The cryptocurrency market has recently experienced another wave of crazy price surges, with Bitcoin breaking through $89,000 to reach a new all-time high, and Solana quickly following suit by surpassing $220, restoring the market sentiment to the glorious "raging bull market" of 2021. However, in this intense market frenzy, there is an unexpected "absentee" - BNB (Binance Platform Token). Currently, the price of BNB is stable around $620, seemingly calm, but its performance is unusually low-key compared to BTC and SOL, as if it has chosen to quietly "lie flat" in this grand cryptocurrency party.

The BNB/BTC trading pair has fallen to 0.007, a new low since March 2024

The BNB/BTC trading pair has fallen to 0.007, a new low since March 2024

Recalling the previous bull market, BNB, with its powerful ecosystem and the support of the Binance platform, had once staged a comeback and become a star in the cryptocurrency market. But now, it has "absented" itself from this wave of the big market trend. Is this silence a temporary fluctuation in the changing market landscape, or a deeper underlying concern within BNB?

BNB's Absence in the Bull Market: Lack of Memecoins Reflects Lagging Ecosystem Development

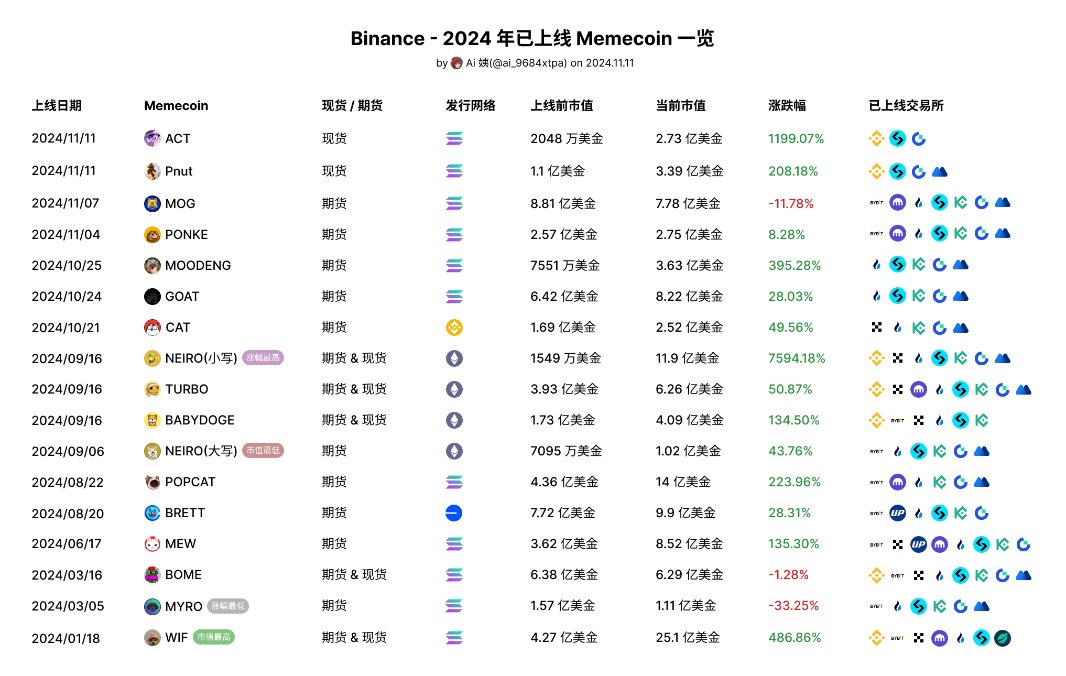

This year, Binance has launched as many as 17 Memecoin projects, but 11 of them are from Solana, 4 are from Ethereum, and BNB Chain has only launched one - the CAT coin. Even more embarrassingly, after the launch of CAT coin, it is only available for contract trading and has not yet entered the spot market, so it is "little known". This inevitably makes one wonder, has the BNB Chain fallen behind?

In the early stages of the previous bull market, the BNB Chain was a popular public chain. Benefiting from its low-cost and high-efficiency transaction system, it quickly attracted a large number of developers and project parties, and even became one of the most popular public chains in the market. But now, Solana seems to have occupied the market share that originally belonged to BNB. BNB's absence is not only reflected in the Memecoin field, but in fact, its DeFi and DApp ecosystems are also in a weak state, and project parties are increasingly unwilling to turn their attention to the BNB Chain.

The Absence of BUSD: A Fatal Blow to the BNB Chain

CZ previously wrote: "We do foresee users migrating to other stablecoins over time. We will also make corresponding product adjustments. For example, we will stop using BUSD as the primary trading currency."

The weak performance of the BNB Chain in the current bull market can be partly attributed to the absence of BUSD (Binance USD). As a key component of the BNB Chain ecosystem, BUSD has played a crucial role in DeFi protocols, the NFT market, and various decentralized applications (dApps). The withdrawal of BUSD has become a major blow to the BSC in this market trend, with far-reaching effects.

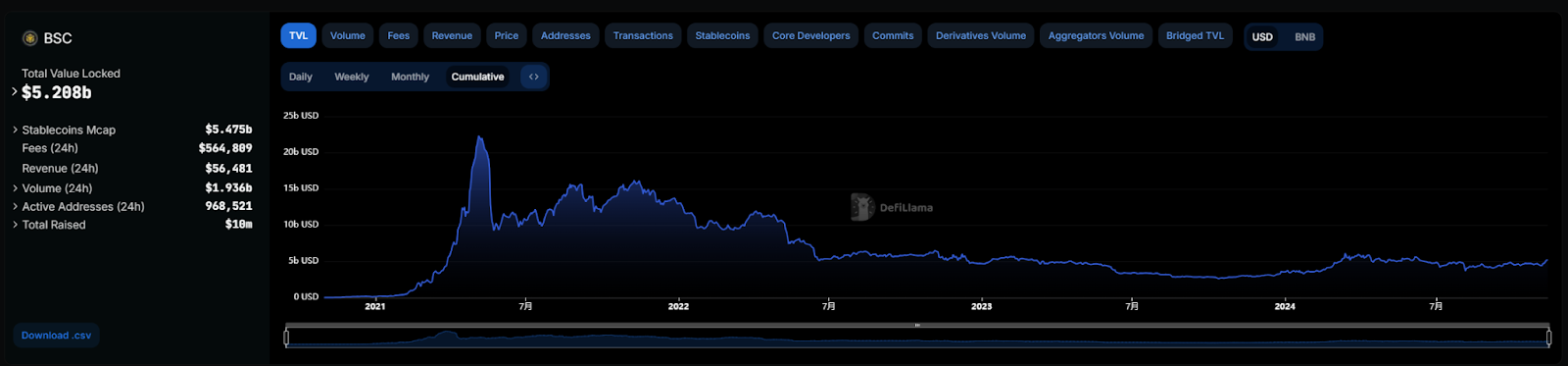

According to defillama data, the current total locked value (TVL) of the BNB Chain is $5.2 billion, far from the peak of $22 billion in 2021.The growth rate of TVL in the past month is less than 15%, ranking second to last among the top 10 Layer1 chains.

Without BUSD, the BNB Chain is unable to deeply embed itself in various DeFi models and ecosystems as it did in the past. Stablecoins, as the basic infrastructure of the DeFi market, provide important support for transactions, lending, and liquidity. Although other chain-based stablecoins have to some extent alleviated the absence of BUSD, these alternatives cannot truly fill the huge void left by the withdrawal of BUSD. This has directly led to a decline in the trading volume of decentralized exchanges (DEXs) and lending protocols, and the yields of DeFi protocols have also failed to attract as much capital inflow as in the past.

Especially compared to competitors like Solana and Ethereum, the stablecoin ecosystem of the BNB Chain has become weaker, putting BNB in a clearly disadvantageous position in attracting new projects and users. The absence of BUSD has not only affected DeFi protocols, but also extended to other core applications on the BNB Chain, further exacerbating the "absence" of the BNB Chain in the market.

The Rise of Solana: Competitive Pressure Faced by the BNB Chain

If the "absence" of the BNB Chain can be understood to some extent, the rise of Solana is probably a reality that BNB finds hard to accept. Solana, with its high throughput and low transaction fees, has been able to flex its muscles in this bull market, quickly attracting a large influx of developers and capital.

Although the current market capitalization of BNB and Solana is not much different, Solana's market capitalization is about 10 percentage points ahead of BNB.

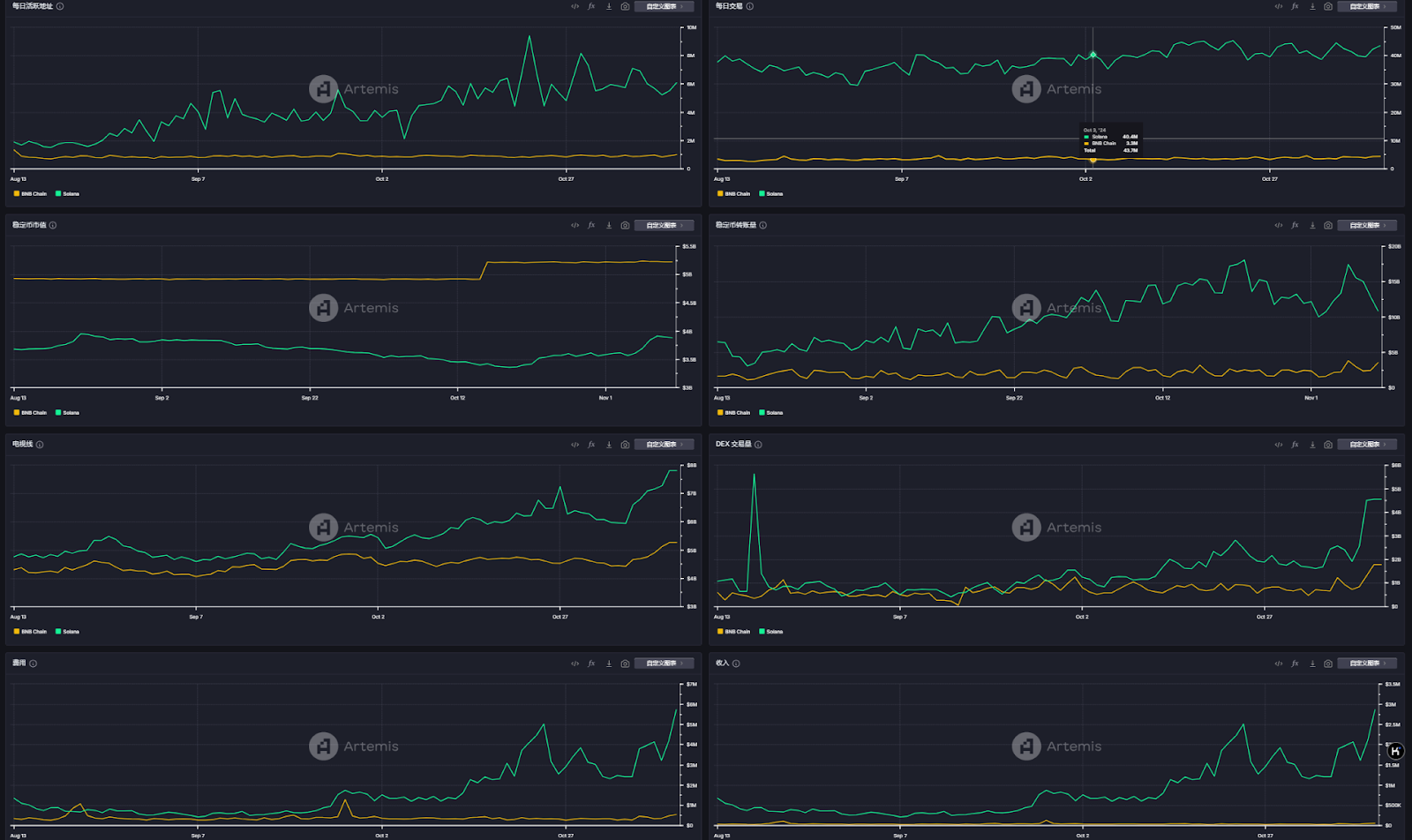

But according to Artemis' data, Solana outperforms the BNB Chain across a range of indicators such as daily active addresses, daily transaction volume, stablecoin market value, stablecoin transfer volume, TVL, DEX trading volume, fees, and revenue.

Some researchers even point out that without the support of Launchpool, the market value of BNB may not even reach $500.

Especially in the fields of NFT and DeFi, Solana's ecological advantages are obvious. Many projects that once relied on BNB and Ethereum have migrated to Solana, further eroding the competitiveness of the BNB Chain. Solana not only has technological advantages, but has also established a strong community support and user base through cooperation with many important projects, completely taking away a portion of BNB's market share.

The rise of Solana has undoubtedly brought tremendous competitive pressure to the BNB Chain. The BNB Chain had once occupied a place in the DeFi and NFT markets with its efficient transaction confirmation speed and low transaction fees, but with the rapid rise of Solana, the market competitiveness of the BNB Chain has gradually weakened. Solana's ecosystem not only has advantages in speed and low cost, but has also established a strong community support and user base through cooperation with many important projects. The biggest challenge for the BNB Chain now is how to regain its market share in DeFi and other core application areas.

BNB Chain's Progress in the Third Quarter: Technological Innovation and Ecosystem Development

Although the BNB Chain's performance in this round of cryptocurrency bull market has been relatively sluggish, facing the dual pressures of the absence of BUSD and the rise of Solana, the BNB Chain has not stagnated. In terms of technological innovation and ecosystem expansion, the BNB Chain is still actively deploying, trying to restore its market competitiveness through technological upgrades and cross-chain cooperation.

In the third quarter of 2024, the BNB Chain has increased its investment in infrastructure and core application areas, particularly making significant progress in areas such as DeFi, Non-Fungible Tokens, gaming, and cross-chain capabilities. These ongoing efforts in technology and ecosystem, although unable to immediately change the weak market performance in the short term, have laid a solid foundation for the future recovery of the BNB Chain.

1. The BNB Chain has launched a number of new incentive programs and initiatives, including the Gas-Free Carnival for stablecoin transfers, the Gas Grants Program, and the fourth phase of the TVL Incentive Program.

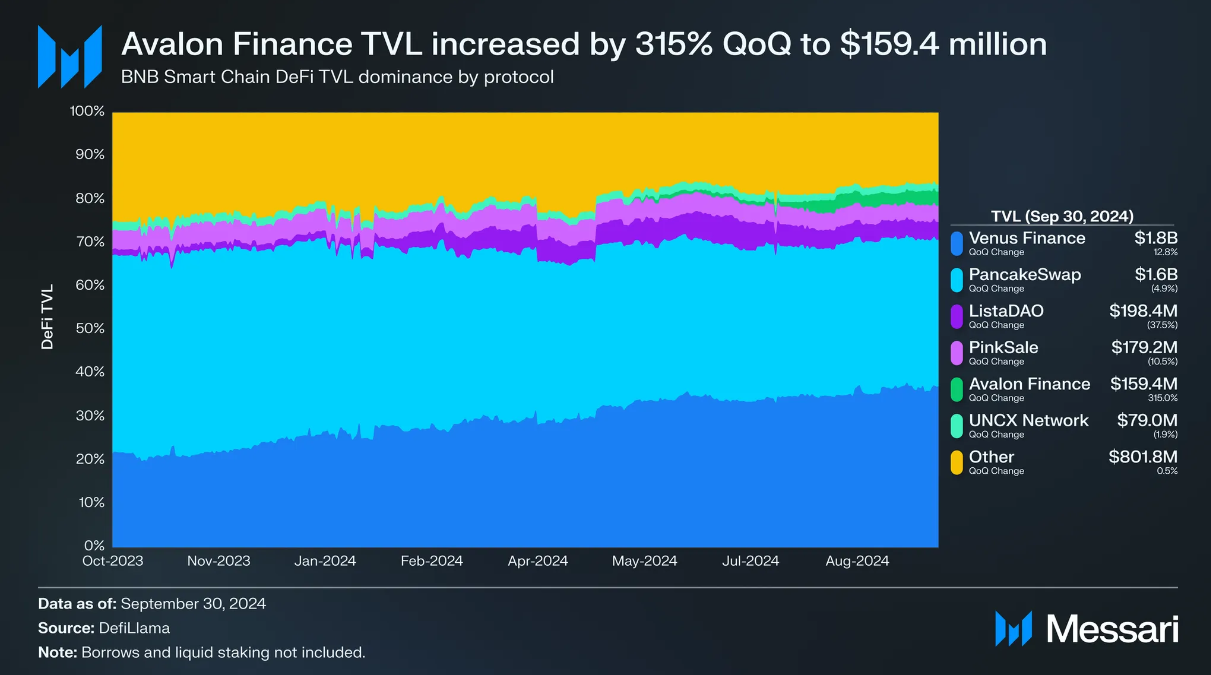

2. The DeFi TVL on the BNB Smart Chain has slightly increased to $4.85 billion, maintaining its ranking as the fourth highest chain. Venus Finance and Avalon Finance have achieved the largest growth, with Venus' TVL growing 13% quarter-over-quarter, and Avalon growing over 300% after joining the BNB Incubation Alliance.

3. NFT activities have shown a recovery, with the daily trading volume increasing by 283% quarter-over-quarter to $600,400, although this growth was mainly driven by large individual traders.

4. The BNB Chain has further promoted its multi-chain strategy through the continuous launch of the BNB Chain Bridge, facilitating cross-chain transfers and improving the liquidity of the entire ecosystem.

Future Outlook: A Rundown of Potential BNB Ecosystem Coins to be Listed on Binance

Despite the challenges faced by BNB, some projects within the BNB Chain ecosystem still have potential and are worth keeping an eye on. Here are some BNB ecosystem coins that may become highlights in the future:

Cheems

Cheems was initially launched on the zkSync mainnet, followed by a 100% airdrop event, which saw its market capitalization reach several million dollars. However, as the hype died down, its market value dropped to less than a million dollars. After Cheems migrated to the BNB Chain, its performance has once again been impressive. It can be said that Cheems is the best-performing Meme project on the BNB ecosystem during this period.

Koma

Koma Inu - The Cutest Memecoin on BNB Chain! Koma Inu is a dog-themed token built around community-driven decentralization and adoption. Driven by pure meme energy, $KOMA was created by the community, for the community. The cats have had their time - now it's the dogs' turn to lead and make BNB Chain memecoins great again.

Conclusion: BNB's Challenges and Path to Rebirth

BNB's "absence" during the current bull market has indeed been disappointing, but it has still demonstrated strong capabilities in terms of technological innovation and ecosystem support. In the future, how BNB Chain can restore its stablecoin ecosystem, attract more developers and projects, and enhance its market appeal will be the key to its ability to return to the competition. If BNB can overcome the current challenges and seize the opportunities for ecosystem expansion, it may still have the potential to experience a new breakthrough.