In this cycle, not everyone will succeed.

You need to shift your mindset and think outside the box. The ranking of the Coinbase app cannot tell you when the market peak will arrive.

You need to start thinking from different angles.

"When a measure becomes a target, it ceases to be a good measure."

In other words, when we set a specific target, people often tend to pursue this target single-mindedly, ignoring other equally important factors.

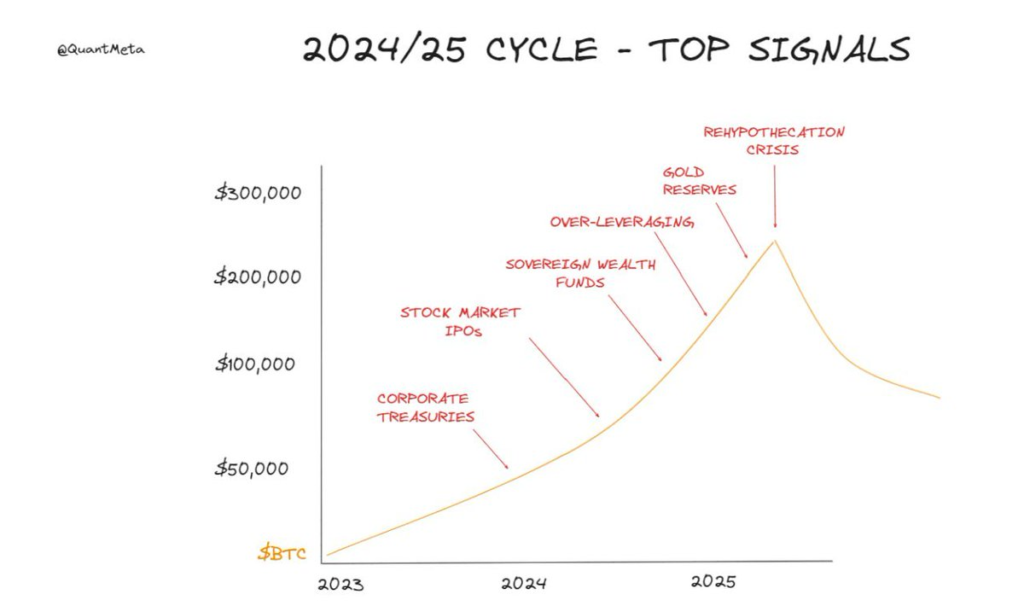

Additionally, I would say that most of the peak signals mentioned on CT may no longer apply.

The obvious peak signals in 2017 are no longer so apparent in 2021, and the same will be true in 2024-25.

We are entering a phase of rapid cryptocurrency adoption, where now all retailers understand cryptocurrencies - some heard about it in 2017, and by 2021 almost everyone has heard about it. Do not mistake the signs of adoption as peak signals. Do not let past traumas influence your judgment.

Another thing to note is the shift in influence - companies like BlackRock now control Bitcoin. They are the major ETF providers and hold shares in each other.

So they can now influence the market sentiment of BTC. They also control many media platforms and can easily guide public opinion.

In other words, if this rally is primarily driven by institutional investment, then the traditional retail indicators may no longer be as important. The key indicators for this cycle will come from those who have not yet entered the market. Yes, it may be the "late majority" and "laggards" - the retail investors who have not yet encountered cryptocurrencies - but you need to think from a more macro perspective.

Sovereign Wealth Funds

Imagine if countries with sovereign wealth funds start diversifying into Bitcoin. Some countries have already invested in stocks, so this is a possibility.

・Saudi Arabia - $400 billion

・Abu Dhabi - $800 billion

・China - $1 trillion

・Norway - $1 trillion

・Australia - $150 billion

・Qatar - $300 billion

・Singapore - $500 billion

Corporate Finances

In 2021, we have already seen Tesla purchase Bitcoin, and Reddit recently disclosed its crypto holdings. This trend is just beginning. When you see more and more companies diversifying their assets into cryptocurrencies on a daily basis, it may be time to consider reducing your risk.

Stock Market IPOs

Coinbase's IPO in 2021 was the first major crypto company to go public. This time, we may see dozens of crypto companies go public, and one of those listings could mark the peak of the market.

Excessive Leverage Usage

In the late stages of a bull market, large hedge funds, companies, and even small countries may use excessive leverage, ultimately suffering losses, which could be another scenario we see in this cycle.

Re-Hypothecation Crisis

The next collapse similar to Luna may originate from the re-hypothecation domain and could trigger a bear market. It seems that many people have overlooked the potentially massive impact that de-pegging events or deleveraging events in this domain could have.

Gold Reserves

The ultimate super-peak signal could be governments diversifying a portion of their gold reserves into Bitcoin - referred to as "digital gold".

Some Additional Minor Signals

Labor shortages in low-income countries

Another significant signal is the labor shortage in low-income countries, as these workers can earn $300 to $600 per month by mapping roads through Hivemapper or other DePIN projects, which is higher than their usual wages. In the previous cycle, this occurred on a smaller scale with Axie and STEPN, and this time it may happen on a larger scale.

Las Vegas Skyline

In 2021, Times Square was dominated by various low-quality meme coin advertisements. In this cycle, the crypto advertisements playing continuously on the Las Vegas skyline for weeks will become a similar phenomenon.

Funding Rounds

A relatively reliable signal is to observe the flow of venture capital funds. When funding rounds surge, potentially even exceeding the investment amounts in traditional finance, this could be an indicator to consider exiting the market.

"Financial markets are often unpredictable. Therefore, we must be prepared for different scenarios... The idea that you can accurately predict future developments is at odds with how I observe the markets." - George Soros.