Stablecoin leader Tether was reported by Bloomberg in October this year that Tether has discussed opportunities for US dollar loans with several commodity traders, intending to use its stablecoin USDT for more mainstream commodity trading.

On November 8, Tether officially announced that Tether's trade finance division had participated in a Middle Eastern crude oil transaction for the first time this October. According to Tether, the transaction involved a collaboration between a publicly listed oil company and a commodities trader, loading and transporting 670,000 barrels of Middle Eastern crude oil, with a transaction value of $45 million.

Simplifying Global Trade Processes

According to the Tether press release, Tether's trade finance business was launched earlier this year and operates separately from its stablecoin reserve business, with the aim of simplifying the processes required for global trade by providing convenient capital solutions to support the $10 trillion trade finance industry.

In this regard, Tether's CEO Paolo Ardoino stated in the press release:

Tether's funding support for this important crude oil transaction demonstrates our commitment to reshaping the trade finance landscape, as we bring efficiency and speed to markets that have historically relied on slower and more costly payment structures through the use of the Tether USDT stablecoin.

This transaction is just the beginning, and we hope to support more commodity classes and industries to bring greater flexibility and innovation to global finance.

Finally, Tether also stated that USDT has inherent advantages over traditional financial lending, as it can not only reduce trade costs, but also comply with anti-money laundering standards, while also enhancing transaction transparency and trust based on the blockchain network.

What is Trade Finance?

Trade finance is primarily used to support international trade. It allows importers and exporters to obtain the necessary funds during the transaction process and reduce risks. Essentially, trade finance is to ensure that the exporter receives payment guarantee before the goods are shipped, and the importer can pay only after the goods have been shipped or arrived.

The main tools of trade finance include letters of credit (L/C), bank guarantees (BG), accounts receivable financing, and bill discounting. These tools can help the buyer and seller reduce trust risks and facilitate the smooth progress of transactions. For example, a letter of credit can allow the seller to receive funds immediately after submitting shipping documents, while the buyer can pay only after confirming that the goods have been shipped or arrived.

Through trade finance, importers and exporters can not only improve their liquidity, but also reduce transaction risks, ensuring that funds and goods can be exchanged safely and efficiently.

USDT Market Cap Surpasses $132.5 Billion

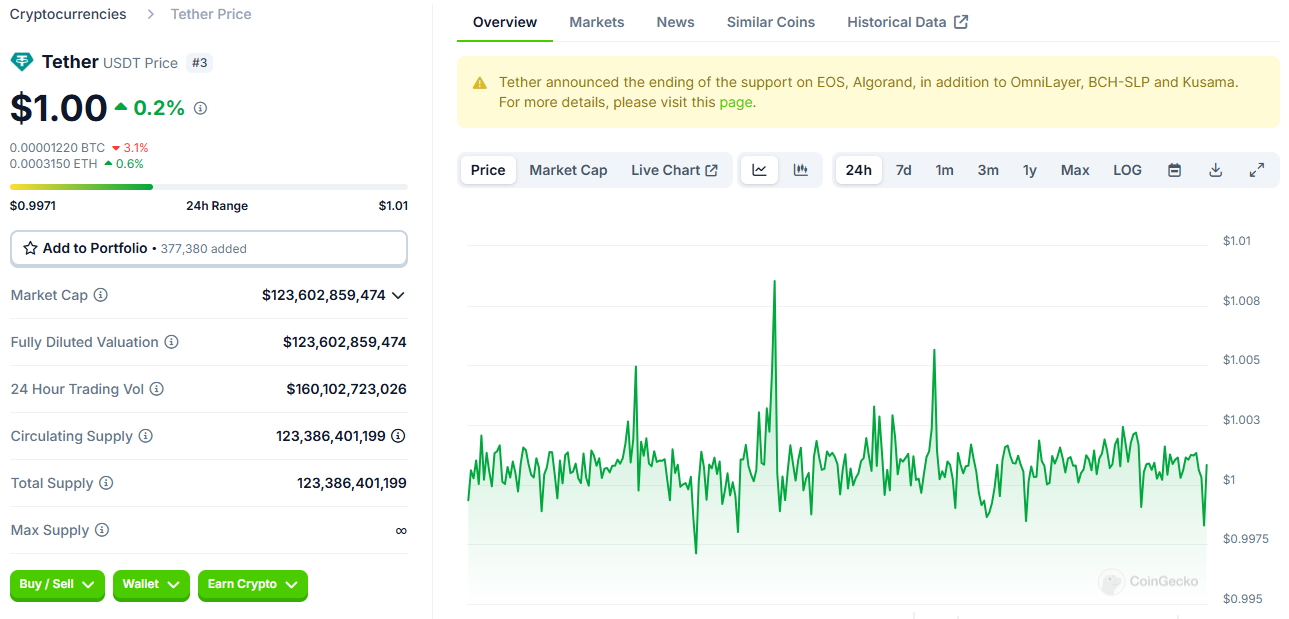

According to CoinGecko data, Tether's stablecoin USDT has a market cap of over $132.5 billion, with a 24-hour trading volume of $127.1 billion, ranking second only to Bitcoin and Ethereum in the overall cryptocurrency market.