Despite the recent price decline, BeInCrypto on-chain data shows that Ethereum (ETH) bulls are aiming for a new bull market. Today, the price of ETH is $3,130, down from its November 12 high of $3,434.

However, investors are confident that the cryptocurrency's decline is temporary. Let's analyze the potential scenarios that could unfold in the current sentiment.

ETH Price Slightly Rises... Exchange Inflow Decreases

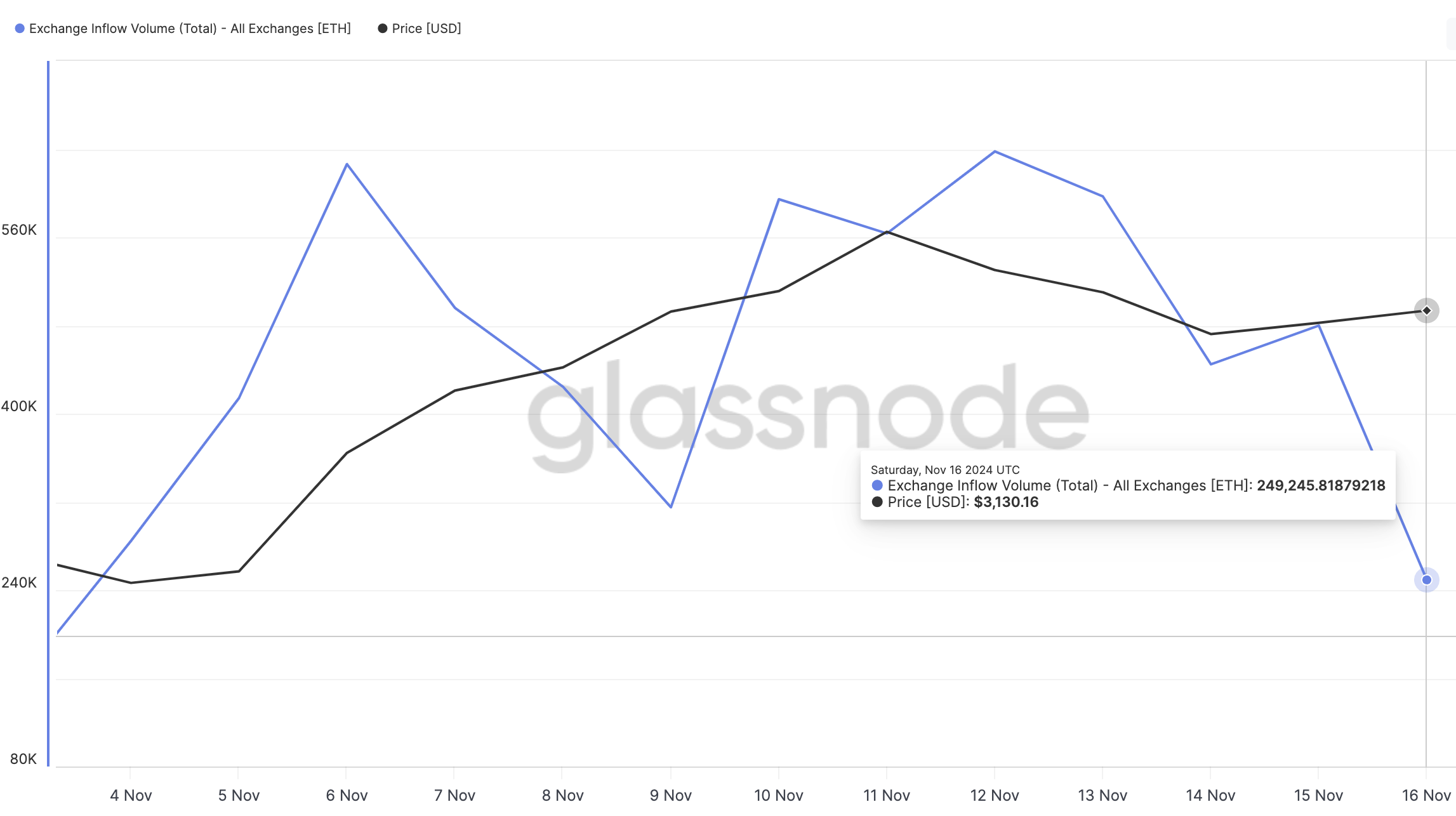

According to Glassnode, the current Ethereum exchange inflow is 249,245 coins. Exchange inflow represents the number of coins sent to exchanges over a given time period. An increase in this metric indicates that more holders are willing to sell, which could be bearish for the cryptocurrency.

On the other hand, a decrease in exchange inflow suggests that investors are withdrawing assets from exchanges. Currently, the Ethereum figure is around $780 million, significantly lower than the Friday, November 15 metric.

Therefore, this suggests that most ETH holders are refraining from selling. If this trend continues, the cryptocurrency may not fall below $3,000 in the short term.

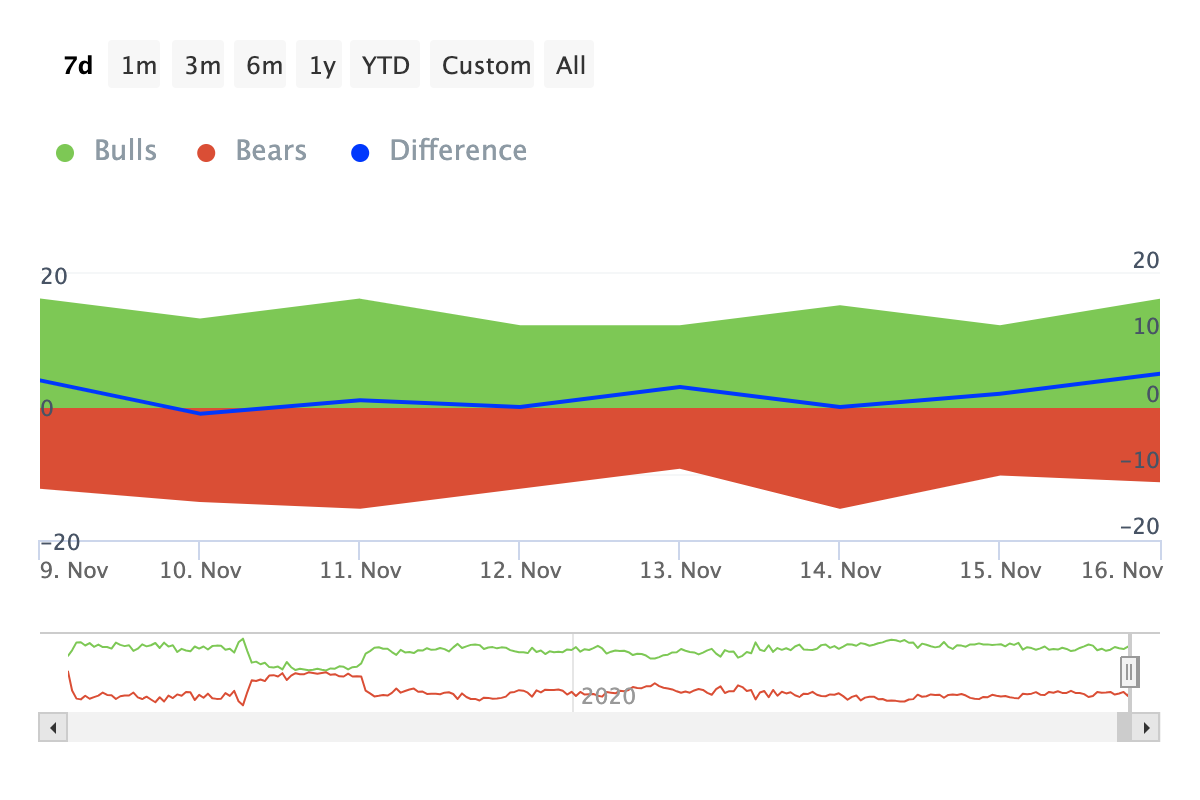

According to IntoTheBlock data, ETH whales are working to maintain the price. This is evident in the 'Bulls (buyers) and Bears (sellers)' indicator, which tracks whether addresses that trade at least 1% of the cryptocurrency's volume are predominantly buying or selling.

If the indicator shows more bulls, it signals that participants are mainly buying. Conversely, a higher number of bears indicates increased selling activity.

Over the past 24 hours, Ethereum bulls have outnumbered bears, suggesting that ETH's price could temporarily exceed $3,130.

ETH Price Prediction: Increased Likelihood of Price Support

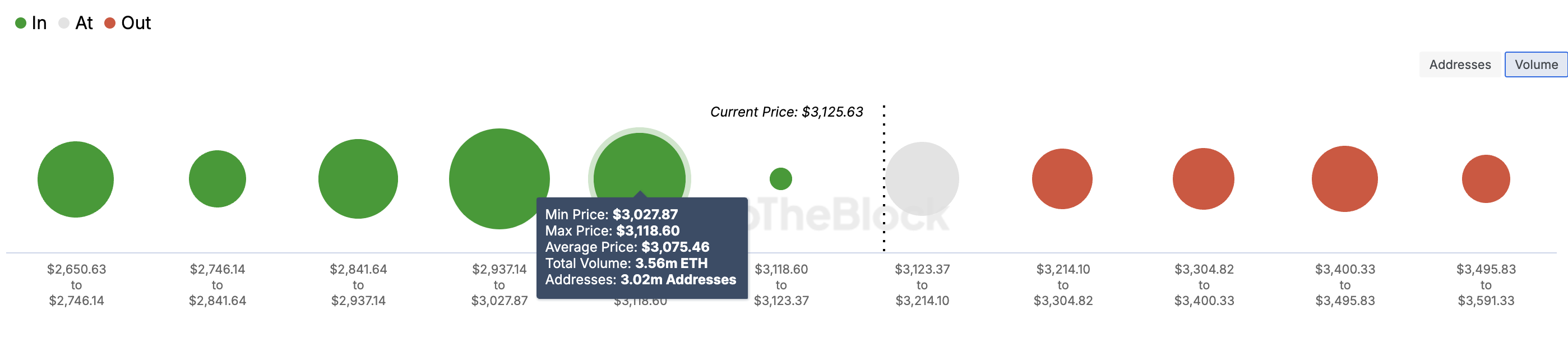

From an on-chain perspective, the In/Out of the Money Around Price (IOMAP) metric supports the bias that ETH's price could trade higher. The IOMAP indicator helps identify significant buying or selling activity at key price levels based on user positions and profitability.

It also highlights support and resistance areas based on the volume of transactions within a price range. Generally, the larger the volume clusters, the stronger the support or resistance.

In the image below, around 300,000 addresses have accumulated Ethereum at the $3,075 price level. These addresses are currently in profit based on the current market price and are 'in the money'.

This cluster suggests strong support at $3,075, and holders at this level may refuse to sell at almost any level between $3,251 and $3,591. Considering this position, Ethereum's price has a high likelihood of rising towards $3,600.

However, if selling pressure increases, this scenario may not materialize. In that case, the value of ETH could fall below $3,000.