Today, the crypto world has seen another major event! After Binance announced the listing of the meme coins ACT and PNUT, the market immediately exploded - the price of ACT soared 16 times in just half an hour, with its initial market cap skyrocketing from $20 million to $350 million. Before the dust could settle, PNUT also showed no signs of weakness, tripling in value within an hour, with its market cap reaching $400 million. The 'grass-root' investors rushed in, fearing to miss the "wealth creation myth", but the question is: is the surge in ACT and PNUT prices a market miracle, or a new round of scythe? This article will explore the "truth" behind it.

ACT - AI Dream and Decentralized Idealism: A Double-Edged Sword of Soaring Bull Market and Internal Strife in the Community

The Project Background and Token Mission of ACT: A Sentiment-Filled AI Research Experiment

ACT, or "The AI Prophecy", the name itself exudes a futuristic vibe, is a decentralized AI experiment project running on the Solana blockchain, claiming to "make AI knowledge accessible to everyone". In plain terms, it aims to create a decentralized AI knowledge platform, providing "AI popularization" for the general public, breaking the "dimensional barrier" between ordinary people and AI technology. Compared to the humorous positioning of most meme coins, ACT can be said to be full of sentiment, claiming to be not just a coin, but a "knowledge preacher of the new era".

ACT proclaimed from the start that it wants to 'make AI knowledge accessible to everyone'. This lofty goal sounds very grand, directly targeting the 'knowledge preaching of the new era', and is full of sentiment. However, like the vast majority of meme coins, ACT cannot escape the stark contrast between ideals and reality.

The Community Turmoil and Violent Fluctuations of ACT Tokens: The Founder Absconded, the Community Self-Rescued

The founding team is very strong, the founder DEV is a member of the GOAT token team AmplifiedAmp (abbreviated as Amp), and after creating ACT, he initially obtained 6% of the token supply as startup capital.

After the launch of ACT, the community did not welcome the "dream take-off", but instead experienced an unexpected bloodbath by the founder Amp.

DEV Amp held a large amount of ACT tokens and sold them frequently, which directly pressed the token price to the ground, angering the community: the community accused him of "shamelessly harvesting the 'grass-root' investors".

Under public pressure, Amp could not hold on and eventually announced his withdrawal, destroying the remaining 1,745,004 ACT tokens he held - don't underestimate this amount of tokens, when they were just destroyed, they were only worth $41,000, but today this amount has soared to $3.87 million, which is simply burning away future profits.

When leaving, Amp also coldly stated that: ACT's brand has never been authorized by him, and he even expressed on Twitter that he does not hope it will be listed on Binance. This final strike before his departure can be said to be an art of exit.

However, Amp's escape did not cause the community to fall apart, but instead led ACT to self-govern in a decentralized manner. Without the founder's control, the community has actually united, established a self-governing organization, focusing on AI knowledge popularization and community education, trying to turn this "leaderless" coin into a decentralized "grassroots AI popularization project". With the traffic boost from Binance, ACT has skyrocketed overnight.

Binance also mentioned in the listing announcement that the listing fee for ACT is 0 BNB, which was later confirmed by ACT community member @0xWizard, which is quite different from the previously exposed sky-high listing fees.

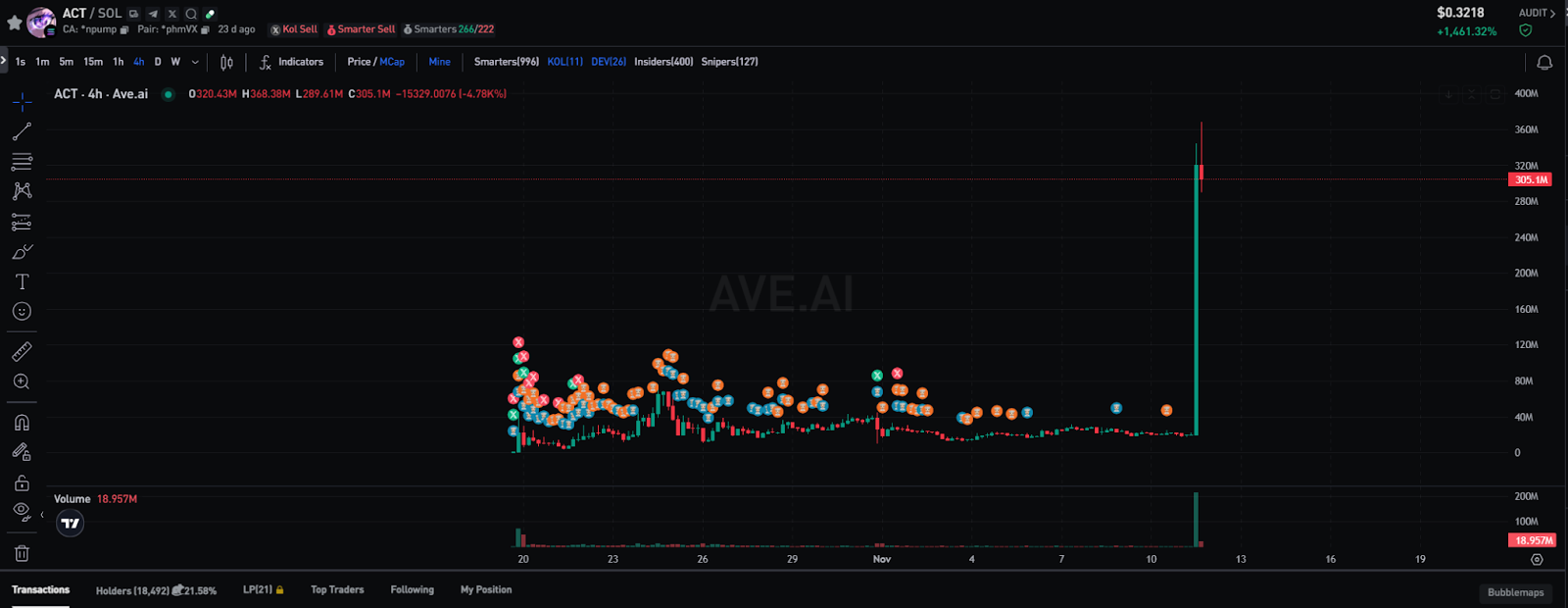

After the crypto exchange Binance announced the listing of ACT, its price surged 10 times in just 10 minutes, with its initial market cap soaring from $20 million to $350 million. Such an amazing increase is largely due to the traffic effect of Binance as the world's top crypto exchange, as well as the emotional drive of the meme coin market.

However, this rapid surge has also exposed hidden risks in the market. For the ACT project, the key to its long-term development lies in whether it can truly establish a high-value AI knowledge sharing community. Although the short-term price fluctuations have attracted a large number of speculators, whether ACT's community governance model and community consensus are strong enough to support the long-term stability of its price remains to be seen.

PNUT - From Internet Celebrity Squirrel to the Success of Meme Coin Leveraging

The Birth of PNUT and Event Marketing: The Tragic Squirrel Ignites the Market

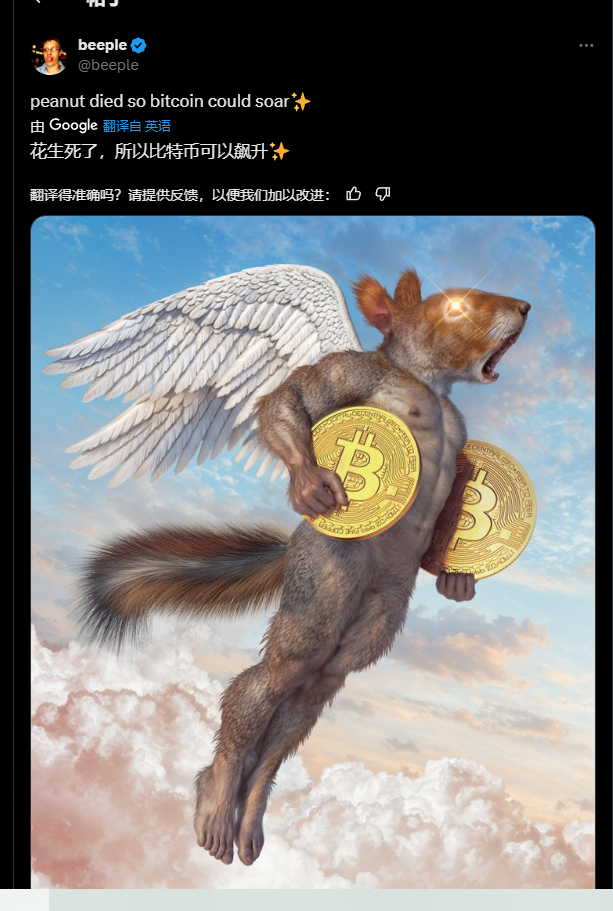

The rise of the PNUT token is backed by an extremely attractive social event: the tragic fate of the American internet celebrity squirrel "Peanut". Peanut's owner Mark Longo is a mechanical engineer who has shared interesting videos of the little squirrel on social media for years, accumulating a large number of fans. However, in a "illegal feeding" dispute, Peanut was arrested by the relevant authorities and euthanized, the event quickly sparked widespread outrage online. Many netizens felt sorry for Peanut's unfortunate fate, including public figures like Musk, who also participated in the support and even pointed out the government's excessive measures in this incident. This was followed by extensive discussions and emotional fermentation on social media platforms, and the event gradually evolved into a public criticism of the government agencies and even the Democratic Party's governance policies in the United States.

At this juncture, the US election was in full swing, the Peanut incident suddenly became a "propaganda weapon" for the Democratic Party government, being hyped by various media as a "symbol of protest". At this time, the PNUT meme coin emerged, and by leveraging the public sentiment, it quickly rose to prominence and successfully heated up the market sentiment.

Siding with the Election, PNUT Doubles in Value

More interestingly, as the US election results were announced, with Trump re-elected as president, the PNUT token took advantage of this "siding with the right team" momentum to surge again, with its market cap soaring from $27 million before the election to $160 million. When Binance announced the listing, PNUT's market cap even reached nearly $400 million. This super-surge, leveraging a social hot spot + political event, can be said to have fully demonstrated the "earning quick money by riding on hot topics" feature of meme coins.

However, despite PNUT's rise to fame thanks to the squirrel incident, which appears to be an "emotional outlet for social events", it still has risks like other meme coins. The behind-the-scenes of the short-term surge is huge price volatility, and for the 'grass-root' investors, the gains may be quick money, but the losses may be next month's rent.

On-Chain Data Tracking: The Harvesting Tactics of Whales, the Behind-the-Scenes Winners of Meme Coins

The short-term surges of ACT and PNUT appear to be a carnival of social sentiment, but behind the scenes, there is a group of big shots quietly laying the groundwork, skillfully harvesting the "emotional dividends".

Taking ACT as an example, a certain trader spent $457,000 to build a position at the bottom, and when Binance listed it, he cashed out at $2.48 million, with the remaining position still safely profitable. The entire operation can be described as 'precise to the last penny'.

The trading data of ACT from October 25 to November 3 was particularly noteworthy. A trader spent 2,658 SOL (about $457,000) to purchase 17.16 million ACT tokens. After Binance announced the listing of ACT on November 3, the trader quickly sold 9.33 million ACT, recovering 11,945 SOL (about $2.48 million), realizing a substantial profit. The remaining 7.83 million ACT are worth about $2.74 million, and the trader's total profit reached $4.77 million - in just 18 days.

Similarly, the on-chain data of PNUT also showed large-scale position operations by whales. After Binance announced the listing of PNUT, the PNUT price surged 180% in a short period of time. A mysterious whale spent 15,140.85 SOL to hold a large position in PNUT, FRED and OPK tokens, with an overall floating profit of $3.97 million, of which the floating profit of the single token PNUT reached $4.06 million, making it one of the top 3 PNUT holding accounts.

More noteworthy is that recently a whale has withdrawn 14,770 SOL (about $3.03 million) from Binance to massively buy PNUT and ACT. The whale account spent 12,000 SOL ($2.46 million) to buy 9.24 million PNUT at $0.266, and spent 2,000 SOL ($410,000) to buy 2.04 million ACT at $0.2. Such a large influx of funds directly pushed up the prices of PNUT and ACT, triggering violent market fluctuations.

Binance's Listing Causes Controversy: Farmer's Feast, BNB Holders "Crowdsourcing Complaints"

Binance's launch of ACT and PNUT has ignited the market, but the applause is not the only thing that comes with it. The ACT and PNUT communities are naturally cheering, but Binance's users, especially the BNB Holders, have started to express their dissatisfaction. In the comments section of Binance's listing announcement, more than 90% of the comments are directly cursing: Why does Binance keep listing these "air coins"? Why don't they learn from Launchpool and choose coins properly? Some users even directly suspect that Binance is "harvesting farmers in the rat cage", suspecting that Binance holds a large amount of chips and uses listing to drive short-term market trends, which is essentially to reap the farmers.

Especially for those who have been holding BNB, this time they are even more disappointed. Not only did the previously promised Megadrop not materialize, but they also have to watch the platform keep listing high-risk Meme coins, as if they are being "excluded from the capital feast". For these BNB holders, Binance's listing strategy not only shakes their trust in the platform, but also makes them feel abandoned. The accumulation of such emotions is undoubtedly a challenge to Binance's long-term brand.

Solution: Transformation of Listing Strategy and Self-Redemption of Exchanges

The listing strategy of crypto exchanges is like a "dance with shackles". Frequent listing can indeed boost trading volume, but when the "hot money" dissipates, the risks will ultimately fall on the investors. As a leading exchange like Binance, in order to balance profits and trust, it may need to make some changes in its strategy.

Faced with the chaos of listing, if Binance wants to avoid becoming a 'farmer's harvester', it might as well try the 'main site + community site' dual-track system: strict review on the main site, keeping high-quality coins; free on the community site, let the retail investors invest in whatever they like, and everyone can enjoy the melon.

Main Site + Community Site: A Win-Win Dual-Track Listing System

The "main site + community site" dual-track system can be used as a reference, setting up a strictly screened main site and an open community site:

- Main Site: Tighten the listing standards, strictly review the technology, application, and profit model, and gradually delist projects that do not meet the requirements, making the main site a stage for high-quality projects.

- Community Site: Emulate DEX, adopt a registration system, allow project parties to list freely, and let the market vote on the survival of the coins, which can reduce Binance's burden and also provide a place for Meme coins, and avoid the suspicion of "rat cage".

Thorough Transparency Disclosure: Let On-Chain Data Speak

Transparent disclosure is a powerful weapon for exchanges to avoid controversies. Binance can track the flow of project funds and team holdings through on-chain data, and regularly publish this information, allowing investors to directly see the "blood flow" of the project. This not only builds trust, but also makes the reputation of the exchange more precious in the "rampant sickle" market.

Investor Education: Upgrade Farmers to Investors

Binance can use investor education to help users understand the risk characteristics of the Meme coin market, mark the risk level of the project, and release simple courses to guide investors to invest rationally. Faced with the emotional frenzy of the market, the concept of rational investment can ensure that users truly understand the risk characteristics of Meme coins, so that they do not become the "bagholders" of whales and founding teams.

Conclusion: The Interplay of Market Sentiment and Listing Strategy

The rise of ACT and PNUT has added another fire to the Meme coin market, but the hidden risks are also evident. Binance's listing strategy has certainly driven the market, but the frequent listing of high-risk projects may also be eroding user trust. In the future, if Binance can find a balance in transparency and standardization, it not only can avoid the shadow of "sickle" harvesting, but also lead the entire market to a more mature direction. For investors, faced with the huge volatility of Meme coins, rational investment and calm judgment are the only shields to cope with the emotional market.