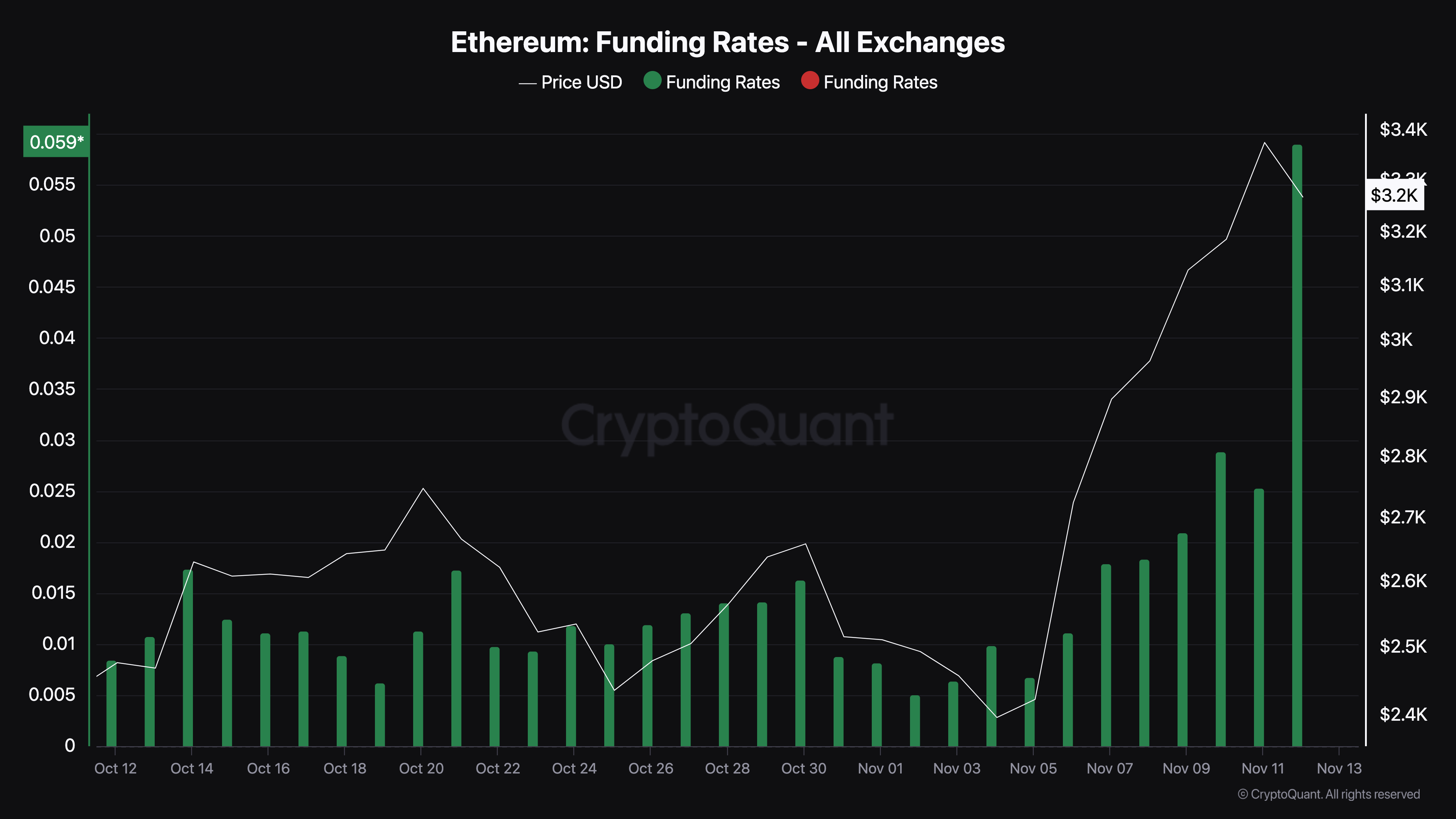

The price of Ethereum (ETH) has recently soared above $3,400, and the funding rate has also reached its highest level since March. However, despite the drop in ETH's price, the bullish sentiment on altcoins remains high.

This new optimism makes traders believe that a new all-time high may be approaching. However, historically, such an increase in funding rates foreshadows problems.

Funding rate reaches an all-time high in 8 months...Is it a sign of market overheating?

Like other cryptocurrencies in the market, ETH's price has recently recorded double-digit increases. Today, altcoins rose to $3,445 before falling back to $3,256. After this surge, Ethereum's funding rate has soared to its highest level in 8 months.

The funding rate is a key indicator used to assess market sentiment in cryptocurrency trading. A high funding rate suggests that many traders are taking long positions, betting on price increases, indicating a bullish market. Conversely, a low or negative funding rate may indicate that traders prefer short positions, reflecting a bearish outlook.

Positive funding rates generally reflect strong demand in a bullish market, but excessively high levels can signal an overheated environment. This imbalance can increase the liquidation risk for Ethereum traders holding long positions and trigger a chain reaction that could further drive down Ethereum's price.

Reflecting this cautionary outlook, one analyst, ShayanBTC, a contributor to CryptoQuant, states that Ethereum's funding rate is a warning signal that the cryptocurrency may retreat.

"In the current market environment, with funding rates at high levels, the risk of increased volatility and potential correction is heightened. An overheated market can lead to a sharp sell-off if triggered by profit-taking or minor adjustments," the analyst explained.

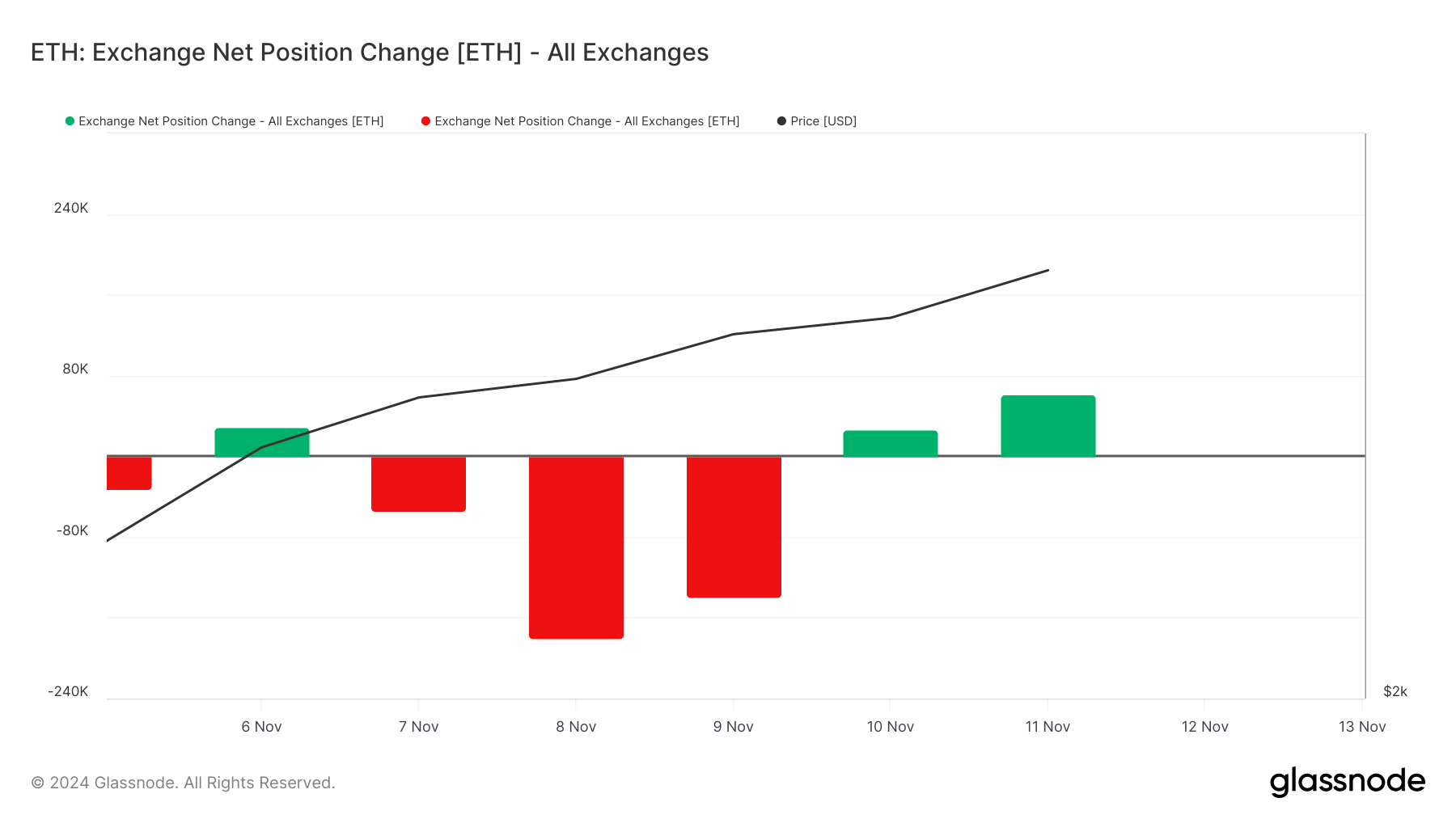

Another signal indicating the potential for further declines in Ethereum is the exchange net position change indicator, which tracks the 30-day change in ETH supply held in exchange wallets. An increase in this metric suggests that investors are moving their assets to exchanges, preparing to sell, while a decrease indicates that holders are refraining from selling. According to Glassnode, at the time of writing, approximately 61,603 ETH, worth around $200 million, have flowed into exchanges. This number rising could lead to another price drop for ETH.

Short-term support at $3,221, resistance at $3,500

Since November 5th, Ethereum's price has increased by 40%. This price increase was due to a breakout from the downward channel seen below. However, it has hit a strong resistance at the $3,500 level, and the price has since retreated, currently trading at $3,256 as of the 13th.

Looking further at the chart, the Balance of Power (BoP) indicator, which measures the strength of buyers and sellers, now shows that sellers have the upper hand. If this persists, ETH could fall to $3,009.

However, if aggressive buyers prevent the cryptocurrency from falling below $3,221, this may not happen. Instead, ETH's price could rise to $3,563 in the short term, and potentially reach $4,000 thereafter.