What is Bitcoin? It is simply a digital currency powered by an encrypted peer-to-peer network outside the control of any one person, group, entity or a central bank. There are several advantages of Bitcoin as a digital currency such as the usage of advanced blockchain technology, decentralisation, anonymity and ease of transacting globally.

So, why does Bitcoin face tremendous backlash? Even though it is a revolutionary technology, the misuse of Bitcoin has caused several countries to levy heavy regulations on its usage, primarily because of the difficulty in tracing its transactions. This has emerged as a novel method for criminals, terrorists, and illegal transactions to thrive beyond national boundaries with ease.

Another major reason was that, more than its usage as a digital currency to make payments, investors were using cryptocurrencies as a means to profit from their price. Just like a stock market exchange, there are different exchanges and platforms where users can buy and sell cryptocurrencies. One of the largest cryptocurrency exchange platforms, FTX, filed for bankruptcy with an estimated $8 billion in missing customer funds.

Such incidents have impacted investors' trust in the cryptocurrency ecosystem. However, institutions are showing increasing interest in Bitcoin, which makes it relevant even in today's time. A key shift in this paradigm came after the SEC's approval of Bitcoin and Ethereum ETFs. The Grayscale Bitcoin Trust, with over $16 billion in assets under management, and the introduction of Spot Bitcoin ETFs, with BlackRock emerging as a leading player, have further added fuel to the momentum of Bitcoin.

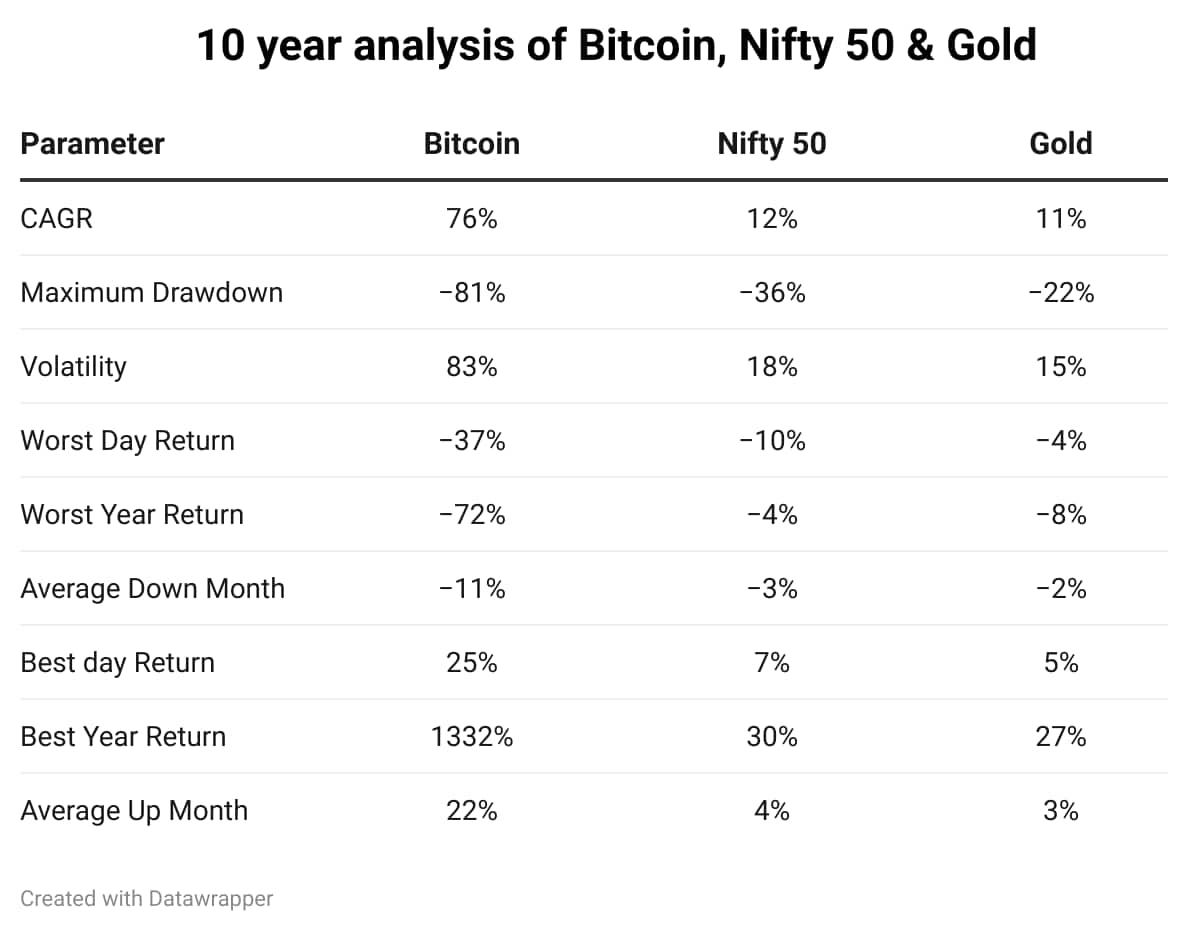

FinSharpe did a 10-year analysis on the price of Bitcoin and compared it with Nifty 50 and Gold to visualise the contrast, even though they are different asset classes.

It can be seen that Bitcoin as an investment is a very volatile instrument that carries significant risk.

In India, cryptocurrencies like Bitcoin are not recognised as legal tender; however, trading and investing are allowed. The gains from Bitcoin are taxed at a 30% rate (along with applicable surcharge and 4% cess), and 1% TDS is applicable (over ₹50,000 in case of specified persons and ₹10,000 in other cases).

Retail investors should be aware of the risks associated with investing in Bitcoin. However, as institutions have started embracing Bitcoin, compared to their initial scepticism, it is definitely an instrument that cannot be ignored.