Source: Four Pillars; Compiled by Bai Shui, Jinse Finance

1. The Composition of Token Value

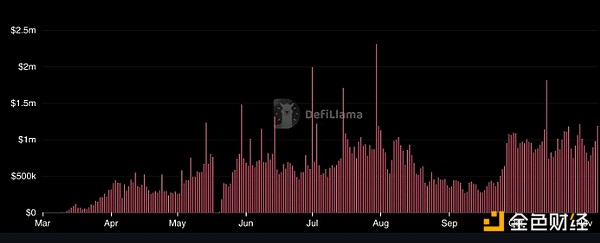

Source: defillama (Pump.fun)

Since the beginning of this year, the crypto industry has witnessed the frenzy of memecoins, marking what many have called the "memecoin super cycle". The scale of this movement is evident in the success of Pump.fun, a memecoin launch platform that generates over $1 million in daily revenue and facilitates the issuance of 20,000 tokens. Solana has become the epicenter of this memecoin revolution, with its DEX trading volume now surpassing Ethereum and other major chains. The surge in this activity is further reflected in the remarkable success of the Phantom wallet, which reached a peak of 700 million MAU.

The impact of memecoins goes far beyond just captivating the imagination of crypto enthusiasts - they have become the most powerful gateway for introducing newcomers to crypto. However, this success also comes with skepticism. Critics argue that memecoins are purely speculative, pointing to their high volatility and the apparent lack of intrinsic value. This raises an important question for the crypto community: how should we truly understand and assess the value of memecoins in today's market?

Within the crypto ecosystem, the value of tokens is composed of three main components:

Store of Value: Similar to gold or Bitcoin, tokens can serve as a hedge against inflation, maintaining purchasing power over time. This is the most fundamental but most challenging form of value, as it requires widespread trust and consensus among users.

Cash Flows and Transaction Demand: This value stems from utility - whether through transaction fees (as seen with ETH and SOL), revenue streams (such as DeFi tokens), or value accrual mechanisms like token burns. Similar to traditional stocks, these tokens can be valued based on their business models and ability to generate sustainable cash flows.

Meme, Narrative, and Attention Value: This component is driven by community interest and engagement. In the crypto market, a project's ability to attract attention and build a strong community often becomes a key value driver. The narratives range from technological innovation and financial infrastructure to the increasingly cultural and social elements, as exemplified by memecoins.

Notably, these factors are not mutually exclusive. Tokens often embody a unique combination of these three value components, and this balance may shift as a project matures and evolves. Here are some notable examples of how these value elements manifest in practice:

Bitcoin: Embodies all three value components, but it is primarily recognized for its store of value attributes. In addition, it has practical uses for payments and cross-border transfers, and a loyal community of Bitcoin maximalists who reinforce its cultural significance.

Ethereum/Solana: The value of these two primarily stems from their role as the native currencies for network transactions and operations, with increased network activity directly driving token demand. Their established economic presence and network effects also help them develop as reliable stores of value.

Dogecoin: While it originated as a meme-driven token, its development has transcended its initial appeal. Through its dedicated community and sustained relevance, it has achieved a certain level of stability, allowing it to serve as a store of value for its loyal holders.

Bonk: Initially a meme token in the Solana ecosystem, it later expanded its utility through various applications like BonkBot and Moonwalk. This evolution has helped it develop sustainable value through genuine transaction demand and value accrual.

Among the thousands of existing tokens, only around 20 protocols have likely truly gained recognition as stable stores of value or achieved the market fit necessary to generate sustained demand. The market value of the vast majority of circulating tokens primarily stems from the third component - meme status, narrative strength, and the ability to capture market attention.

2. Where is the Value of Memecoins?

As we discussed above, the fundamental factors determining the value of memecoins are fundamentally similar to other crypto tokens. Beyond the practical utility of using stablecoins for payments and transfers, the true potential of crypto lies in the concept of tokenization itself. At its core, crypto excels at transforming community engagement and cultural value into tangible economic value, creating new markets, and establishing incentive-driven networks and communities.

This is why other crypto infrastructure or platforms exist in the first place - from DeFi protocols like Uniswap and Jupiter to middleware solutions like oracles and restaking, and even basic infrastructure like rollups and DA layers. They all help facilitate token-based economic activity and the interactions around it.

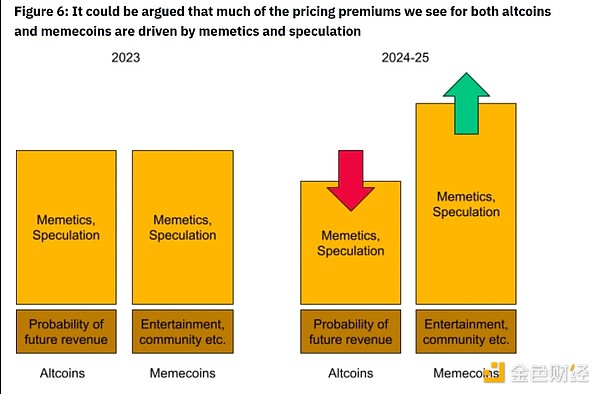

Source: Understanding the Rise of Memecoins

Most infrastructure and DeFi projects emphasize technological and financial innovation through their tokens, but their value primarily stems from narrative and attention economics, rather than as stores of value or cash flow generators. The unique aspect of memecoins is that they deliberately eschew these traditional crypto narratives, instead embracing the fundamental values of community and entertainment. In doing so, they offer a satirical commentary on the limitations of venture capital and insider-driven markets, as well as their typically shallow utility claims.

"In the short run, the market is a voting machine, but in the long run, it is a weighing machine." - Benjamin Graham

Market events and investor sentiment drive short-term price fluctuations, but over time, assets typically revert to their true intrinsic value. This principle is not exclusive to stocks - it applies to all assets, including physical assets, tokens, and memecoins.

Source: memecoinrace.xyz

Yes, compared to other assets, memecoins exhibit greater volatility and more intense reactions to market events. But their success or failure cannot be explained solely by short-term trading and speculation. Among the thousands of memecoins, only a few have successfully built enduring communities and maintained their value. The rest typically disappear shortly after the initial hype subsides.

What accounts for this difference? The key is to understand that memecoins are not just speculative tools - they are a tokenized expression of community and cultural value. To better understand this, let's look at three key factors that influence the meme value of tokens, or more broadly, the meme value of assets:

1. Background and Narrative

A powerful origin story and compelling narrative are key elements driving the initial success of memecoins. Like genes, memes propagate through replication and evolution - but among the countless memes that emerge, only those with truly powerful narratives can gain influence and virality.

The most successful memecoins have an extraordinary ability to read the market and tap into things that capture people's attention. PEPE, launched in the crypto market's dark period at the beginning of 2023, brought much-needed humor and levity, helping to shift the market sentiment and triggering a broader memecoin revival. In the aftermath of the FTX collapse, BONK became a beacon of hope in the Solana ecosystem, embodying resistance to centralized power and the resilience of the community. More recently, GOAT has carved out a unique position by building a narrative around an AI-driven memecoin backed by Marc Andreessen.

The distinguishing feature of these successful memecoin is not only their entertainment value, but also their ability to create stories that resonate with market sentiment and captivate the public's imagination through engaging narratives.

Influential figures often play a key role in shaping the stories and success of memecoin. For example, DOGE and Elon Musk, WIF and Ansem, or SPX and Murad. These key figures are not just advocates; they transform into community pillars, supporting the growth of the token while shaping its core vision and values.

However, even the most compelling stories and the most powerful leadership cannot guarantee lasting success. Look at the memecoin super cycle at the beginning of 2024 - while initially exciting, the vast majority of the launches quickly became irrelevant. Although the initial hype and FOMO may temporarily drive up prices, what often follows is predictable: once the momentum stalls, it becomes a desperate race to exit, with holders rushing to sell before others, typically resulting in the token's value plummeting to zero. This cycle of boom and bust has become a common pattern in the memecoin domain.

2. Community and Branding

In Sapiens, Yuval Noah Harari points out a defining characteristic of humans: our ability to believe in fictional realities. As more people believe in these fictions, they become more powerful and real. The way memes and communities operate is largely the same. They spread through the most viral forms of ideas (fun and culture), and as more people engage with them, they form powerful network effects and genuine cultural value.

Source: Milady Maker

To translate the initial hype and capital of memecoin into genuine success - sustainable value - they must build a strong community and brand foundation. Tokens like Bonk and WIF, as well as NFTs like Pudgy Penguins, CryptoPunk, and Milady, have evolved from simple memes into cultural symbols and recognized brands. Just as luxury and fashion brands represent certain lifestyles and values, these digital assets confer unique identities and a sense of belonging to their holders. When people hold these tokens and participate in their communities, they are not just speculating - they are engaging in a new form of cultural consumption.

Compared to traditional brands or cultural groups, the unique aspect of crypto communities is how they combine cultural value with economic incentives. Take Degen as an example - it directly rewards early Farcaster community members for content creation and social participation. Participants are not just consumers; they are active value creators. This forms a positive feedback loop, where earlier and more active participation brings greater rewards, encouraging early adoption and long-term community loyalty.

3. Organic Growth and Fairness

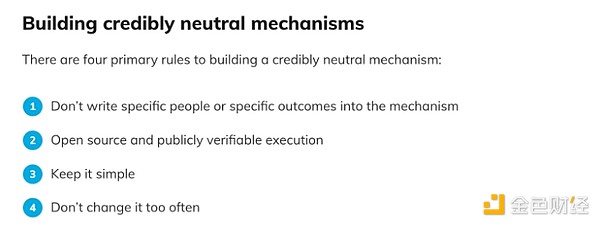

Source: Guided by Trustless Neutrality

Decentralization is not only crucial for blockchain networks, but also a fundamental requirement for memecoin to build organic communities. This aligns with Vitalik Buterin's concept of "trustless neutrality". People are highly sensitive to discriminatory conditions or interests that benefit specific groups or individuals. For example, people get angry when social media platforms censor certain political ideologies or content, but they don't complain when food delivery apps filter out low-rated restaurants.

As mentioned earlier, the true value of memecoin depends on how many people resonate with its meme culture and community and want to participate in it. Therefore, organic growth and fairness are not just moral requirements, but practical necessities. How tokens are fairly and transparently issued and distributed becomes a key criterion for winning people's trust and motivating their participation.

This is particularly important for memecoin, where community engagement is crucial. The success of platforms like Pump.fun not only lies in their lowering of the token issuance barrier, but also in their responsiveness to the market's demand for fairness and transparency in early token investments.

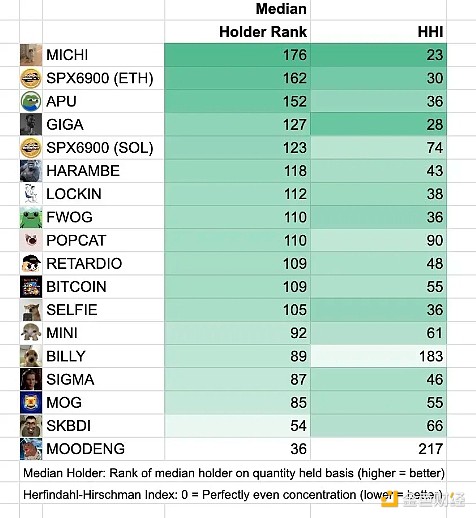

Source: X(@MustStopMurad)

The demand for fairness and organic growth can be quantified through metrics that measure the health of the token community. Murad emphasizes the community aspects of memecoin, highlighting metrics like median holder rank and HHI (Herfindahl-Hirschman Index) to assess the fairness of token distribution and the loyalty of holders. HHI was originally intended to measure market concentration, and can be used to determine the degree of concentration among token holders.

Conclusion

Those who still harbor skepticism towards Web3 and cryptocurrencies may view blockchain and tokens as vehicles for gambling and speculation. However, beneath this surface lies an ideology aimed at building a decentralized, better financial system and a new internet infrastructure. Speculative demand has undoubtedly been a powerful catalyst for the birth and development of this industry, regardless of the intentions. After countless iterations, we have reached a stage where prediction markets can replace traditional media, stablecoins are gaining attention as the next-generation payment networks, and blockchain applications are becoming more user-friendly.

Memecoin, beneath their seemingly worthless and unsound gambling and speculation facade, also possess deeper meanings - they represent the fusion of tokens, communities, and culture. Memecoin embody the purest form of the decentralization and fairness ideals of the crypto ecosystem. They demonstrate that sustainable value can be created solely through community participation and transparent operations, without the need for complex technology or financial products. This suggests that beyond pure speculative frenzy, there are more possibilities for blockchain technology to realize new forms of social networks and services.

More memecoin will continue to emerge and perish. Through these cycles of innovation and failure, we gradually discover the reasons for the thriving of digital communities, and how token economies can better align with human behavior and social dynamics. Although this ongoing evolution is volatile, it is steadily guiding us towards more complex and sustainable community-driven value creation models in the digital age.