Assuming the 4-year cycle continues, Bitcoin is expected to reach a new all-time high in the fourth quarter of 2025.

We always like to say "this time is different," but I would rather see the classic pattern: Bitcoin rallies, followed by Ethereum, SOL, and other large-cap coins, and then all the other coins (possibly especially meme coins) start to surge.

Until the market reaches the inflection point, we will enter another two-year cool-off period.

After a year of frenzied gains, we will be exhausted, and the two-year cooling-off period will be just right.

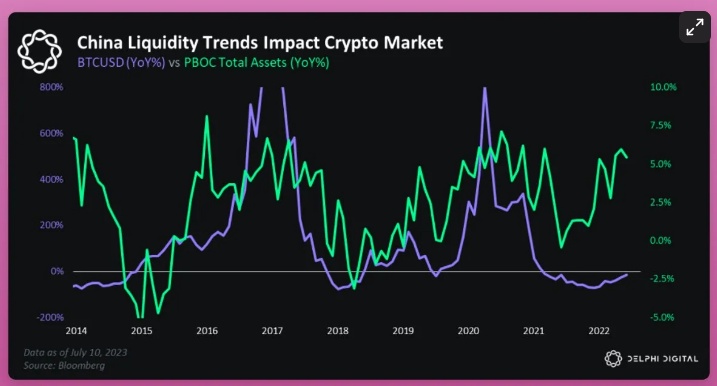

The Delphi research firm predicted the Q4 2025 peak as early as mid-2023.

This prediction is gradually being realized. The only difference is that the ETH approval is still absent, while Bitcoin has reached its previous all-time high as early as March due to the FOMO of the BTC ETF.

Respect to Delphi!

Everything seems to be progressing as planned, and if Trump wins the election, it could lead to more favorable cryptocurrency regulation, and we may see the final catalyst for an extremely crazy bull market.

This bullish sentiment contrasts sharply with the "slightly uncertain bullish" market state I shared in July. Now, there is no longer the pressure of Grayscale ETF redemptions, the fear of Mt. Gox selloffs, or election uncertainty, and global interest rates are also declining.

Delphi also predicts that China will start the printing press due to deflationary risks

In fact, China has launched the most aggressive stimulus policies since the pandemic, but many believe the efforts are still insufficient, demanding that China further print "useless fiat currency".

Historically, when China injects liquidity, it usually has a positive impact on the global economy and the cryptocurrency market.

On X platform, it seems that few people have noticed China's bullish attitude towards cryptocurrencies: not only printing money, but also potentially changing the restrictive cryptocurrency regulations.

Additionally, past Bitcoin halving events have always led to massive BTC rallies, but it usually takes about half a year for the full effect to manifest - the current situation is no different.

If everything goes as expected, this will be the most well-predicted and easiest-to-grasp bull market in history.

How bullish is the market?

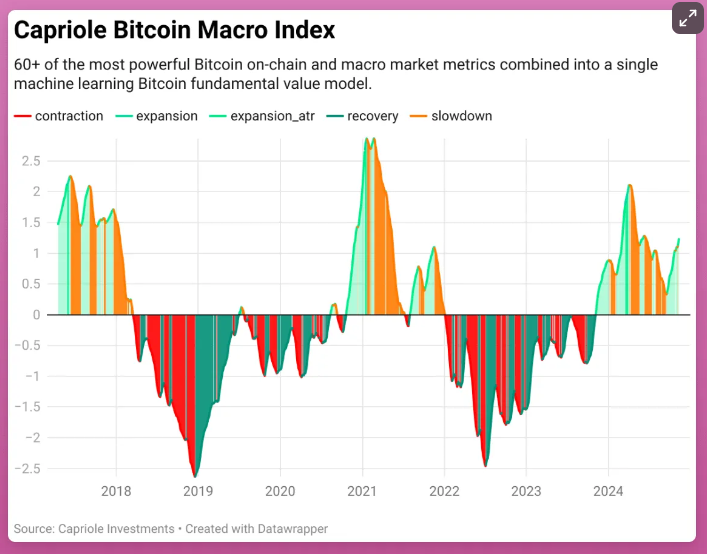

Research from Capriole Investments provides some insightful depth charts worth noting.

Their flagship Capriole Bitcoin Macro Index aggregates over 60 key Bitcoin-related metrics, including on-chain data (such as dormant flows, supply, hash ribbons, active addresses, etc.), macroeconomic indicators, and equity market indicators.

The index is divided into multiple stages. We are currently in the second expansion stage, but have not yet reached the March 2024 peak, and are far below the market peaks of 2017 and 2021.

Conclusion: Bullish.

Capriole's founder predicts that Bitcoin will reach at least $140,000 in Q4 2025. I directly asked him about his Ethereum outlook, and he believes "it will definitely reach $5,000, and possibly even higher."

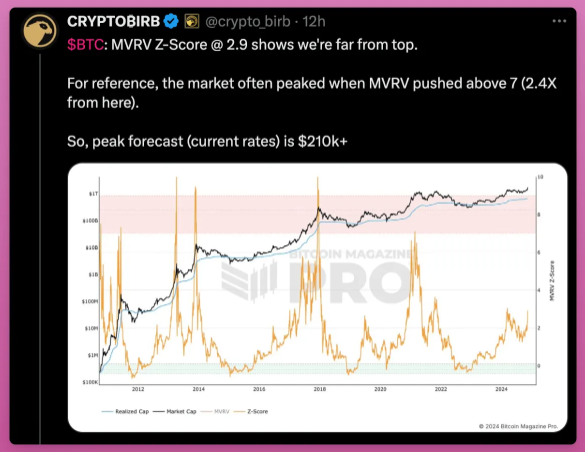

If this forecast is too low for you, and you believe in technical analysis, then the peak Bitcoin forecast is $210,000.

This chart uses the MVRV Z-score to show whether Bitcoin is overvalued or undervalued. Past peaks: when the Z-score reached above 7, Bitcoin reached its peak. Current level: the Z-score is now only 2.9, indicating we are far from the market peak. Forecast: if we reach the previous peak levels, Bitcoin could reach $210,000.

I hope the market pattern is the same as the last cycle, as I have heavy investments in SOL, ETH, and DeFi and meme coins.

When Bitcoin starts to rally, many will feel frustrated because their altcoins are not following Bitcoin's rise. Be patient, dear "degens". After Bitcoin rallies, the altcoins should catch up.

And altcoins still have a lot of room to grow.

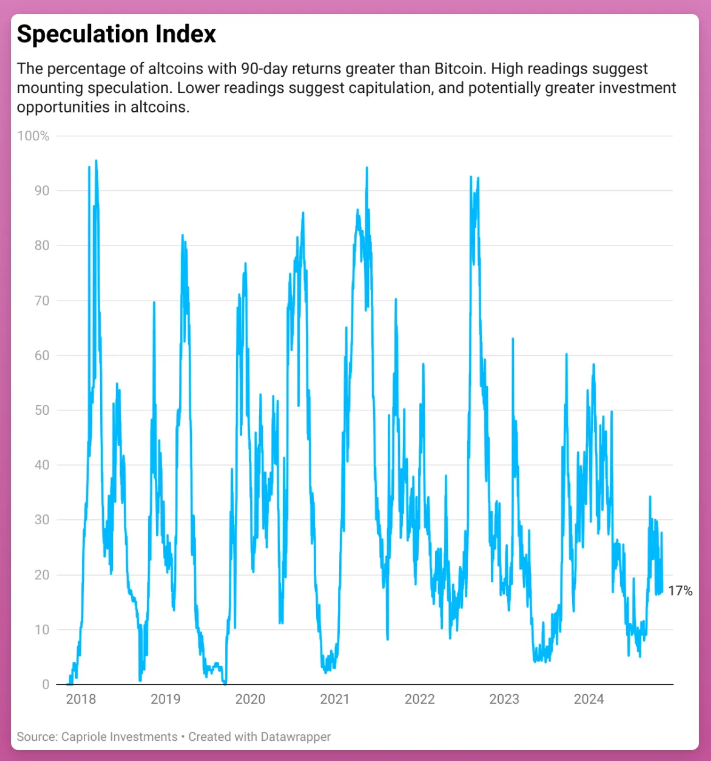

Also from Capriole Investments, the Altcoin Speculation Index shows that the altcoin rally has not yet begun. High percentages indicate speculative sentiment, while low percentages suggest capitulation and potentially better altcoin opportunities.

No matter how you look at it, things are too good to be true. This is concerning.

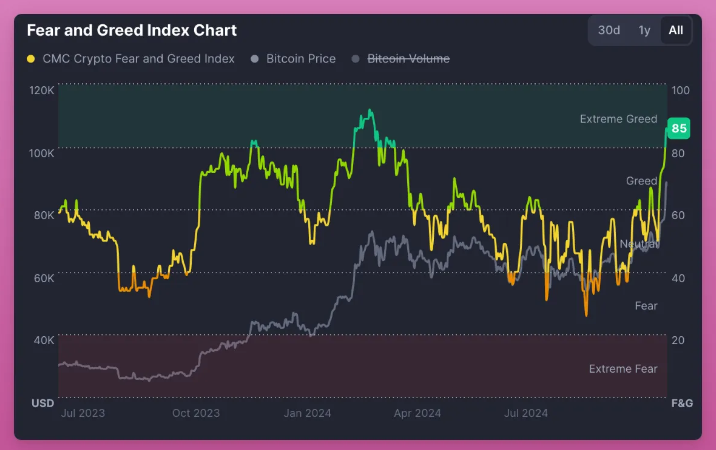

We have just entered the realm of extreme greed.

However, greed can last much longer. From November 2020 to March 2021, the Greed Index remained above 80 and had few pullbacks (source: Crypto Koryo).

Nonetheless, even if everything looks bullish, we still need a cooling-off period, so don't just rely on leverage to chase the rally. As Raoul Pal said...

Meme Coins

The other day, I read a Financial Times article titled "Bitcoin's Momentous Moment Cannot Be Ignored".

The comments from the general public were really interesting. You know the drill: Ponzi scheme, scam, "no utility" whatsoever, and so on.

These so-called smart people completely miss the point. Then I suddenly realized.

The crypto natives' rejection of meme coins is like the general public's rejection of Bitcoin: scam, no utility, no value, and so on.

Bitcoin is to the general public what meme coins are to the skeptical crypto natives. Yet, both have been persistently rising and cannot be ignored. Just look at the meme coin performance post-election. Major meme coins have doubled in value within 10 days.

Meme coins have crossed the Rubicon: Binance even listing meme coins is an important step in normalizing meme coins.

Just before listing a slew of meme coins, Binance published a research piece on meme coins, noting that retail investors are exploring new avenues for wealth creation, and meme coins embody principles of enhanced transparency and accessibility, "working to reduce internal advantages and increase global investor parity."

Meme coins reflect "broader shifts in how value and cultural significance intertwine in the modern financial landscape."

Binance needs to list assets that will go up, but low-float, high-FDV tokens often can't do that. This is why I expect to see more meme coins listed on Binance.

If you're still skeptical about meme coins, I have some recent outperformers that might reignite your confidence in cryptocurrencies.

DeSci

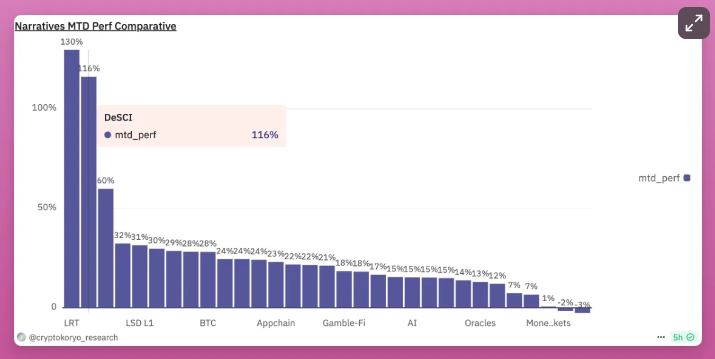

Decentralized Science (DeSci) tokens outperformed meme coins last month, with only LRT performing better (surprised?)

Meme Coin MTD Performance Ranked 3rd

DeSci aims to make scientific research more open, accessible, and transparent, giving researchers direct access to funding and data. The idea is to "empower patients, scientists, and investors to initiate, develop, and co-own new drugs and therapies outside of the traditional pharmaceutical industry."

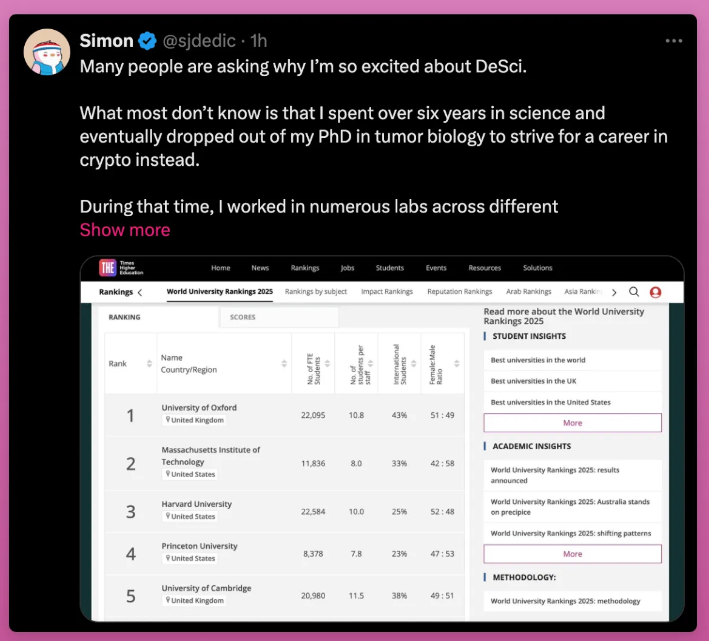

Take a look at why Simon is bullish on DeSci tweets.

In his years of scientific research experience, he has seen how funding pressures can lead to falsified research results, even at top institutions like Oxford. DeSci, through transparent funding management and peer review mechanisms, can prevent this and promote decentralized control of research.

If that's not enough to make you bullish, just last week, Binance invested in the Bio protocol (valuation and amount undisclosed), which should put DeSci on your radar.

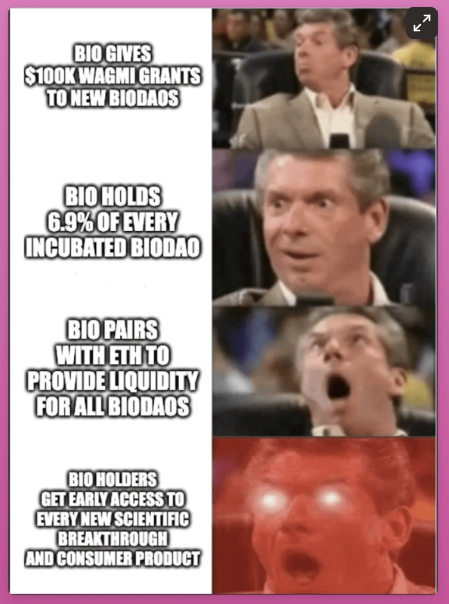

"BIO is an autonomous, community-owned scientific community launchpad - just like Pump Fun and Daos Fun for memecoins, BIO will make the curation, formation and funding of scientific communities fun, accessible and open."

Imagine Bio as the Y Combinator of the on-chain science space, with BioDaos providing funding, development and ownership for projects in areas like rare diseases, mental health, and longevity.

Some BioDAO tokens are already trading (and appreciating):

- VitaDAO: Funding and supporting early-stage longevity research. VITA has doubled in a week, currently at a $79M market cap.

- HairDAO: A nation-state for solving hair loss. HAIR currently has a $100M market cap.

I actually invested in Bio's public sale. Token economics are fascinating, but we can simplify it with a meme:

Overall, if memecoins have let you down, DeSci is your redemption trade. As crypto is the best tool to fund communities, I hope DeSci can grow and help crypto have real-world impact.

Solana vs Ethereum

Oh my dear ETH, when will you take off? Watching memecoins soar, my bags are getting heavier. FOMO tempts me to shift to stronger investments, but I cling on - hoping I'm not wrong.

In this crypto cycle, if ETH and the entire Ethereum ecosystem fail to see a bull run, that will be the biggest wealth generation opportunity missed.

Because the capital required to drive a $382B market cap ETH, legacy DeFi, and the new low-float, high FDV tokens, may be better suited to flow into multiple new frontiers this cycle: DeSci, Runes, Solana DeFi, other L1s, and memecoins.

Last cycle, Ethereum and DeFi players got rich. They all hope to 3-5x again to retire. Maybe this time we don't give them that chance? Make them grind for longer.

The capital needed to 3x ETH could 10x other ecosystems bringing new ideas.

This is very plausible.

Justin Drake's recent ETH 3.0 (Beam Chain) roadmap failed to excite the community. More importantly, it's slated for late 2020s, completely missing this cycle.

Meanwhile, Solana has been performing strongly.

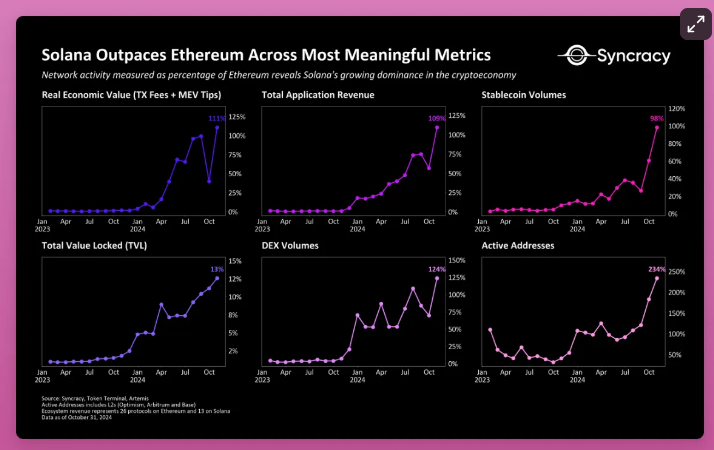

Syncracy's recent research clearly compares the competitive dynamics between Ethereum and Solana.

Last cycle, Solana's story was future potential, this time it's momentum driven by fundamentals.

Just look at the network activity metrics compared to ETH. Notable are: TVL growth, DEX and stablecoin volumes, and active addresses.

To be fair, comparing Solana to ETH L1 is somewhat unfair, as Ethereum's L2s should also be considered. But since L2s are still seen as parasitic to Ethereum, their value remains unclear in the retail investor mindset.

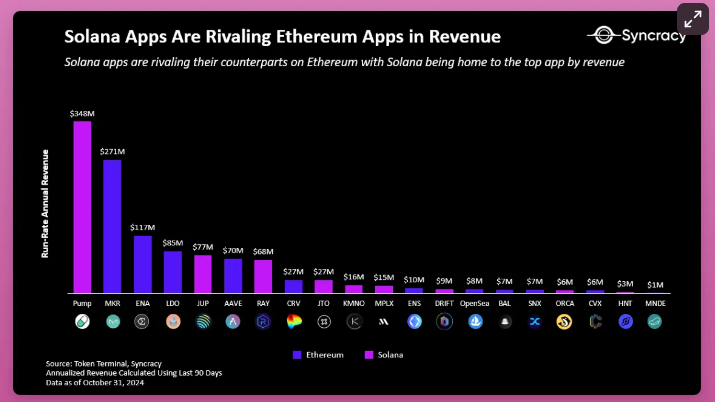

Even looking at dApp revenue levels, Solana's dapps can now rival Ethereum's.

Yet, Solana's market cap is only 33% of Ethereum's, despite the strong economic metrics, suggesting Solana still has room to grow and potentially converge towards Ethereum's market cap.

Is SOL truly flipping ETH? I believe when this narrative gets stronger, it may be a good time to rotate back into ETH.

Ethereum flipping Bitcoin (ETH flipping BTC) has always been the best signal for ETH/BTC market tops.