By Animoca Digital Research

Compiled by: ChainCatcher

Key Questions

Why the world needs Polymarket

Will Polymarket’s popularity continue after the US election?

Is Polymarket the next killer app for crypto?

Will Polymarket issue coins?

Polymarket is an on-chain prediction market that solves the critical problem of missing information by providing quantified odds for future events, providing a numerical representation of probabilities that was previously lacking in news media and social discussions.

summary

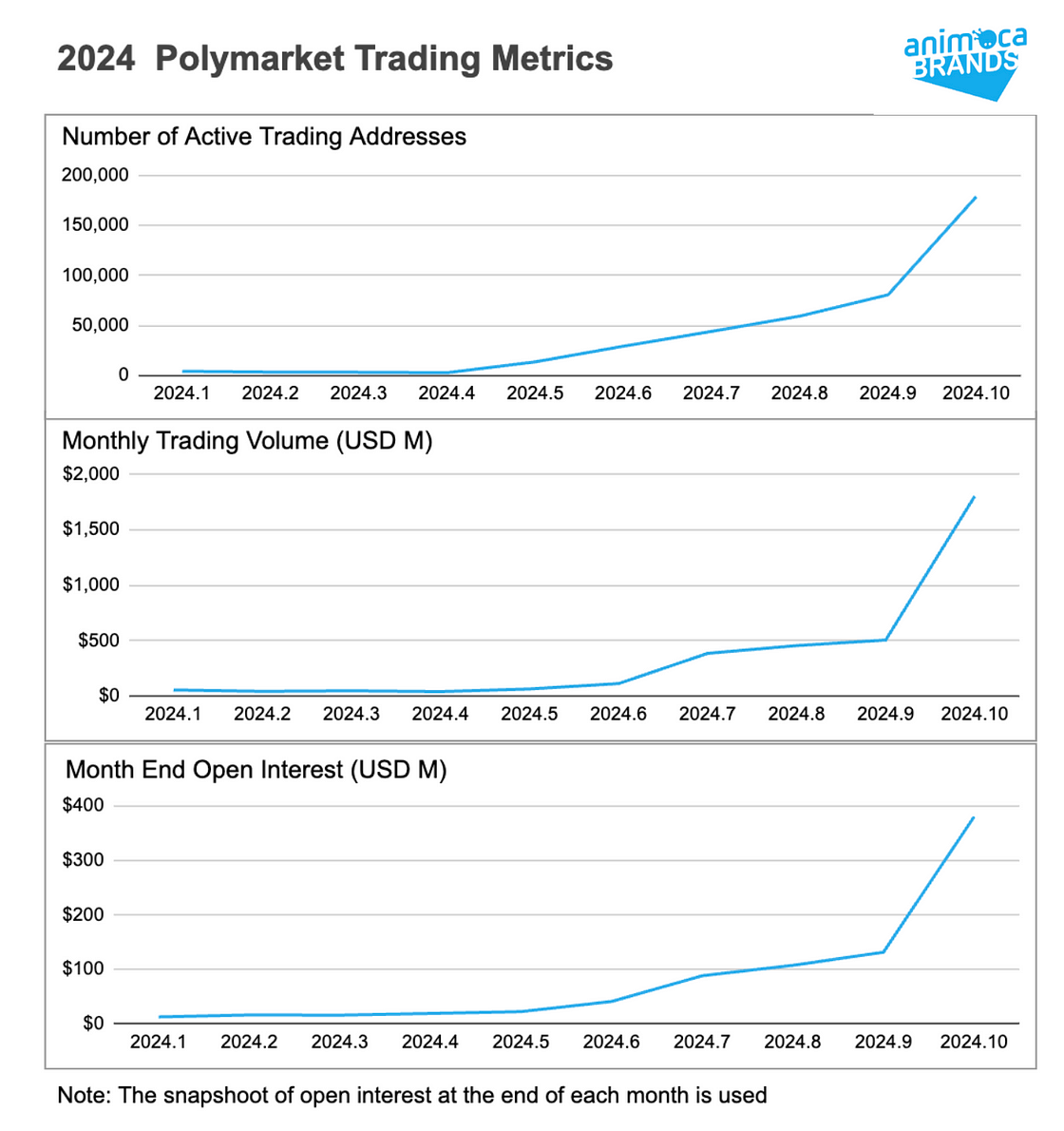

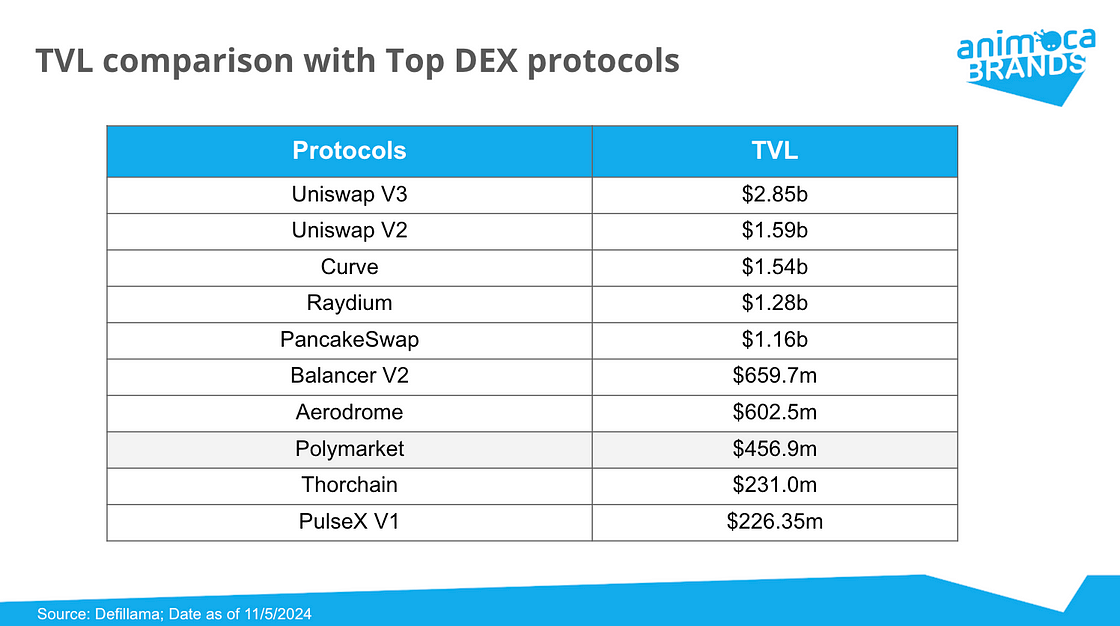

The platform has experienced significant growth over the past six months. From April to October, monthly trading volume surged from $40 million to $2.5 billion, while open interest grew from $20 million to $400 million. The amount of locked capital is now comparable to leading decentralized exchanges such as SushiSwap AMM V3, and even matches the total value locked (TVL) of networks such as TON.

In October, Polymarket's website received 35 million visits, twice the number of visits to popular gambling sites such as FanDuel. Its predictions for the US election were frequently cited by mainstream media such as The Wall Street Journal and Bloomberg. This growth shows that Polymarket has evolved from a well-known project in the crypto space to a platform that can reach mainstream audiences, marking a long-awaited milestone in public adoption of Web3.

Our analysis shows that new Polymarket users are likely to continue using the platform beyond the US election cycle. About three-quarters of users trade on non-election related topics, indicating a sustained interest in diverse topics.

Polymarket has not yet confirmed its plans to issue a token. The company is exploring the possibility of introducing tokens for verifying the results of real-world events, but no official decision has been made.

introduction

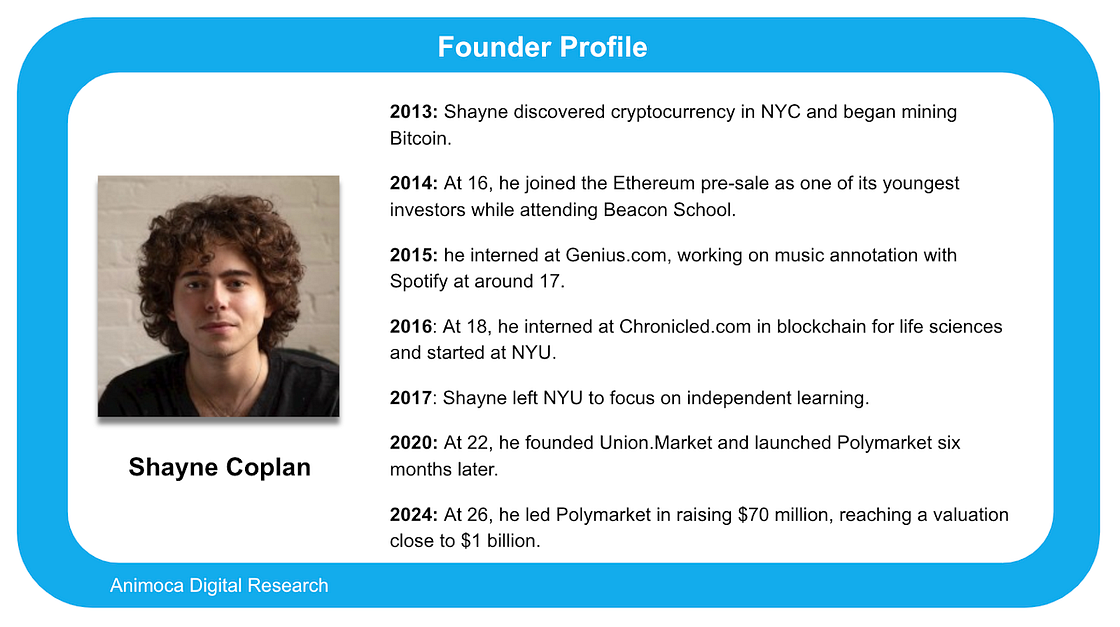

Polymarket is a blockchain-based prediction market platform founded in 2020 by 22-year-old Shayne Coplan. Its timely launch quickly attracted a lot of attention during the 2020 US election cycle. Despite the subsequent volatility in the crypto market, Polymarket has survived tenaciously and returned with even greater popularity during the 2024 US election cycle.

Prediction markets are innovative trading platforms where participants can create and trade contracts on whether future events will occur. By trading on "yes" or "no" options, the market is able to gather collective opinions, where the price of a "yes" contract represents the consensus probability of the event occurring at a certain moment. This real-time pricing provides valuable insights into public expectations and predictions.

Real-time tracking of event probabilities is often overlooked by news media and social platforms. Although the US election attracts a lot of attention, there is no centralized platform that can integrate information about daily developments into quantitative expectations in real time. The "Electoral College" system in the US election makes predictions more complicated, which also makes analysis sites like FiveThirtyEight focus mainly on poll results and fail to provide clear odds of potential winners.

Polymarket filled this gap with its presidential election prediction market. New information such as candidate events and polls are immediately reflected in the future price of events. This quantitative and instantly updated nature helped Polymarket quickly gain popularity and become a common reference when discussing the election on social media.

In the near future, Polymarket’s probability trends may become a common chart in mainstream news broadcasts. If so, it is not difficult to imagine that news networks like CNN and ABC will incorporate real-time probability charts into their coverage of major events, just like CNBC and Bloomberg TV, providing viewers with data-driven insights and context similar to those in financial news reports.

How did Polymarket become popular?

Birth

Polymarket was founded by Shayne Coplan in 2020, coinciding with the US presidential election. The prediction event on "whether Trump will win the 2020 US presidential election" attracted a large number of participants, with trading volume reaching $10.8 million in a few months, pushing Polymarket's monthly trading volume to over $25.9 million at one point.

The platform has also attracted the attention of many well-known figures, including Vitalik Buterin, who expressed his recognition of Polymarket's potential through a blog post in 2021. Although the platform was still relatively niche at the time, the trading volume of some of its popular events had exceeded $1 million, showing great development potential.

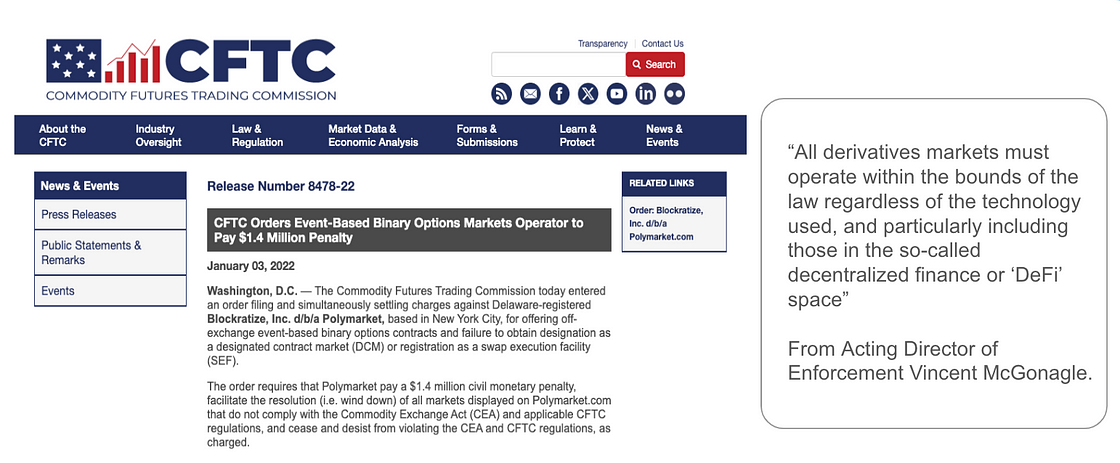

Regulatory setbacks

As a platform somewhere between gambling and futures trading, Polymarket faces unique regulatory challenges. These challenges culminated in October 2021, when the U.S. Commodity Futures Trading Commission (CFTC) launched an investigation into the platform for providing unlicensed futures trading services after its initial rapid growth. In January 2022, Polymarket reached a settlement with the CFTC, agreeing to pay a $1.4 million fine for providing binary options trading without a futures trading license.

Source: CFTC Official

As part of its compliance efforts, Polymarket subsequently restructured its operations to an offshore platform, prohibiting U.S. residents from participating in its markets. The company also hired former CFTC Commissioner J. Christopher Giancarlo as a consultant to help navigate complex regulatory issues and ensure future compliance.

The settlement resolves some of the uncertainty surrounding Polymarket’s operations, allowing market activity to gradually return to levels seen in early 2021. However, an important question remains: when will Polymarket be able to break through its current limitations and enter the mainstream market?

Going mainstream

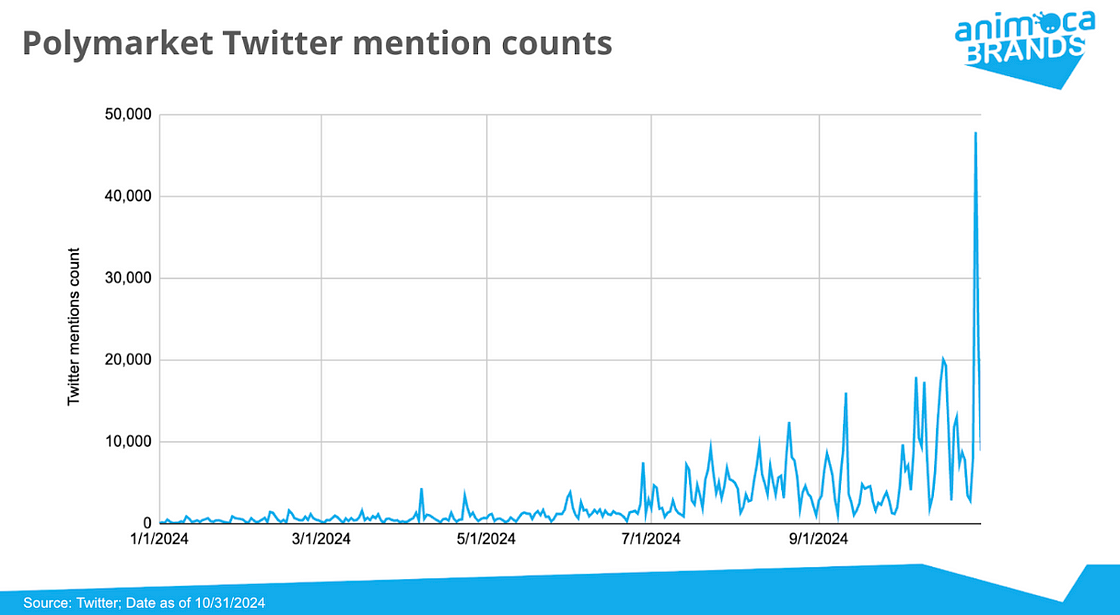

A year after the CFTC settlement, Polymarket launched the "2024 U.S. Presidential Election Winner" market in January 2024, which quickly sparked a surge in trading activity. As the year progressed, major political events—including Trump's assassination attempt and Biden's unexpected withdrawal—further fueled a strong interest in election predictions. In the final month of the election, as early voting results were released, Polymarket's popularity reached an all-time high.

Throughout the 2024 election cycle, Polymarket’s monthly volume soared, growing from a few million dollars to $50 million in January, reaching nearly $400 million in July, and easily surpassing $1 billion in October. Total open interest — the amount of USDC locked and potentially paid out if all contracts settle — grew from $7 million on January 1, 2024 to about $400 million on November 1. This locked-in capital exceeds TON’s total TVL, making Polymarket the 18th largest blockchain infrastructure ecosystem by locked-in value.

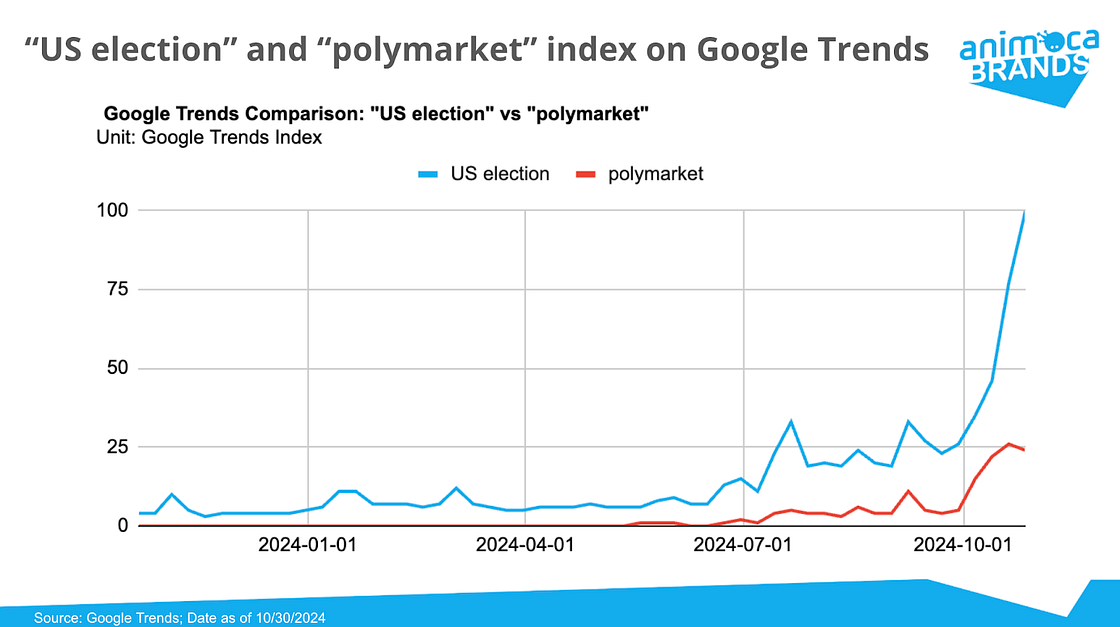

Polymarket’s attention is not limited to the trading community, its Google search popularity and website traffic surged, reflecting widespread public attention. Polymarket’s election predictions are frequently cited by major media such as the Wall Street Journal, Bloomberg, CNN, and public figures such as Trump. In an important milestone in mainstreaming, Bloomberg integrated Polymarket’s election odds into its terminal system in August. Polymarket has not only become a major project in the crypto industry, but has also successfully attracted widespread public attention, which is exactly what the Web3 industry has long aspired to achieve.

The Web3 industry has yet to achieve mainstream adoption, primarily due to the lack of a “killer app” that could create something like the iPhone for the space. Telegram’s partnership with TON has created a lot of excitement in the Web3 community as it has great potential to drive mass adoption. Similarly, Polymarket is exploring new directions that are expected to push the industry frontier, provide promising participation paths for a wider audience, and drive Web3 to wider adoption.

Platform Activities

Website traffic

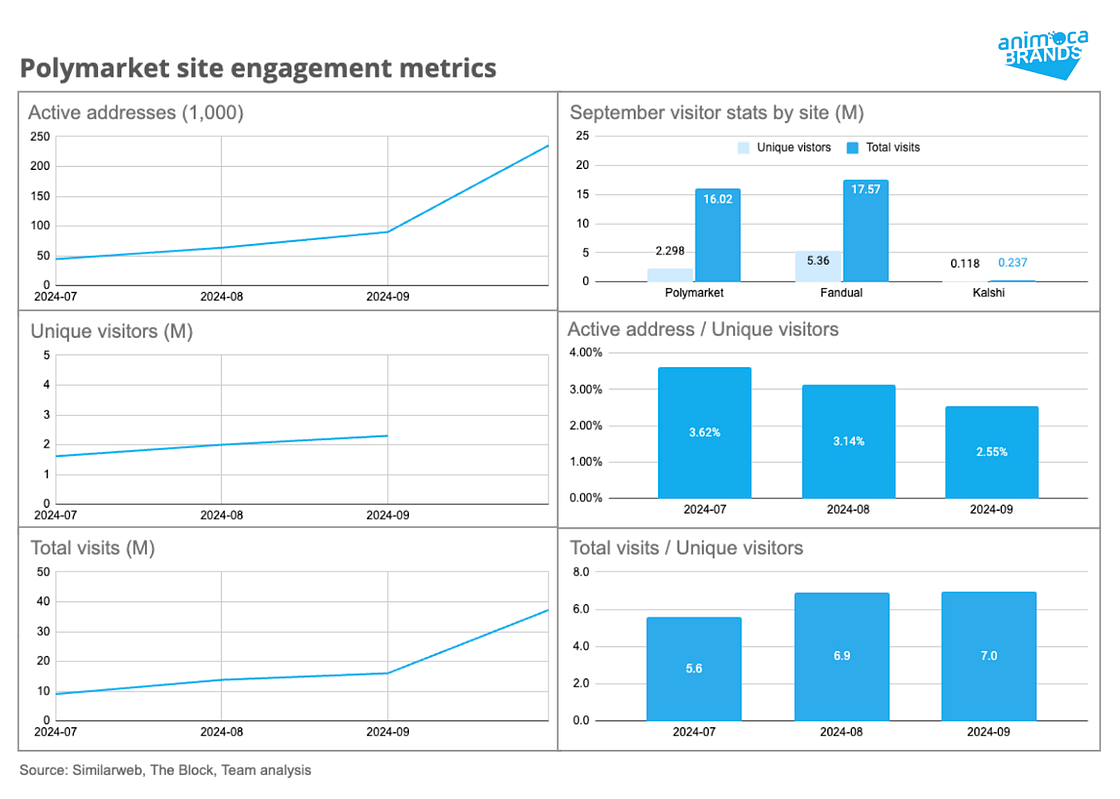

As Polymarket hit new highs in trading volume and number of participants, its website traffic also surged. In September 2023, Polymarket had 2.3 million unique visitors and 16 million total visits. By October, monthly visits doubled to 35 million, joining the ranks of popular betting platforms such as FanDuel. FanDuel had 5 million unique visitors and 17 million total visits in September, while regulated prediction trading site Kalshi had 118,000 unique visitors and 237,000 total visits in the same month, far outperforming these platforms.

In terms of user engagement, the ratio of active traders to visitors to Polymarket was about 3% in July, but has declined over the past three months. This suggests that most of Polymarket's audience is primarily seeking information rather than trading. As Polymarket's popularity continues to rise, this trend has become more pronounced, reflecting its appeal as an information resource.

In addition, the ratio of visits to unique visitors shows that the average website visitor visits the site seven times per month, indicating that Polymarket users are highly engaged and sticky. This combination of high traffic and high engagement highlights Polymarket's potential not only as a trading platform, but also as a widely trusted source of information on major event predictions.

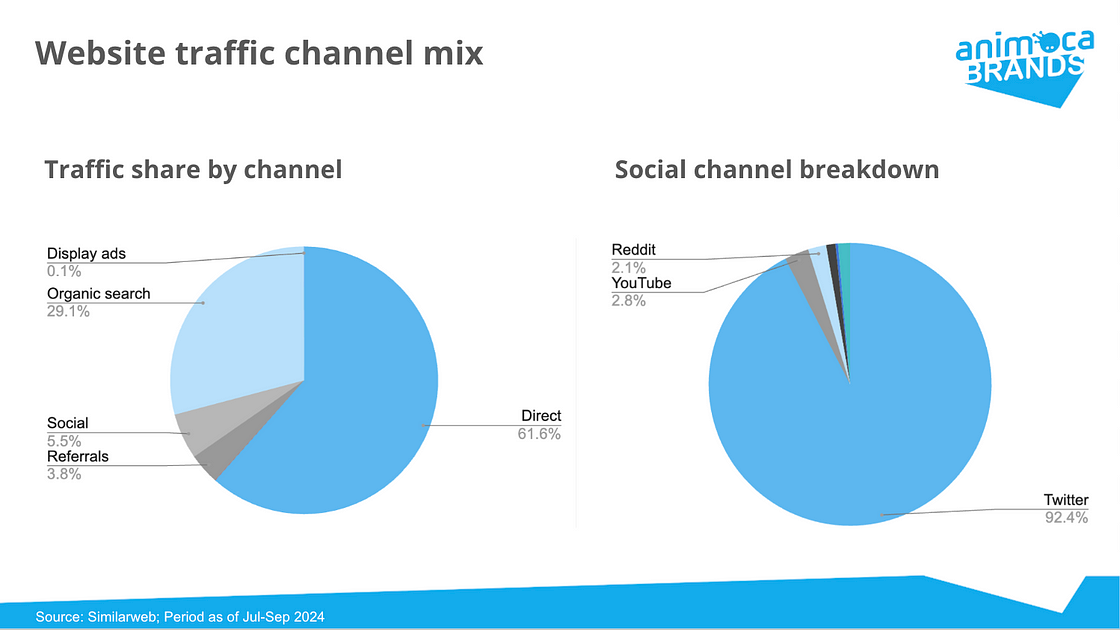

Polymarket's main traffic source is direct URL access, which indicates that most users have already known about the platform before visiting. Another 30% of visitors enter through organic search, indicating that many users visit the website specifically by searching for the name of Polymarket. Social media contributes about 5% of traffic, with Twitter being the main source, which is consistent with Twitter's active role in cryptocurrency and election discussions.

It is worth noting that paid traffic sources, such as paid search and display advertising, account for a very low proportion, which highlights that the platform attracts users through brand awareness and organic interest rather than relying on paid advertising. This combination of traffic sources shows Polymarket's growing influence among users, who are increasingly turning to it as a reliable source of forecasting information.

In terms of geography, more than half of the traffic comes from the United States, followed by four countries that have close ties with the United States and will be significantly affected by the results of the US election.

These observations suggest that most Polymarket users have adopted the platform as a regular reference source, using it regularly to track major events as they unfold. This trend is consistent with CEO Shayne Coplan’s view that Polymarket’s value lies in providing “the most accurate information signals on the internet.”

market

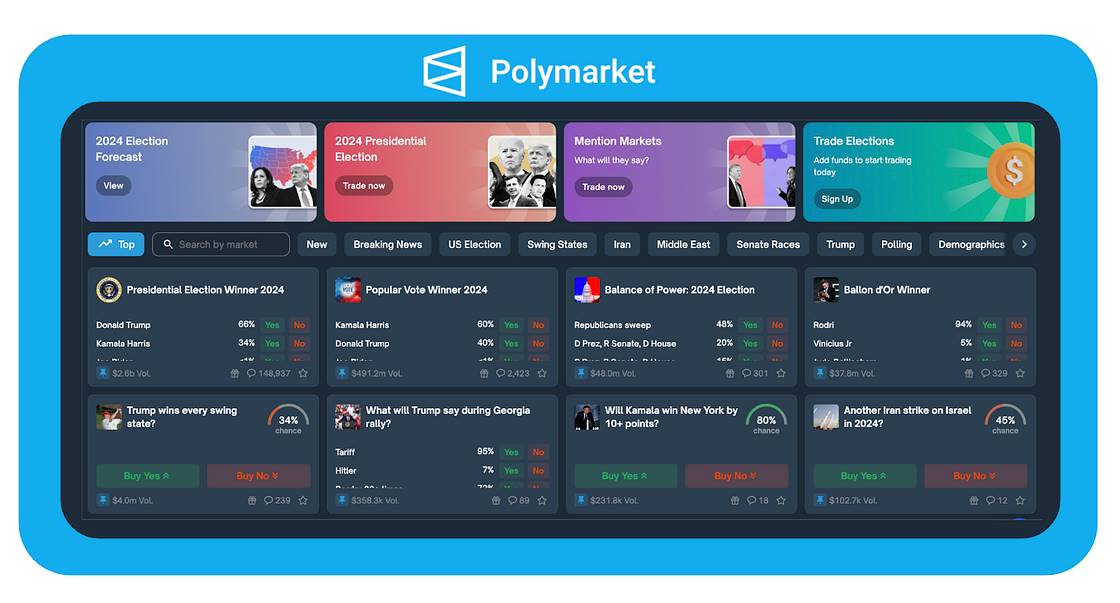

Each event predicted on Polymarket typically consists of one or more markets, each of which takes the form of a binary outcome pair. For example, in the event "US Election", the independent markets include "Trump wins Y/N" and "Harris wins Y/N", as well as some lower priority markets such as "Biden wins Y/N".

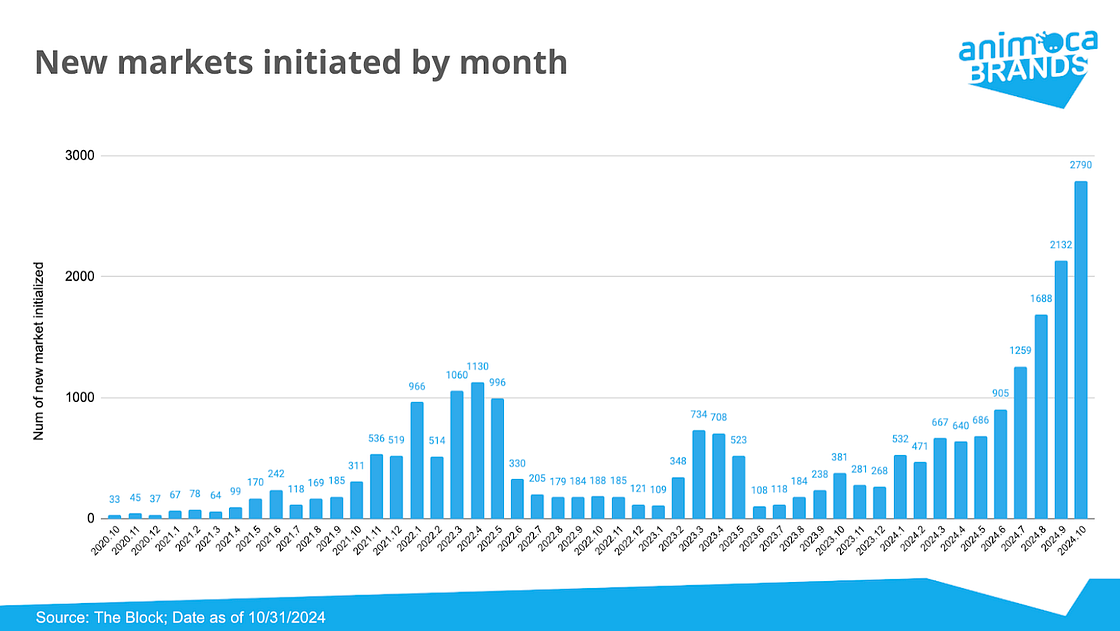

The Polymarket team is responsible for creating new markets, taking community input into account in the process. In late 2021 and early 2022, the team experimented with launching up to 2,000 markets per month, likely in an effort to increase user engagement. However, this rapid pace eventually stabilized at a few hundred markets per month. Starting in January 2024, market creation surged again, showing exponential growth, indicating that the recently added markets have received widespread acceptance and positive feedback from users.

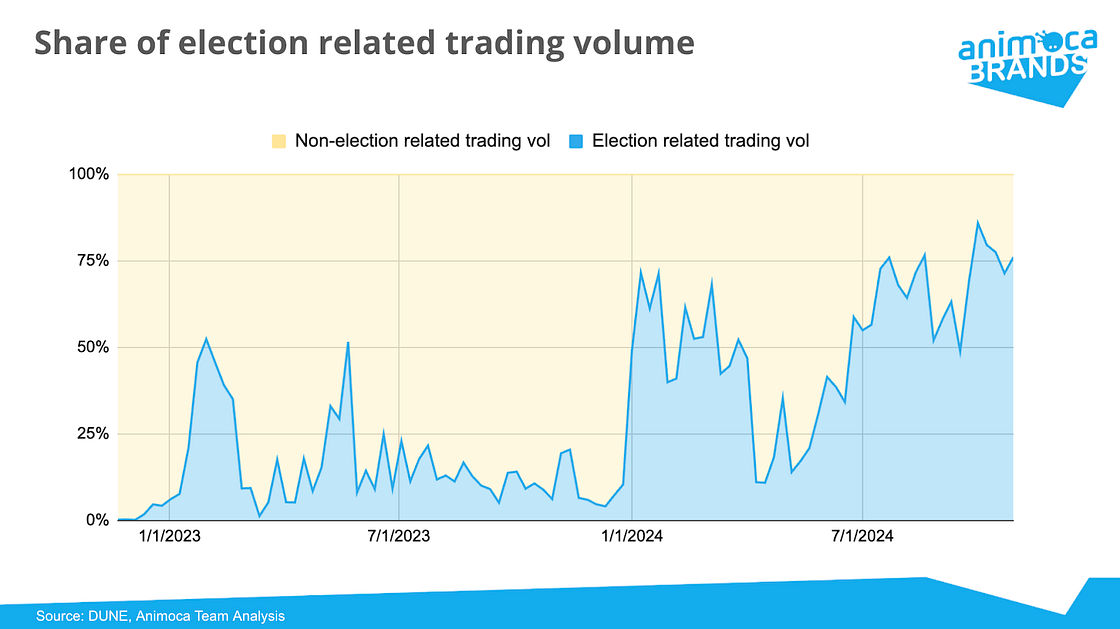

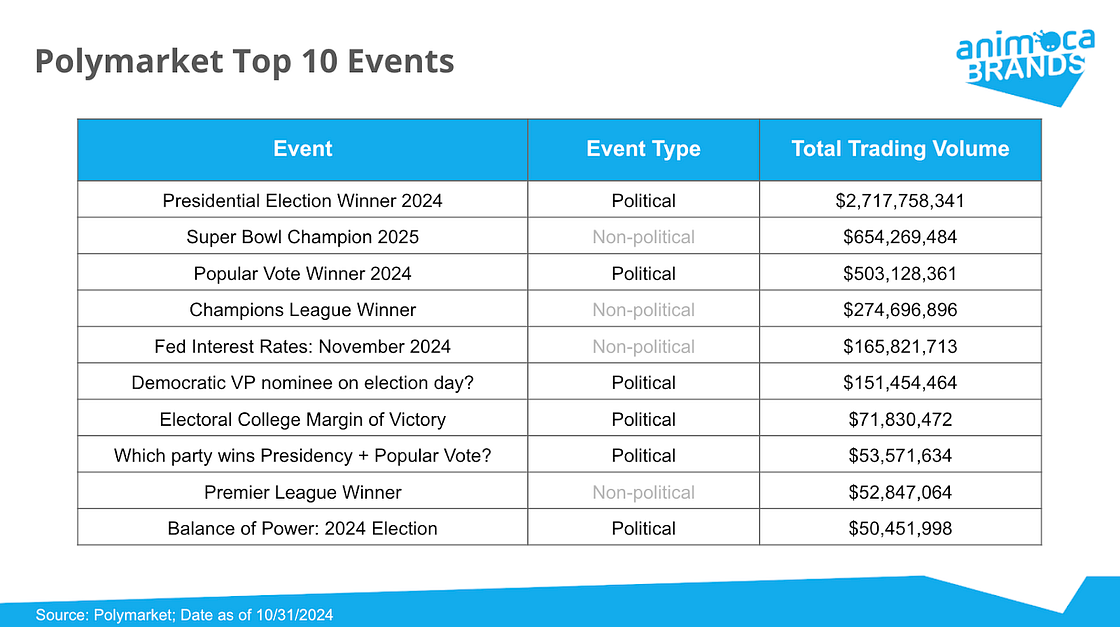

Since January 2024, markets on the US election have been the primary driver of Polymarket’s volume, accounting for around 50% of total volume in the first half of 2024 and reaching over 75% as interest in the election surged. Interestingly, despite the surge in election-related volume, non-election markets continue to attract a significant amount of trading activity, accounting for nearly 25% of total volume. Sports-related markets, such as Super Bowl and UEFA Champions League predictions, have performed particularly well, demonstrating the diversity of user interest beyond the election cycle. This balance suggests that Polymarket’s appeal is broadening, gradually positioning itself as a versatile prediction platform.

user

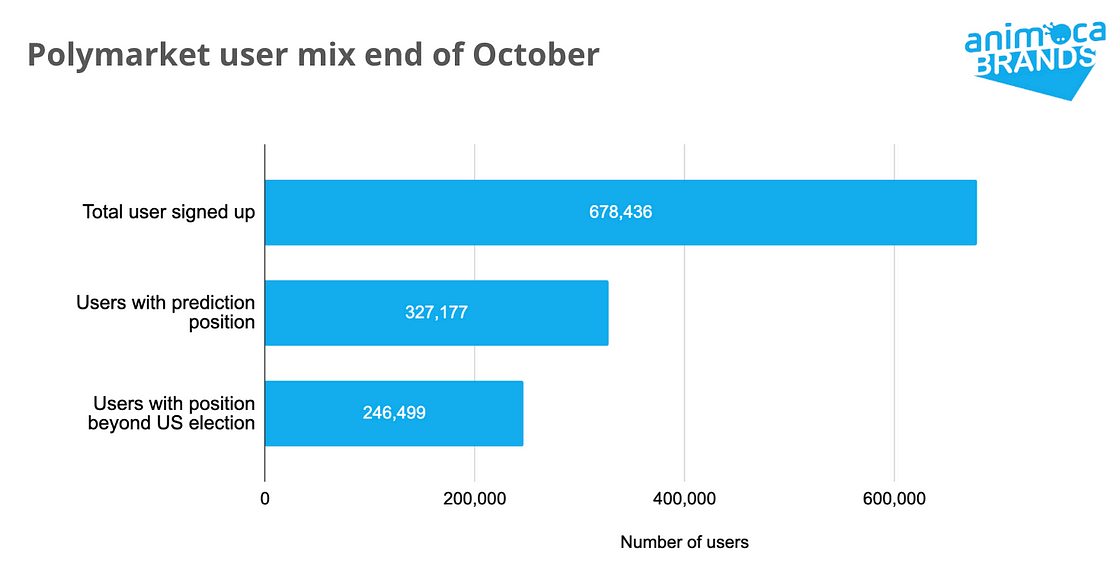

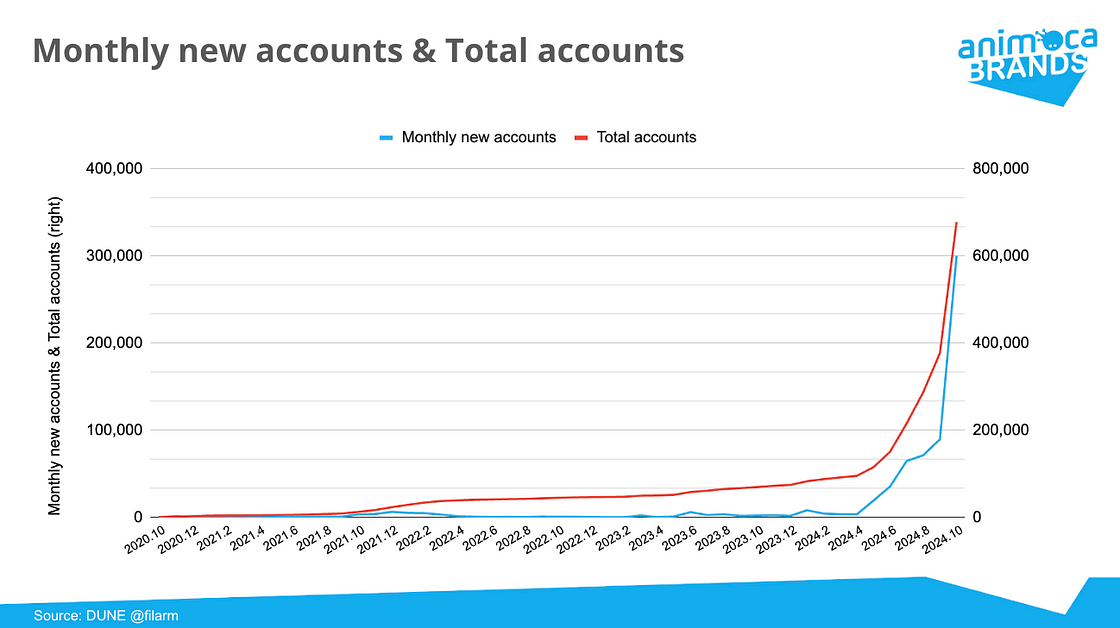

Since mid-2024, Polymarket has seen a surge in new user registrations, with more than 300,000 new registered users in October alone. This rapid growth means that 86% of users have joined the platform in the past six months. In October, the platform recorded 235,000 active trading addresses, accounting for 35% of all registered users.

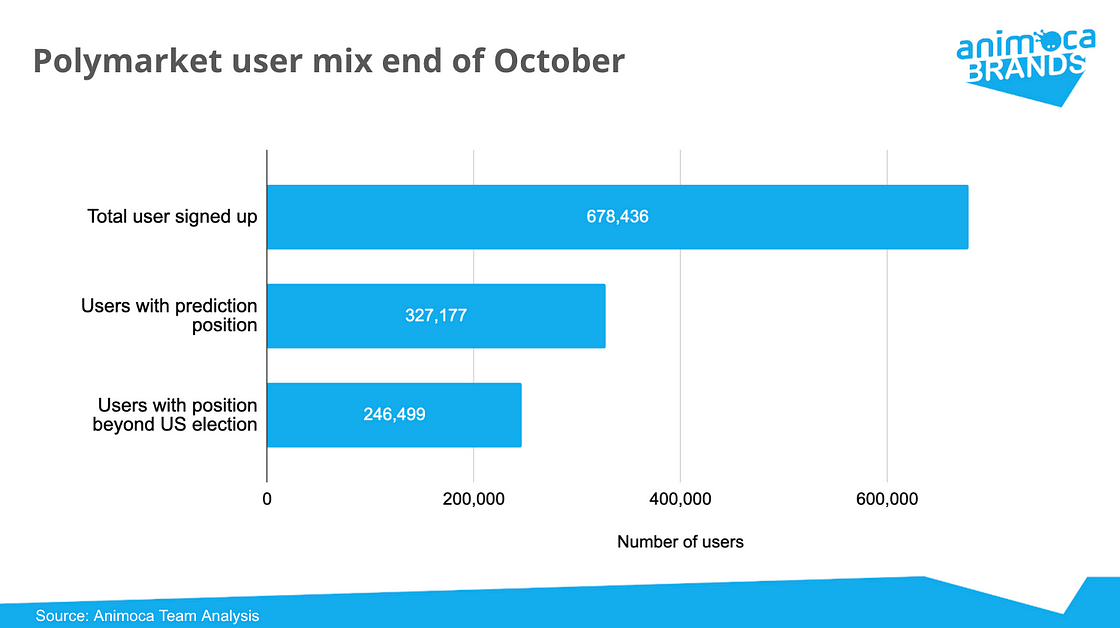

As of November 3, there were 327,000 users in total, with half of those registered maintaining active positions. Of these active users, approximately 80,000 users focus on markets related to the US election, while the remaining 247,000 users dabble in other market categories. This suggests that significant participation in non-election markets reflects continued user interest in the platform, which is likely to support continued growth and relevance of the platform even after the election cycle ends.

The United States from a Global Perspective

These observations reveal an interesting phenomenon: although most of Polymarket’s visitors are from the United States, only non-US users are able to participate in trading due to regulatory restrictions. This creates a unique situation — users from other parts of the world are actually predicting the next US president, while Americans are mainly on the sidelines.

Polymarket has thus become a platform for international players to provide a global perspective on U.S. political events, all with the core goal of meeting the needs of a predominantly U.S. audience.

How Polymarket works

Prediction Market Mechanism

Prediction markets date back to political betting in the 16th century, initially focusing on events such as the succession of the Pope. These markets allow participants to bet on future outcomes and have evolved into platforms that collectively aggregate public opinion on uncertain events. In July 2018, prediction markets entered the crypto space with the birth of Augur as the first decentralized prediction platform built on Ethereum. Two years later, Polymarket went live, allowing users to deposit USDC and bet on the future outcomes of various events.

Prediction markets work similarly to futures markets: they create contracts that pay a fixed amount if a specific event occurs, and participants trade these contracts by submitting buy and sell bids. The contract price at each moment represents the market's consensus estimate of the probability of an event occurring.

Traditionally, prediction markets have been highly valued for their ability to efficiently integrate multiple sources of information, which enhances the accuracy of predictions, as discussed in James Surowiecki’s The Wisdom of Crowds. Prediction markets are able to capture people’s opinions from a variety of sources, continually improving the collective insight through the participants’ probability estimates.

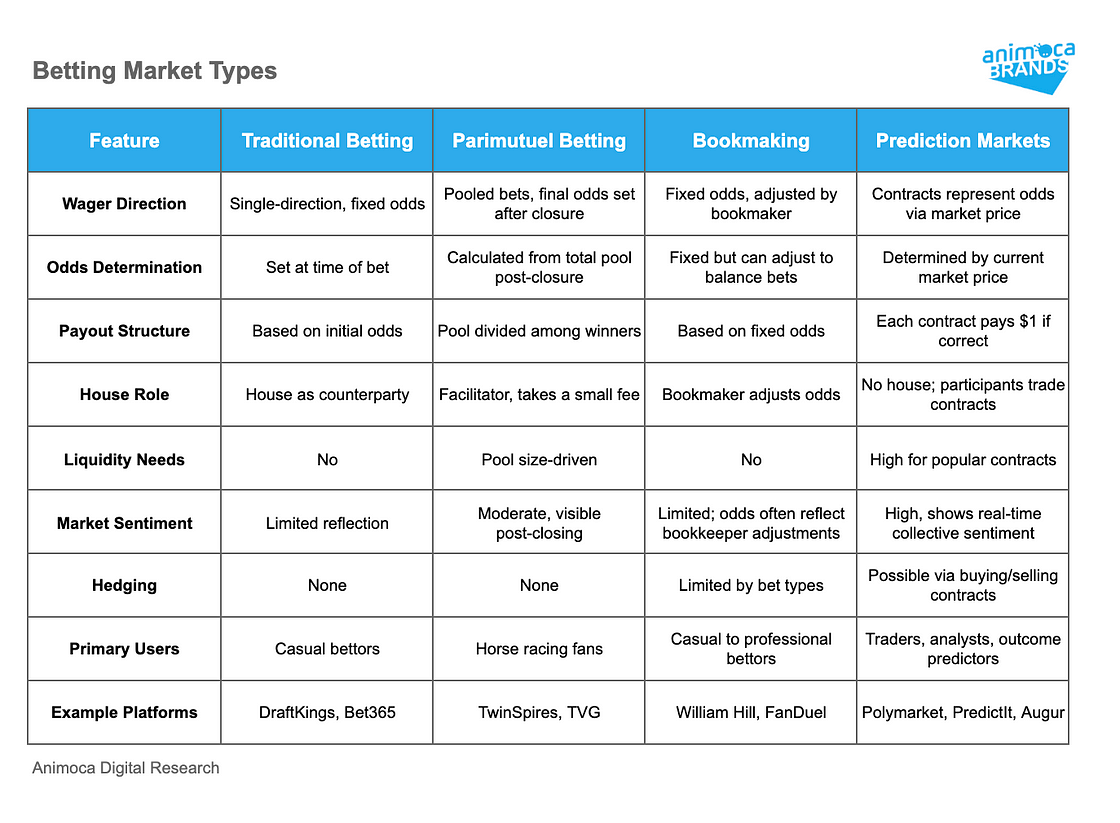

Differences from traditional gambling

Although prediction markets have been around for a long time, traditional betting markets continue to attract more participants. To understand why, we first need to take a closer look at betting markets.

There are several key differences between prediction markets and traditional betting markets. First, prediction markets are two-way trading markets that allow participants to exit their positions at any time before the outcome of an event is determined. Second, prediction markets continuously update consensus odds to reflect public sentiment in real time, while traditional bookmakers mainly balance the betting pool by adjusting odds to ensure that bookmakers minimize potential losses. This practice often leads to bookmakers over-correcting odds, distorting the true probability of an event.

However, prediction markets also face unique challenges, especially in terms of liquidity. In order to enable smooth trading, the platform must ensure that the contract has sufficient liquidity, which requires a stable source of liquidity. This can be achieved through automated market makers (AMMs), similar to decentralized exchanges (DEXs), or through order books supported by market makers, similar to centralized exchanges (CEXs). Either way, incentives need to be provided to liquidity providers, which increases costs for traders or exchanges themselves.

Liquidity issues are particularly acute for low-traffic events. While traditional betting caters to different needs by setting initial odds and aggregating bets into a pool, prediction markets rely on sufficient user interest to keep trading active. In the absence of sufficient activity, prediction markets struggle to reach meaningful odds, which limits their accuracy and appeal to low-traffic events.

Polymarket’s user interface

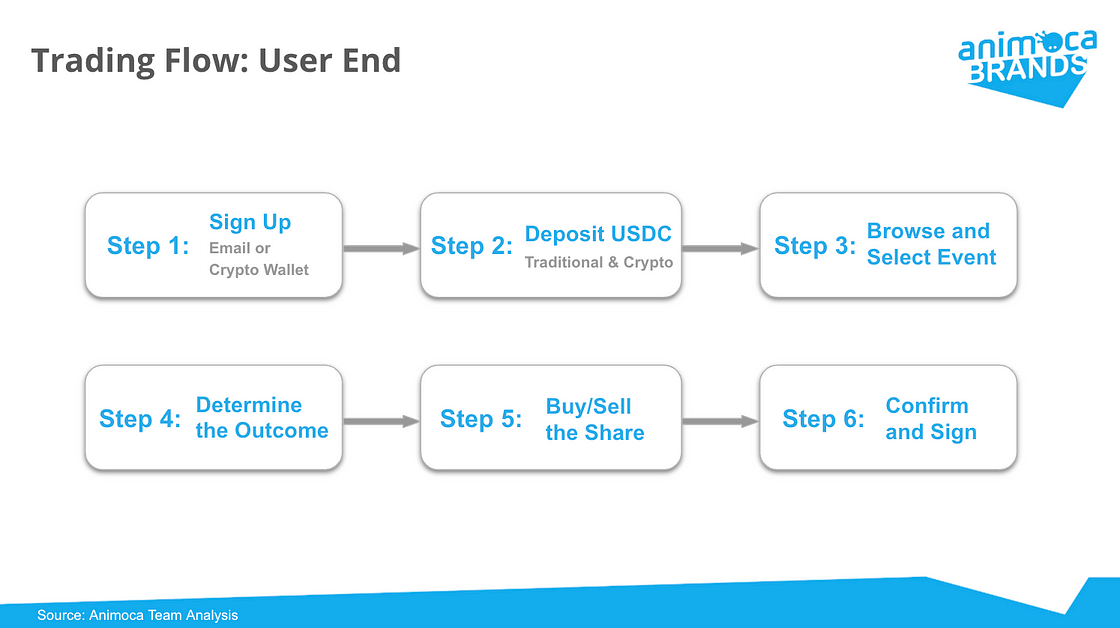

Polymarket stands out for its simple and smooth user experience. The platform uses USDC (US Dollar Stablecoin), a federally regulated stablecoin backed by the US dollar, for transactions and payments. Since transactions are completely based on on-chain operations, using on-chain currency is a must.

The user journey starts with signing up via email or crypto wallet, followed by transferring USDC from an existing wallet to the platform, or buying USDC directly with fiat currency through Moonpay. After users browse the available markets and select an event, they can use real-time data to guide their predictions. The next step is to buy and sell based on these insights, and the interface will display potential returns. Once the transaction is confirmed, the user's account address will complete the transaction. In the event of a dispute, users can also raise a challenge to resolve the event.

trade

In Polymarket's peer-to-peer prediction markets, trades occur directly between users, and prices are formed naturally by user-driven orders. New markets launch with no stake or preset prices, and traders post limit orders based on the price they are willing to pay, effectively acting as market makers. For binary events, users can bet on a "YES" or "NO" outcome. When the total amount of "YES" and "NO" orders reaches $1.00, these orders will be paired to form the initial market price. For example, a $0.60 "YES" order will be paired with a $0.40 "NO" order, setting the price. As trading proceeds, buy and sell orders can be matched directly at existing prices, increasing liquidity.

Polymarket uses ERC-1155 tokens, called “outcome tokens,” to represent these binary predictions. In addition to binary choices, the platform also supports more complex market scenarios:

Category Marketplace: Users select from multiple mutually exclusive results (e.g. A, B, C).

Scalar markets: Break down broad questions into a series of yes/no contracts.

Combination Markets: Allows for hierarchical forecasting through the combination of multiple questions.

This diversification expands the flexibility of the platform, allowing for a wider variety of events to be created in the future.

When an event ends on Polymarket, profits are distributed based on the winning outcome. The winner's stake is worth $1.00, while the loser's stake is worth $0.00. The market will settle when the outcome is clear and meets the established rules. If a user disagrees with the settlement, they can challenge it by staking a $750 USDC deposit, which will only be returned if the challenge is successful, which provides incentives for effective disputes and avoids meaningless appeals.

Technical Architecture

There are several components in Polymarket’s technical design that ensure prediction markets operate in a decentralized manner.

The Gnosis Conditional Token Framework (CTF) provides the infrastructure for creating conditional tokens, allowing tokens to be created for various event outcomes. CTF swaps are the on-chain component of the Polymarket order book, supporting atomic swaps between CTF ERC-1155 assets and ERC-20 collateral, and non-custodial settlement of matched orders. Meanwhile, off-chain operators are responsible for order matching and trade submission, managing outstanding orders, and allowing immediate off-chain order placement and cancellation.

To match betting information, the UMA CTF adapter connects the Optimistic Oracle to the CTF conditions, initializes the market and settles the conditions by querying the UMA oracle and obtaining settlement data. The UMA Optimistic Oracle solves the prediction market problem and allows dispute handling during the challenge period, ensuring that off-chain events are accurately reported on the chain. Then, another component: the NegRisk adapter enables Gnosis CTF to manage binary markets, convert "NO" tokens into collateralized "YES" tokens, and consolidate binary results into a unified market structure. Finally, the NegRisk Exchange is a simplified trading contract of Polymarket that allows trading through the Central Limit Order Book (CLOB) within the NegRisk market.

Company Overview

team

The Polymarket team is led by three key individuals:

Shayne Coplan, Founder and CEO: A native of New York, Shayne entered the Web3 space and started mining Bitcoin at the age of 15. He dropped out of NYU in 2017 and subsequently launched the market in 2020 and launched Polymarket in the same year.

David Rosenberg, VP Business Development & Strategy: David has extensive experience in business development and strategy, having worked at Foursquare, GIPHY, and Snap. He joined Polymarket in June 2020 after four years as Director of Strategy at Snap. David graduated from Cambridge University in 2011.

Liam Kovatch, Head of Engineering: Liam dropped out of Columbia University in 2018 to start his DeFi career. He previously founded Paradigm Labs and served as Chief Engineer at 0x. He joined Polymarket in 2021 and was quickly promoted to Head of the Engineering Team.

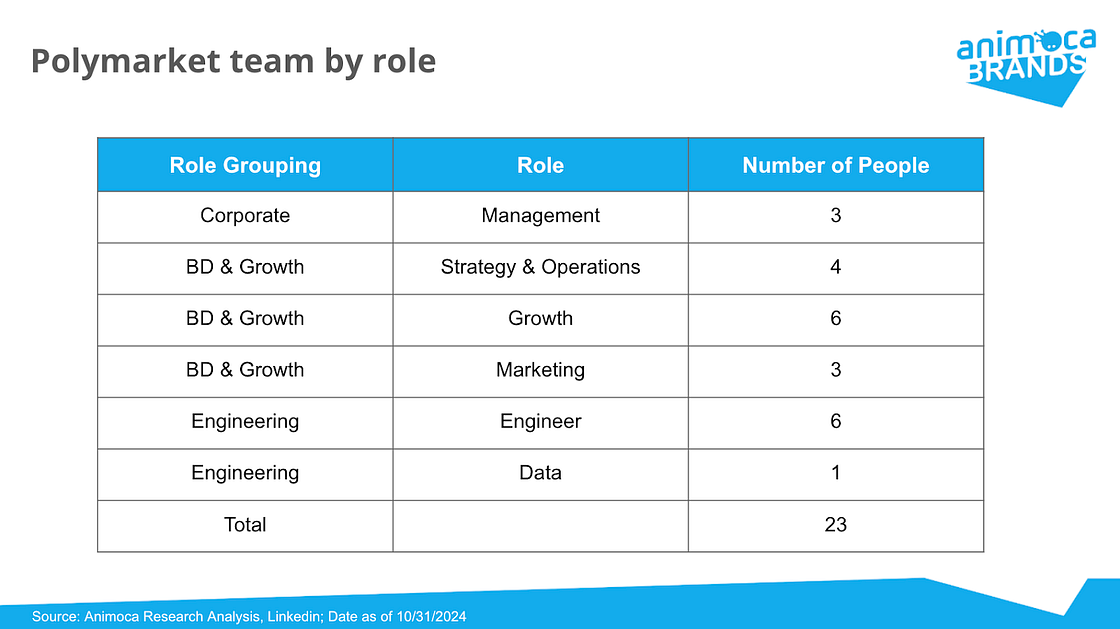

The rest of the company is organized around business development and engineering, with 12 members of the team focused on growth, marketing and strategy, and 8 members focused on engineering and data, for a total of 23 employees. The company also hires part-time or outsourced professionals to support other functions such as finance. Most team members are based in New York.

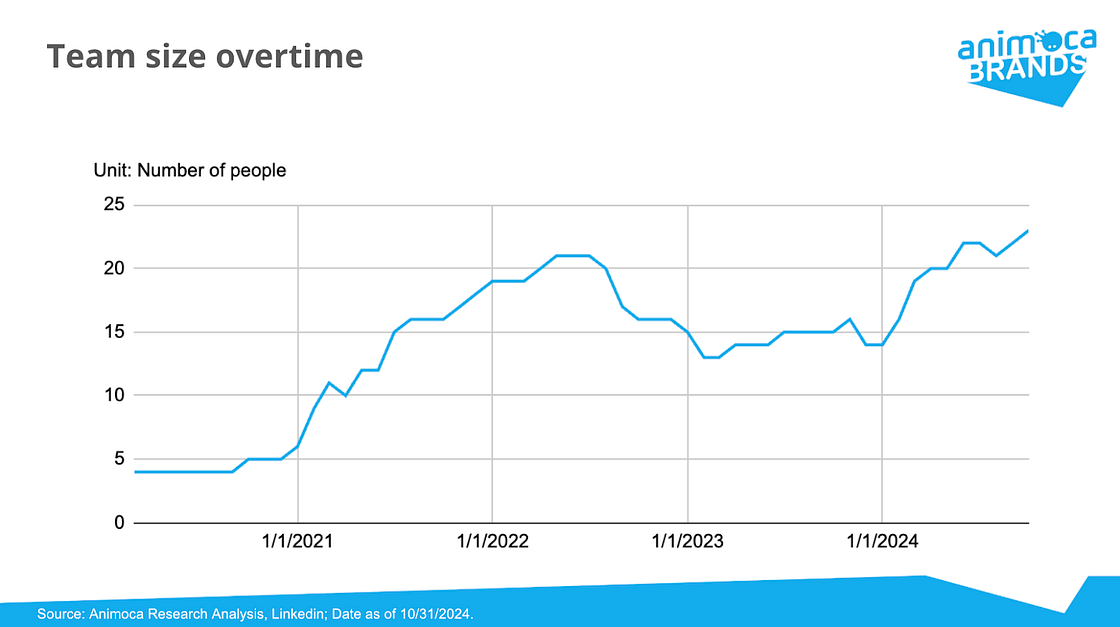

Polymarket's team size has changed over time. The company started with just four employees, and after initial success in 2020, the team expanded rapidly, reaching approximately 20 employees by mid-2022. However, in the second half of 2022, due to the impact of the CFTC investigation, the team size was reduced and remained lean until early 2024.

In early 2024, the company began to expand its staff again, indicating that leadership expected the platform's operating environment to become more favorable to cope with the subsequent significant increase in trading volume.

Operating profit and loss

Currently, Polymarket does not charge any fees for the use of the platform, including fees for buying and selling positions, reward issuance, and fund deposits and withdrawals. Previously, the platform charged liquidity provider (LP) fees for transactions to compensate liquidity providers under the automated market making mechanism, but this fee was cancelled after the switch to an order book architecture at the end of 2022. Although there are fees when using third-party services to convert fiat currency to USDC, these fees are paid to the service provider, not Polymarket.

In addition to free fees, Polymarket also supports platform operations by subsidizing operating costs, including order book market making rewards, fuel fees for on-chain transactions, and website maintenance fees. It is reported that Polymarket has distributed more than $3 million in USDC incentives to date, and popular markets provide liquidity providers with rewards of up to 600 USDC per day.

Polymarket’s early cash flow was likely supported by ecosystem incentives. The platform received approximately 160,000 UMA tokens, valued between $40,000 and $48,000, from UMA as an incentive for adopting the UMA technology stack. However, there is no public information on whether Polymarket received incentives or profit sharing from Moonpay, its exclusive fiat-to-USDC channel partner, or its blockchain partner Polygon. These incentives are essential to maintaining day-to-day operations, especially considering that the company has only raised $4 million by mid-2024.

Although no official profit plans have been announced, the CEO hinted that platform usage fees may be introduced in the future. On the other hand, given their recent success in fundraising, the team may not rush to find sources of profit, but continue to consolidate its leading position in the prediction market field by subsidizing platform operations. Considering that more than 95% of the platform traffic is for content consumption rather than transactions, the platform can also quickly obtain cash by increasing display ads instead of charging transaction fees.

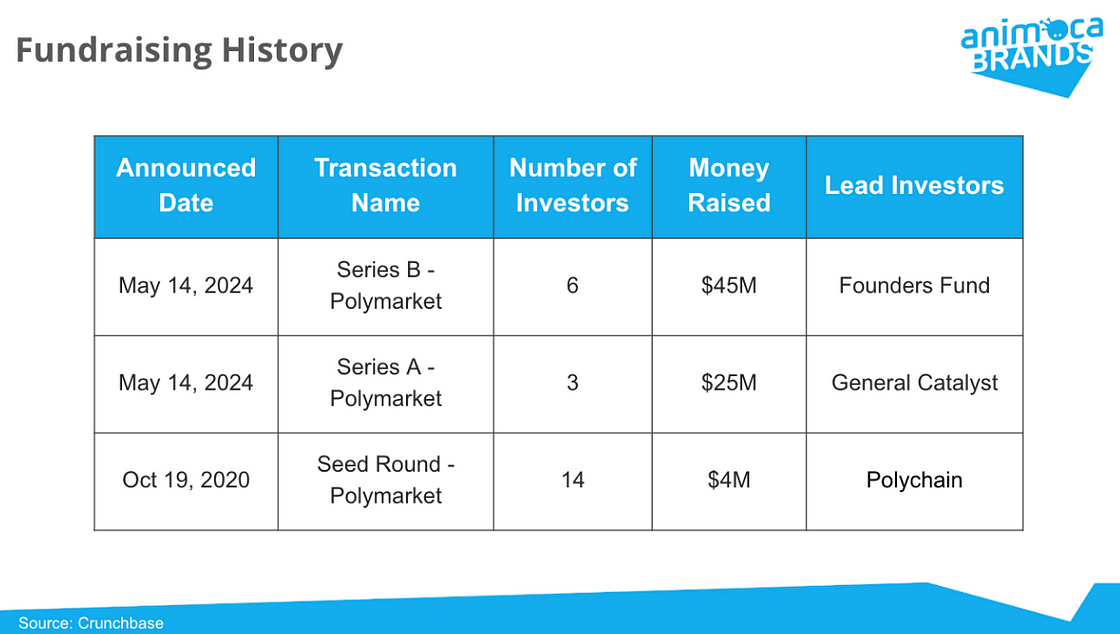

Financing

Polymarket's first round of financing took place in 2020, when the company successfully raised $4 million. In May 2024, the company closed two rounds of financing, attracting a total of $70 million from nine investors. This funding is expected to significantly enhance Polymarket's expansion capabilities, including strengthening talent reserves and market coverage.

There are no confirmed plans for a token generation event (TGE), but recent reports suggest Polymarket is exploring a possible $50 million funding round. The company has also hinted at the possibility of launching a token designed to allow users to verify the results of real-world events.

Considering the rapidity of Polymarket's fundraising and the challenges of traditional IPOs due to its overseas structure, the possibility of a token issuance event seems quite high. As for the company's valuation, the valuation was not disclosed in the financing round. But based on the $45 million raised in the B round, it is reasonable to speculate that Polymarket's valuation may have reached the billion-dollar level.

SWOT Analysis

Although Polymarket has been in operation for four years, it has only recently gained significant market attention and is still in a highly volatile phase. Rather than speculating on the future, it is better to use a SWOT analysis to clearly examine its potential development path:

Advantages

Polymarket’s greatest advantage is its unprecedented public attention. This high exposure attracts a large number of participants, forming a virtuous circle - more participation means more accurate and trustworthy predictions. This self-reinforcing cycle, if managed properly, can consolidate Polymarket’s market leadership.

In addition, Polymarket’s on-chain architecture also distinguishes it from traditional prediction markets, ensuring the highest level of transparency, thereby building trust. However, this advantage is not significant compared to other on-chain competitors, as Polymarket’s lack of proprietary intellectual property or a dedicated blockchain makes it easier for other projects to copy its model.

Disadvantages

The liquidity problem for niche events is the main bottleneck for Polymarket when expanding to multiple topics. This problem is an inherent challenge in prediction market design, and the order book model makes it more prominent. Unlike traditional sportsbooks that can easily cover a wide range of events, Polymarket must provide sufficient incentives for the market to narrow the spread and improve liquidity for less popular topics.

Another limitation is that because Polymarket's team is US-centric, the platform it operates inherently excludes US users from participating in transactions. This mismatch may hinder its global development, while it may also continue to face regulatory issues in the United States. The "Super Bowl Championship" remains the most popular sporting event on the platform, indicating that its strategy is still heavily biased towards the US audience.

Chance

With its growing reputation for reliable crowdsourced event predictions, Polymarket is poised to become a core component of media and social content consumption. This integration could drive more traffic and open up new revenue streams.

Polymarket’s data also has great potential to become an alternative asset for quantitative trading. With its high reliability in forecasting, the platform can attract more attention from institutional investors and algorithmic traders, thus stimulating demand for forecasting of a wider range of events.

From a geographical perspective, Polymarket’s success can quickly expand to regions where Web3 adoption is growing, such as Asia and the Middle East. Regional event predictions in local languages will also be in strong demand.

threaten

Like other similar platforms, Polymarket faces legal uncertainty. Regulatory challenges have affected platforms like Betfair and Predict It, raising questions about whether peer-to-peer predictions will be classified as gambling, securities or other financial products. Increased regulatory scrutiny poses a significant risk.

Another operational threat lies in the possibility of market manipulation. Since Polymarket is a decentralized platform, individuals or groups with large amounts of capital could influence the odds, leading to misleading trends and undermining the market’s trust in its predictions.