Source: Liu Jie Chain

After several days of a wild surge, BTC has finally successfully retested the 5-day moving average, driving away those who had set stop-losses along the 5-day line, and is currently hovering around 88k. This is very good, as it pours a bucket of cold water on the overheated market and cools it down. Whenever BTC heats up the market, the chickens and dogs start to soar, and countless meme coin holders emerge overnight, bragging about earning A8 or A9, and they would be embarrassed to even show off earning A7. The exchanges also disregard their integrity, hyping up anything that's hot, and they are even the ones stoking the fire, using news hotspots to create dreams of getting rich overnight, luring the shrimps to dump their BTC and speculate on meme coins, and then trapping them in a net, catching them all.

Some people claim with certainty that this wave of breakthroughs to new highs is due to several countries quietly purchasing BTC. They will soon announce the establishment of a BTC national reserve. The intention is obvious - to get ahead, to grab a position before the US establishes a BTC national reserve.

Michael Saylor, the founder of MicroStrategy, the super diamond-handed, said that the US should accumulate at least 4 million BTC to establish a BTC national reserve, following the Trump maximization principle.

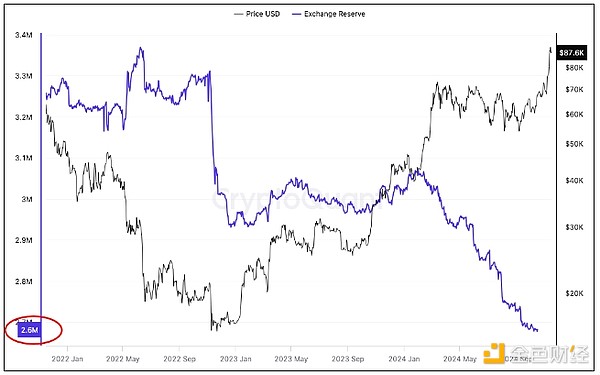

The Chain Education was shocked to hear this and quickly checked the BTC reserve data of all the crypto exchanges in the world, and it turned out to be far from 4 million BTC! Guess how much? Only 2.6 million BTC!

Wow. If the old diamond hands are unwilling to sell, the US would have to empty out all the BTC in all the crypto exchanges in the world, and still not be able to gather 4 million BTC.

This is simply a blatant game of poker.

Guess if I know someone wants to buy, and there's not that much supply in the market, am I more willing to sell to them or less willing to sell to them?

Definitely reluctant to sell.

This is a seller's market, waiting for the right price. Let's see how high a price you can offer. I'm in no hurry to sell.

Soon, the whole world will realize the wonders of BTC.

The Chain Education uses "wonders" rather than "benefits". "Benefits" is a subjective judgment, while "wonders" are objective characteristics.

After a deeper understanding of BTC, you will realize that BTC is not a typical commodity or ordinary good that is priced based on the supply-demand relationship.

Ordinary goods follow the basic economic laws: increase supply, price goes down; decrease supply, price goes up. Increase demand, price goes up; decrease demand, price goes down. Conversely, a decrease in price will suppress supply and increase demand; an increase in price will stimulate supply and suppress demand.

Fundamentally, the use value of these goods remains unchanged. A loaf of bread can satisfy the hunger regardless of whether its price is $1 or $10.

But there are also some goods that do not follow this rule, but exhibit a so-called reflexive or self-referential phenomenon. That is, the higher the price, the greater the demand, which will further drive up the price, forming a positive feedback loop; when the price collapses, there will also be a cycle where the lower the price, the lower the demand, and the price will further collapse.

Housing prices and stock prices, although constrained by the supply-demand relationship at the fundamental level of providing rents and dividends, are largely driven by the self-referential effect of market speculation due to their financialization, rather than the response to the supply-demand relationship.

If we remove the fundamentals, we get the purest commodity driven solely by the self-referential effect of market speculation - meme coins.

Worse than meme coins are the listed company stocks that pretend to have fundamentals but have actually been hollowed out by major shareholders. Meme coins are just a game of gambling, while junk stocks are carefully packaged fraud.

Why are the shrimps this round willing to speculate on meme coins rather than touching the altcoins and VC coins with large holdings by project parties and VCs? Because VC coins are the junk stocks of the crypto world - with large holdings by project parties and VCs, that's a blatantly raised sickle, "the overlord's whip is high overhead".

Even the dumbest and most foolish shrimps, after being harvested once in 2017-2018, and again in 2021-2022, should have learned to be a little smarter, right? Are they going to be harvested again in 2025-2026? So the shrimps either just quietly hold BTC, or they'd rather PVP in the meme coins, but they don't want to prop up the stinky feet of the project parties and VCs anymore.

But BTC is different from all the above commodities. It is actually quite unique. (Chain Education note: There are some other unique commodity categories in economics, such as Giffen goods, Veblen goods (conspicuous consumption goods), etc., but this article is limited in scope and will not go into further discussion.)

First, BTC cannot be used to directly satisfy people's physiological needs or production needs, i.e. it lacks utility. It can't be eaten as food, nor can it be lived in as a house, and it doesn't even have some industrial uses like gold and other precious metals.

Many economists see this as BTC's biggest flaw.

But Chain Education says this is BTC's advantage. The lack of utility frees BTC from the market price constraints of ordinary commodities subject to supply-demand relationships.

Secondly, BTC is not an income-generating asset, nor can it meet people's financial needs, i.e. it lacks the so-called productivity. Productivity, especially the productivity of financial products, is also known as exploitativeness - getting something for nothing, simply put, lying down and making money.

Buffett and other true financial capitalists understand this well, so their main criticism of BTC is this point.

But Chain Education believes that the so-called fundamentals and valuation models of productive financial assets are actually a double-edged sword. The fundamentals provide support for asset prices, but also constrain the volatility of asset prices - prices are always drawn back to the so-called value given by the valuation model.

Housing prices cannot escape the constraint of the rent-to-sales ratio. Stock prices cannot escape the constraint of the P/E ratio. The lack of fundamentals allows BTC to escape the market price constraints of general financial assets subject to valuation models.

Finally, BTC is not a purely reflexive asset either. The price movement of purely reflexive assets like meme coins is simply a Ponzi scheme. But the price movement of BTC is not a pure Ponzi scheme, but a process of value discovery. This is the fundamental reason why meme coins will go to zero, while BTC can always "collapse again" to a higher level.

Many retail investors cannot distinguish the difference between meme coins and BTC. They fantasize that meme coins will last like BTC. This fantasy will definitely be shattered.

Chain Education says that the higher the price of BTC, the greater its use value as a store of value and value transfer tool, and the greater use value will support an even higher price of BTC, forming a positive feedback loop.

Why?

Because BTC's positive feedback loop is not a simple "price-price" loop of reflexivity, but a "price-value-price" loop. Fundamentally, it is based on Proof-of-Work (PoW), on computing power.

Higher prices drive more computing power deployment; more computing power brings higher security; higher security enhances the value of BTC as a safe store of value and safe transfer of value; higher value supports even higher prices of BTC.

This is a process of value construction and value discovery in an upward spiral.

Soon, the whole world will realize the wonders of BTC.

The "whole world" that Chain Education refers to is not just retail investors and companies, but sovereign states.

As is well known, in 1944, on the eve of the end of World War II, the US brought together many countries around the world to plan the post-war order and established the Bretton Woods system with the US dollar as the global currency base.

The US promised that $35 would be pegged to 1 ounce of gold. Countries no longer needed to move gold back and forth for trade, which was slow and expensive. Everyone stored their gold in the US and used the US dollar for business, which was convenient and easy to use.

However, the United States has defaulted. It could not resist the temptation to secretly print more US dollars, printing far more than the amount of gold. Particularly in the 1960s, the United States was deeply mired in the Vietnam War, with soaring fiscal deficits. The US dollar had become very difficult to maintain its peg to gold.

The then French President Charles de Gaulle was very dissatisfied with the United States' secret printing of more US dollars. In 1965, de Gaulle instructed that France's foreign exchange reserves would no longer hold US dollars, but would directly demand that the United States exchange them for gold. De Gaulle sent warships to bring the gold stored in New York back to France.

"On August 15, 1971, the 37th President of the United States, Richard Nixon, unilaterally announced the suspension of the convertibility of the US dollar into gold, known as the 'Nixon Shock'"-The History of Bitcoin, Chapter 42

However, not all countries have the status and strength of France as a permanent member of the UN Security Council, and not all presidents have the skill and ability of de Gaulle.

In 2012, Argentina's economic situation was unstable, with exacerbated inflation and a shortage of foreign exchange reserves. In order to enhance the country's financial sovereignty and reduce its dependence on the Western financial system, the Argentine government decided to repatriate its gold reserves stored abroad.

Most of Argentina's gold reserves were stored in vaults in London, England, and Argentina's relations with the UK were tense (especially over the Falkland Islands dispute). When Argentina requested to repatriate its gold, it encountered complex international pressure and resistance.

To make matters worse, the large-scale repatriation of gold required complex logistics and security measures, involving high costs, transportation safety, and international insurance arrangements.

Ultimately, despite Argentina's insistence on repatriating the gold, the plan could not be smoothly implemented due to various obstructions, and most of the gold reserves remained stored in the UK.

Imagine if Argentina's national reserves were not gold but BTC, would it still need to put its testicles in someone else's hands to be bullied and humiliated?

For major powers with strategic nuclear missiles, there is naturally no need to worry about using any assets as national reserves, because holding the truth (military force) can always persuade people.

But for the hundreds of large and small countries outside the five permanent members, how can they achieve financial autonomy and defend national dignity?

They will soon realize the benefits of BTC as a national reserve.