BTX Insights: "Trump 2.0" policy expectations ignite market frenzy, Bitcoin soars, US dollar strengthens, gold's safe-haven demand weakens

Recently, the market has been swept up in a new wave of the "Trump trade" frenzy amid expectations of Trump's potential return to the White House. The US dollar has strengthened, Bitcoin has soared, Tesla has rebounded significantly, while gold has declined due to reduced safe-haven demand. At the same time, the "widow trade" has led to record inflows into US Treasury ETFs, as investors are increasingly confident that the interest rate peak has been reached.

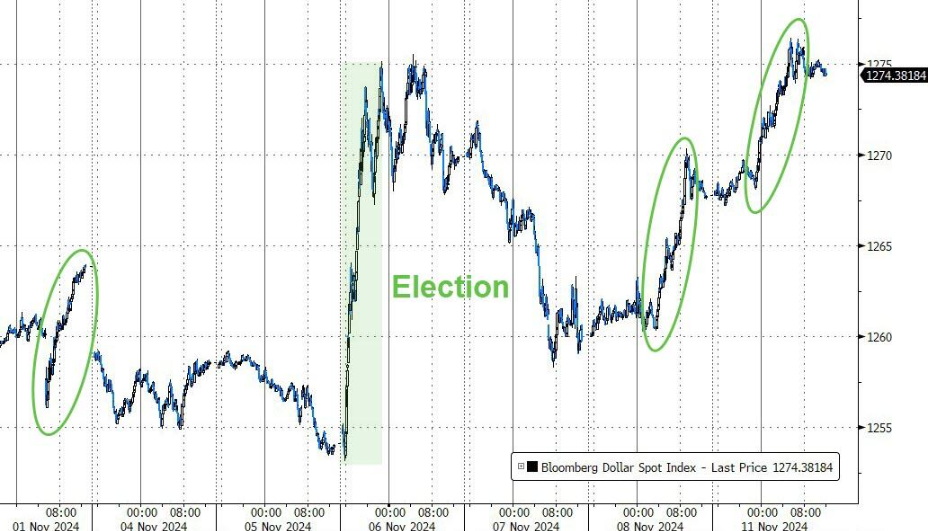

US dollar rises: Non-US currencies generally under pressure

The US dollar has continued to rise, with the Bloomberg Dollar Index gaining 0.5% last week, reaching a new four-month high, driving non-US currencies lower. The euro fell more than 0.6% against the US dollar, briefly dropping to $1.063, the lowest level since April; the British pound fell 0.40% against the US dollar, while the US dollar rose 0.70% against the Japanese yen. The potential tax cuts and tightening policies under a Trump administration are expected to boost demand for the US dollar, and market expectations for a strong US dollar are becoming increasingly firm.

Bitcoin soars: A beneficiary of decentralized assets

Bitcoin has become one of the biggest winners of the "Trump 2.0" policy expectations. On Monday, the Bitcoin price broke through $88,000 for the first time, rising more than 11% intraday, with a cumulative gain of over 30% since Election Day. Trading volume in Bitcoin ETFs has surged, with market confidence high, and investors generally betting that Bitcoin will reach the $100,000 milestone by the end of the year. Deribit data shows that there are 9,635 Bitcoin open contracts betting on Bitcoin reaching $100,000 by December 27, with an expected return of 18.6%. Bloomberg analyst John Stepek points out that Trump's leaning towards a "small government" ideology, reducing government intervention and spending, may further support the appeal of Bitcoin as a decentralized asset.

Gold cools: Safe-haven demand weakens

While Bitcoin has been rising, gold has continued to decline since the election, with prices falling below the 50-day moving average and approaching the $1,600 level. Previously, the market had expected Trump to drive more fiscal spending, supporting gold's safe-haven value, but now the expectation has shifted towards a "small government" approach, reducing deficits, which has reduced gold's safe-haven attributes and appeal. Analysts such as Brent Donnelly believe that after taking office, Trump may focus more on inflation management to alleviate public concerns about inflation, further suppressing gold demand, while Bitcoin is gradually becoming the new hedge tool in investors' minds.

Tesla rises: Market momentum drives the surge

Tesla has rebounded 39% since the election, with its market capitalization increasing by over $300 billion. Analysts point out that Tesla is a representative of "momentum stocks", and the dramatic change in investor sentiment may drive its snowball-like rally. In addition, the call option premium in the options market has reached its highest level in recent years, further reinforcing the bullish sentiment towards Tesla. Wedbush analyst Daniel Ives points out that Trump's policy expectations may fundamentally change Tesla's layout in the fields of autonomous driving and artificial intelligence.

The "widow trade" continues: Funds flow into US Treasury ETFs

Even with high US bond yields, the "widow trade" in the market remains active. Last week, the Direxion 3x long US Treasury ETF (TMF) attracted $625 million in inflows, a record high, while the iShares 20+ Year Treasury Bond ETF (TLT) attracted $1.4 billion in inflows. Even though TLT and TMF have not generated positive returns since 2020, the market continues to pour in, with TLT receiving about $14 billion in inflows so far this year, and TMF receiving over $3.3 billion. Bloomberg analyst Athanasios Psarofagis points out that although this type of trade has hurt many investors, the inflows continue unabated, as the market generally believes that interest rates will peak and may decline in the future.

The market may continue to fluctuate under the influence of expectations for Trump's policies in the future. The policy shift that "Trump 2.0" may bring may redefine the appeal of safe-haven assets and risk assets. The rise of Bitcoin may continue, and the strength of the US dollar and the appeal of US Treasuries still exist. Meanwhile, whether gold will once again become an investor's safe-haven choice remains to be further observed. The market's response to policy changes may also bring investment opportunities.

The above content is from public market information and is for reference only, and does not constitute any investment advice. The cryptocurrency market has high risks, and investment requires caution.

About BTX

Visit the BTX website: https://www.btxweb.com/

Register now: https://btxweb.com/user/register

BTX official Telegram group: https://t.me/BTXExchangeOfficial

BTX official Twitter: https://x.com/btxexchange

Business cooperation: business@btxweb.com

Official customer service: support@btxweb.com

VIP service: vip@btxweb.com