- The key is that if the Republicans control the House, we believe the likelihood of these bills being fast-tracked in 2025 will be reduced. A unified Republican Congress may focus the initial 100 days of 2025 on tax reform, trade, and other priorities, pushing through Republican priorities via budget reconciliation. This does not mean that crypto legislation will not make progress in the next Congress, but in a unified Congress, we believe it will take a backseat to other priorities, requiring close coordination between Congress and regulators on crypto policy. Our base case is that crypto legislation will be delayed to the latter half of the 119th Congress, to allow cabinet officials and independent regulators to solidify their positions before engaging with Congress on policy.

- Energy policy. If Trump is president, especially with Republicans controlling both chambers of Congress, domestic energy and power production will be highly optimistic. This will be supportive of BTC miners, data centers, and any entities with large power supply needs (of course including energy producers).

Impact on market participation

With regulatory frictions eased, combined with specific no-action letters, interpretive guidance, or regulatory directives, US institutional investors will be able to access crypto assets more broadly.

SEC relaxation of SAB 121 applicability

If the SEC relaxes the applicability of SAB 121, or even rescinds the guidance, in September, this will pave the way for the world's largest custodian banks to enter the crypto market. BNY Mellon has already obtained an exemption as its primary prudential regulator is the New York Department of Financial Services (NYDFS), while the primary prudential regulators for national banks like Citi and JPMorgan Chase is the OCC. Given the potential for a significant shift in the OCC's stance on allowing banks to engage directly in crypto, these large banks will gradually gain more opportunities to participate.

Further institutionalization

This will facilitate crypto asset financing options, allowing spot crypto to be more broadly accessed through existing institutional trading platforms and relationships, and elevate the maturity of the institutional crypto market.

SEC relaxation of Howey standard

If the SEC relaxes the applicability of the Howey standard to digital assets, or expands the scope of "crypto asset securities" that can be traded on broker/dealer platforms, this will allow more institutions to enter the trading market, potentially including traditional financial institutions like banks, exchanges, or brokerages. Additionally, SEC relaxation of the Howey standard could drive the launch of more spot crypto ETFs in the US.

Regulatory clarity and inclusiveness

Clear and inclusive regulatory policies will for the first time allow traditional financial service companies and investors to operate on-chain, bringing new opportunities for yield and other investment strategies. Expanded access to public blockchains may also revolutionize aspects of trading efficiency, transparency, issuance, and finance. Depending on the regulatory stance and potential legislation, the convergence of traditional finance and decentralized finance (DeFi) may truly materialize.

New token forms and expanded asset ecosystem

If the SEC further clarifies its stance on the Howey standard and token disclosures, we may see a proliferation of novel token types, potentially even equity-like tokens. Existing tokens may also add more equity-like features to enhance their value proposition. An expanded and improved asset ecosystem will support the development of a more mature and continuously expanding investable crypto hedge fund industry. Improved token disclosures and issuance capabilities may challenge and potentially disrupt the current VC capital-dominated SAFT model, enhancing liquidity in the crypto market.

Crypto company IPO opportunities

On the venture capital front, the IPO market may become more open to crypto-native companies, ultimately providing venture investors with exit paths to realize returns. Currently, Coinbase is the only venture-backed crypto startup that has gone public (aside from some SPAC listings). If conditions are right and regulators are supportive, we estimate that dozens of crypto companies may be poised to list in the US.

Bitcoin market analysis

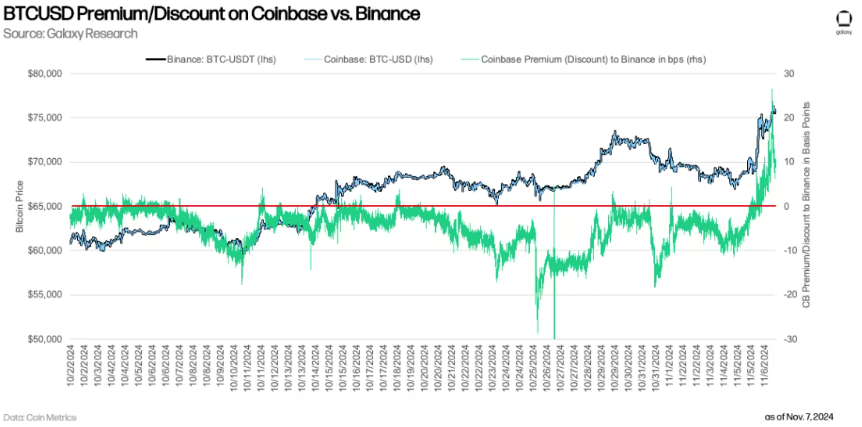

On Monday, November 4th, Bitcoin traded as low as $66,700, but has since rallied 15% to new all-time highs. With the increasing likelihood of a Trump victory on November 5th, BTC spiked to new record highs and is holding in the $75,000 to $76,000 range. While BTC is up 15% since Monday and 26% since October 1st, the market does not appear overheated from a fundamental perspective. Late Tuesday, BTC surged following election news, with the "Coinbase premium" significantly rebounding to positive territory for the first time in at least a month.

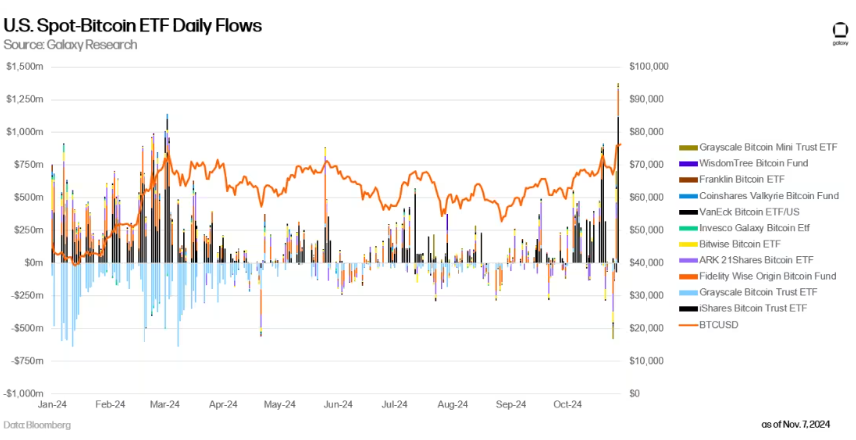

BTC ETFs have been performing strongly, with November 7th (Thursday) seeing the largest single-day net inflow on record at $1.375 billion, driving BTC to new highs. This figure exceeds the previous record of $1 billion net inflow on March 12, 2024.

Bitcoin's cyclicality

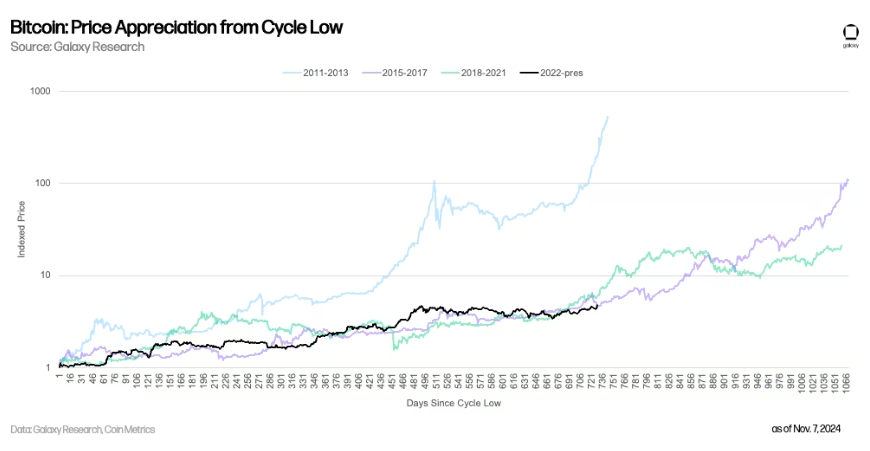

Looking back at Bitcoin's historical price action, Bitcoin's current performance is tracking closely with the trajectories of the previous two bull markets. Measured from cycle bottoms (2011: $2, 2015: $152, 2018: $3,122, 2022: $15,460), Bitcoin's ascent is highly consistent with the 2017 bull market, only slightly lagging the pace of the 2021 bull market.

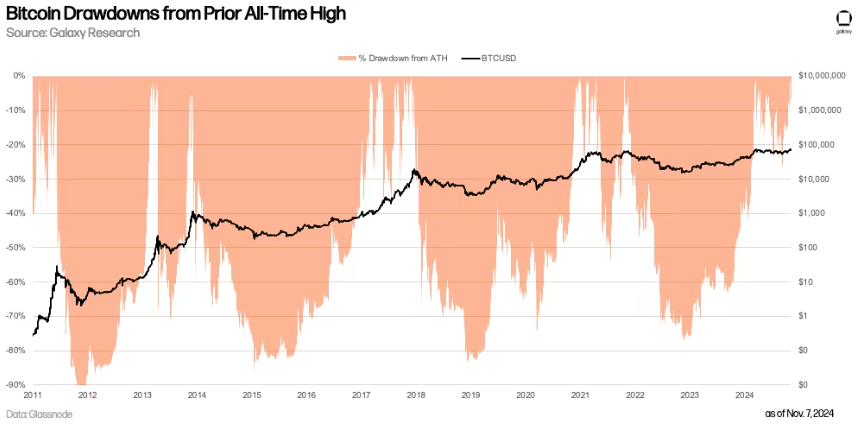

Reviewing past bull market corrections, the 2024 drawdown has been much more mild compared to the corrections during the 2021 and 2017 bull markets.

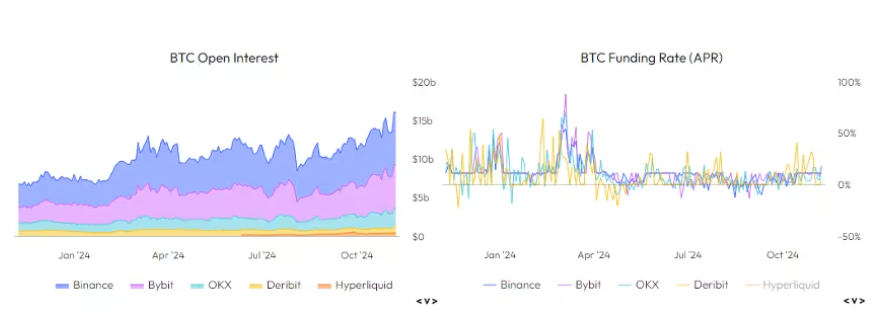

Futures and Financing

While crypto exchange futures open interest has ticked up to new yearly highs, financing rates have remained largely flat, suggesting these fluctuations are primarily driven by the spot market.

Source: Velo.xyz

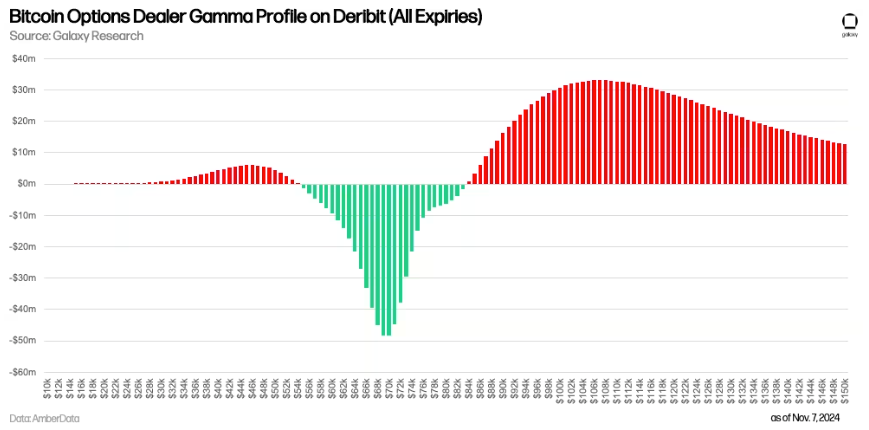

Bitcoin Options Market

Bitcoin options traders are in a net short Gamma position between $54,000 and $84,000, which will accentuate price volatility. In simple terms, when traders are short Gamma, they typically hedge by buying spot as prices rise, or selling spot as prices fall. This can exacerbate price moves in either direction and increase market volatility. Conversely, when traders are net long Gamma, they will act in the opposite manner, selling as prices rise and buying as prices fall, dampening volatility. Our analysis indicates that the largest short Gamma position is currently at $70,000, so this effect will gradually diminish as BTC/USD moves higher. Notably, many call option holders at high strike prices are now in-the-money, and these investors may choose to roll their options to even higher strike prices, pushing the short Gamma further up the strike price spectrum. The chart below shows our view of options traders' net Gamma positions across all BTC option expiries from November 7th to September 26, 2025.

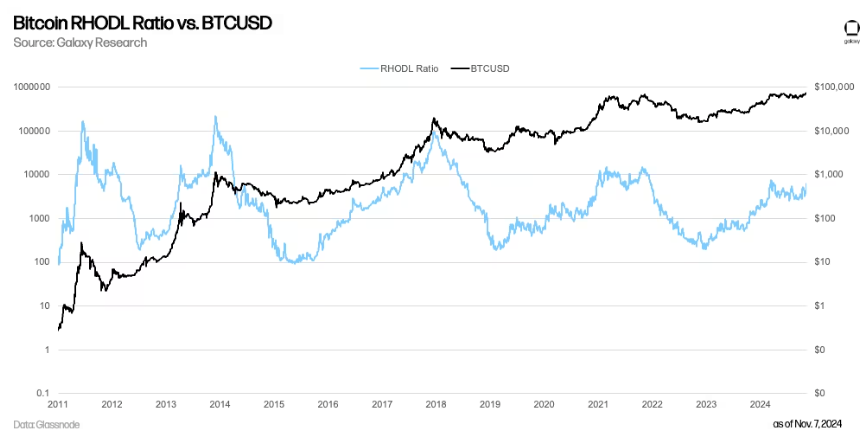

Bitcoin Fundamentals

The Realized HODL Ratio (RHODL) is a metric that measures the ratio of realized market capitalization between the 1-week and 1-2 year HODL bands (i.e., the realized value of coins last moved within those time frames). A higher ratio typically indicates an overheated market, often coinciding with market tops. The 2024 RHODL sideways trend is more akin to the 2019-2020 consolidation, rather than any peak activity, suggesting there is more upside potential in the short to medium term.

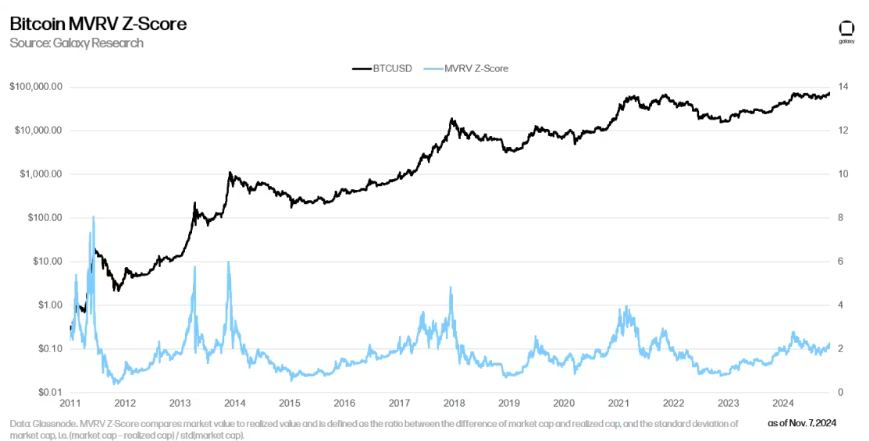

MVRV Z-Score

The MVRV Z-Score is the ratio of market value to realized value, and the standard deviation of market value, used to help identify differences between an asset's trading value and its overall cost basis. Historically, this metric has been highly effective in identifying market tops, and the current value indicates that BTC/USD is not yet approaching overbought or top territory.

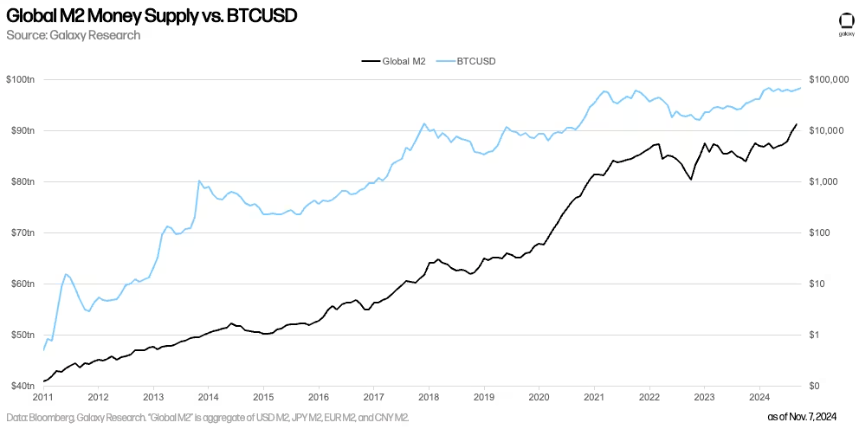

Bitcoin and Global M2

Bitcoin has historically responded to changes in the global money supply. While this correlation is not unique to Bitcoin, if Bitcoin begins to be used more as a hedge asset, as Larry Fink has advocated, this trend is worth watching.

Outlook

The arrival of the Trump administration, coupled with a strong Republican Senate able to confirm his agency appointments, is a positive development for regulatory easing in the US crypto industry. We expect that some form of exemptive relief will be forthcoming soon, but a more robust supportive regulatory framework may take more time to take shape. The relaxation of the enforcement environment, combined with progressive policy thinking, will pave the way for traditional financial services companies and institutional investors to participate more deeply in this asset class. This will challenge the moats of existing crypto infrastructure firms, but will also broadly support the expansion and maturation of the asset class. In this environment, we expect Bitcoin and other digital assets to trade at levels significantly above their current all-time highs over the next 12-18 months.