- Author: Cointelegraph Reporter Tom Mitchelhill

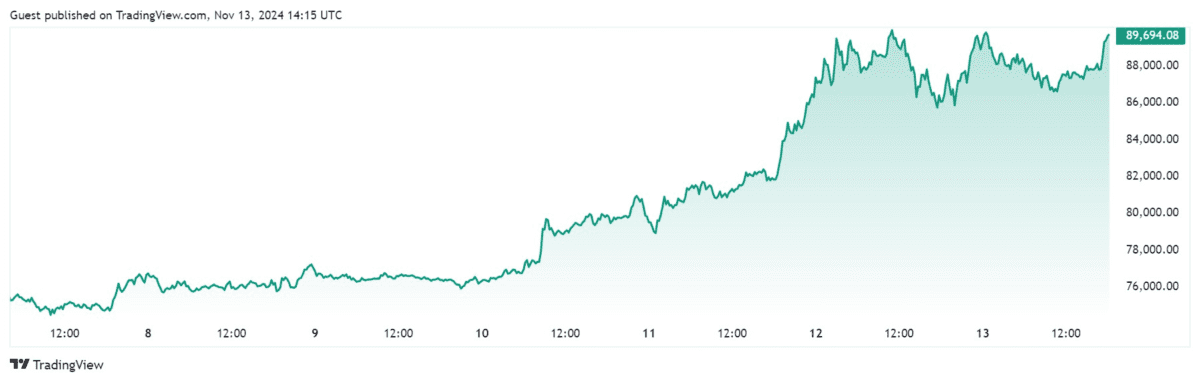

After Donald Trump was elected as the next President of the United States, Bitcoin exhibited a strong rebound, surging nearly 30% in a week, setting a new all-time high of over $90,000. Now, analysts are studying the potential highs or lows that Bitcoin may reach by the end of the year, and have shared their expert price forecasts with Cointelegraph.

Table of Contents

ToggleOKX Global Business Director Lennix Lai: Over $100,000

Lennix Lai, the Global Business Director of cryptocurrency exchange OKX, stated that he expects Bitcoin to reach a price of "over $100,000" on the last trading day of 2024.

Lai said, "We are seeing signs of a potential paradigm shift in the growth stage of cryptocurrencies, and I believe this could potentially push BTC above $100,000 by the end of this year."

According to data from TradingView, as of the time of writing, Bitcoin is trading above $89,000, up nearly 30% in a week.

However, Lai warned that the market has already priced in several bullish catalysts - the election outcome and the rally in traditional stock markets - and Bitcoin's recent surge is largely driven by short-term euphoria.

"It's important to note that there is still a considerable amount of macroeconomic uncertainty. The post-election landscape may include significant government spending cuts and tariff reforms, which could impact the markets," he added. "I believe these factors, combined with geopolitical risks, including tensions in the Middle East and the U.S. stance on active conflicts, could further complicate the market outlook and lead to short-term volatility."

IG Markets Analyst Tony Sycamore: $90,000 Low to Mid-Range

IG Markets analyst Tony Sycamore told Cointelegraph that he expects Bitcoin to be in the "low to mid-$90,000 range" by the end of the year. He said that many of the "good news" factors following Trump's election have already been priced in, as BTC unexpectedly rebounded above $90,000 on November 11.

"Another reason is that we may be approaching the time when Altcoins start to catch up. For example, Ethereum's trading price is 20% below its year-to-date high, so I suspect a rotation from Bitcoin to Altcoins will be a theme we see before the end of the year," he added.

eToro Analyst Josh Gilbert: $100,000

eToro market analyst Josh Gilbert stated that the recent record-breaking highs for Bitcoin are far from over, and he expects the cryptocurrency to reach a six-figure all-time high of $100,000 before the end of the year.

Gilbert, along with several other analysts, believes that Trump's victory in the presidential election, declining interest rates, a strong U.S. economy, and the growth in institutional demand seen in the record daily inflows into Bitcoin ETFs last week are the key catalysts for future growth. Gilbert said, "This rally hasn't seen the kind of 'frenzy' from retail investors that we've seen in previous cycles."

Despite the bullish sentiment, Gilbert warned that BTC is likely to "take a breather" in the coming weeks, but acknowledged that the overall trend remains strongly positive.

"This asset has been like a freight train over the past two weeks - it's going to take some major resistance to slow it down."

CryptoQuant CEO Ki Young Ju: $58,000

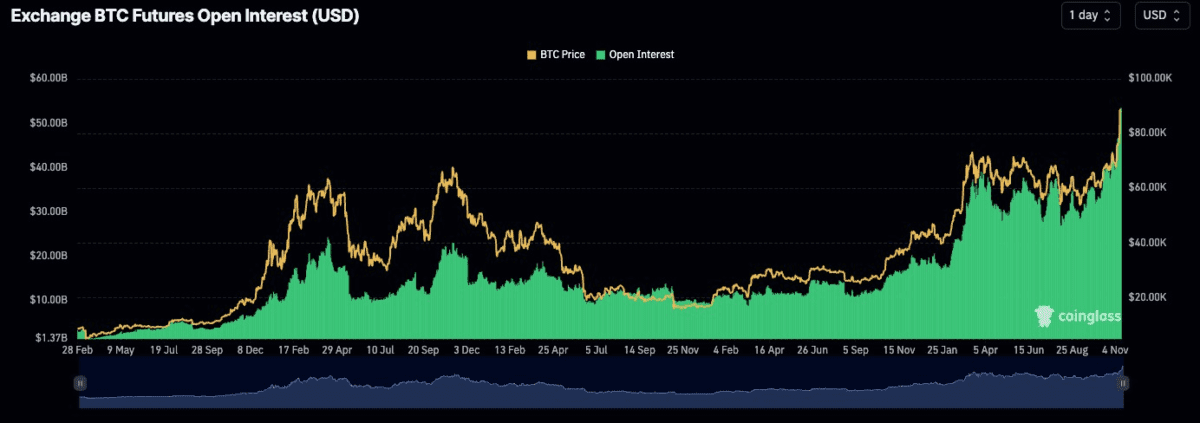

CryptoQuant CEO Ki Young Ju has a more bearish outlook on the price trajectory of BTC over the next few months. In a tweet posted on November 9, Ki said he expects BTC to close the year at $58,974 and pointed to the overheated derivatives activity as a reason for the impending correction.

"I expect a correction as the BTC futures market indicators are overheated, but we are entering the price discovery phase, and market sentiment may even further increase. If there is a correction and consolidation, the bull market may be extended; however, a strong year-end rally may lay the foundation for a bear market in 2025."

According to data from CoinGlass, BTC's current open interest has reached a record-breaking $55 billion, which is an indicator of how much active positions there are in BTC derivatives like futures and options.

SwyftX Analyst Pav Hundal: $103,000

SwyftX's chief market analyst Pav Hundal told Cointelegraph that while it's difficult to pinpoint the exact target for the end of the year, he expects BTC to end 2024 trading slightly above $100,000.

"If you apply the general Fibonacci Extension to the highs and lows of the previous cycle, it yields a year-end price of $103,000," he said.

HDI Fund Partner Guy Armoni: Around $100,000

HDI Fund managing partner Guy Armoni told Cointelegraph that BTC has not yet reached the peak of this cycle, and given the continuation of current trends, he expects the trading price of BTC to be even higher.

Armoni sees the increasing global adoption of cryptocurrencies and a more crypto-friendly policy environment in the U.S. as the main drivers for BTC's price for the rest of this year and 2025.

"If this trend continues, not only will we see BTC reach $100,000 this year, but I expect the bull market to extend into 2025, with BTC potentially surprising us and reaching $250,000."

Quantum Economics Founder Matti Greenspan: Higher

Quantum Economics founder and CEO Mati Greenspan said that BTC has been "ignoring" the extremely bullish fundamentals for most of this year and has been consolidating rather than rallying, and expects the asset to continue performing well before the end of 2024.

Greenspan pushed back against the widespread view that this bull run could end in a few months, saying he expects the upward trajectory of cryptocurrencies to continue "for a very long time."

"Bull markets in stocks usually take 10 years or more to form, and yet some people act like it's all going to be over in a month, so they're rushing to eat as much as they can while the food is still on the table, or else they'll just be left with the scraps."

Collective Shift CEO Ben Simpson: $100,000

Collective Shift CEO Ben Simpson told Cointelegraph that while there may be pullbacks and corrections in the short term, he predicts BTC will end the year trading around $100,000.

"With Trump's election, interest rates coming down, potential future quantitative easing policies, and BTC ETFs seeing daily volumes of over a billion dollars, more and more people are starting to pay attention to this space," he said. "When you have an asset like BTC with a limited supply and such massive demand, this space can only go in one direction."

Independent Analyst Tom Wan: Between $80,000 and $95,000

Independent analyst Tom Wan told Cointelegraph: "I believe BTC will break through the $95,000 to $100,000 range before the end of 2024, however, it's important to note that $100,000 is a key psychological price level, and we may see a significant sell wall around that area."

Wan said investors are currently reflecting the expected Trump administration's support for crypto regulations and the surge of BTC spot ETF inflows, but he also mentioned the record-high BTC open interest as a potential short-term negative factor.

Like many other crypto industry experts, Wan is highly optimistic about the long-term price outlook. Wan added:

"With the expectation of crypto-friendly regulations, I believe we should see more institutional investors, such as pension funds, RIAs, state governments, and publicly traded companies, start to allocate to cryptocurrencies, which could drive BTC above key price levels."

Conclusion

Overall, the consensus among the analysts is that BTC's trading price at the end of this year will be above or around the $100,000 mark. While the bullish sentiment is high, most analysts warn of significant volatility and major corrections for BTC in the coming months.