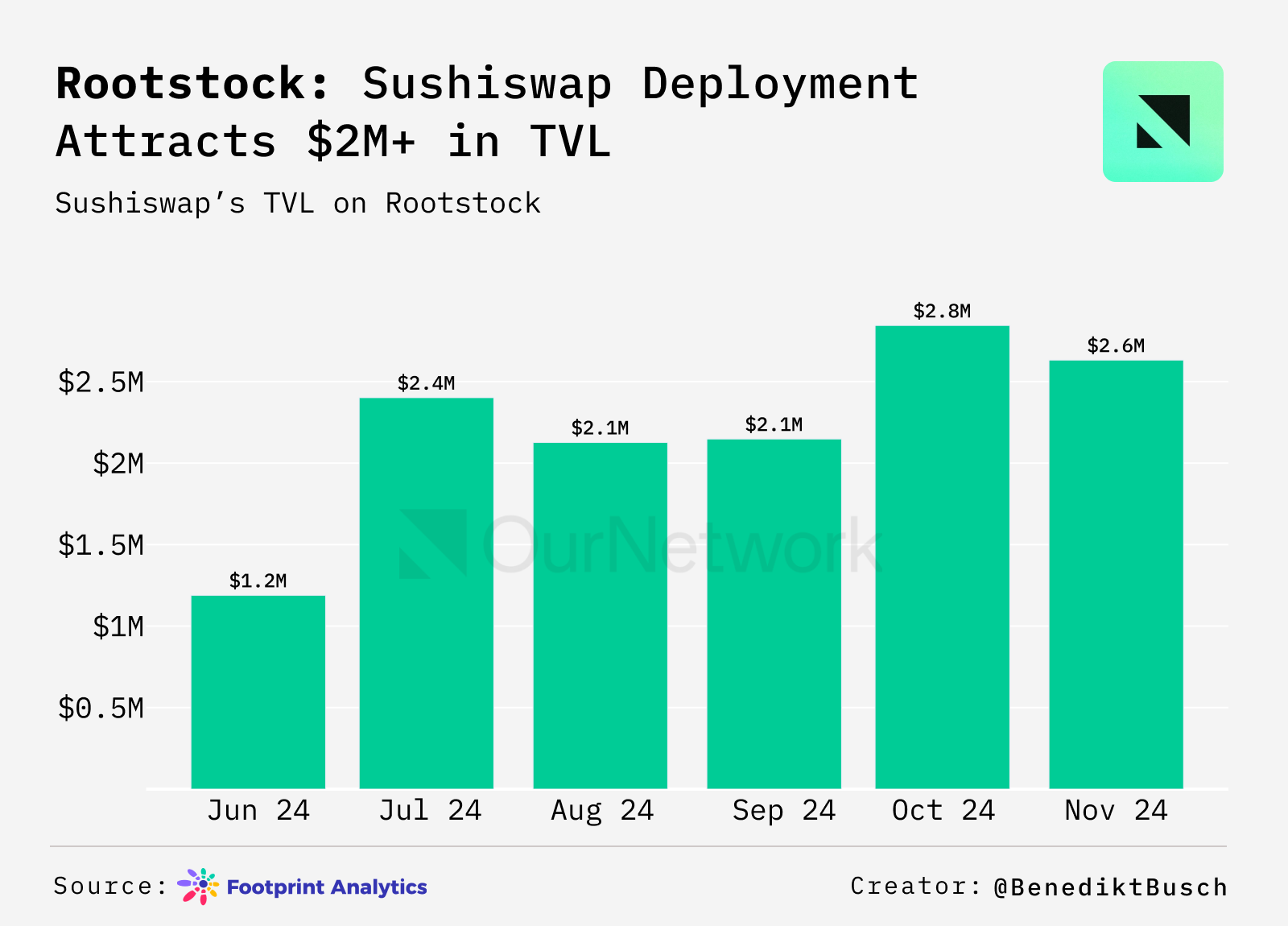

Rootstock is the leading DeFi Layer 2 solution on Bitcoin. Its innovative roadmap (including BitVMX and Union Bridge) and focus on interoperability have driven secure and scalable DeFi innovation. In Q4 2024, the average Total Value Locked (TVL) reached $171 million, a 68% increase from Q4 2023. This growth was primarily driven by collaborations with protocols like SushiSwap and Uniswap, as well as rising demand for Bitcoin DeFi.

Rootstock introduced SushiSwap as a new partner and decentralized exchange in June, which not only diversified its product offerings but also drove significant monthly growth in TVL. This collaboration enhanced Rootstock's DeFi capabilities, connecting Bitcoin to the broader DeFi ecosystem.

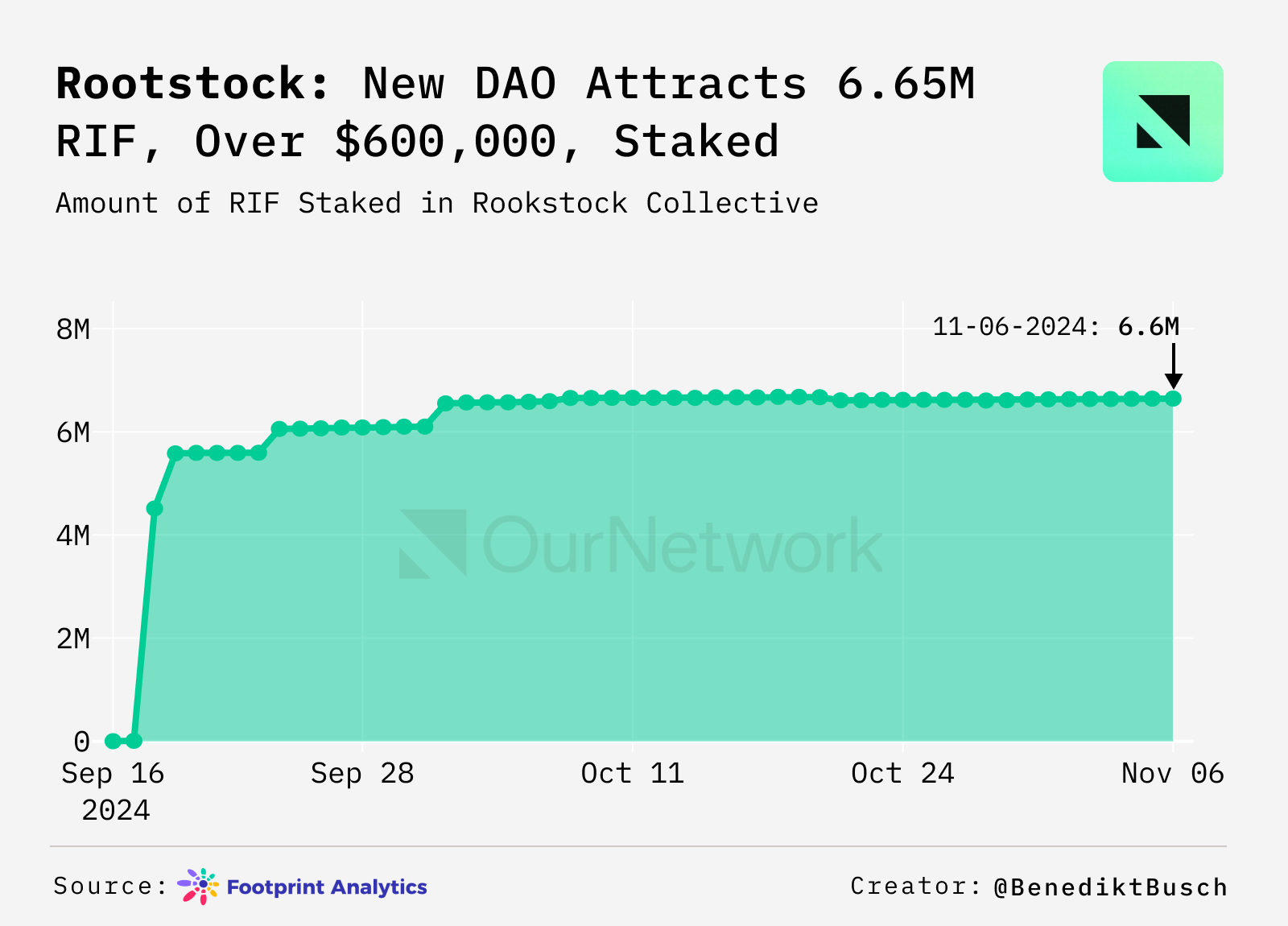

The RootstockCollective, launched in September 2024, is a new DAO aimed at supporting developers and incentivizing projects on Bitcoin. Through the RootstockCollective, developers can receive funding and governance rights. As of November 6, 2024, 6,645,263 RIF have been staked.

BOB

BOB's Summer Activity Surge, Daily Transactions Spike 27%

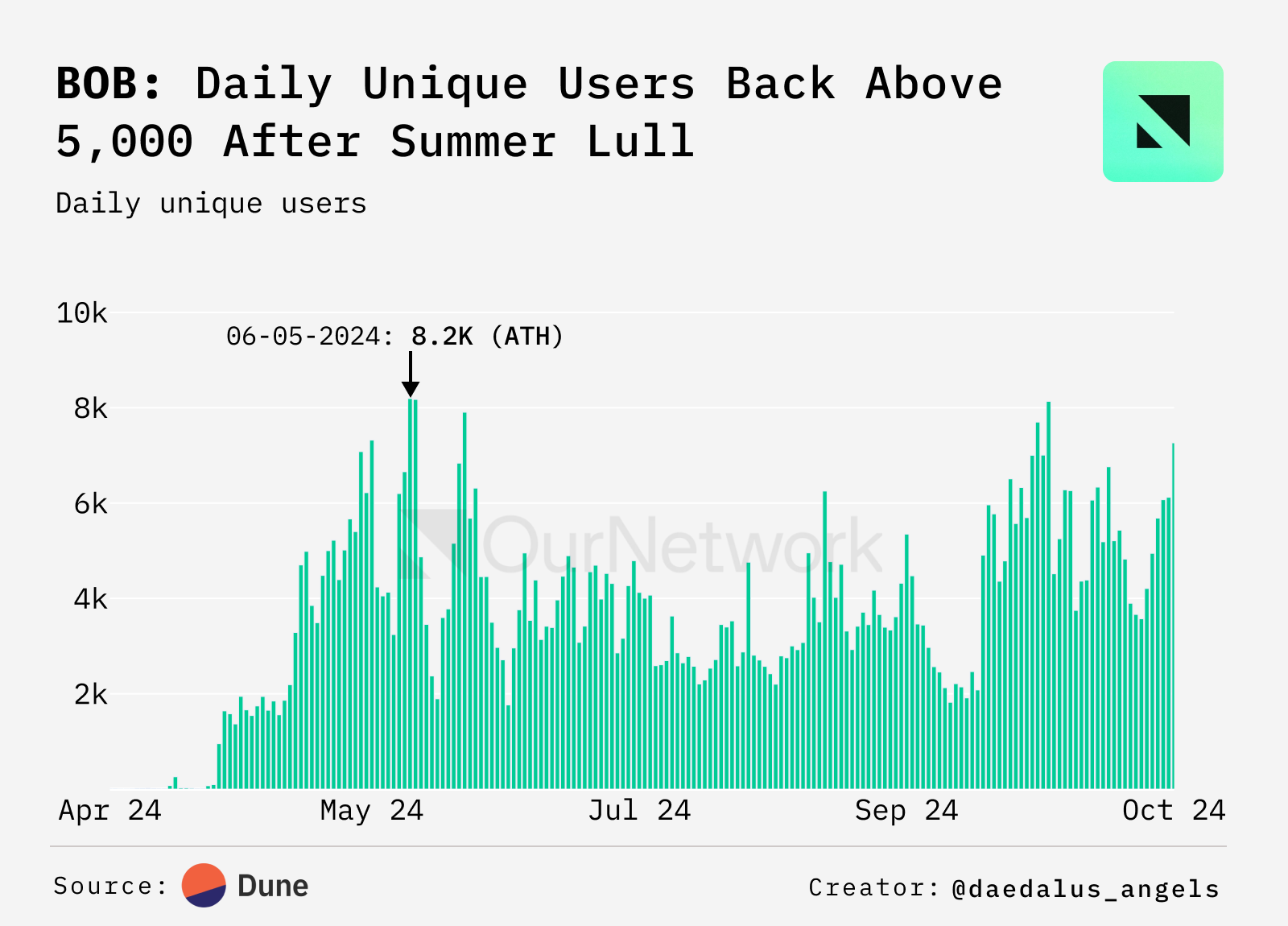

Since launching on May 1, BOB's daily active users have steadily increased, peaking at 8,192 on June 4. However, throughout the summer, BOB's daily active users mostly ranged between 3,000 and 3,500. This summer activity lull may suggest that the concept of "DeFi on Bitcoin" is losing traction. However, this trend did not last long - BOB's daily active users have risen again, averaging 5,589 over the past month, bringing the platform's total users to 172,379.

Similarly, BOB's daily transaction volume hit a record high of 145,224 on May 27, then stabilized between 55,000 and 65,000 transactions over the next three months. Recently, BOB's daily transaction activity has broken out of this sideways trend, with a 4-week average of 74,033 transactions, an increase of around 27%.

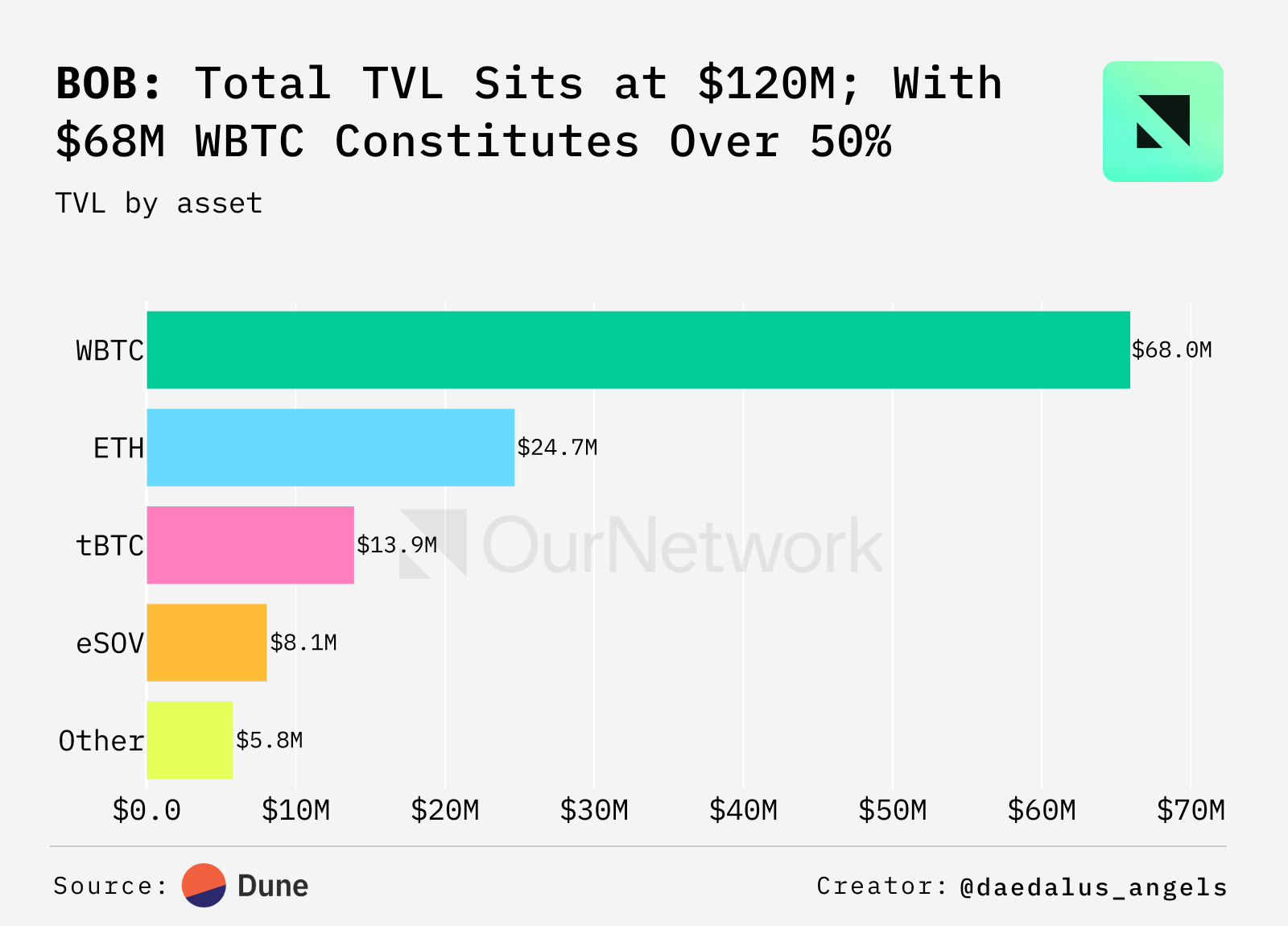

BOB's Total Value Locked (TVL) currently stands slightly above $120 million, comprising $68 million in WBTC, $24 million in ETH, $14 million in tBTC, and $8 million in eSOV.