A quick overview of important events this week (11/10-11/16)

- Bitcoin News : Ball warned that " there is no rush to cut interest rates ." The price of Bitcoin once fell back to $86,600, and its market value surpassed that of silver , becoming the world's 8th largest asset.

- The meme sector is very popular : the Memecoins track has an average increase of 60% this week, significantly ahead of other tracks.

- The progress of the Federal Reserve's interest rate cuts : Soros's comrades said that it is too early to declare victory over inflation , and inflation may resurgence.

- Market buzz : Upbit’s cryptocurrency trading volume surpasses the South Korean stock market ; Glassnode reports that Bitcoin has entered the “ euphoria phase .”

- Financial Supervisory Commission: The Virtual Asset Service Provider (VASP) registration system will be launched by the end of the year.

- Arthur Hayes : Predicts Bitcoin to rise to $1 million due to unlimited quantitative easing (QE) policy.

- 18 states in the United States jointly sued the SEC : unconstitutionally exceeding their powers and unfairly cracking down on the cryptocurrency industry.

- Trump appoints Musk to lead the Department of Government Efficiency DOGE : Musk’s resurgence has sparked a craze for related meme coins.

Changes in trading market data this week

Sentiments and Sectors

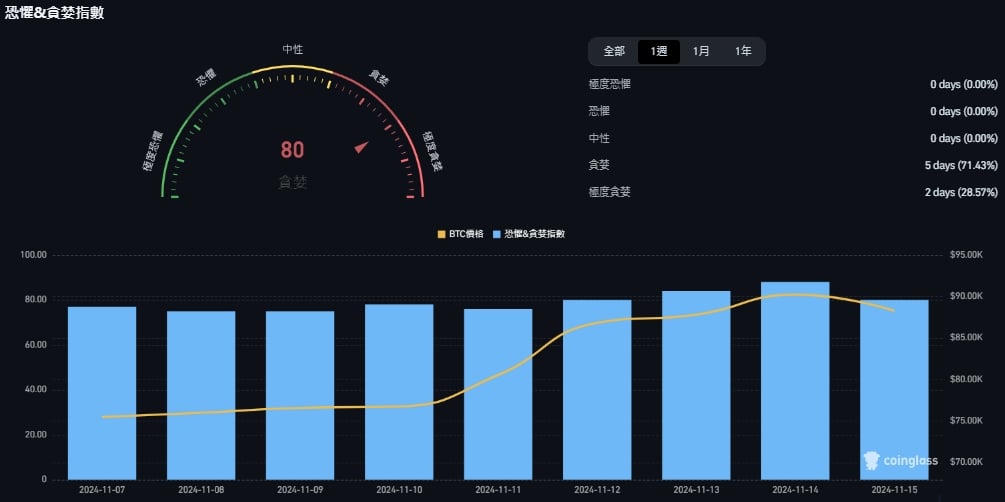

1. Fear and Greed Index

This week's market sentiment indicator rose from 75 (greed) to 88 (extreme greed), and the whole week was in the range of (greed) and (extreme greed).

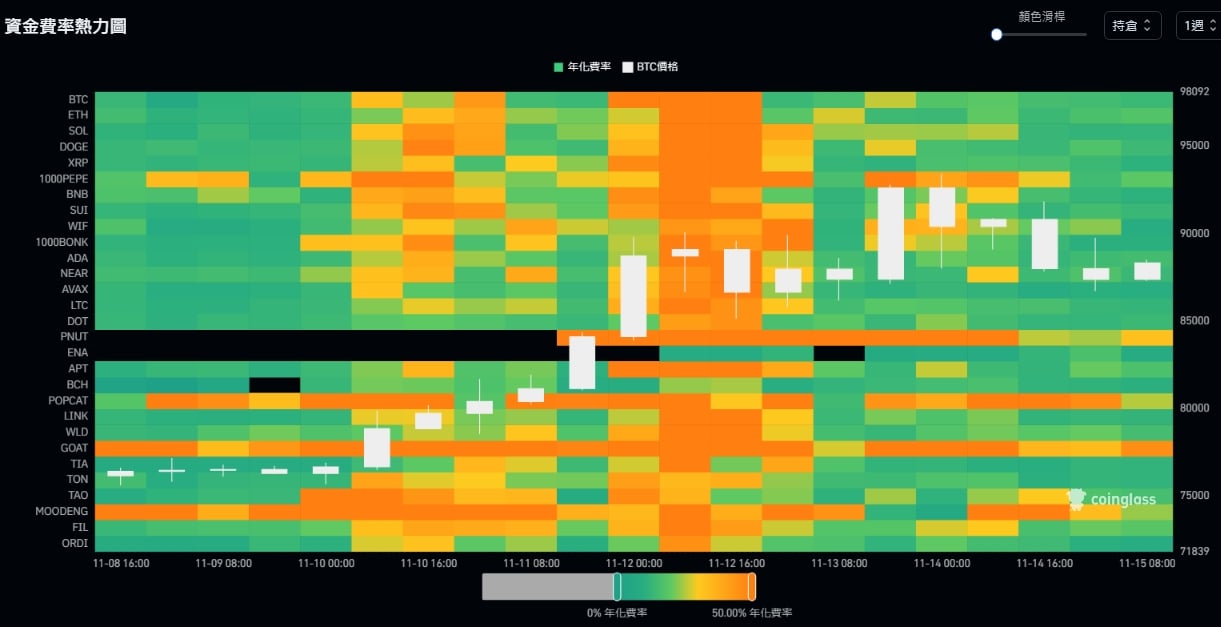

2. Funding rate heat map

This week, the Bitcoin funding rate reached a maximum of 58.59% and a minimum of 6.13% , indicating that the bullish sentiment continues to be strong.

The funding rate heat map shows the changing trend of funding rates for different cryptocurrencies. The color ranges from green with zero rate to yellow with 50% positive rate. Black represents negative rate; the white K-line chart shows the price fluctuation of Bitcoin. , in contrast to the funding rate.

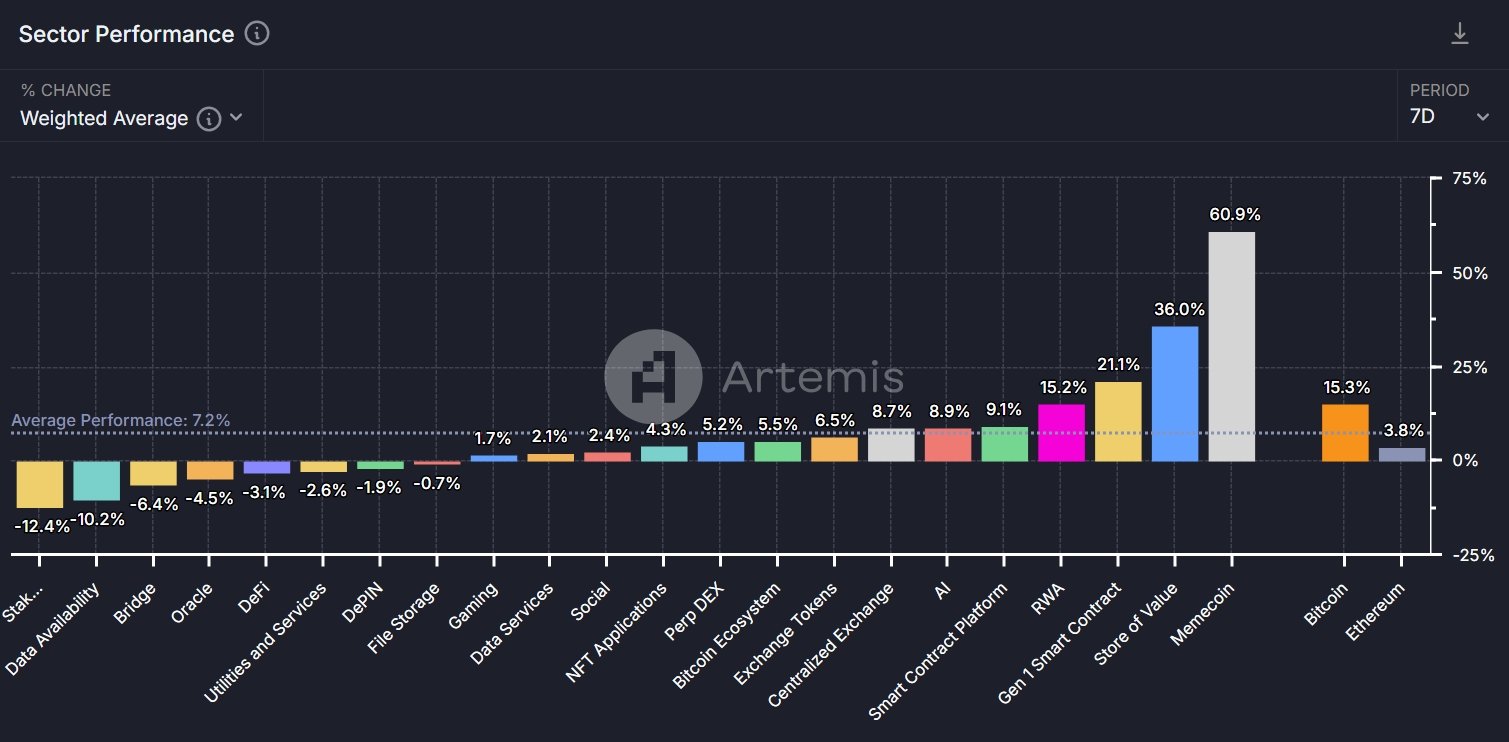

3. Sector performance

According to Artemis data, the average increase in the blockchain sector this week was (7.2 %) , with MemeCoin , Store of Value, and Gen 1 smart contracts occupying the top three respectively (60.9%, 36.0%, and 21.1%) .

This week’s gains for Bitcoin and Ethereum were (15.3 %, 3.8%) .

The three worst performing areas are: Staking (-12.4%), Data Availability (-10.2%) and Bridge (-6.4%) .

market liquidity

1. Total cryptocurrency market capitalization and stablecoin supply

Data on the total market value of cryptocurrency this week showed that it rose from US$2.68 trillion to US$3.06 trillion , an increase of US$380 billion, and the total market value increased by approximately 14.2%. BTC’s market share is 55.42%, and ETH’s market share is 12.21%.

The total stablecoin supply, an important indicator of market health and liquidity, increased this week from $167.81 billion to $177.14 billion , an increase of $9.33 billion, an increase of approximately 5.6%.

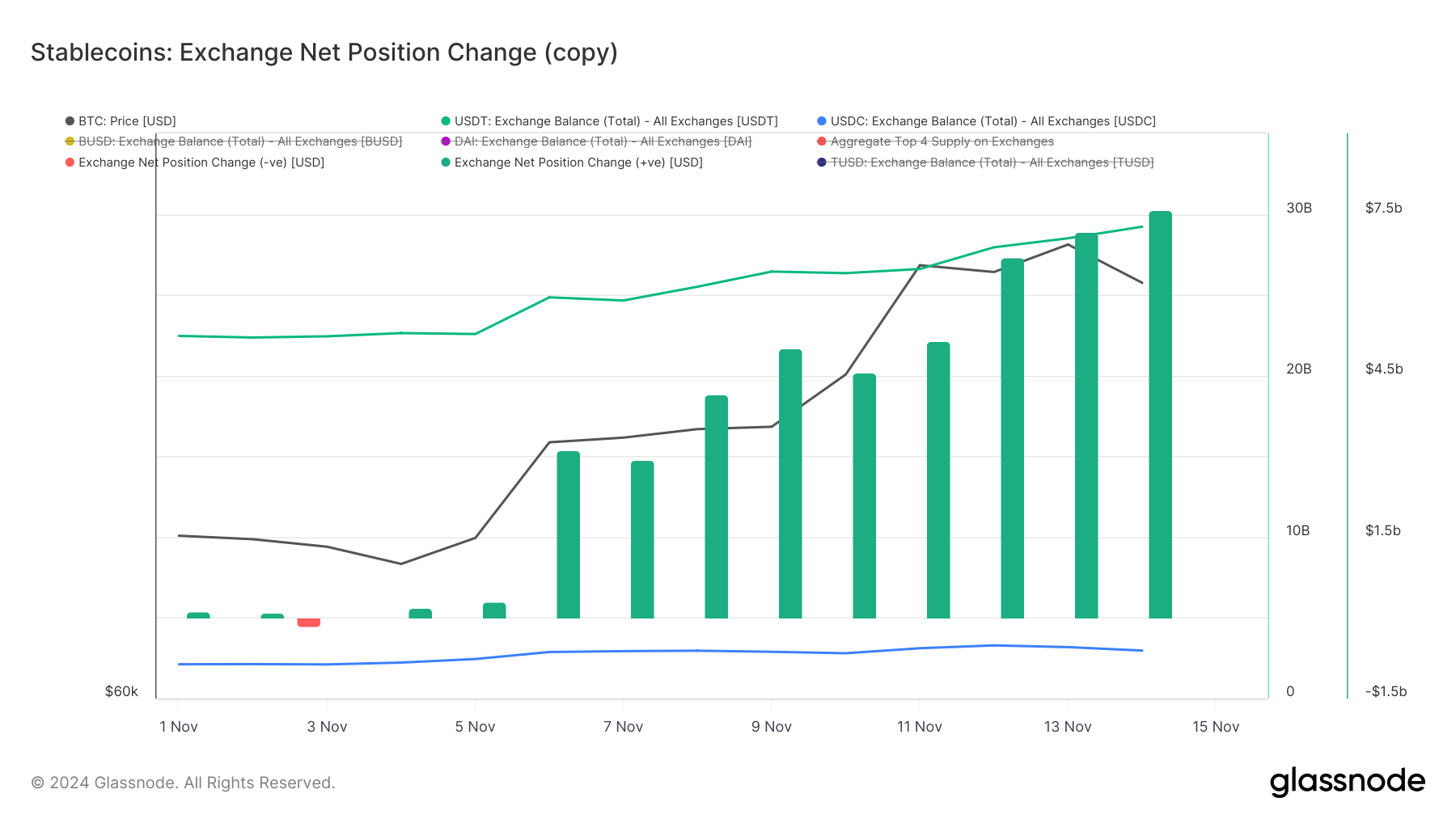

2. The potential purchasing power within the exchange has increased significantly

Data shows that exchange assets showed a net inflow trend this week, especially the large inflow of USDT after the US election. This phenomenon may be investors preparing for upcoming market fluctuations, and the inflow of funds into exchanges may mean increased buying demand in the short term.

In addition, the highest single-day net inflow of funds reached US$7.5 billion , surpassing the highest single-day net inflow of US$6.7 billion in the last bull market, indicating ample market liquidity.

3. Increase in the top 100 companies by market capitalization

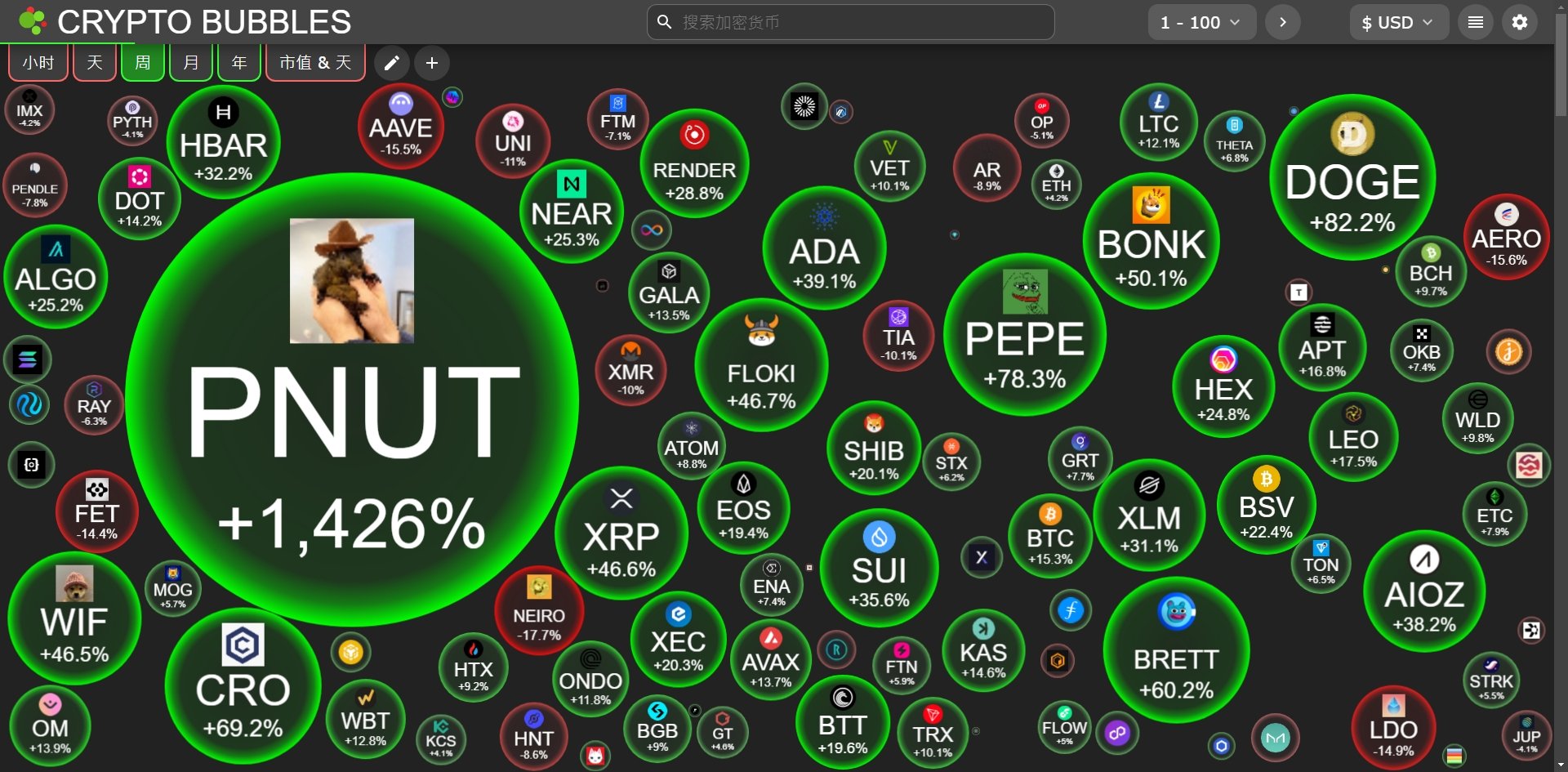

The crypto market has risen strongly this week, with PNUT leading a gain of +1,426%, DOGE, PEPE, etc. also rising sharply, showing that investors' risk appetite has increased and a large number of MEME coins have risen. According to Blockchaincenter data, the current Altcoin seasonal index is 27 , indicating that the market is still dominated by Bitcoin and the popularity of Altcoin is relatively low.

Bitcoin Technical Indicators

1. Bitcoin spot ETF saw a large net inflow of funds

Bitcoin ETF inflows this week were $2.3215 billion, with net inflows nearly double last week. On November 11, single-day inflows hit the second highest record in history, reaching US$1.12 billion.

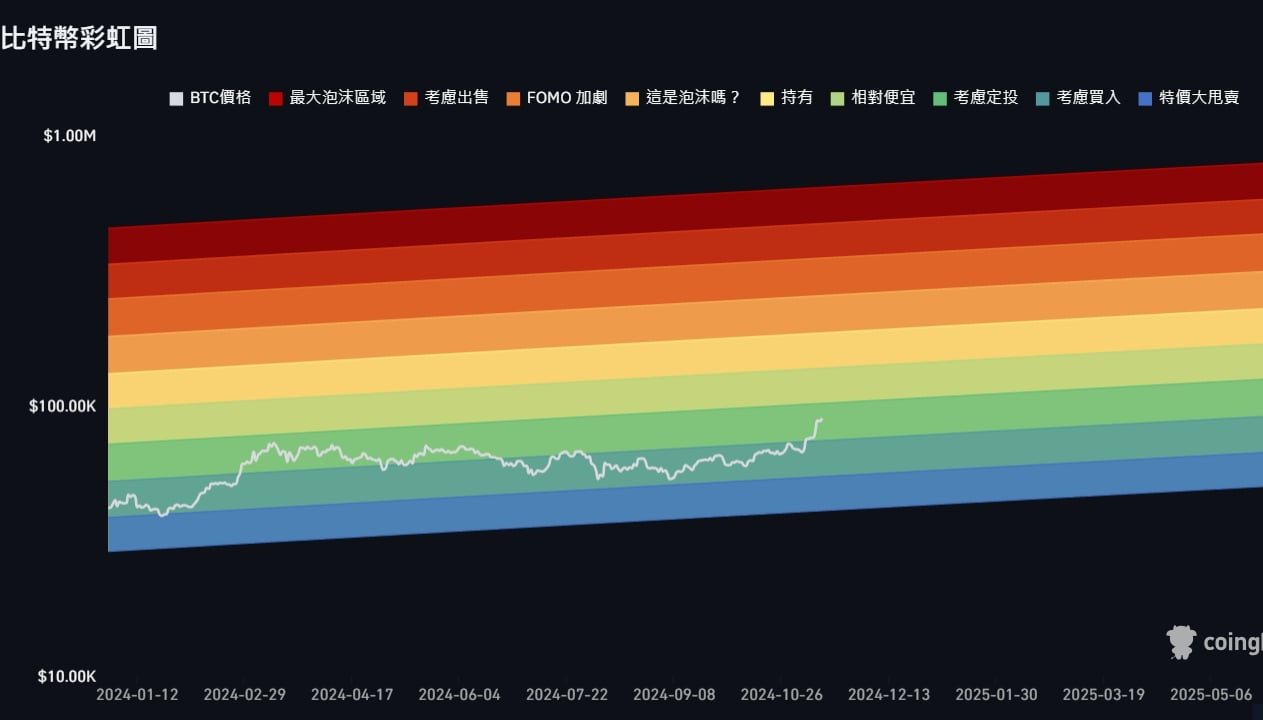

2. Bitcoin Rainbow Chart

The Bitcoin rainbow chart shows that the current price of Bitcoin ( $87,000 ) is in the " consider fixed investment " range.

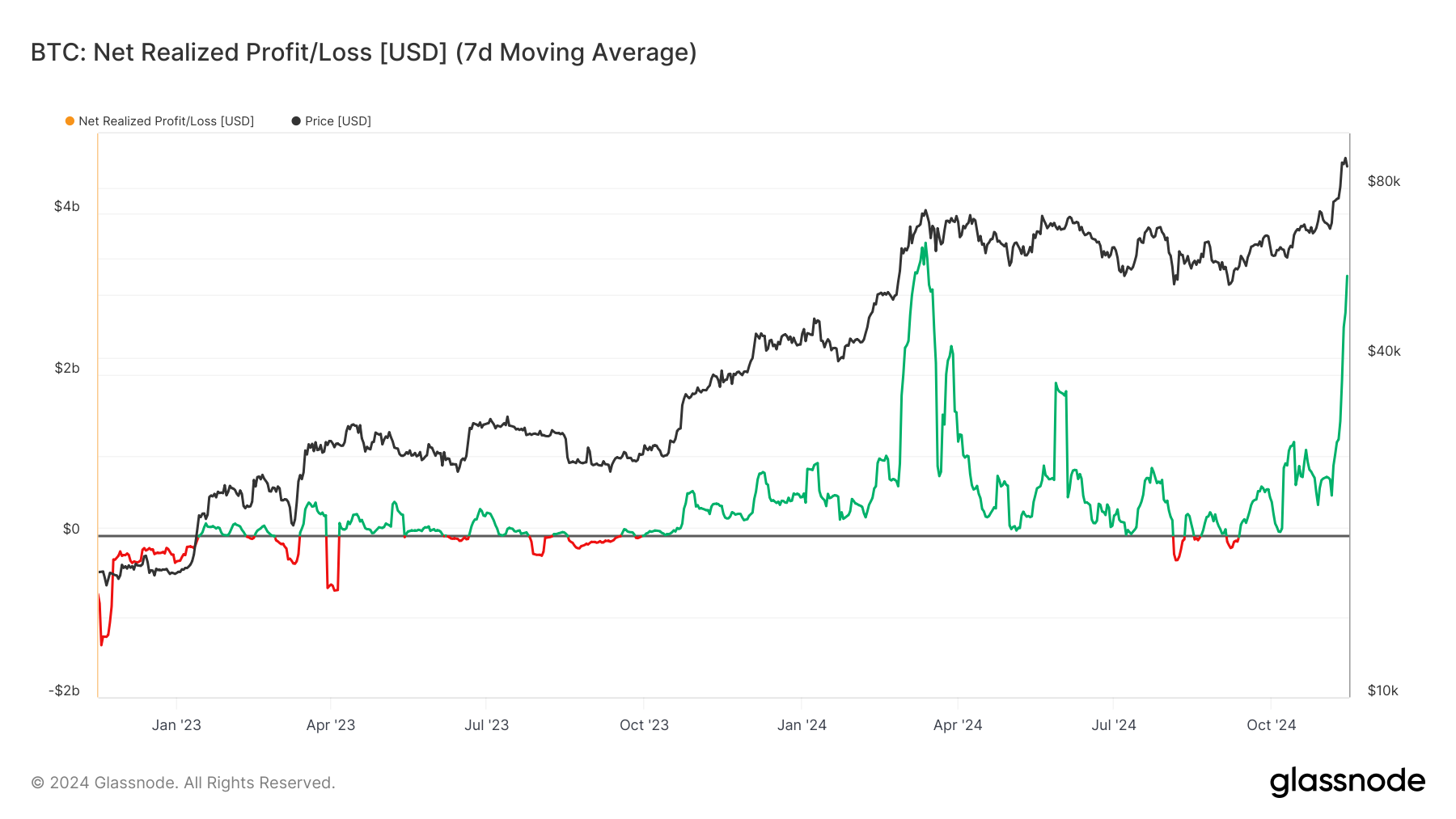

3. Bitcoin net profit and loss performance

Bitcoin's realized net profit and loss indicator shows that the market is currently recovering, and the proportional structure of profits and losses is similar to the situation in early March this year , when the price of Bitcoin reached a high in mid-March. The increase in this indicator reflects the increase in profits realized by investors and the turn to positive market sentiment, which may indicate that prices may rise further in the future. However, be wary of the risk of a potential pullback, especially profit-taking in the market after a rapid rise.

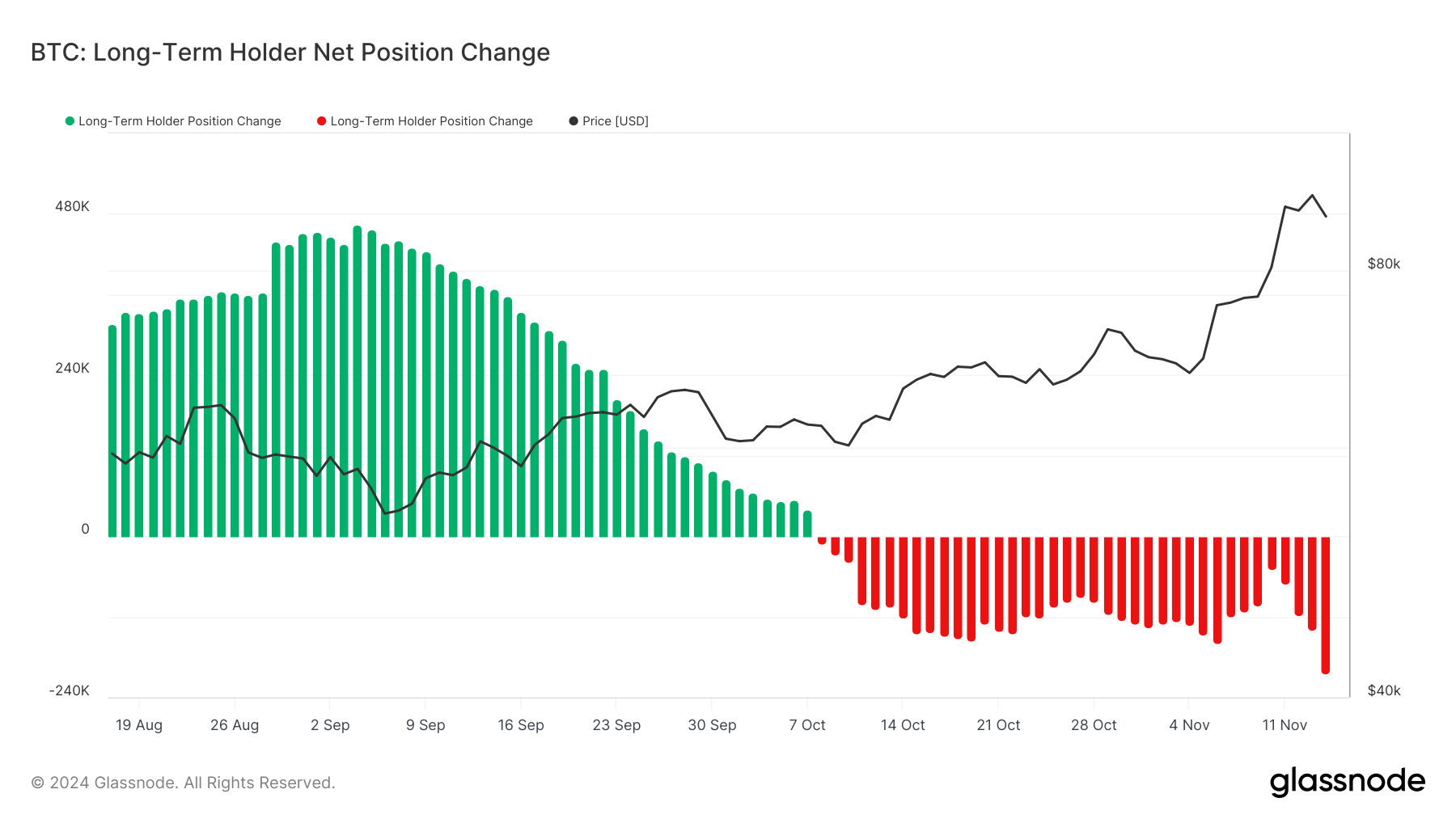

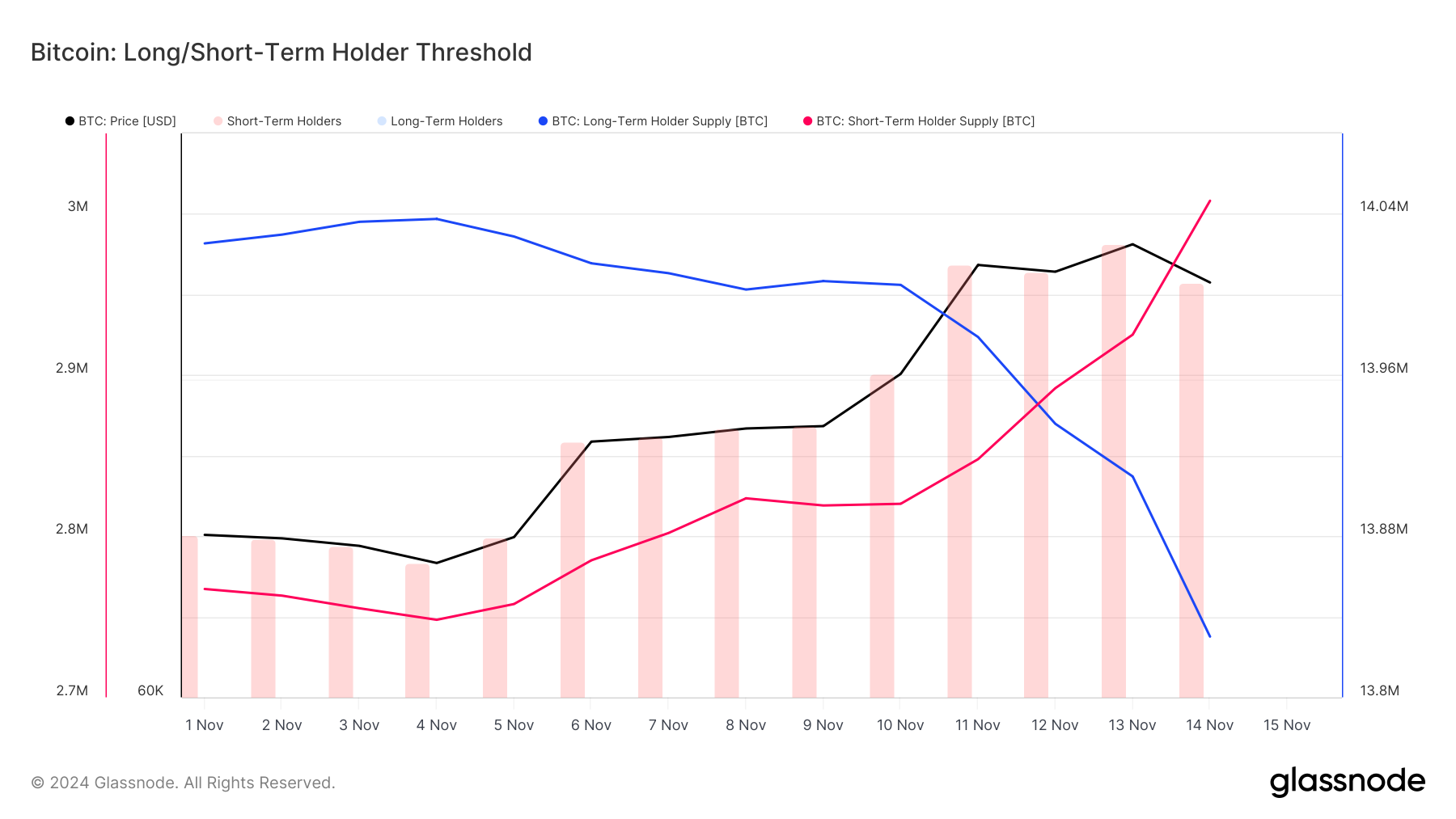

4. Long-term Bitcoin holders reduce their holdings

According to on-chain data , long-term Bitcoin holders have seen a significant decline in their net positions, with the red bar chart showing a gradual increase in selling pressure. Since mid-October, the net position changes of long-term holders have turned from positive to negative, showing that some long-term investors have begun to gradually take profits. This phenomenon is especially obvious when the price of Bitcoin rises to near new highs, indicating that a part of the capital in the market chooses to make profits at high levels.

The dynamics of long-term holders are worthy of attention, especially changes in positions when the market is at a high, which may indicate a potential market correction or capital rotation.

5. The purchasing power on the Bitcoin chain is strong

According to on-chain data , this week’s data on long- and short-term Bitcoin holders shows that as the price rises, the positions of short-term holders (red line) increase significantly, while the positions of long-term holders (blue line) decrease. This trend shows that short-term investors actively enter the market during the upward price stage, further boosting market vitality; in contrast, some long-term holders choose to take profits at this time.

Increases in short-term holders' positions often reflect optimism in market sentiment, as short-term funds are more susceptible to market news. The reduction in positions of long-term holders may reduce market stability, and attention should be paid to potential short-term correction risks.

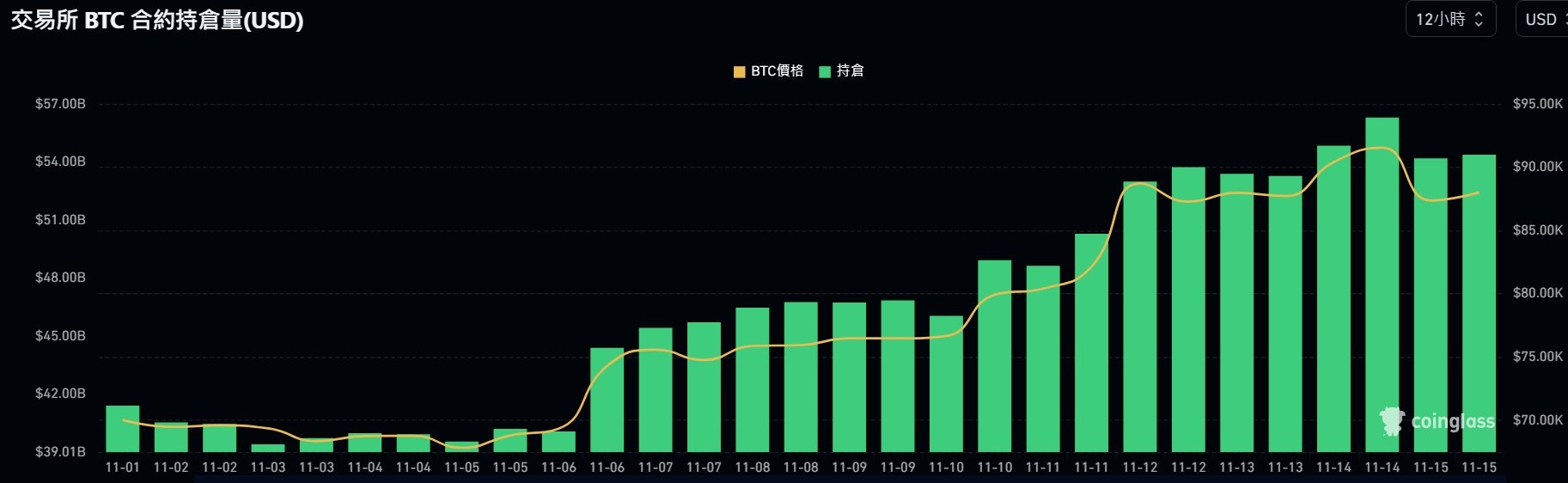

6. Bitcoin contract holdings hit a new high

According to data , Bitcoin contract positions on exchanges rose rapidly this week, climbing from US$46.53 billion to US$56.3 billion . Not only did it set a record high for contract positions, but at the same time, the price of Bitcoin also hit a new high, breaking through After breaking the position record in March this year, the market's enthusiasm for Bitcoin investment continues to rise; but it also reminds investors that volatility may rise further.

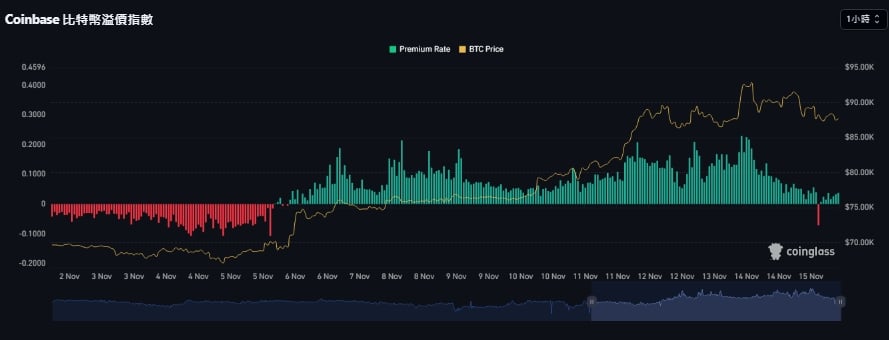

7. Coinbase Bitcoin Premium Index

This week, the Coinbase Bitcoin Premium Index turned positive from negative last week, indicating that the demand for Bitcoin in the US market has increased, driving the premium upward.

The positive premium differential may suggest that U.S. investors have greater purchasing power in the market than global investors.

8. Short-term on-chain cost benchmark belt

This week, Bitcoin's short-term on-chain cost benchmark band shows that the price is close to the upper track (red line) of $96,800 , reflecting rising market sentiment and the increased willingness of short-term investors to make profits. The realized price for long-term holders (blue line) is $68,700 .

In the short term, the price may face resistance at the upper track, and the risk of a correction increases. It needs to be observed whether it can stabilize at a high level to support further upward movement.

Important technical indicators of Ethereum

1. Ethereum spot ETF net inflow of funds

The net inflow of Ethereum ETF funds this week was approximately US$642.1 million . On November 11, single-day inflows hit a record, reaching $295.5 million .

2. Bitcoin Relevance

This week's data shows that the correlations between BTC and ETH and SOL are 0.24 and 0.72 respectively. Compared with last week's high correlation, the correlation between major tokens has declined this week, showing that the market consensus has weakened. Correlation coefficients for most major coins are lower than last week’s 0.90 level, reflecting increased volatility in market risk appetite. The correlation between TON and BNB and other mainstream cryptocurrencies is still low, for example, the correlation with BTC is only 0.38 and 0.21.

This week's data shows that the overall market linkage has declined, and investors' views on the future trend of the market have become more divergent.

3.DeFi market total locked position (TVL)

This week’s data shows that the total locked-up volume in the DeFi market increased from US$104.917 billion to US$96.553 billion last week.

Market analysis news this week

1. Ball said there is no rush to cut interest rates. Bitcoin dropped $86,600, US stocks collapsed, and October PPI showed inflation is still sticky.

The U.S. October PPI data came out last night, showing that controlling inflation was hindered. The reaction of U.S. stocks was not dramatic, but Bitcoin fell below the $89,000 mark. ( continue reading )

2. Upbit’s cryptocurrency trading volume far exceeds that of the Korean stock market. Are there signs of market overheating again?

South Korea's stock market has been hit recently due to Trump's potential America-first doctrine. On the contrary, the South Korean cryptocurrency market is in full swing, but may this also indicate that the market is about to reverse? ( continue reading )

3. Arthur Hayes’ new view: The Trump administration will start unlimited QE, and Bitcoin is expected to reach $1 million

Arthur Hayes, the founder of BitMEX, published a latest long article today titled "Black or White", which describes the future fiscal measures of the US government and stated that Bitcoin will reach US$1 million as the United States continues to create credit. ( continue reading )

4. China’s new stimulus policy is weak, A-shares surged higher and then fell back, and the People’s Bank of China proposed five major goals to rescue the market.

China announced a new fiscal stimulus policy on the 8th. However, the reaction of A-shares was calm compared to the stock market surge after the introduction of the new policy in late September. After a brief surge at the opening today, it quickly fell back. Recently, Pan Gongsheng, Governor of the People's Bank of China, elaborated on five major policy directions for the future, including increasing monetary policy adjustment, strengthening financial supervision, and guiding financial institutions to support emerging industries. ( continue reading )

5. Bitcoin’s market value surpasses silver and becomes the “eighth largest asset in the world.” Analyst: BTC spot ETF is expected to surpass gold ETF in January next year

After Trump won the election, Bitcoin soared by US$22,000 a week, hitting a record high of 89,575 this morning. Its market value overtook silver and became the eighth largest asset in the world. Bloomberg analysts estimate that the asset size of Bitcoin ETF is likely to surpass that of gold ETF on the first anniversary of its listing in January next year. ( continue reading )

6. Comrade Soros warns: The probability of inflation rebounding is high, and the Fed may be too happy too early

The U.S. Federal Reserve began its four-year interest rate cut cycle in September, which revived enthusiasm in the asset market. However, Stanley Druckenmiller, a comrade of Soros, said that it was too early for the Fed to declare victory over inflation, and that inflation may resurgence. ( continue reading )

7.CZ reminds: Don’t be greedy! Bitcoin hits new highs for four consecutive days, don’t put all your eggs in the same basket

Bitcoin reached a maximum of $77,200 around 4 a.m. in the morning, setting a new all-time high for four consecutive days. In this regard, Binance founder CZ(CZ) reminded investors to manage risks well, not to put all their eggs in the same basket, and to avoid excessive greed. ( continue reading )

8. Big changes will happen when Trump takes office! The central bank points out three major financial and economic shocks to Taiwan: Tariff barriers may cause disaster

Trump is about to return to the White House, and his style may bring great uncertainty to the global political and economic situation. Central Bank President Yang Jinlong said today that Trump’s future adoption of new trade policies may have three major impacts, including global economic growth momentum. Slowing and rising inflation, weakening economic momentum in China, and uncertainty in U.S. monetary policy have affected the stability of global financial markets. (continue reading )

8. Glassnode Warning: Bitcoin may see profit-taking correction within 10 days as it enters “euphoria phase”

The Glassnode report pointed out that Bitcoin has entered the "euphoric phase" of high profitability. Historically, such phases have been corrected after about 22 days, and it has lasted for 12 days, suggesting that the risk of a correction may come within 10 days. In addition, realized profits in November reached US$20.4 billion, which may trigger selling pressure if it exceeds the historical peak of US$30 billion. ( continue reading )

9. Trump won the election and won gold for 5 consecutive days! Falling below $2,600, will the decline in safe-haven demand become a hidden concern for Bitcoin?

After Trump won the election, the price of gold continued to fall. After falling below the $2,600 mark yesterday, it fell further to $2,554 today, falling for five consecutive days. At the same time, the correlation between Bitcoin and gold has dropped to the lowest level in 11 months. At its lowest point, analysts noted that capital was being reallocated from traditional safe havens such as gold to cryptocurrencies. ( continue reading )

Cryptocurrency regulatory status in various countries

1. 18 U.S. states jointly sued the SEC: unconstitutionally exceeding its powers and unfairly cracking down on the cryptocurrency industry

The attorneys general of 18 states in the United States jointly sued the SEC, accusing its enforcement of cryptocurrency of "unconstitutional and ultra vires". The lawsuit claims that the SEC lacks a clear regulatory framework but enforces tough laws, hindering states' autonomy in economic management. The lawsuit could redefine the distribution of federal and state powers over crypto regulation in the United States. ( continue reading )

2. Combating Fraud》Online "real-name advertising system" will be implemented on New Year's Day next year. Financial Supervisory Commission: VASP registration system will be launched by the end of the year

Chairman of the Financial Supervisory Commission Peng Jinlong stated at the Legislative Yuan yesterday that the Financial Supervisory Commission supports the real-name system for online advertising proposed by the Ministry of Digital Development to combat fraud. He also announced that a virtual asset registration system for VASP operators will be launched on January 1 next year. ( continue reading )

3.FTX sues Binance and CZ CZ! What’s going on with the demand to “give back US$1.8 billion” of sky-high stock buyback funds?

The bankrupt exchange FTX recently filed a lawsuit against Binance Holdings and former CEO CZ(CZ), demanding the return of funds that SBF paid CZ at a sky-high price in 2021 to repurchase shares. ( continue reading )

As Bitcoin begins a new upward cycle, national Bitcoin "Pixiu" players including Bhutan are reaping huge returns. At the same time, as the attitude of major economies such as the United States towards Bitcoin gradually turns positive and open, it is expected that more countries will list Bitcoin as a national reserve asset in the future. ( continue reading )

The decentralized prediction platform Polymarket has attracted much attention because of its accurate betting predictions of Trump’s victory. However, after the election, the Biden administration launched legal action against Polymarket. The U.S. Department of Justice filed a lawsuit against Polymarket for allegedly accepting transactions from U.S. users. Polymarket launched an investigation, and the FBI seized Polymarket CEO Shayne Coplan's cell phone and electronic devices on Wednesday. ( continue reading )

The South Korean police announced today that they arrested 215 people related to similar investment consulting companies on charges of fraud and other crimes under the "Aggravated Punishment for Specific Economic Crimes Act" and detained 12 people, including the leader, Mr. Youtuber A (pseudonym). The group is suspected of defrauding more than 15,000 people by "investing in virtual currency" and defrauding a total amount of 325.6 billion won. ( continue reading )

Market focus next week

11/18 (Monday)

- Hong Kong: Unemployment rate in October, previous value 3.0%

11/19 (Tue)

- Eurozone: Consumer Price Index CPI in October (year-on-year), forecast 2.0%, previous value 1.7%

11/20 (Wednesday)

- UK: Consumer Price Index (CPI) in October (year-on-year), previous value 1.7%

11/21 (Thursday)

- Hong Kong: Consumer Price Index CPI in October (year-on-year), previous value 2.20%

- United States: Initial Jobless Claims

- United States: Philadelphia Fed Manufacturing Index in November, previous value 10.3

- United States: Finished home sales in October, previous value 3.84M

11/22 (Friday)

- Germany: Q3 GDP (quarter-on-quarter), forecast 0.2%, previous value 0.2%

- United States: Manufacturing PMI in November, previous value 48.5

- United States: Services PMI in November, previous value 55.0

Recommended interview videos

1.ABS: "The Evolution of Cryptocurrency" - Dr. Han Lin, founder of Gate.io (English)

( Video link )

Top 5 popular articles this week

1.5 years ago today: A Hangzhou wife bought 60 Bitcoins and was sent to a mental hospital by her husband..

Recently, a screenshot of an article from five years ago was widely circulated in the crypto community. The text of the article stated that a Hangzhou woman spent more than 3 million yuan to purchase 60 bitcoins and was sent to a mental hospital for treatment by her husband. According to the price at that time, the cost of Bitcoin was about US$7,000 to US$10,000. If the woman had held it for five years, she could have made nearly 35 million yuan. ( continue reading )

2. Dogecoin becomes the 6th largest cryptocurrency! "Target 1U", will DOGE replicate the increase in 2021?

Trump's victory triggered a surge in the currency market. Dogecoin (DOGE) once exceeded $0.3, rising 27.1% in the past 24 hours, surpassing USDC and becoming the sixth largest cryptocurrency by market capitalization. The recent surge in Dogecoin is estimated to be the market’s early reaction to the launch of the “Government Efficiency Department” after Trump took office, and the expectation that Musk’s leadership of the department will bring new attention to Dogecoin. ( continue reading )

3. Rich dad disclosed his Bitcoin holdings of "73 coins" and plans to increase his position to 100 coins: the rise has not yet been capped!

Robert Kiyosaki, the author of "Rich Dad, Poor Dad", published an article today revealing that he first bought Bitcoin at a price of US$6,000 per coin, currently holds 73 coins, and plans to increase his holdings to 100 coins in a year. Looking forward to the Bitcoin market outlook, Lookonchain analyzed 5 indicators suggesting that the price of Bitcoin has not yet reached the peak of this bull market. ( continue reading )

4. Arthur Hayes’ new view: Trump will start unlimited QE when he takes office, and Bitcoin is expected to reach $1 million

Arthur Hayes, the founder of BitMEX, published a latest long article today titled "Black or White", which describes the future fiscal measures of the US government and stated that Bitcoin will reach $1 million as the United States continues to create credit. ( continue reading )

5.2 Earn tens of millions in seconds: How can post-2000 students use the information gap to become billionaires?

In the ever-changing currency market, how do the advantages of speed and information become the key to victory? This article explores the extraordinary story of Vida, a young trader who transformed from an ordinary student into a successful trader with a net worth of billions in just a few years. ( continue reading )