Author: Anderson Sima, Foresight News

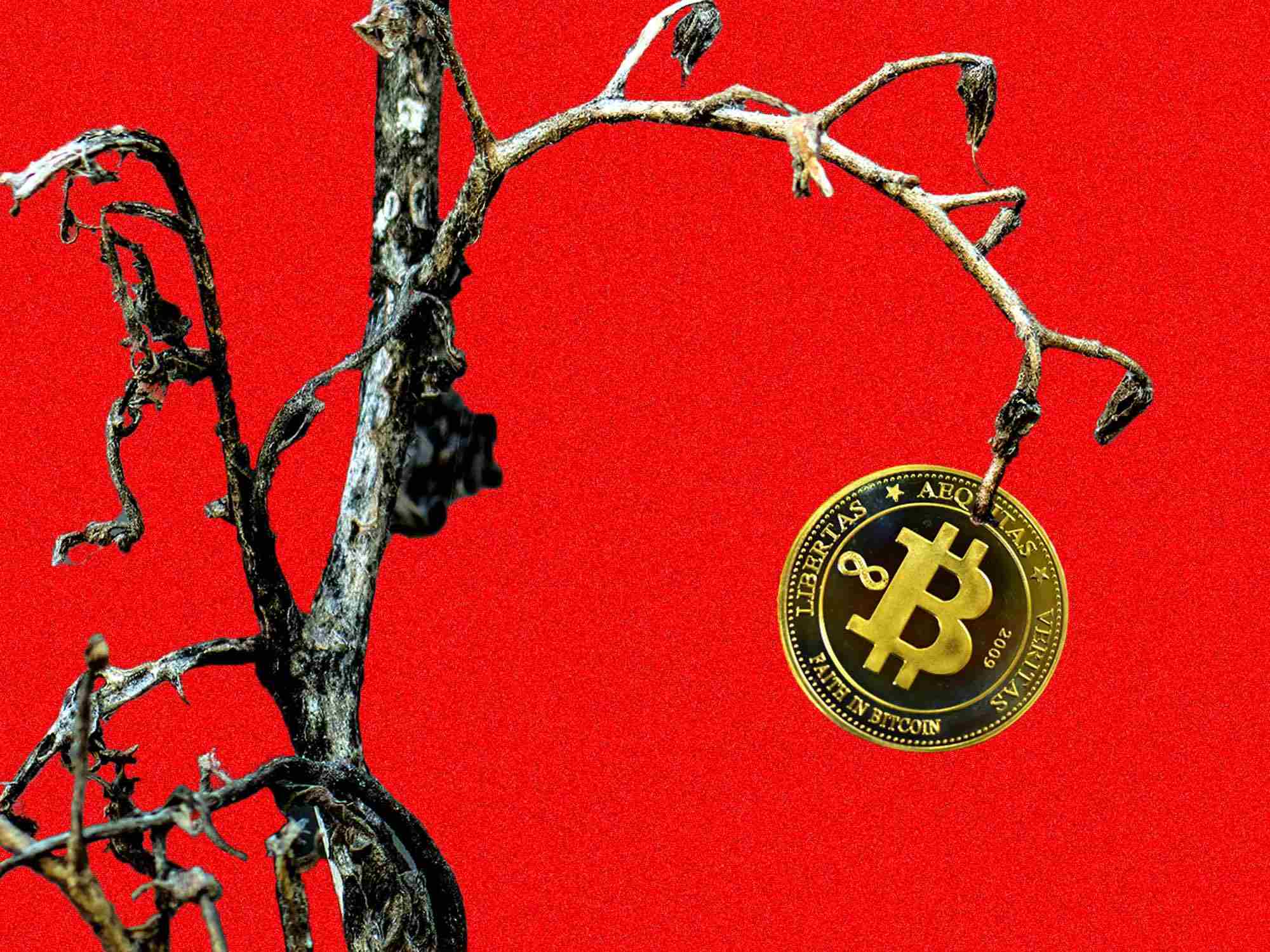

On November 10, the price of Bitcoin broke through $80,000, setting a new historical high. From the beginning of this year to date, the increase in Bitcoin has exceeded 84%, making it the strongest performing major asset class globally, outperforming traditional major asset classes such as gold. Bitcoin often creates new highs in each bull market cycle, so what will its potential price be after the 2024 halving?

Van Eck, one of the world's largest ETF management institutions, CEO Jan van Eck recently stated in an interview: "My basic assumption is that the overall value of Bitcoin will ultimately be half the value of all outstanding gold, so its potential price is around $300,000. Individual investors are indeed pouring into Bitcoin ETFs."

However, the author believes that due to the chain reaction of Trump's return to the White House, Bitcoin is expected to challenge the $200,000 mark in this bull market.

The New Era of Bitcoin: A National Strategic Reserve Asset

The main reason why Bitcoin is expected to break through $200,000 is that it has entered a new narrative stage. After the positioning of "digital gold" has been gradually recognized by mainstream financial institutions, Bitcoin is becoming an important asset class: a national strategic reserve asset.

On November 10, David Bailey, CEO of Bitcoin Magazine, stated on his social media platform that "at least one sovereign nation is actively acquiring Bitcoin and has already become one of the top five holders, and we hope to hear their news soon."

This is consistent with the information the author has learned. Recently, the author has learned from an informed source an unverified news: "A country has recently expressed strong interest in purchasing Bitcoin and has already contacted the relevant institutions."

Currently, among the world's sovereign nations, the governments of China, the United States, and Russia are all involved in holding Bitcoin.

First, the US government does indeed hold a large amount of Bitcoin, which mainly comes from the confiscation and seizure actions of law enforcement agencies. According to the latest data, the US government is estimated to hold more than 200,000 Bitcoins, and the value of these Bitcoins fluctuates with the market, currently estimated to be between $5 billion and $12 billion.

And on July 28, Trump stated at a Bitcoin conference that if elected in November, he would fire the US SEC chairman Gary Gensler and prevent the US from selling its Bitcoin holdings, and would establish a "strategic Bitcoin reserve".

On the Russian side, its involvement in Bitcoin is due to the sanctions imposed on it, which have limited its access to the global financial system. After being sanctioned by the US, Russia has begun to actively explore alternative cross-border trade solutions bypassing the SWIFT system, with Bitcoin becoming an important tool. In 2024, Russian President Putin signed a law officially legalizing Bitcoin mining, emphasizing the use of Russia's abundant energy resources to support the Bitcoin mining industry, which can provide a stable source of Bitcoin for the country's reserves and trade needs.

These actions show that Russia is using Bitcoin and other digital assets as a means to counter sanctions and enhance its financial autonomy. On October 23, according to Bloomberg terminal information, as the BRICS summit opened in Kazan, Russia, the issue of cryptocurrencies was put on the agenda. Russian lawmakers are pushing the idea that Russian miners can sell their tokens to international buyers, and domestic buyers can use Bitcoin exchanges and other crypto markets to pay for imported goods, effectively bypassing Western sanctions.

On the Chinese side, it has mainly been involved with Bitcoin at the level of judicial disposition. In many cases involving the freezing and confiscation of virtual currency assets, law enforcement agencies have repeatedly conducted investigations into illegal funds and money laundering, including the freezing and confiscation of Bitcoin. These confiscated Bitcoins have all been seized by the relevant departments, and although there are no public records, some judicial cases have shown that government departments need to hold crypto assets in certain situations.

And the first movers have already been two small countries. El Salvador has been purchasing Bitcoin since 2021, and according to El Salvador's Bitcoin Office, El Salvador is still continuously purchasing 1 BTC per day, and currently holds 5,929.7 BTC, worth about $470 million. Another mysterious sovereign nation is Bhutan, located in the Himalayas, whose national investment institution Druk Holdings has been mining Bitcoin using hydropower resources since 2019, and currently holds about 13,029 BTC, worth over $1 billion.

Bitcoin: An Important Chip in the Great Power Game

Why are these sovereign nations all starting to get involved in Bitcoin? The fundamental reason lies in the changes in global geopolitics.

Within the past decade, the global economy has experienced multiple major changes, with anti-globalization and trade protectionism on the rise. The hedging properties of traditional assets have been greatly challenged. The Federal Reserve has implemented aggressive interest rate hike policies in recent years, exacerbating the uncertainty in financial markets and significantly increasing the global demand for safe-haven assets. As a decentralized and immutable digital asset, Bitcoin is increasingly being seen by institutions and investors as a tool to hedge against inflation and risk.

Although Bitcoin does not have physical backing, its unique properties have made it an important "digital gold". As global demand for gold purchases increases, countries like Russia, Turkey, and China are hoarding gold to hedge against US dollar risks, and the enthusiasm for investing in digital assets is also rising. As a complement to gold, Bitcoin can provide these countries with a more flexible and convenient hedging method.

And the current market is predicting that the policies of the next US president, Trump, are highly likely to further relax the regulation of digital assets. If he takes office in the future, his crypto-friendly policies will have a far-reaching impact on the global perception of Bitcoin. If the Trump administration strongly promotes a Bitcoin strategy, whether it is US allies or competitors, they will have sufficient motivation to purchase Bitcoin to hedge their risks. This not only reduces their dependence on the US dollar, but also provides an anti-inflationary tool for the financial system. This will significantly increase the international demand for Bitcoin, driving its price to new highs.

Aiming for $200,000

Historically, each Bitcoin halving event has been accompanied by a significant price increase. For example, after the halvings in 2012, 2016, and 2020, the price of Bitcoin soared. The Bitcoin halving in 2024 may become a catalyst for price appreciation, with the peak of the bull market expected to occur 12-18 months after the halving.

The increase in institutional investors in this cycle, with the launch of the US Bitcoin spot ETF, as the world's largest asset management companies are increasing their investments in Bitcoin, the participation of institutional investors may provide more liquidity and stability, which is also an important driving force for the rise in Bitcoin prices this cycle.

The Federal Reserve has also entered a new interest rate cut cycle, with the latest FOMC meeting announcing a 25 basis point rate cut, and according to its dot plot, it is expected to enter an interest rate cut cycle by 2025. The rising expectations of interest rate cuts will also support the upward momentum of Bitcoin prices.

By 2024, the global gold market capitalization will be around $13.5 trillion. In comparison, the market capitalization of Bitcoin is about $1.57 trillion, which is one-tenth of that. Although the market capitalization is relatively small, Bitcoin has characteristics such as scarcity of supply (a total of only 21 million), decentralization, and convenient storage and technological advantages, which give Bitcoin huge potential in terms of future market capitalization.

Due to the Republican Party's control of both the Senate and the House of Representatives, representing Trump, there will be a lax regulatory policy and monetary environment for cryptocurrencies before the next US midterm elections, which is before 2027. If Bitcoin can reach a market capitalization of $4 trillion within two years, its price will reach $200,000. As for the final price, we will have to wait and see.