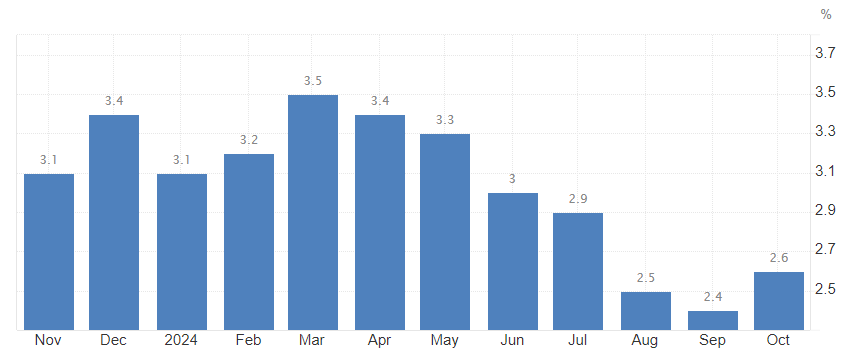

Bitcoin soared to an all-time high of $92,000 after the announcement that the US Consumer Price Index (CPI) rose 2.6% year-on-year in October.

The recent inflation figures have amplified concerns about the Federal Reserve's monetary policy, suggesting potential volatility in the cryptocurrency market.

CPI in Line with Wall Street Expectations

The rise in Bitcoin may be attributed to the positive sentiment in the cryptocurrency market following the US election. The market anticipates regulatory changes that are important to the US financial system.

At the same time, the CPI data released today came in lower than expected. Previous reports had suggested that inflation could be higher.

The Labor Department reported that the monthly CPI inflation remained at 0.2%, the same as in September. However, the 2.6% annual increase was the first rise in 8 months.

The core CPI, excluding volatile food and energy prices, was unchanged at 0.3% monthly and 3.3% annually, in line with expectations.

However, despite today's Bitcoin rally, the Federal Reserve's aggressive stance can inject volatility into the market. The possibility of rate hikes can weigh on investors' sentiment, affecting the broader financial market, including cryptocurrencies.

It is also important to consider the traditional view that inflation concerns drive investors to seek assets with limited supply, such as Bitcoin. High CPI figures increase the likelihood of more restrictive monetary policy, but also suggest ongoing economic uncertainty.

Bitcoin's all-time high and sustained uptrend reflect the market's optimism about its long-term potential. This is because institutional adoption and positive perception of cryptocurrency assets continue to grow, even amid inflationary pressures.

Inflation Rate Rises for the First Time in 8 Months

Bitcoin's behavior in August and September was particularly sensitive to inflation and Federal Reserve policy expectations. The August CPI inflation fell to 2.5%, below the market's expected 2.6% and July's 2.9%.

This slowdown in inflation suggested easing price pressures, triggering speculation about a 25bp rate cut in September.

The muted reaction of Bitcoin indicated that the market had largely anticipated the favorable inflation data and priced in potential monetary easing before the CPI release.

In September, inflation rebounded slightly to 2.9%, but Bitcoin maintained above $61,000. The market viewed this figure as a continuation of the July slowdown trend and strengthened expectations that the Federal Reserve would pause further tightening.