Introduction

With Trump's victory in the presidential election, the market has high hopes for his pre-election promise of a crypto-friendly policy, and Bitcoin has ushered in a new round of upward trend. Since the election, Bitcoin has soared from $66,822 to over $22,000, hitting a new high of $89,575 this morning, and is currently stable at $88,604, up nearly 8.8% in the past 24 hours. This round of Bitcoin's rise not only helped its market value surpass silver, but also made it the eighth largest asset in the world.

Latest price trend of Bitcoin BTC

Bitcoin's market value surpasses silver, ranking eighth in the world

According to CoinMarketCap data, Bitcoin's market value reached $1.77 trillion this morning, slightly higher than silver's $1.732 trillion, marking a further consolidation of Bitcoin's position as a digital asset. As Bitcoin's market value continues to rise, its global asset ranking has entered the top ten, ranking eighth. Bitcoin's strong performance has not only attracted traditional investors, but also further boosted the trading volume of spot ETFs to a record high.

Bitcoin spot ETF: Expected to surpass gold ETF in market value by January next year

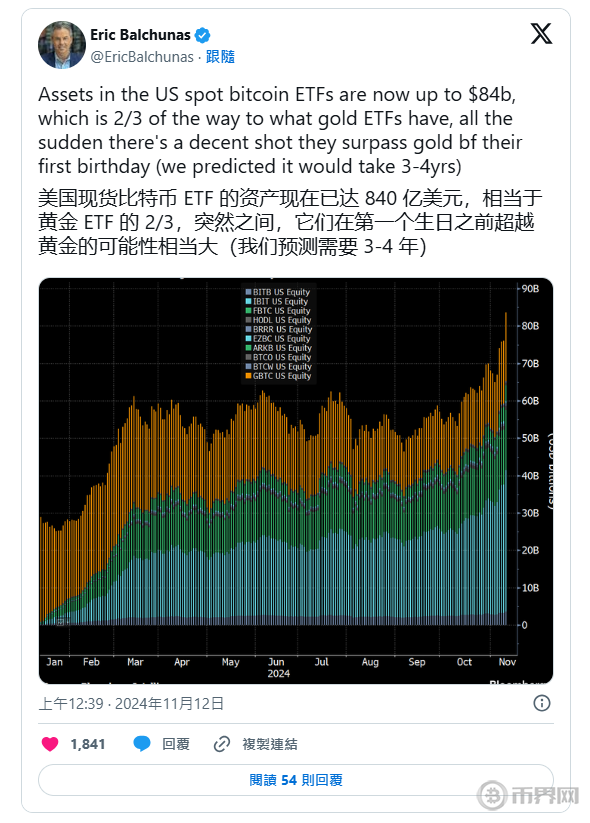

Since Trump's victory, the performance of Bitcoin spot ETFs has also been remarkable. According to the forecast of Bloomberg senior ETF analyst Eric Balchunas, the asset management scale (AUM) of Bitcoin spot ETFs has reached $84 billion, close to two-thirds of the gold ETF. He believes that the asset management scale of Bitcoin spot ETFs may surpass the gold ETF when it is listed for one year, which was originally expected to take three to four years.

Eric Balchunas further stated that "the rapid growth of Bitcoin ETFs may achieve the surpassing of gold ETFs within one year of listing." The acceptance and acceptance of Bitcoin spot ETFs in the traditional financial market is rising rapidly, especially with the expected crypto-friendly policies to be implemented after Trump's inauguration, the market expects the growth potential of Bitcoin ETFs to be greater.

Bitcoin trading frenzy drives Coinbase and MicroStrategy stocks to soar

Bitcoin's strong performance has also triggered a trading frenzy in the related stock market. On Monday, Coinbase (COIN) and MicroStrategy (MSTR) were among the top five stocks in trading volume. Coinbase closed up nearly 20% at $324.24, while MicroStrategy surged 25.74% to $340. After hours, MicroStrategy continued to rise, with the stock price breaking through $358.

In addition, the daily trading volume of BlackRock's Bitcoin spot ETF "IBIT" also reached $450 million, showing strong investor enthusiasm. Furthermore, the "Bitcoin industrial complex" formed by Bitcoin and its related stocks and ETFs - including ETFs, Coinbase, MicroStrategy and other assets - has reached a daily trading volume of $3.8 billion, a new high. This strong trading performance indicates that the capital market is closely watching Bitcoin and its surrounding assets, and the investment enthusiasm for related stocks has also risen significantly.

Tech stocks decline, investors' attention shifts to cryptocurrencies and Bitcoin ETFs

In contrast to the booming cryptocurrency market, tech giants have performed poorly recently. Apple (AAPL), Nvidia (NVDA), Amazon (AMZN), Microsoft (MSFT) and Meta Platforms (META) all saw slight declines on Monday, with only Alphabet (GOOGL), the parent company of Google, rising, while Tesla (TSLA) closed up nearly 9%. The market has clearly seen a shift from tech stocks and gold to cryptocurrencies.

At the same time, gold prices have fallen 4.5% since the election, further indicating that capital flows are gradually shifting.

Trump's election and the future prospects of Bitcoin

The market performance after Trump's victory has injected new momentum into Bitcoin, and the policy expectations brought by his election have accelerated Bitcoin's soaring. Analysts believe that the crypto policy under Trump's administration will be more relaxed, which is expected to have a far-reaching impact on Bitcoin's market ecology and investment environment. Many investors are therefore more optimistic about cryptocurrency assets, especially Bitcoin.

The rise of Bitcoin has sparked renewed market attention to cryptocurrencies, especially in the context of expected policy benefits. Over the next few months, Bitcoin's performance may still be influenced by the direction of Trump's policies. The "lagging" of gold ETFs relative to Bitcoin ETFs also reflects that more and more traditional investors are seeing cryptocurrencies as a new safe-haven asset, accelerating Bitcoin's process of becoming a mainstream asset.

Conclusion:

The policy expectations after Trump's victory have driven a significant rise in Bitcoin prices, a trend that has also helped Bitcoin's market value surpass silver and become the eighth largest asset in the world. In addition, the trading volume of Bitcoin ETFs and related stocks has repeatedly hit new highs, indicating the market's strong interest and investment confidence in Bitcoin. The Bitcoin spot ETF is expected to reach a milestone in January next year, surpassing the asset size of the gold ETF, which will not only inject new vitality into the Bitcoin market, but also further consolidate its position in the global investment market.

As cryptocurrencies are increasingly attracting attention, the ebb and flow between Bitcoin, gold and tech stocks is also worth continued attention. Under the influence of Trump's new term, Bitcoin's performance may continue to strengthen, which could bring potential positive impacts on market liquidity and the overall investment landscape. However, the volatility of the cryptocurrency market is still relatively high, and investors need to be vigilant while focusing on the prospects of Bitcoin, and do a good job in risk prevention.