Author: Biteye core contributor Viee

Editor: Biteye core contributor Crush

On November 11, Binance listed two small-cap tokens, $ACT and $PNUT. These two tokens performed exceptionally well, with $ACT surging 10 times in 10 minutes, and $PNUT's market value exceeding $1 billion this afternoon, less than 2 weeks after its launch.

According to the on-chain data monitoring platform Lookonchain, within just 2 seconds after Binance announced the listing of $ACT, an address quickly bought 10.9 million ACT with $320,000. After the rapid rise of ACT, the profit of this investment quickly soared to $3.4 million (about RMB 24 million).

Can newbies without a technical background have the opportunity to profit from news arbitrage? The answer is yes.

Today, we will focus on discussing the arbitrage opportunities around Binance's token listings 🤔 Both novices and veterans can join! 👇

01 Timely news, focus on news channels first

Binance has been listing tokens at a much faster pace recently, and the listing requirements are very different from the past. In summary, the tokens have low market capitalization, a heated community with a narrative, and are from second or third-tier projects.

How to capture useful news in a timely manner? I recommend following the Telegram channel of Bwenews (https://t.me/bwenews) or Layergg (https://t.me/layergg), and pin and enable notifications for these channels.

02 Familiarize with the ecosystem, flexibly use tools

Most recently, Binance has listed many MEME coins on the Solana blockchain, as well as $cow on Ethereum and $cetus on Sui.

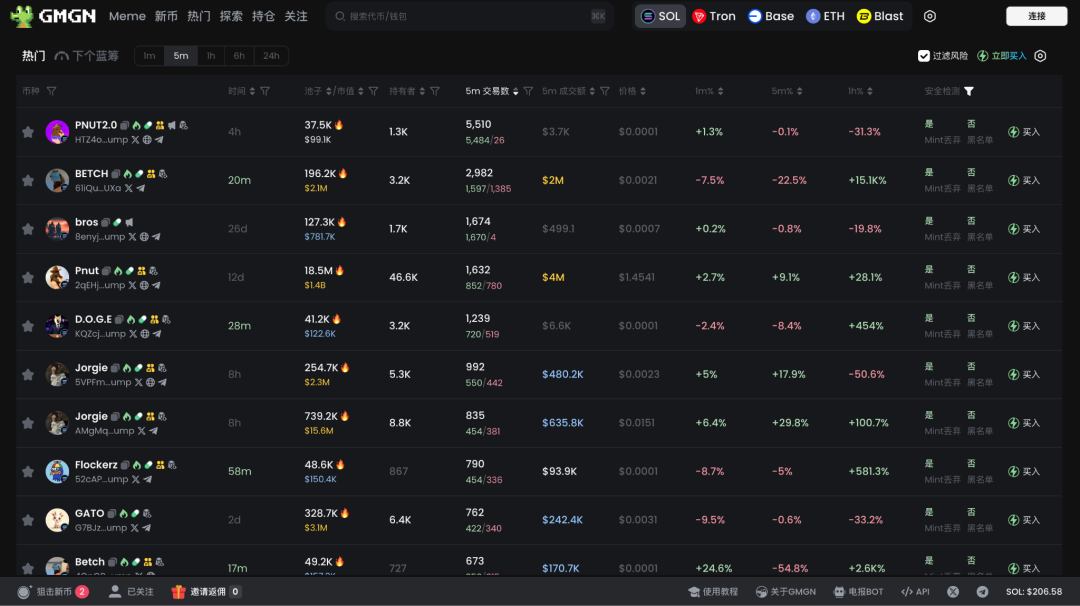

1. The Solana ecosystem should be relatively familiar to everyone. If the listed token is on the Solana ecosystem, you need to react very quickly, and tools are extremely important. I recommend using the Telegram bots of @gmgnai and @PepeBoost888. In this case, it's best not to use Jupiter or Raydium, as they may be a step behind.

Use the GMGN website to trade hot tokens and target new coins

2. In addition to Solana tokens, other chain tokens will have more arbitrage time. For example, $cow and $cetus were listed at the same time, with $cow being a dual-chain token on Ethereum and Gnosis Chain, and $cetus being on Sui.

After seeing the listing news, open @CoinMarketCap to check if the token is multi-chain, and whether there are price differences between the exchanges and on-chain.

Next, I recommend using @dexscreener to view the price charts. If it's a multi-chain token, you can open the multichart function to view the charts of multiple chains simultaneously.

3. This type of arbitrage needs to be completed in a very short time, usually only 3-5 minutes. When there are price differences between different chains or between exchanges and on-chain, you can profit by buying low and selling high.

03 Case studies

The first example is $cow:

1. After seeing the listing news, go to @CoinMarketCap to check for price differences. You'll find that the price difference between the Ethereum chain and the exchange is not large, but it is a multi-chain token.

2. Next, open @dexscreener and find that the price on the Gnosis Chain is cheaper than on Ethereum. At this point, you can buy at a lower price on the Gnosis Chain and sell at a higher price on the exchange. First, choose the official bridge, and the cross-chain time is 3 minutes, which is not too long, so this cross-chain transaction is feasible.

The second example is $cetus:

The feature of $cetus is that there is a significant price difference between the exchange and the on-chain price. If you have funds on-chain, you can directly buy and sell on the exchange. If you don't have funds on-chain, you can directly withdraw to the Sui Chain, as the Sui Chain is also very fast, and you can complete the transaction within 2 minutes.

The third example is the recently popular $Pnut and $ACT:

$Pnut and $ACT are the type where the profit will be very high if you buy immediately after seeing the news, but the profit will be much lower if you buy later, as the time window for arbitrage on the Solana and Ethereum chains is very short, and many automated tools will front-run. If you have the capability, you can use scripts to front-run and arbitrage, but it's quite complex, so I won't go into details. For most people, it's basically impossible to outpace the automated tools, so be cautious about chasing the highs.

For tokens on other chains, there is about 3-5 minutes of arbitrage time, which is enough to complete the investigation and take action immediately.

04 Summary

The tools mentioned above are all included in the MEME coin tool mind map recently compiled by Biteye, which covers nearly 40 other types of tools. It covers on-chain monitoring and trading, including MEME coin discovery, smart money tracking, data dashboards, trading tools, and security tools, etc. Feel free to read it 👇

How to Discover 100x Opportunities? A Complete MEME Coin Tool Kit!