Bitcoin broke out of the range it had been consolidating in for nearly half a year on 11/6, surging from $73,000, which is closely related to Trump's victory and the start of the rate cut cycle.

VX: TTZS6308

Trump's victory: Prior to the election, he promised to release a number of crypto-friendly policies, including turning the US into a global cryptocurrency hub and firing the current SEC chairman, etc. Although it is uncertain whether he will be able to fulfill his promises after taking office, it is foreseeable that the crypto market has often faced regulatory pressure in the past, and this situation will be alleviated after Trump takes office, which is undoubtedly a major factor driving the market upward.

The rate cut cycle has been launched: Rate cuts mean that the US is releasing more liquidity into the risk market, which theoretically will lead to a rise in the stock market and other asset classes such as foreign currencies. As the highest risk and relatively smaller market cap asset, BTC can also benefit from this. The rate cut in November has had a positive market reaction in traditional finance, with the S&P closing at a new high and the bond market rising. However, the transmission of liquidity often takes time, and Q4 2024 is the opportunity for the crypto market to absorb the spillover liquidity.

From the policy side to the liquidity injection, we are currently in the "early bull" period, and since the previous high of BTC is the bottom of the new bull cycle, we can boldly assume that $73,000 is the support price for this bull market.

Beware of corrections after the surge

Although this may be a topic that most people are reluctant to face, the necessary risk planning must be in place. Although there may be some who will criticize me, saying that I said it would correct to $80,000, how come it's $90,000 today? I still hold the same view, sell as it rises, no problem, and reducing positions or selling out of high-chasing is also fine. To each his own, if you feel the bull market has arrived, just hold on.

Because the secondary market is now also experiencing a wealth effect, but if you bought some altcoins in March, many people still haven't broken even on their spot holdings, and have already been scared by BTC to think there will be a correction. In this position, they don't dare to add more for fear of being trapped, and they don't dare to reduce positions for fear of missing the pump.

In this position, the only thing to do is to control your position size, don't FOMO, even if there is a correction it is reasonable, try not to touch contracts and leverage, just hold the spot, and if you reach your profit target, sell some to rotate. The coins will definitely take turns to rise!

The bull market is like this, it's not a one-way upward trend! Keep your mentality in check! Those who are out of the market and missed the pump will also have opportunities to get in, no need to panic or FOMO.

Some signals of a correction

Policy fulfillment expectations

The first factor is the expectation of policy fulfillment under Trump, i.e. whether the industry can welcome the expected changes in the regulatory environment after Trump's victory.

Although the market is generally optimistic, the degree of regulatory change is still uncertain, and will ultimately depend on the policies of the White House and Congress, so the strength and timing of policy implementation is still to be determined.

There is also a rather delicate situation here, which is that Trump's inauguration is on January 20 next year, about 2 months away, the outlook is relatively optimistic, but the window period before it can actually be implemented. This means that the good news is not yet certain.

In summary, the fulfillment of policies will be a decisive factor in whether this bull market can be sustained, but considering the existence of the window period, this factor may not have an immediate impact on the short-term market. Relatively speaking, the latter two factors may have a more direct impact on the short-term market trend.

Changes in the "liquidity injection" rhythm

The second factor is the impact of Trump's victory on the Fed's rate cut pace, i.e. whether the victory will reduce the market's previous rate cut expectations.

Looking at the latest market sentiment, several institutions have already predicted that Trump's victory will directly lead to a reduction in the Fed's rate cut expectations before 2025 - the current probability of the Fed cutting rates by 25 basis points in December is 68%, compared to about 83% before Trump's victory.

This week, multiple Fed officials, including Powell (4:00 am Beijing time on Friday), will give speeches in quick succession; in addition, the release of the October CPI data (9:30 pm Beijing time on Wednesday) will also have a major impact on the market's rate cut expectations. This may be the most critical factor in determining the subsequent market trend this week.

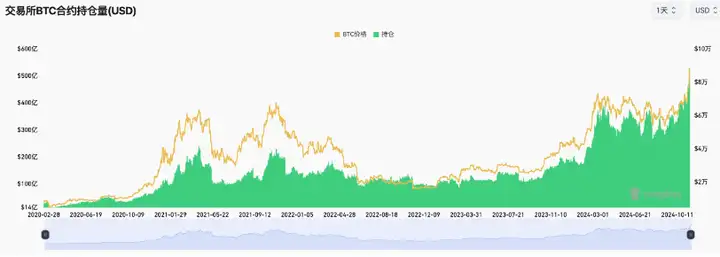

The gradually rising leverage

The third factor is the gradually rising leverage in the current market, which objectively creates conditions for large fluctuations in the market.

Coinglass data shows that the total open interest of BTC futures contracts on the network has reached 594,500 BTC (about $52.3 billion), continuously hitting a new high; the notional value of the total open interest of BTC options on the network is $34.4 billion, also reaching a historical high.

Since the position size of derivatives is affected by the price of the underlying asset, considering that BTC has set a new high, the actual leverage situation may not have reached a new high level, but the current upward trend is still worth vigilance.

Looking back at past market trends, leverage is the booster of the bull market, but also the fuse of extreme market conditions. While predicting market trends cannot be "grasping at straws", risk control is an eternal subject. To be honest, this position size plus the liquidation chart, the more I look at it, the more scared I get.