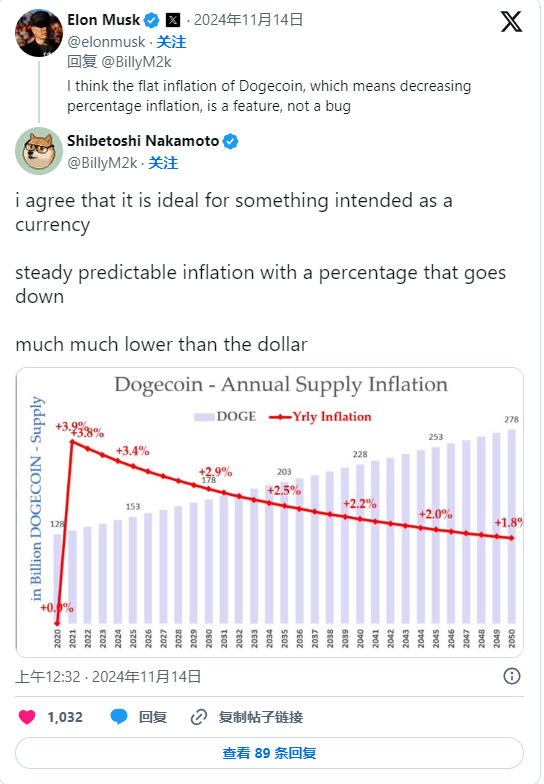

In the world of Dogecoin, Elon Musk has always been a true "believer". This global top-ranked billionaire, Tesla CEO, and SpaceX founder, who is now the Minister of Government Efficiency in the United States, has recently taken to Twitter (now renamed X) to endorse Dogecoin's inflationary model, stating that its "seemingly eccentric" token economics have actually become one of its biggest advantages.

The trigger for the discussion was a tweet by Dogecoin co-founder Billy Markus, who explained to the community how to adjust Dogecoin's token economics, even proposing that developers could directly initiate a vote to modify it. As Markus said: "You can change it on the spot, make a request, convince the community and miners to use the new version. Now stop bothering me."

Musk then stepped forward to directly support it, stating that the "stability" of this inflationary model is actually one of Dogecoin's biggest features, rather than a flaw. In response to Markus' proposal, he humorously replied, "I think that's the charm of Dogecoin."

Unlimited Inflation: What's Special About Dogecoin?

Many people may frown at the word "inflation" - that's right, the supply of mainstream cryptocurrencies like Bitcoin and Ethereum is limited, which is an important reason why they attract investors. But Dogecoin is different, its supply is unlimited - 10,000 new coins are minted every minute, and it's estimated that Dogecoin's annual supply could reach 5.2 billion coins.

However, Musk and Markus have a different view on this "seemingly unrestrained" inflationary model. Musk believes that this unlimited supply actually guarantees Dogecoin's "liquidity", and this "stable" inflation is the unique selling point that sets it apart from mainstream coins like Bitcoin and Ethereum. "This is not a flaw, but a feature," Musk said.

Markus also stated that Dogecoin's economic model actually makes it an "ideal currency", able to adapt to a wider range of applications, especially in consumer payments, and can avoid the hesitation of consumers caused by the large price fluctuations like Bitcoin.

Strange Token Economics Become an Advantage?

Dogecoin's "unlimited supply" is not just a theoretical academic discussion, it has a history of actual application. Billionaire and crypto heavyweight Mark Cuban pointed out as early as 2021 that this unique economic design is precisely the advantage that allows Dogecoin to be used as a payment method.

Cuban said, "Dogecoin is easy to accept because it's not as expensive as Bitcoin, and not as complicated as Ethereum. If you have $100, you can only get a little bit of Bitcoin or Ethereum. But with Dogecoin, the price is low, and after it appreciates, it's easy to buy goods, this intuitive feeling makes Dogecoin an ideal payment method."

Cuban also revealed that during his tenure as owner of the Dallas Mavericks, the team started accepting Dogecoin as payment for tickets and merchandise as early as 2021. And behind all this is the advantage of Dogecoin being "easy to use".

Elon Musk and Dogecoin: From Hobby to Strategy

It must be said that the relationship between Elon Musk and Dogecoin has long since gone beyond the simple "investment" category. Since 2018, Musk has become a loyal fan of Dogecoin, and almost every time he speaks on social media, he mentions Dogecoin and continues to amplify its potential. More interestingly, Musk has stated that he is not actively involved in the crypto field, but just "a bit" fond of Dogecoin, simply because "it has dogs and emojis, and I like all of that."

This may sound a bit casual, but in fact, Musk's enthusiasm for Dogecoin has never waned, and he has even sometimes driven Dogecoin's price fluctuations, becoming a "weathervane" for the market. And in 2019, Dogecoin's developers revealed exclusively that they had collaborated with Musk to turn Dogecoin into a practical payment cryptocurrency.

The Future of Dogecoin: "Inflationary Advantage" or "Bubble Risk"?

Clearly, Dogecoin's "eccentric" economic model can be both an advantage and a disadvantage, depending on the individual. For some investors, Dogecoin's inflation brings a "long-tail effect", and its liquidity in retail payments makes it a "tool coin" that is convenient for consumption; for others, this kind of inflation also means that its value may face long-term pressure and lack the scarcity of Bitcoin.

However, with Musk and other crypto heavyweights continuing to focus on Dogecoin, its market position will undoubtedly maintain its heat. In the future, whether Dogecoin will become a "payment tool" and go mainstream, or just a "meme coin", is still a hot topic in the crypto field.

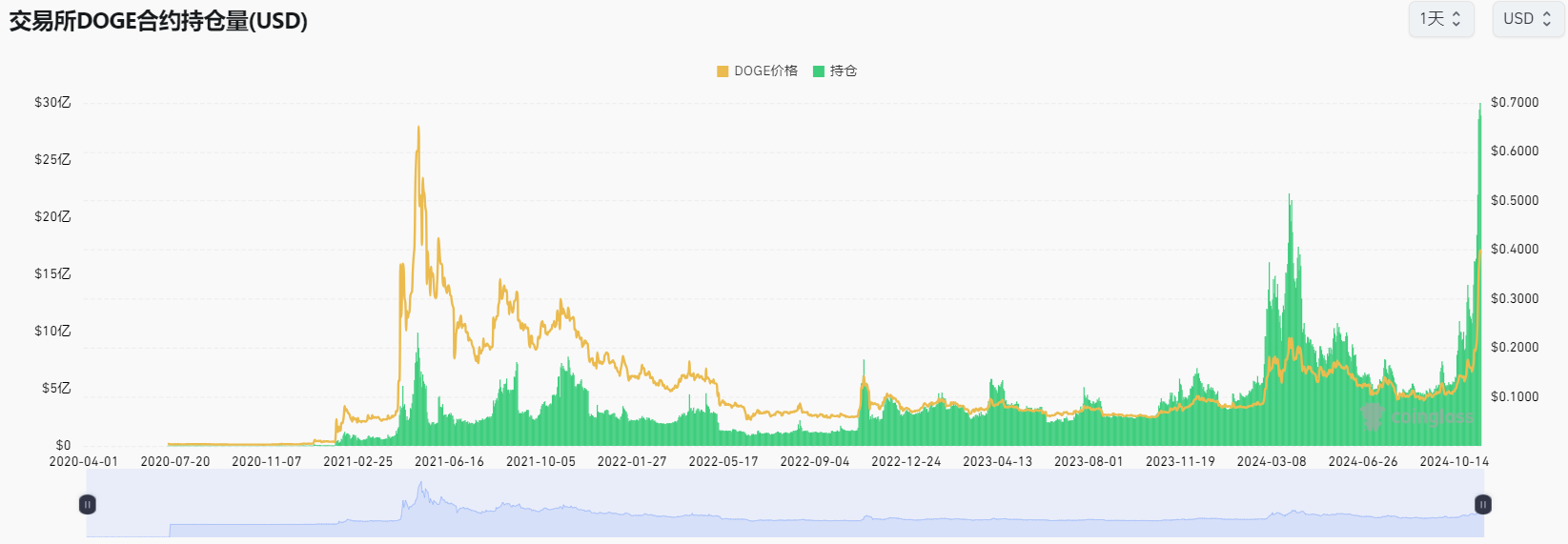

Price Far from Historical Peak, Holding Volume Hits New High

Currently, Dogecoin is priced at $0.39, with a staggering 350% increase over the past three months. Dogecoin once reached a historical high of $0.74, which is nearly 89% away from the current price. However, considering Dogecoin's continuous issuance in recent years, if calculated based on market capitalization, Dogecoin still needs about a 54% increase to return to its historical peak.

It is worth mentioning that the contract holdings of Dogecoin on exchanges have reached a new historical high, with the peak of Dogecoin contract holdings in 2021 being only $900 million, while the current Dogecoin contract holdings are close to $3 billion. This means that the future direction of Dogecoin is likely to be more influenced by the futures market.

In general, the future of Dogecoin has become more and more uncertain. Although its market performance is strong, its issuance mechanism also means that it faces more challenges to return to historical highs in the future. In the highly volatile crypto market environment, whether Dogecoin can break through the bottleneck and reach a new historical high again remains to be seen.