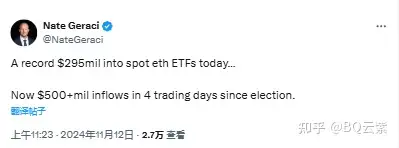

Yesterday, the spot Ethereum ETF saw a daily inflow of $295 million, setting a new record high, and with the surge in ETH price following Trump's election victory, the inflow has also accelerated.

The spot Ethereum ETF has once again become the focus, with the largest daily inflow since its establishment on Monday. As a result, the ETH price has also risen by 5.5%, soaring to $3,370. With this move, ETH's weekly gain has expanded to nearly 38%.

Spot Ethereum ETF Steals the Limelight

Yesterday, November 11th, the spot Ethereum ETF saw a record inflow of $295 million, setting a new daily inflow record. According to data from Farside Investors, Fiedlity's FETH led with a daily inflow of $115.5 million, while BlackRock's ETHA also saw an inflow of $100 million, and Grayscale's mini ETF (ETH) had an inflow of $63.3 million.

Since Donald Trump's victory last week, the inflow into Ethereum ETFs has surged for several consecutive days. Over the past four days, the inflow into Ethereum ETFs has exceeded $500 million. BlackRock and Fidelity have both made significant contributions to this.

This indicates that the situation is indeed improving, and Ethereum ETFs are catching up with the inflow into Bitcoin spot ETFs in recent weeks. On Monday, Bitcoin spot ETFs saw an inflow of over $1 billion, with BlackRock's IBIT leading the way.

CoinShares analyst James Butterfill emphasized that this is the largest inflow since the launch of Ethereum ETFs in July. This is because more and more investors are turning to traditional financial products to invest in major cryptocurrencies.

ETH Price Trend

As mentioned above, the Ethereum price has been on an unstoppable upward trend, with a weekly gain of 38%. ETH is now looking forward to reaching the critical $4,000 milestone and further setting new highs.

According to the technical chart, the ETH price currently has the potential to break out of its expanding wedge pattern. After the breakout, the bulls can push it up to $5,450.

Ethereum has seen a rapid rise recently, with a market capitalization exceeding $400 billion, surpassing banking giants like Bank of America. Furthermore, Ethereum derivatives investors are expected to maintain a bullish sentiment, with the open interest in Ethereum futures reaching a record high of $17.93 billion on Monday.

Therefore, if ETH continues to perform strongly, the overall Altcoin market will continue to thrive.