With the election of Donald Trump, a crypto-friendly regulatory body may replace SEC Chairman Gensler, paving the way for spot ETH ETFs to offer staking rewards.

With the overwhelming victory of President-elect Donald Trump, the days of SEC Chairman Gary Gensler appear to be numbered.

Market and political observers expect Trump to appoint a new commission chairman, a shift that could allow spot ETH ETFs to offer staking rewards, boosting the price of Ether (ETH).

Trump has made many significant promises to the U.S. crypto industry. One of them is to fire Gensler on the "first day" of the new administration. But that's easier said than done.

Cybersecurity and digital media lawyer Andrew Rossow told Cointelegraph that "the president has the power to appoint and remove certain individuals, which extends to SEC commissioners."

However, he said, "whether the president can directly fire the SEC chairman is a bit murky."

Trump would need to provide a legitimate reason for dismissal, such as neglect of duty, inefficiency, or misconduct. Directly firing Gensler would be unprecedented and could mean the Trump administration would face political backlash.

Rossow said Trump may not be deterred by the potential political consequences, as the digital asset industry is generally dissatisfied with Gensler's "enforcement-heavy" regulatory approach. Additionally, Trump's combative political style suggests he has little respect for systemic norms.

Carol Goforth, a professor at the University of Arkansas Law School who specializes in corporate associations and securities regulation, told Cointelegraph that there is a faster path to remove Gensler without having to oust him from the SEC: "The president can demote the chairman at any time and replace him with another sitting commissioner. This could happen immediately."

Rossow said the president has the power to shuffle the chairman position among commissioners under the authority defined in Reorganization Plan No. 10. He said Trump "may just choose to transfer the chairman position to another SEC commissioner, citing the faithful execution of his executive power as constitutional."

However, Rossow added, "in most cases, SEC chairmen tend to resign when there is a change in the White House."

Goforth pointed out that Gensler's resignation would make the appointment of a new SEC chairman more complicated, as it would require Senate confirmation, involving a longer and potentially contentious hearing and legislative process.

However, she said that even Senate confirmation would be "relatively easy" for "President Trump," as the Republicans have already gained control of the legislative body.

Trump has already made it clear that he wants to appoint a crypto-friendly SEC chairman. One of the SEC's restrictive measures has been considering Staking as a security product, which has hindered the growth of the U.S. crypto industry.

There is hope that the new SEC chairman will stop ongoing enforcement actions and open the door for ETF issuers to provide staking services.

Ethereum Staking May Boost Struggling Spot ETFs

The price of Ethereum has been underperforming market expectations. There are several reasons why Ethereum has underperformed compared to Bitcoin or its direct competitors like Solana. One factor is the lackluster performance of spot Ether ETFs since their launch.

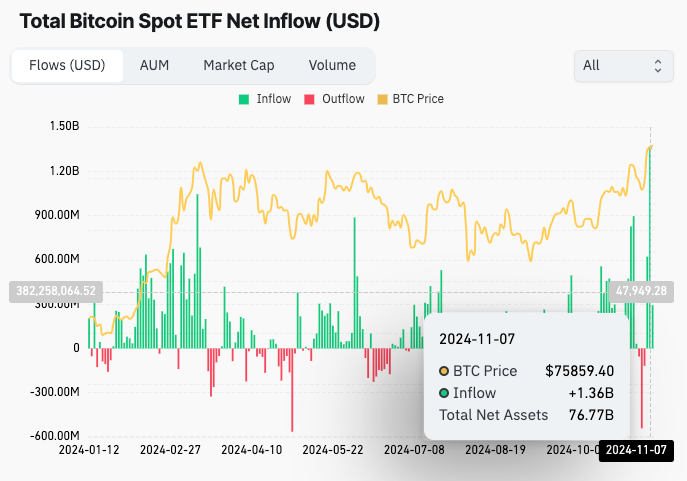

Market observers expected spot Ether ETFs to replicate the success of spot BTC ETFs. BlackRock's spot Bitcoin ETF saw inflows of over $1.1 billion on November 7, pushing the BTC ETF's total assets under management (AUM) above $25 billion.

On November 7, the spot Bitcoin ETF saw inflows of $1.34 billion. Source: CoinGlass

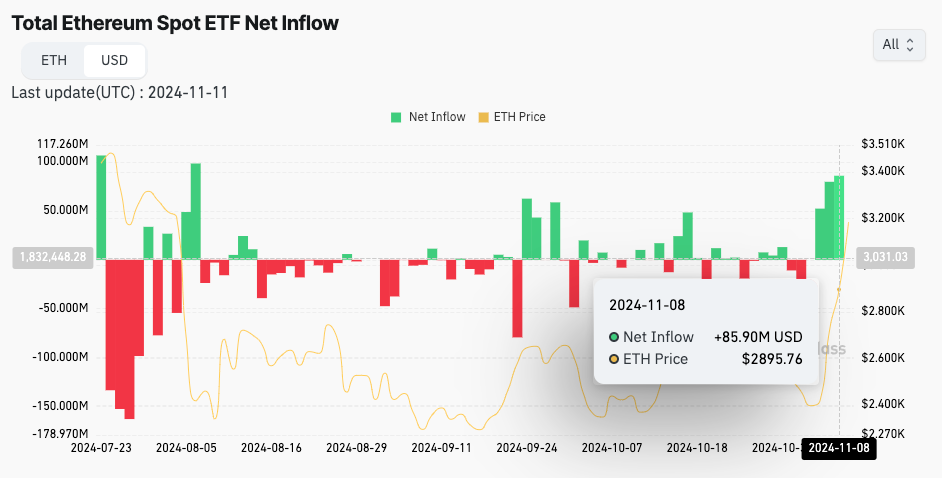

In comparison, BlackRock's iShares Ethereum Trust ETF saw one of its highest inflows on November 8, with nearly $860 million, bringing its total AUM to over $8 billion. However, this boost has not offset the outflows from Grayscale's Ethereum Trust ETF, which continues to hinder its overall momentum.

On November 8, the total inflows for the spot Ether ETF were $859 million. Source: CoinGlass

Federico Brokate, head of U.S. business at crypto ETF issuer 21Shares, told Cointelegraph that "the flow dynamics of ETH ETFs have been somewhat disappointing." However, he remains optimistic, saying, "We see stable demand for Ethereum; however, we expect this demand to accelerate," stating that "institutional interest is expected to grow as regulatory clarity on ETH as a commodity increases confidence."

Brokate said that the inability of ETF investors to participate in staking is a key factor behind the lackluster performance of spot ETH ETFs. "Staking can be viewed as a passive income stream for investors, so for what we expect to be the early adopter crypto-native or crypto-adjacent population, they may have been sitting on the sidelines so far."

Tom Wan, an on-chain data researcher and former 21Shares analyst, shared on X that he believes spot Ether ETFs can attract investors by promising passive income through staking, allowing them to better compete with spot BTC ETFs and draw in capital inflows.

The structure providing staking rewards could vary, depending on the regulatory and operational setup. ETF issuers could capture the staking rewards, effectively allowing them to offset their management fees and market their products in this way.

Currently, the fees charged by ETH ETF issuers range from 0.15% to 0.25%, with Grayscale's ETHE being significantly higher at 2.5%. According to Wan, even staking 25% of the managed assets could generate enough revenue to fully offset these fees. Wan said the prospect of fee-free or low-cost ETH ETFs may attract institutional investors, particularly appealing to retail investors.

Another possibility is for ETF issuers to provide indirect staking rewards to investors. Investors would not directly stake their assets, but would benefit from the staking rewards generated by the ETF's pooled assets.

Wan noted that even moderate staking yields could have an impact. "If issuers provide 0% management fee plus around 1% yield, it would become a competitive alternative to the BTC ETF." While a 1% yield may seem negligible, he said "the yield could be a meaningful differentiating factor." The current Ether staking yield is around 3.5% annual percentage yield (APY), depending on the specific staking method chosen.

Regardless of the model chosen, ETF issuers have enough flexibility to attract investors. Wan concluded, "Enabling staking rewards could be a game-changer."

"A key factor hindering the potential of ETH ETFs is the lack of staking. For institutional investors who may be just getting introduced to cryptocurrencies, Bitcoin is already a new asset - Ethereum is even more novel. To attract capital inflows, ETH ETFs need a clear differentiating factor that makes it easy for investors to understand."

Investors still perceive Ethereum as a more nebulous concept. Brokate said the widespread adoption of the spot BTC ETF is related to the branding of Bitcoin for institutional investors. "Ethereum's brand awareness is lower than Bitcoin. Bitcoin is the industry's flagship, with a simpler narrative."

Allowing staking on ETH ETFs could be a powerful catalyst for institutional and retail adoption. The change in SEC leadership will mark an important milestone for the crypto industry, especially for the price outlook of Ether, as altcoin ETFs for assets like XRP or SOL have not yet been approved.

A New SEC Chair Can't Change Everything About Staking

The SEC's current concern is that staking is like an investment contract, where profits come not just from the asset itself, but through a structured process involving third-party efforts. This interpretation may require staking services to comply with securities regulations, including registration, disclosure, and investor protection.

Although the crypto community hopes the new SEC chair will take a more lenient approach, Goforth warns not to assume that regulation will change quickly, even with a new, potentially crypto-friendly SEC chair at the helm.

She said the SEC chair often "sets the tone for the commission, but they can't single-handedly force policy changes." Commissioners can override the chair's decisions, allowing enforcement actions to continue.

Under Gensler's leadership, the SEC has taken enforcement actions against several U.S. crypto companies offering staking services.

Some companies, such as the cryptocurrency exchange Kraken, have chosen to settle rather than face protracted legal battles, agreeing to pay a $30 million fine by February 9, 2023. Other companies, such as the U.S.-based cryptocurrency exchange Coinbase, have decided to take their cases to court.

Goforth said the SEC chair "can't unilaterally dismiss ongoing cases." They need to convene a majority of commissioners to agree and have the enforcement division drop those cases. Nevertheless, Goforth said the most likely path is to settle the cases on terms favorable to the defendants, removing them from the court's docket.

Goforth also noted that regardless of the SEC's stance, the Department of Justice can still take criminal action under securities laws. If there are disputed cases with plaintiffs, the courts can intervene without SEC approval, and even private parties who have lost money through staking could file class-action lawsuits against exchanges.

Goforth said the U.S. Securities and Exchange Commission can only determine which actions can be brought to court; its analysis is not binding on the courts, and it is ultimately up to the judges to decide what is legal.