Since the dust settled on the US election on November 5, Bitcoin has broken out of a half-year consolidation range, surging from $73,000 to $89,863 (data from CoinGecko), with a market capitalization of $1.76 trillion, surpassing Meta and silver to become the 8th largest asset in the world.

According to CoinGecko data, as of November 13, Bitcoin's market share reached 57.2%, with a year-to-date increase of over 137.1%. Meanwhile, the search interest for Bitcoin on Google has also risen sharply, reaching 78% of the highest level in the past five years. In addition, since the US presidential election, the inflow of funds into Bitcoin ETFs has exceeded $1 billion for two consecutive days.

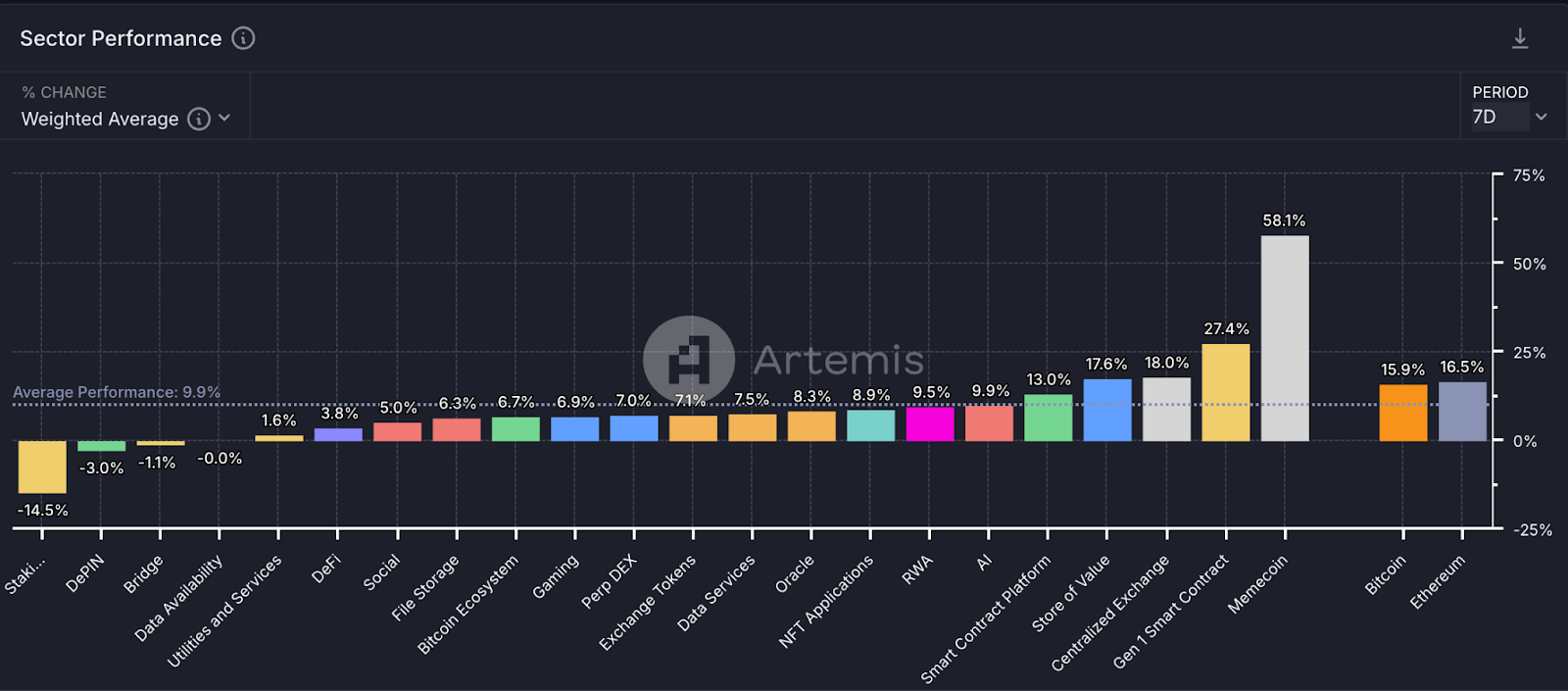

In the early stage of this bull market, Bitcoin and other cryptocurrencies have risen in sync, with MEME coins in particular showing outstanding performance. According to Artemis Terminal data, during this market surge, the performance of MEME coins has outperformed BTC, with an overall increase of over 50%, reaching 58.1%, demonstrating strong market rebound capabilities.

MEME coins rebound strongly, triggering a wave in the crypto market

According to Coingecko data, in mid-October, the total market capitalization of the MEME sector was about $58 billion, accounting for 2.46% of the total cryptocurrency market capitalization at the time. Recent data shows that the market capitalization of the MEME sector has increased to $104.5 billion, accounting for 3.62%, leading all other sectors. Among the top 100 coins by market capitalization, MEME-themed coins have occupied 12 seats.

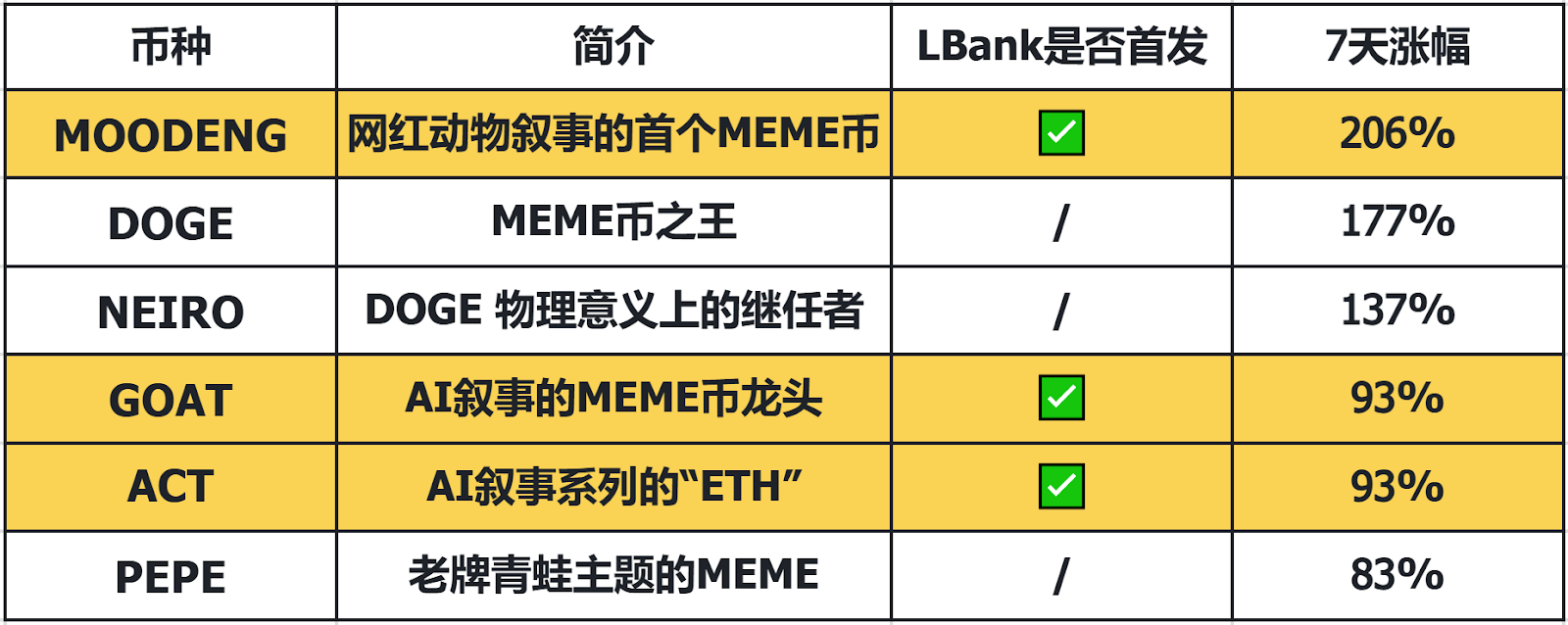

As one of the driving forces behind MEME coins, LBank has launched a series of high-quality MEME coins, igniting the heat in the crypto market. Among them, MOODENG, GOAT, ACT, and PNUT have seen significant gains and have become the focus of investors. As Murad, the new generation representative of MEME coins, said, this is the early stage of the MEME coin super cycle, and there are more opportunities for explosion in the future.

In this regard, we have reviewed the rebound situation and changes in market capitalization of the recent hot MEME coins since the BTC surge on November 5, in order to track the potential layered evolution and capital flow logic.

According to the statistics, the well-known new MEME coins GOAT and ACT in this rebound wave were first launched on the LBank trading platform. Among them, the highest increase of GOAT was 20,812%, MOODENG was 4,344%, and ACT was 4,345%. Compared to the gains in this rebound cycle, the return rate of grabbing the first-issued coins on the LBank platform is significantly higher.

MEME narratives

MOODENG - MEME driven by hot events

In September, a cute hippopotamus named Moo Deng swept across social media and made headlines. This two-month-old hippopotamus from the open-air Khao Kheow Zoo in Thailand quickly became a new internet sensation due to its unique appearance and funny videos, and the eponymous MEME project was first launched on the Solana chain on September 11.

Since its launch on November 5, it has reached a maximum increase of 206%. Currently, MOODENG's market capitalization has reached $340 million, temporarily ranking 223rd on the cryptocurrency market capitalization list.

Doge - the direct beneficiary of the "Trump trade", shilled by Musk

As the earliest MEME coin, the price trend of Doge to some extent reflects the rise and fall of the MEME track. Musk not only is the brand ambassador of Doge, but also played a key role in Trump's campaign team. Since Trump's victory, Musk's influence has directly driven a significant increase in Doge, with a maximum increase of 177%.

Currently, Doge's market capitalization has reached $56.2 billion, temporarily ranking 6th on the cryptocurrency market capitalization list.

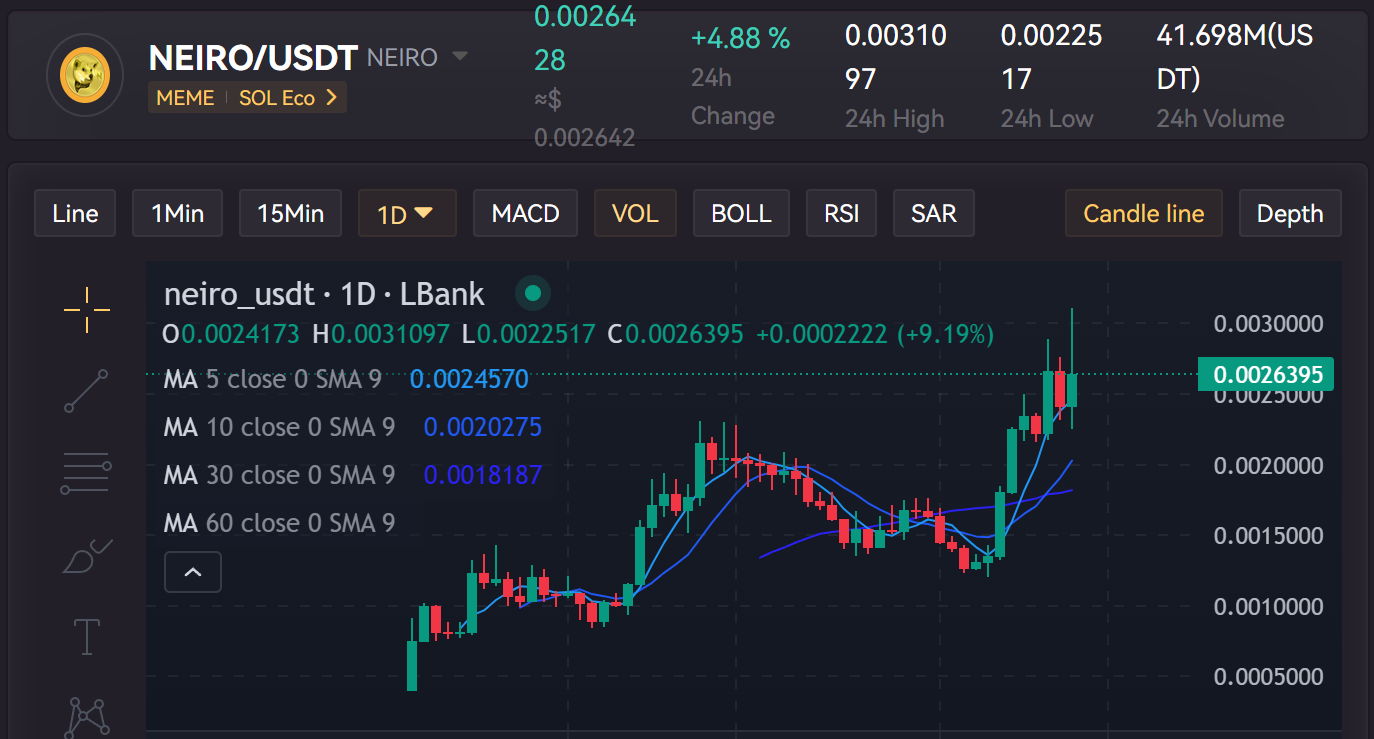

NEIRO - a dog-themed MEME coin, second only to Doge

As the physical successor to Doge, NEIRO's popularity has remained high since its launch. The market generally believes that NEIRO has the potential to replicate the wealth myth created by Doge, and has also sparked heated debates about its capitalization naming. Since November 5, the maximum increase has reached 137%.

Currently, NEIRO's market capitalization has reached $1.1 billion, temporarily ranking 72nd on the cryptocurrency market capitalization list.

GOAT - the leader in the AI MEME track

GOAT, full name goatseus maximus, is a MEME coin issued by the AI BOT truth_terminal on October 11. As the leader of the AI narrative series, MOODENG saw a maximum increase of 3,320.00% after its first launch on LBank.

Since November 5, the maximum increase has reached 93%. Currently, GOAT's market capitalization has reached $870 million, temporarily ranking 88th on the cryptocurrency market capitalization list.

ACT - an AI MEME potential, already listed on Binance

Recently, ACT has surged again due to its listing on Binance, as the "ETH" of the AI series, crypto market users have high expectations for it. As a basic infrastructure MEME coin, ACT has features such as scriptless and self-generated interactions, multi-agent dynamics, and continuous and long-term observations, making it highly competitive in the AI MEME narrative. Since the US market opened on November 5, the maximum increase has reached 93%. Currently, ACT's market capitalization has reached $520 million, temporarily ranking 212th on the cryptocurrency market capitalization list.

PEPE - an old-fashioned frog-themed MEME

As the representative of the frog-type MEME in the field, PEPE has quickly accumulated a large number of supporters due to its unique cultural symbols and community power, even sparking heated discussions about its market positioning and future development direction. Since the US market opened on November 5, PEPE's price has seen a significant increase, with a maximum increase of 83%. Currently, PEPE's market capitalization has reached $5.5 billion, temporarily ranking 23rd on the cryptocurrency market capitalization list.

How to accurately capture investment opportunities?

In the secondary market of the cryptocurrency industry, the key for investors to profit from the rapid fluctuations of MEME coins is to capture market trends in a timely manner and adopt flexible trading strategies.

First, paying attention to the direction of centralized exchanges is crucial. CEXs are the core of the crypto market, with strong market analysis capabilities, and can quickly select potential MEME coins based on multi-dimensional data indicators and guide market sentiment through rapid listing. Therefore, investors should pay attention to the popular coins on CEX platforms, especially exchanges like LBank, which have outstanding performance in the MEME coin sector. By trading in a timely manner on these platforms, investors can effectively avoid the risks brought by market sentiment fluctuations and maximize their investment returns.

In addition, traders can also use the real-time data and market trends provided by the platform to enter or exit the market at the best time, ensuring that they are always in a favorable position in the market. The recent rumor in the community of "ambushing LBank and selling on Binance" is a judgment made by holders on the timing of buying and selling cryptocurrencies.

Furthermore, enhancing risk management capabilities is also a necessary strategy for successful trading. In the MEME coin market, extreme price fluctuations often catch investors off guard. To cope with this highly volatile environment, investors can control risks by setting take-profit and stop-loss points, avoiding significant losses during violent price fluctuations. In general, a successful strategy in MEME coin trading not only requires a quick response to market changes, but also requires ensuring long-term stable returns through rigorous risk control and fund management.