Introduction

In the turbulent cryptocurrency market, the price of Bitcoin has always been the focus of investors. In 2024, Bitcoin broke through the historical high again, surpassing the $886,000 mark, attracting the attention of global investors. Behind this wave of rise, it is not only the technical factors or short-term speculation of the market, but also the joint drive of the strong demand in the spot market and the policy expectations after the US presidential election. With more and more institutional funds flowing in, the direction of the cryptocurrency market has become clearer, especially against the background of policy changes after the US election. This article will delve into the key factors driving the soaring Bitcoin price, analyze how the demand in the spot market dominates this upward trend, and how the policy changes after the US election further intensify the market's optimism. Through a comprehensive analysis of the spot market, futures market and the flow of institutional funds, we try to reveal the deep-seated reasons behind Bitcoin's historical high and make predictions about the future market trend.

Bitcoin Price Hits New High: Strong Demand in the Spot Market

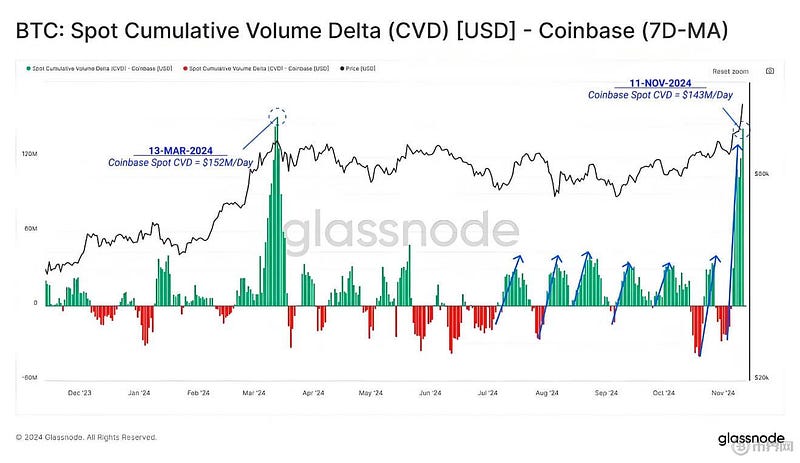

The rapid rise in Bitcoin price is not accidental, but driven by the strong demand in the spot market. The spot market is the core part of cryptocurrency trading, where buyers and sellers directly trade Bitcoin. Recently, the trading volume in the spot market of Coinbase, one of the largest cryptocurrency exchanges in the US, has shown significant growth. According to the data, Coinbase's daily cumulative trading volume (CVD) has recently reached $143 million, close to the previous high of $152 million on March 13. This indicates that the buying pressure on Bitcoin has risen sharply, and investors' interest in Bitcoin remains strong, driving the continuous increase in market demand.

As the price of Bitcoin continues to rise, investors are more inclined to choose spot trading rather than leveraged trading. This surge in spot trading reflects the market's optimistic expectations about the future value of Bitcoin. Especially in the traditional financial market, institutional investors are also increasingly inclined to invest through products such as the US Bitcoin spot ETF, rather than leveraged trading in the futures market. This trend of spot investment indicates that the market is more focused on the actual holding of Bitcoin, rather than just speculating through the derivatives market.

Latest Bitcoin BTC Price Trend

US Election and Capital Inflow into the Bitcoin Market

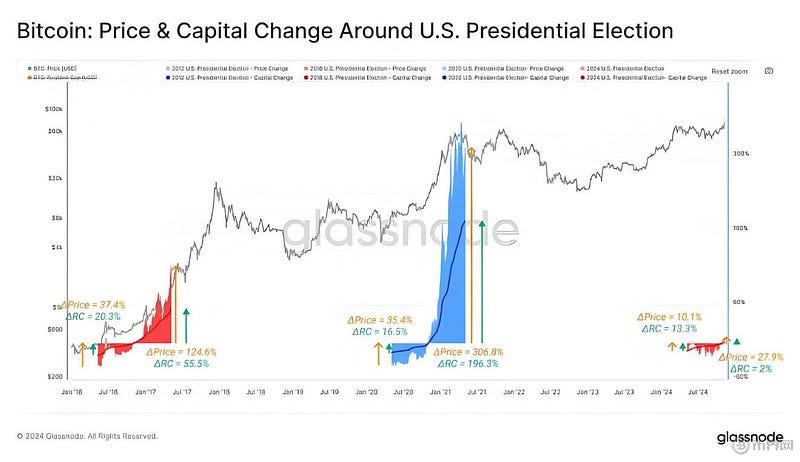

The impact of the US presidential election on the Bitcoin market cannot be ignored. Historically, the market has experienced violent fluctuations after each US presidential election, especially during the Trump administration. After the 2024 US presidential election, the market generally believes that the Republican Party may adopt a more friendly cryptocurrency policy, which has brought great confidence to the Bitcoin market. The Trump administration may implement a more relaxed cryptocurrency regulatory policy, injecting more capital inflows into the market.

After the election results were announced, the price of Bitcoin experienced a significant increase. According to historical data, after the 2020 election, the price of Bitcoin rose by 306.8%, while after the 2016 election, it experienced a 124.6% increase. After the 2024 election, the price of Bitcoin rose by 27.9%. Although the magnitude of this increase is somewhat slower compared to the post-election trends in the past, it still shows an extremely strong upward momentum, indicating that the market is optimistic about the future cryptocurrency policy.

2016 Election (Republican Government):

- Before the election, actual capital surged by 20.3%, and then increased by 55.5% after the election.

- The price increased by 34.7% before the election, and then soared by 124.6% in the following months.

2020 Election (Democratic Government):

- Before the election, actual capital inflow grew by 16.5%, and then increased by 196.3% after the election.

- The price increased by 35.4% before the election, and then skyrocketed by 306.8% after the election.

2024 Election (Republican Government to date):

- Before the election, actual capital increased by 13.3%, but then increased by only 2% after the election.

- Before the election, the price increased by 10.1%, and has increased by 27.9% (so far) after the election.

Therefore, the current cycle reflects a relatively moderate reaction compared to the previous elections, although it is still very optimistic. The market is currently adapting to the potential changes in cryptocurrency policy that may occur in the coming years.

The market's response after the election also shows that investors are confident in the relaxed policies that the Trump administration may implement. The increase in Bitcoin's price and the acceleration of market capital inflows demonstrate investors' optimism about the future of cryptocurrencies, especially in the fintech sector. As the US cryptocurrency policy gradually relaxes, more institutional capital will flow into the market, further driving up the price of Bitcoin.

The Interplay of Spot and Futures Markets: Driving the Bitcoin Surge

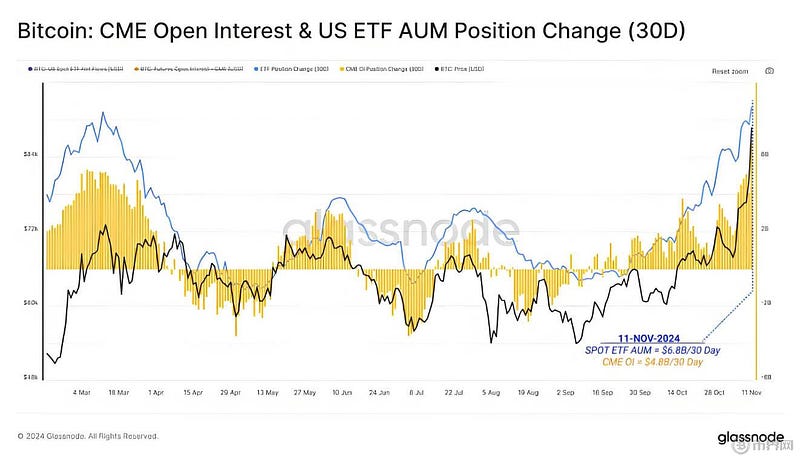

The skyrocketing Bitcoin price is not solely driven by the demand in the spot market, as the performance of the perpetual futures market has also played a crucial role. The perpetual futures market typically has a high leverage effect and is a common trading tool for cryptocurrency investors. However, compared to the past, the current upward trend is clearly more dependent on the demand in the spot market. Although the perpetual futures market also shows strong speculative demand, with the recent peak in market premium reaching $1.59 million per hour, which is much higher than the peak in mid-March, it is still lower than the historical level. This indicates that the current rise in Bitcoin price is more driven by the spot market rather than leveraged trading.

According to data from CME (Chicago Mercantile Exchange), the increase in open interest in futures contracts has also contributed to the rise in Bitcoin prices to a certain extent. However, the inflow of funds into the US spot ETF far exceeds the increase in open interest in futures contracts, indicating that investors' preference for spot investment is on the rise. Over the past 30 days, the assets under management have increased by $6.8 billion, while the increase in CME's open interest contracts was only $7.6 billion during the same period. This further demonstrates that the demand in the ETF market far exceeds that of the futures market, further confirming the dominant position of spot investment.

Bitcoin's Price Discovery Phase and Market Sentiment

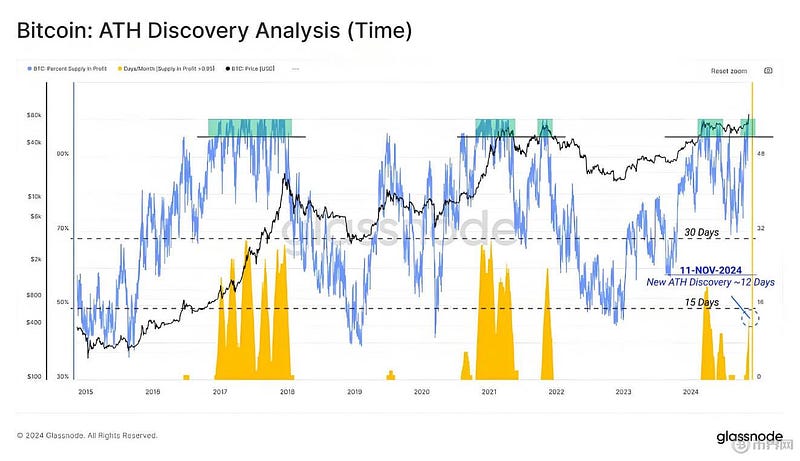

In 2024, Bitcoin has entered a new price discovery phase, which means that all the circulating Bitcoin supply has turned into a profitable state. Data shows that currently more than 95% of the Bitcoin supply is in a profitable state, which is a relatively rare phenomenon in Bitcoin's history. Typically, this high-profit market phase lasts about 22 days, after which a certain adjustment may occur.

In the new price discovery phase, the market sentiment for Bitcoin has significantly improved. When new investors enter the market, they usually buy Bitcoin at a relatively high price, causing the price to frequently approach the statistical upper limit and test the upper limit price multiple times. Recently, the price of Bitcoin has approached the upper limit of $94,900, while the current price is $88,000. Due to the still strong market demand, Bitcoin may continue to rise in the short term, and even break through the upper limit to set a new high.

Although there is some profit-taking activity in the market, the current profit level is still lower than the historical high. This indicates that despite some selling pressure, market participants remain optimistic about Bitcoin's long-term prospects, and many investors are willing to hold and wait for higher prices. The recently accumulated realized profits are about $20.4 billion, far lower than the peak values in the previous ATH cycles. This means that although there may be some adjustments in the short term, there is still significant upside potential.

Forecast of the Future Development of the Bitcoin Market

Currently, Bitcoin has entered a new cycle, in which the spot market demand dominates, and the role of the futures market is relatively small. With the gradual relaxation of the US cryptocurrency regulatory policy and the continuous inflow of institutional funds, the price of Bitcoin may continue to rise in the future, breaking through more historical highs.

In addition, although there is a certain profit withdrawal in the market, the current market demand is still strong. With the entry of new investors and the continued influx of long-term holders' capital into the market, the price of Bitcoin is likely to usher in a new round of upward trend. Especially against the background of the Trump administration's possible implementation of a more relaxed cryptocurrency policy, the prospects of the cryptocurrency market appear increasingly optimistic.

In the long run, Bitcoin still has huge investment potential. As the uncertainty of the global economy increases, investors' demand for digital assets will continue to grow. As a decentralized digital currency, Bitcoin's unique value attributes make it an important part of investors' asset allocation. In the future, Bitcoin is expected to continue to occupy a place in the global market and may become an important asset class outside the traditional financial system.

Conclusion

The strong demand in the spot market and the policy expectations after the US election are the main driving factors behind Bitcoin's new historical high. Through in-depth analysis of the spot market and the futures market, we found that the current rise of Bitcoin is mainly driven by the spot market, and the inflow of institutional funds has further consolidated this upward trend. Although there is a certain profit-taking activity in the short term, the market sentiment remains optimistic, and it is expected that Bitcoin still has room for further upward movement. With the relaxation of cryptocurrency regulatory policies and the continued inflow of institutional funds, Bitcoin's future performance is worth close attention for investors.