The digital asset industry is on the verge of a golden age. Cryptocurrency in the United States is poised to welcome a new regulatory approach, while gaining more endorsements from supporters in both houses of Congress and the White House. The industry has demonstrated its political power, issuing a strong warning to its adversaries, with the impact spanning the political spectrum. The severe headwinds that have hindered the industry's progress and increased legal costs over the past four years have weakened, and now the crypto industry is sailing with the wind in the world's largest capital market.

About Tuesday Night

President-elect Donald J. Trump made history - becoming the second president in U.S. history to win a non-consecutive second term. The only other to achieve this feat was Grover Cleveland, who defeated Benjamin Harrison in 1892 to win a second non-consecutive term. At the time, this anti-tariff, gold standard Democrat regained power; now, this pro-tariff, pro-Bitcoin Republican has won a second non-consecutive term in 2024. History often has its similarities.

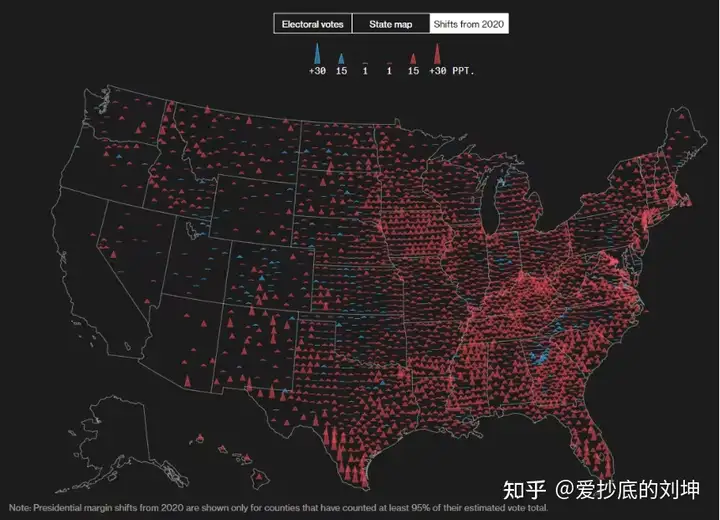

Trump's victory also holds historic significance in the modern era. His projected Electoral College vote count is expected to exceed 310, surpassing the 306 votes he won in 2016. He becomes the first Republican to win the popular vote majority since George W. Bush in 2004. Trump again carried the "blue wall" states of Pennsylvania, Michigan, and Wisconsin, similar to 2016, but he is likely to have also won Nevada, which Hillary Clinton carried in 2016. In Florida, Trump won by a stunning 13% margin, a performance partly attributed to demographic shifts in the state over the past several election cycles. This Bloomberg heat map shows county-level reporting of over 95% of the vote, and the changes in Republican and Democratic presidential candidates from 2020 to 2024. The red has significantly increased.

Source: Bloomberg

The Senate has flipped to Republican control, with an expected final result of 54 Republican seats. The House outcome may take longer to determine, but Republicans hold a slight edge and are poised to maintain control of the lower chamber.

Other key points about this election:

- The crypto industry has demonstrated its political power. In addition to actively advocating a comprehensive and far-reaching crypto agenda to the President-elect Trump, the industry has also gained broad support in the House and Senate. The most notable victory was Bernie Moreno (R-OH) defeating incumbent Senate Banking Committee Chairman Sherrod Brown (D-OH). Crypto political action committees invested tens of millions of dollars in defeating Brown, a key ally of Elizabeth Warren. Defeating Brown - a vocal crypto critic - sends a strong message: opposing cryptocurrencies is a political dead end.

- Trump enters his second term. Presidents in their second term typically focus more on complex and cutting-edge issues to build a political legacy, without the pressure of re-election. The scale of this victory is larger than 2016, giving Trump greater governing authority, and he has the support of perhaps the most diverse Republican voter coalition in decades. This increases the likelihood of Trump implementing sweeping reforms, which could include major modernization of the financial system.

- Trump's team is very supportive of the digital asset industry. Trump's core team is very pro-digital assets, with many openly holding Bitcoin. Vice President-elect J.D. Vance has publicly disclosed his Bitcoin holdings, Vivek Ramaswamy was a vocal industry supporter during the campaign, Robert F. Kennedy Jr. has been actively and deeply supportive of the crypto industry for at least the past two years, and Transition Co-Chair Howard Lortnick has stated that he and other Canto Fitzgerald members hold substantial Bitcoin (Canto Bank supports USDC), while many major donors are either directly involved in the crypto industry or have a positive attitude towards the asset class and industry. Additionally, Trump himself has issued NFTs and launched initiatives related to DeFi protocols. The pro-crypto attitudes of his team, family, and donors increase the likelihood of Trump fulfilling his promises to the crypto industry.

Expected Policy Changes in Washington

Let me paint a picture of how crypto policy might evolve in the coming period:

Banking Regulators. Upon taking office, Trump will immediately appoint new acting Comptroller of the Currency (OCC) and Federal Deposit Insurance Corporation (FDIC) chairs. These agencies have prudential regulatory authority over banks and insured depository institutions. Within days, the banking regulators may issue guidance explicitly prohibiting unfair targeting of specific industries (similar to "Operation Choke Point 2.0"), as Trump did upon his first inauguration, and may also rescind existing adverse interpretive guidance or letters (such as the joint letter of January 3, 2023) against the crypto industry. In weeks or months, the OCC may issue guidance explicitly permitting banks to custody digital assets and to use, operate, and interact with public blockchains and stablecoins. (Recall that Trump's former acting Comptroller of the Currency, Brian Brooks, issued similar interpretive letters in 2020).

Market Regulators. Trump will elevate a current commissioner at the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) to serve as acting chair. While Trump has promised to "fire Gary Gensler," most constitutional scholars believe the president cannot remove independent agency commissioners who have been formally confirmed. However, the president can immediately designate existing commissioners to serve as acting heads. Shortly after personnel changes, some crypto enforcement actions may be paused, and some litigation may be suspended or withdrawn, with the SEC potentially issuing "no-action" letters on specific projects or topics, opening the door for industry and regulators to discuss reasonable paths forward. More comprehensive rulemaking will take longer, but the crypto industry can expect to see exemptive relief soon, likely in key areas such as relaxing the SEC's definitions of "security" and "exchange." The CFTC's approach will be similar, but ensuring the chairs of these two market regulators can coordinate to develop progressive policies will be crucial in the absence of comprehensive market structure legislation delineating the regulatory boundaries between the SEC and CFTC.

Congressional Legislation. The largest crypto policy agenda in Congress includes: market structure (clarifying the regulatory status and authorities over digital assets) and stablecoins (legalizing and licensing stablecoin issuance). In May, the FIT21 bill passed the House with strong bipartisan support, and future market structure legislation may build on this foundation. Bipartisan divides on stablecoin legislation are relatively narrow, with the main points of contention in the House Financial Services Committee being 1) whether to allow only national banks or also state-chartered paths to issue, and 2) which agency(ies) should have prudential supervisory responsibility over these issuers.

- The key is that if the Republicans control the House, we believe the likelihood of these bills being rapidly advanced in 2025 will be reduced. A unified Republican Congress may focus the initial 100 days of 2025 on tax reform, trade, and other priorities, pushing through Republican priorities via budget reconciliation. This does not mean that crypto legislation will not make progress in the next Congress, but in a unified Congress, we believe it will take a backseat to other priorities, requiring close coordination between Congress and regulators on crypto policy. Our base case expectation is that crypto legislation will be delayed to the latter half of the 119th Congress, to allow cabinet officials and independent regulators to solidify their positions before engaging with Congress on policy.

- Energy policy. If Trump is president, especially with Republicans controlling both chambers of Congress, domestic energy and power production will be highly optimistic. This will be supportive of BTC miners, data centers, and any entities with large power supply needs (of course including energy producers).

Impact on market participation

With the easing of regulatory resistance, combined with specific no-action letters, interpretive guidance, or regulatory directives, U.S. institutional investors will be able to access crypto assets on a larger scale.

SEC relaxing the applicability of SAB 121

If the SEC relaxes the applicability of SAB 121, or even withdraws the guidance, in September, it will pave the way for the world's largest custodian banks to enter the crypto market. BNY Mellon has already obtained an exemption as its primary prudential regulator, the New York Department of Financial Services (NYDFS), did not object, while the primary prudential regulators of national banks like Citi and JPMorgan Chase are the OCC. Considering the potential for a significant shift in the OCC's stance on allowing banks to engage directly in crypto, these large banks will gradually gain more opportunities to participate.

Further institutionalization

This will facilitate financing options for crypto assets, enabling spot crypto to be more widely accessed through existing institutional trading platforms and relationships, and elevating the maturity of the institutional crypto market.

SEC's relaxation of the Howey test

If the SEC relaxes the applicability of the Howey test to digital assets, or expands the scope of "crypto asset securities" that can be traded on broker/dealer platforms, it will allow more institutions to enter the trading market, potentially including traditional financial institutions such as banks, exchanges, or brokerages. Additionally, the SEC's relaxation of the Howey test could pave the way for more spot crypto ETFs to be launched in the U.S.

Regulatory clarity and inclusiveness

Clear and inclusive regulatory policies will for the first time allow traditional financial service companies and investors to operate on-chain, bringing new opportunities for yield and other investment strategies. Expanded access to public blockchains may also revolutionize aspects of trading efficiency, transparency, issuance, and finance. Depending on the regulatory stance and potential legislation, the convergence of traditional finance and DeFi may truly be realized.

New token forms and an expanded asset ecosystem

If the SEC further clarifies its stance on the Howey test and token disclosures, we may see a proliferation of new token types, potentially including equity-like tokens. Existing tokens may also add more equity-like features to enhance their value proposition. An expanded and improved asset ecosystem will support the development of a more mature and continuously expanding investable crypto hedge fund industry. Improved token disclosures and issuance capabilities will challenge and potentially disrupt the current VC-capital-dominated SAFT model, enhancing the liquidity of the crypto market.

Crypto company IPO opportunities

In the venture capital space, the IPO market may become more open to crypto-native companies, ultimately providing venture capitalists with exit paths to realize returns. Currently, Coinbase is the only venture-backed crypto startup that has gone public (aside from some SPAC listings). If conditions are right and regulators are supportive, we estimate that dozens of crypto companies may be poised to list in the U.S.

BTC market analysis

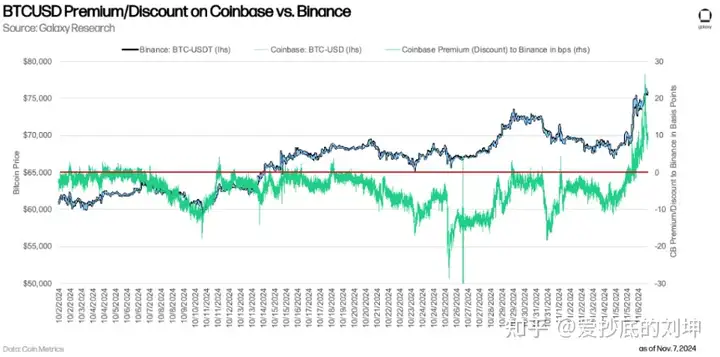

On Monday, November 4, BTC traded as low as $66,700, but has since risen 15% to set a new all-time high. With the increasing likelihood of a Trump victory on November 5, BTC surged to new highs and is holding in the $75,000 to $76,000 range. Although BTC is up 15% since Monday and 26% since October 1, the market does not appear overheated from a fundamental perspective. Late Tuesday, BTC saw a significant spike following election news, with the "Coinbase premium" turning positive for the first time in at least a month.

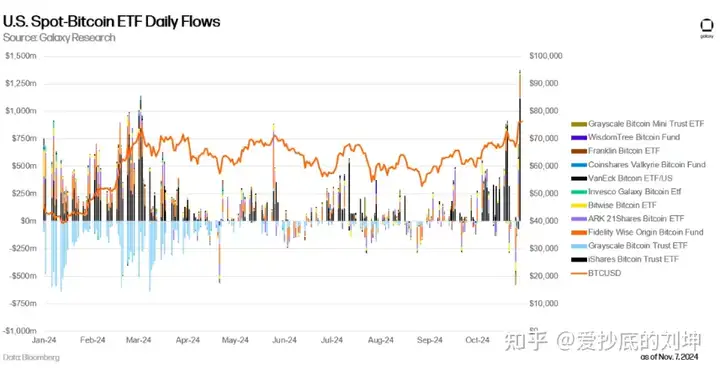

BTC ETFs have been performing strongly, with November 7 (Thursday) seeing the largest single-day net inflow on record at $1.375 billion, driving BTC to new highs. This figure surpassed the previous record of $1 billion net inflow on March 12, 2024.

BTC's cyclicality

Looking back at BTC's historical price movements, BTC's current performance is consistent with the trajectories of the previous two bull markets. Measured from the cycle bottoms (2011: $2, 2015: $152, 2018: $3,122, 2022: $15,460), BTC's uptrend is highly consistent with the 2017 bull market, only slightly lagging the pace of the 2021 bull market.

Reviewing past bull market corrections, the 2024 drawdown is much milder than the corrections during the 2021 and 2017 bull markets.

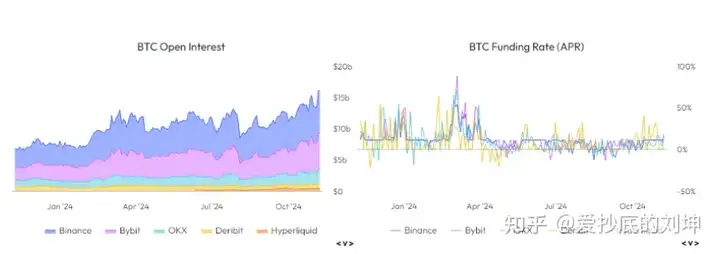

Futures and Funding

While the open interest on crypto exchange futures has risen to new yearly highs, funding rates have remained largely flat, indicating that these fluctuations are primarily driven by the spot market.

Source: Velo.xyz

BTC Options Market

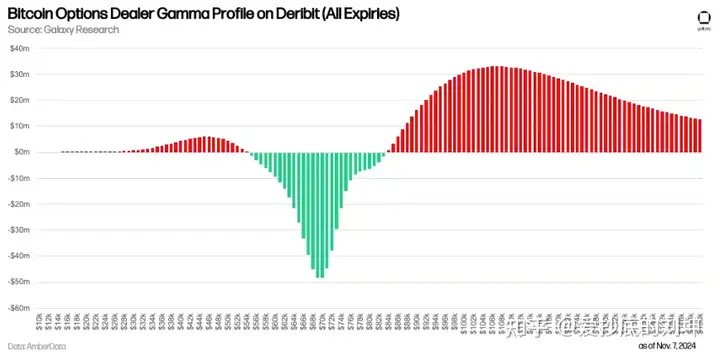

BTC options traders are in a net short Gamma position between $54,000 and $84,000, which will accelerate price volatility. In simple terms, when traders are short Gamma, they typically hedge by buying spot as prices rise, or selling spot as prices fall. This effect can amplify price movements in either direction and increase market volatility. Conversely, when traders are net long Gamma, they will act in the opposite manner, selling as prices rise and buying as prices fall, dampening volatility. Our analysis shows the largest short Gamma position is currently at $70,000, so this effect will gradually diminish as BTC/USD moves higher. Notably, many call option holders at high strike prices are now in-the-money, and these investors may choose to roll their options to even higher strike prices, pushing the short Gamma further up the strike price spectrum. The chart below shows our view of the options traders' net Gamma positions across all BTC option expiry dates from November 7 to September 26, 2025.

BTC Fundamentals

The Realized HODL Ratio (RHODL) is an indicator that measures the ratio between the realized market cap HODL bands of 1 week and 1-2 years (i.e., the realized value of coins last moved within those time frames). A higher ratio typically indicates an overheated market, often coinciding with market tops. The sideways trend of 2024 RHODL more resembles the consolidation seen in 2019-2020, rather than any peak activity, suggesting there is more upside potential in the short to medium term.

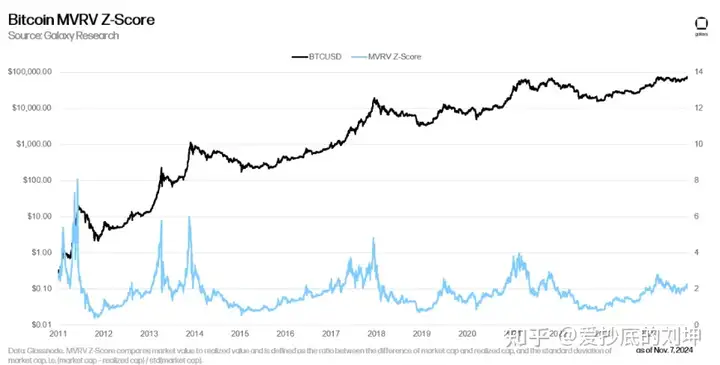

MVRV Z-Score

The MVRV Z-Score is the ratio of market value to realized value, as well as the standard deviation of market value, to help identify the difference between the trading value of an asset and its overall cost basis. Historically, this metric has been very effective in identifying market peaks, and the current value indicates that BTC/USD has not yet approached the overbought or top area.

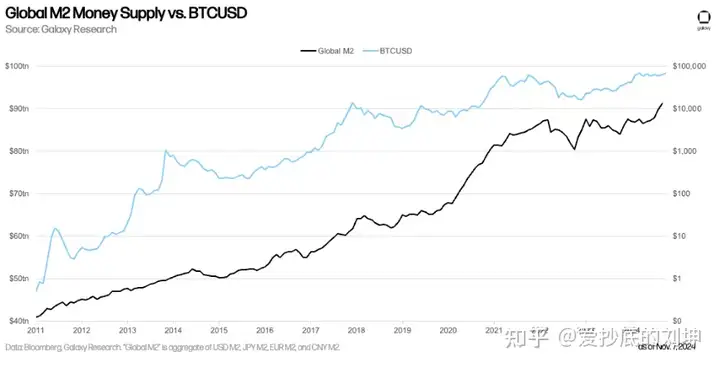

Bitcoin and Global M2

Bitcoin has historically responded to changes in the global money supply. While this correlation is not unique to Bitcoin, if Bitcoin begins to be used more as a hedge asset, as Larry Fink has advocated, this trend is worth watching.

Outlook

The arrival of the Trump administration, coupled with a strong Republican Senate able to confirm his agency appointments, is a positive development for regulatory easing in the U.S. crypto industry. We expect that some form of exemptive relief will be forthcoming soon, but a more robust supportive regulatory framework may take more time to take shape. The relaxation of the enforcement environment, coupled with progressive policy thinking, will pave the way for traditional financial services companies and institutional investors to participate more deeply in this asset class. This will challenge the moats of existing crypto infrastructure firms, but will also broadly support the expansion and maturation of the asset class. In this environment, we expect BTC and other digital assets to trade at levels significantly above their current all-time highs over the next 12-18 months.