Goldman Sachs takes the lead, Wall Street institutions are actively deploying Bitcoin ETFs

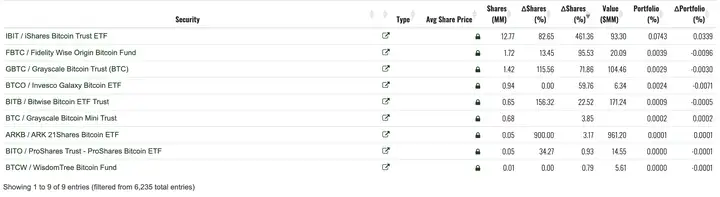

According to the recent 13F filing, the Wall Street financial giant Goldman Sachs (Goldman Sachs) significantly increased its holdings of Bitcoin ETFs in the third quarter, with its holdings surging from $418 million in the previous quarter to $710 million, an increase of nearly double. According to Fintel data, Goldman Sachs mainly invested in the iShares Bitcoin Trust (IBIT) under BlackRock, with a shareholding of nearly 13 million shares.

VX: TTZS6308

At the same time, the Australian investment bank Macquarie Group (Macquarie Group) also entered the market for the first time, purchasing $4.8 million worth of IBIT, about 132,000 shares. Other major financial institutions such as Morgan Stanley, Bank of America, and UBS Group have maintained relatively stable positions.

A strong wait-and-see atmosphere in the third quarter, with a conservative attitude among institutional investors

The 13F filing data for the third quarter reflects the weak price trend of Bitcoin at the time. Most institutional investors tend to deploy funds cautiously, observe market trends, and have not rushed to occupy the traditionally strong fourth quarter.

In fact, during the third quarter (July to September), the price of Bitcoin fluctuated roughly between $53,000 and $66,000, continuing the sideways trend of the second quarter, which also explains why institutional investors generally adopted a wait-and-see attitude.

The fourth quarter market turns around, and institutional investment is expected to accelerate

With Bitcoin's price breaking out of the range consolidation in the fourth quarter, it has not only surpassed the historical high of $73,700 set in March, but has further risen to a new high of $93,400, and the market sentiment remains unchanged. In the future, there will be more institutional investors rushing in, and many institutions are expected to actively prepare behind the scenes to ensure that their portfolios have at least 1% allocation to cryptocurrencies.

It is worth noting that BlackRock also holds about 2.55 million shares in its own Bitcoin ETF fund, with a current market value of $130 million. The continued deployment of these large financial institutions may bring a new wave of investment enthusiasm to the cryptocurrency market in the fourth quarter.

Is 93,000 just the beginning of the bull market?

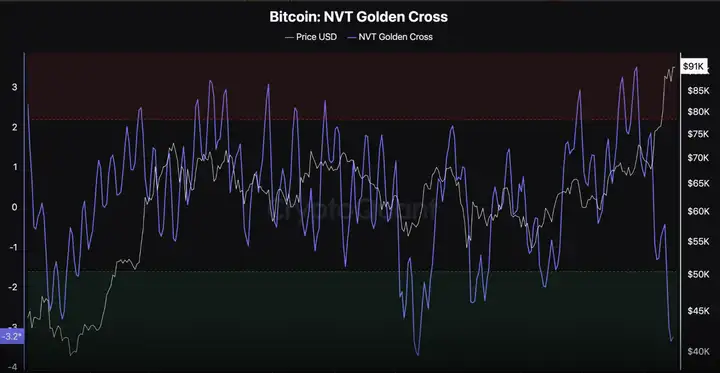

The "NVT Golden Cross" index of the Bitcoin (BTC) network shows that the recent price increase above $93,000 may not yet mark the peak of the current cycle.

As of the time of writing, the BTC trading price is $91,200. This is why this moderate correction may not last, but on the contrary, the price of Bitcoin may rise to a new all-time high.

Data shows Bitcoin is still undervalued

The NVT Golden Cross index is a tool that helps identify the tops and bottoms of the Bitcoin price cycle. When the index exceeds the 2.2 point threshold (red zone), it indicates that the price trend is overheated in the short term, which may signal a local top. Conversely, when the index falls below -1.6 points (green zone), it indicates that the price has cooled excessively, implying a potential local bottom.

The index is currently at -3.25, indicating that Bitcoin still has room for upside. For example, in January this year, when the index was -2.60, BTC was trading below $42,000. Just about two months later, the leading cryptocurrency soared to $73,000. Based on historical data and the current position of the index, Bitcoin is very likely to reach $100,000 by the end of this year.

When Bitcoin breaks through the $100,000 mark, it will surprise everyone, and then continue to break through, never to return. This has always been a psychological milestone, and once it happens, it will trigger a strong FOMO wave among retail investors.

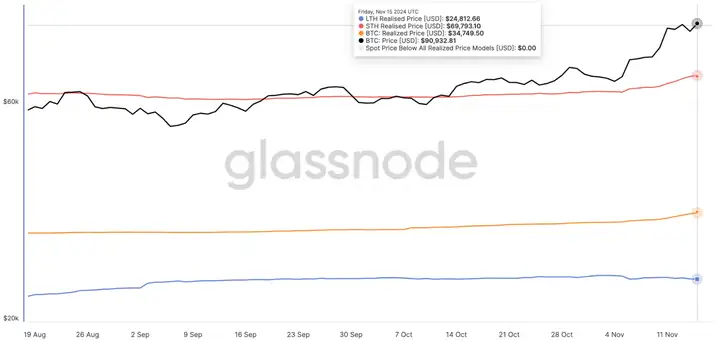

In addition, Glassnode's data shows that the current trading price of Bitcoin is higher than its actual price among both short-term (STH) and long-term (LTH) investors. The realized price is the average price at which investors purchased the tokens, and is considered a key indicator of potential support or resistance levels.

Typically, when the actual price is higher than the BTC price, the cryptocurrency will face resistance and have difficulty rising. However, the current data shows that the realized price for STH is $69,793, lower than the current value of BTC, suggesting that the price may continue to rise.

100,000 by the end of the year is not a difficult task

On the 3-day chart, Bitcoin has formed a "bull flag" pattern. This is a bullish chart pattern characterized by two growth stages with a short-term accumulation stage in between. The "flagpole" is formed during a period of strong price appreciation, when buying power overwhelms selling power.

Then the price corrects slightly, creating parallel trend lines above and below, forming the flag shape. From the current outlook, if buying pressure continues to increase, Bitcoin's price could rise to $100,000.

HUAHUA has hit a new high again today, how can you guys be so addicted to it every day, just reduce your positions, HUAHUA still has inventory that can be reduced by another half. 200K-6.5M, the highest is 8M. Is 10M still far away, once it reaches 10M, 20M will also be very easy, perhaps HUAHUA will be the next 100x dog after GIKO. About SBF mentioned yesterday, there will also be room for it.