Coinbase's Wrapped Bitcoin (cbBTC) has surpassed $1 billion in market capitalization just 57 days after its launch.

This growth trajectory currently accounts for nearly 10% of the $12.88 billion market capitalization of Wrapped Bitcoin (WBTC), according to CoinMarketCap.

cbBTC Exceeds $1 Billion... Mostly Held on Ethereum Blockchain

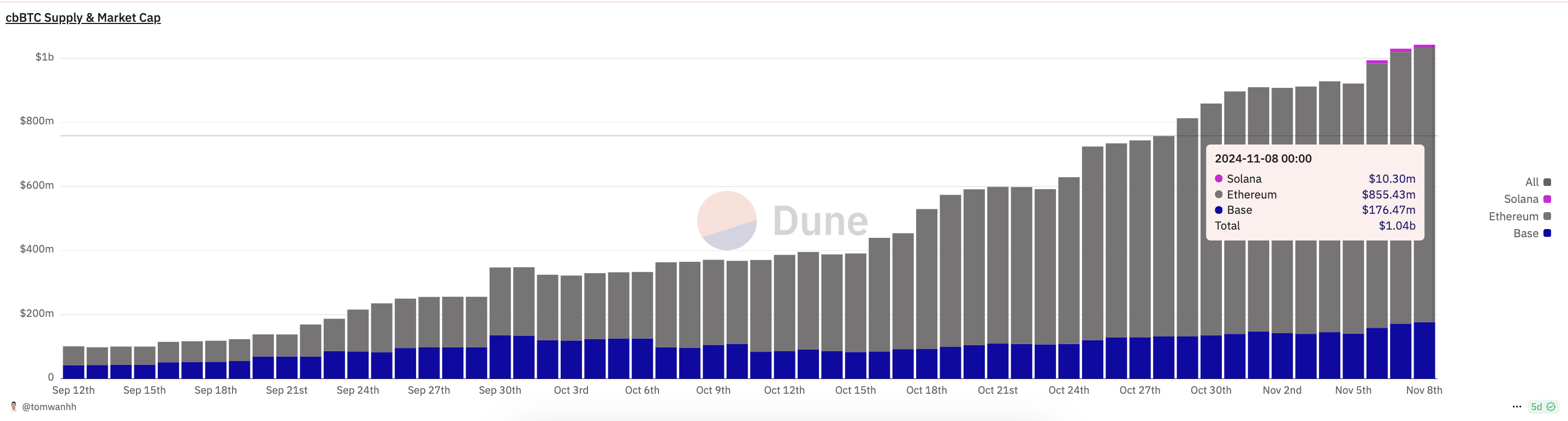

According to Dune data, the current market capitalization of the cbBTC Bitcoin wrapper is $1.04 billion. The majority of this value, $850 million, is held on Ethereum, followed by Base Layer-2 blockchains and Solana.

Specifically, out of the total cbBTC supply of 14,678.95, over 12,000 are held on Ethereum. Meanwhile, Base and Solana hold 2,388 and 262, respectively.

As a Bitcoin wrapper, cbBTC allows BTC to be represented on other blockchain networks. This surge highlights an important trend that Ethereum-based assets are experiencing faster net supply changes than other major Bitcoin liquid staking tokens (LSTs).

"Network effects are unbeatable. They can offer rebates/discounts/business to MMs/funds to easily secure liquidity and adoption," said on-chain data researcher Tom Wan.

This rapid growth, achieved in just two months after launch, indicates remarkable demand for Coinbase's wrapped Bitcoin product. This pace also reflects an increasing preference for cross-chain compatibility within DeFi.

This trend emerges as users and protocols seek more accessible and flexible Bitcoin-pegged assets. Coinbase announced plans to launch cbBTC on Base in mid-August.

This product has been positioned as a potential market competitor to Wrapped Bitcoin (WBTC). Bitcoin wrappers are also gaining increasing support and interest across the DeFi landscape.

The idea of Bitcoin wrappers is to expand user access to BTC. For example, through cbBTC on Solana, users can leverage the network's low fees and high transaction speeds.

These metrics are particularly relevant for high-frequency DeFi transactions. The major DeFi protocol Aave has already targeted cbBTC for its V3 protocol.

Initially, cbBTC garnered attention from venture capitalist Dan Elitzer. In August, he predicted that cbBTC would be "highly strategic" for Coinbase and could surpass WBTC's supply within six months.

"Honestly, it's surprising they didn't launch this a few years ago," said Elitzer.

Elitzer also emphasized that the introduction of cbBTC could encourage DeFi users to seek more decentralized Bitcoin wrapping options when considering the "mishandling" associated with Justin Sun.

Will cbBTC Surpass the Veteran WBTC?

Indeed, the emergence of Coinbase's cbBTC came against the backdrop of the controversy surrounding Justin Sun and WBTC. As a solution for wrapped Bitcoin on Ethereum, WBTC has faced growing skepticism due to concerns over management and transparency under Justin Sun's influence.

The rapid rise of cbBTC has not been without controversy. Coinbase's approach to transparency and proof of reserves (PoR) has been the subject of criticism. Specifically, critics argue that there are still unresolved issues.

Prominent X user Duo Nine warned that Coinbase's reliance on user trust without providing specific evidence of BTC reserves could lead to a collapse similar to the FTX downfall, as the outcome hinges on Coinbase minting more cbBTC than it can back.

"They won't provide proof of reserves for the BTC they *claim* to have, nor proof of backing for the new paper BTC that is cbBTC. If they mint too much paper BTC, they'll go the way of FTX," said Duo Nine.

Justin Sun echoed these sentiments, questioning Coinbase's decision to omit standard reserve audits for cbBTC. TRON's management argued that this lack of transparency poses significant risks. In response to these concerns, Coinbase's custody practices have come under scrutiny, leading BlackRock to amend its custody contract with the exchange.

This unease has driven users to migrate to the "safer" wrapped Bitcoin option of cbBTC, backed by Coinbase. As cbBTC gains more traction, it poses an increasing threat to WBTC's long-standing dominance. Whether cbBTC will ultimately surpass WBTC remains to be seen, but its rapid growth indicates a significant shift in user preferences within DeFi.