Today, the Solana price rose 13%, performing strongly in the past 24 hours, and the crypto community generally celebrated Donald Trump's election victory.

Over the past 24 hours, Solana has been one of the best performing cryptocurrencies, with a 12% increase, breaking through $242 on November 17, reaching a new high in three years.

*SOL/USDT 4-hour price chart. Source: TradingView*

**Reasons for the Surge in Solana Price**

**The rise in Solana's price today is mainly attributed to two key factors:**

- **VanEck's comments on the approval of a Solana spot ETF in the US**: VanEck's views have sparked optimism among investors.

- **Growth in network metrics**: The improvement in key network metrics indicates an increase in market demand for the SOL token, providing further support for the price increase.

**VanEck: Solana ETF Likely to be Approved by Late 2025**

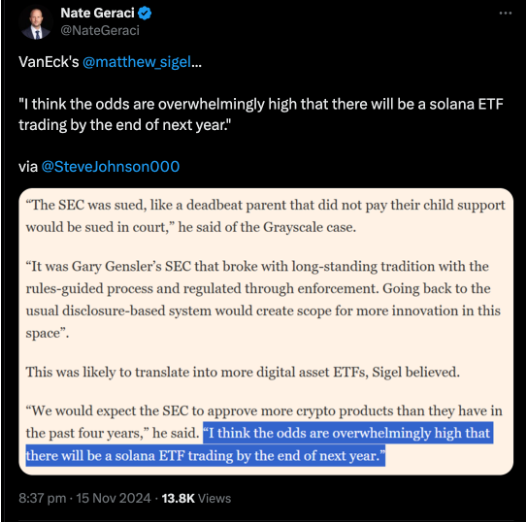

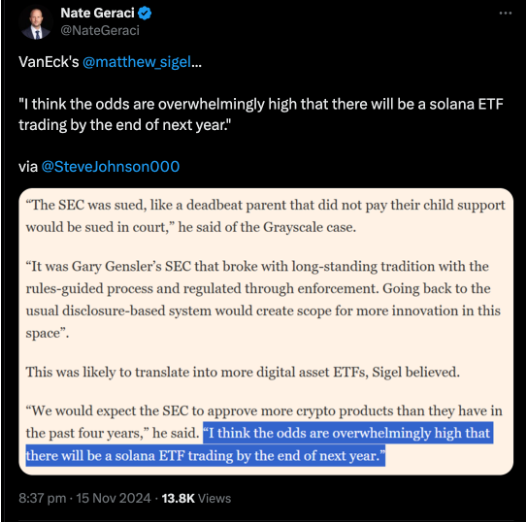

Matthew Sigel, Head of Digital Asset Research at VanEck, expressed confidence in the approval of a Solana spot ETF in the US, driving the rise in Solana's price.

On November 15, Sigel mentioned that the likelihood of a Solana ETF listing before 2025 is "very high".

He expects the US Securities and Exchange Commission (SEC) to approve more crypto products, especially after Donald Trump's crypto-friendly presidential election victory on November 5. This anticipation may open the door for institutional investors to enter SOL.

*Source: [Nate Geraci](https://x.com/NateGeraci/status/1857417598670877109)*

Sigel stated that the regulatory authorities are expected to approve the launch of more cryptocurrency products (including a Solana ETF), which may open the door for institutional investors to invest in SOL. This optimism seems to have stimulated investor demand.

After Sigel's optimistic comments on Solana, the price of SOL soared 18.51%, including a 12% increase in the past 24 hours.

**Solana Decentralized Exchange (DEX) Data Hits New Highs**

The rise in Solana's price is further supported by strong network fundamentals.

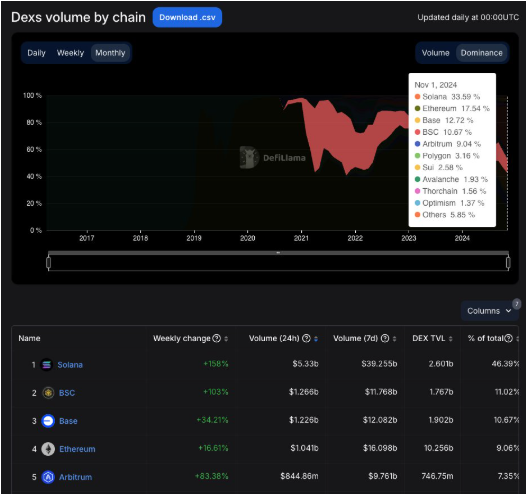

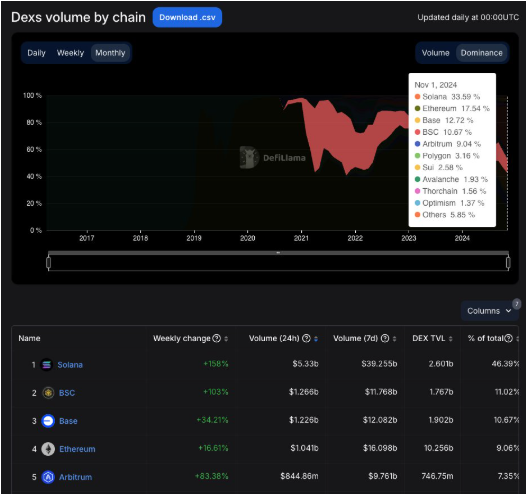

According to data from defillama, as of November, Solana has occupied the largest share of decentralized exchange (DEX) trading volume, accounting for **33.59%** of market activity, far exceeding Ethereum's **17.54%**.

*DEX trading volume (by chain). Source: defillama*

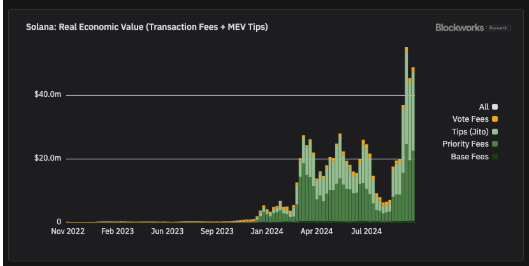

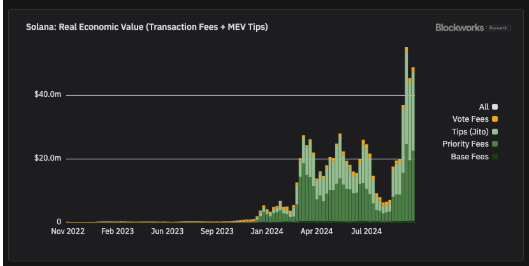

Furthermore, Solana's real economic value (measured by transaction fees and MEV fees) has also reached a new historical high, reflecting the increase in network usage.

*Solana real economic value chart. Source: Blockworks*

Market analyst Aylo stated that Solana's growing adoption, network utilization, and dominance in DEX trading volume are driving investor sentiment and supporting the revaluation of SOL relative to Ethereum.

He pointed out: "Solana's market cap is currently around **29.5%** of Ethereum, and this trend is still continuing to adjust."

> **"$SOL is about to enter a price discovery phase"**

**Massive Short Liquidations Propel SOL Price Surge**

The rise in Solana's price today coincided with large-scale short liquidations in the futures market.

On November 17, the amount of short liquidations in the Solana futures market reached **$14.47 million**, while long liquidations were only **$3.6 million**.

*SOL total liquidation chart. Source: CoinGlass*

When traders short an asset, they bet on its price to decline. However, if the price rises instead, they may be forced to buy back the position to limit their losses. The rise in SOL's price forced many short traders to cover their positions, further fueling the bullish sentiment in the cryptocurrency.

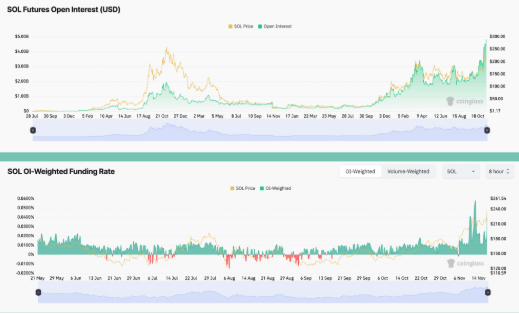

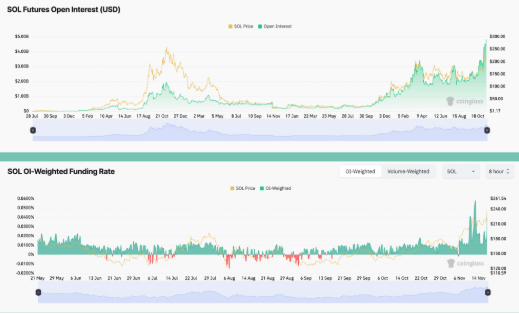

Meanwhile, Solana's open interest (OI) soared to a record high of **$4.82 billion** on November 17, nearly four times the level in November 2021 (when SOL reached an all-time high of around $260).

*SOL OI and funding rate as of November 17. Source: CoinGlass*

Solana's weekly funding rate spiked to **0.827%** on November 17, compared to only **-0.0378%** two weeks earlier.

**High open interest (OI)**: Indicates an increase in active positions in the Solana futures market, significantly enhancing market speculation and liquidity.

**Positive funding rate**: Suggests that long traders are willing to pay a premium to maintain their bullish positions, reflecting strong market confidence in Solana's continued price appreciation.

These indicators demonstrate robust demand for bets on Solana's continued price increase.

**Solana's Technical Outlook Suggests More Upside**

From a technical perspective, Solana's price surge today is part of a **breakout from a descending triangle pattern**.

The descending triangle is typically formed by a downward-sloping resistance line and a horizontal support line, and is generally considered a bearish pattern. However, when the price breaks above the resistance line, it signals a shift in market sentiment to bullish.

*SOL/USDT weekly price chart. Source: TradingView*

On the weekly chart, since Trump's victory on November 6, Solana has clearly broken out of the descending triangle resistance, and the increase in trading volume further confirms the strength of this bullish trend.

**Target Price: $267-$270**

According to technical analysis, Solana's target is to continue the uptrend by the **end of 2024**, reaching the **$267-$270 range**, which would set a new all-time high.

This target price is calculated by measuring the maximum height of the triangle and adding it to the breakout point.

The current technical formation and market sentiment collectively support the prospect of continued upside for SOL.

*SOL/USDT 4-hour price chart. Source: TradingView*

**Reasons for the Surge in Solana Price**

**The rise in Solana's price today is mainly attributed to two key factors:**

- **VanEck's comments on the approval of a Solana spot ETF in the US**: VanEck's views have sparked optimism among investors.

- **Growth in network metrics**: The improvement in key network metrics indicates an increase in market demand for the SOL token, providing further support for the price increase.

**VanEck: Solana ETF Likely to be Approved by Late 2025**

Matthew Sigel, Head of Digital Asset Research at VanEck, expressed confidence in the approval of a Solana spot ETF in the US, driving the rise in Solana's price.

On November 15, Sigel mentioned that the likelihood of a Solana ETF listing before 2025 is "very high".

He expects the US Securities and Exchange Commission (SEC) to approve more crypto products, especially after Donald Trump's crypto-friendly presidential election victory on November 5. This anticipation may open the door for institutional investors to enter SOL.

*SOL/USDT 4-hour price chart. Source: TradingView*

**Reasons for the Surge in Solana Price**

**The rise in Solana's price today is mainly attributed to two key factors:**

- **VanEck's comments on the approval of a Solana spot ETF in the US**: VanEck's views have sparked optimism among investors.

- **Growth in network metrics**: The improvement in key network metrics indicates an increase in market demand for the SOL token, providing further support for the price increase.

**VanEck: Solana ETF Likely to be Approved by Late 2025**

Matthew Sigel, Head of Digital Asset Research at VanEck, expressed confidence in the approval of a Solana spot ETF in the US, driving the rise in Solana's price.

On November 15, Sigel mentioned that the likelihood of a Solana ETF listing before 2025 is "very high".

He expects the US Securities and Exchange Commission (SEC) to approve more crypto products, especially after Donald Trump's crypto-friendly presidential election victory on November 5. This anticipation may open the door for institutional investors to enter SOL.

*Source: [Nate Geraci](https://x.com/NateGeraci/status/1857417598670877109)*

Sigel stated that the regulatory authorities are expected to approve the launch of more cryptocurrency products (including a Solana ETF), which may open the door for institutional investors to invest in SOL. This optimism seems to have stimulated investor demand.

After Sigel's optimistic comments on Solana, the price of SOL soared 18.51%, including a 12% increase in the past 24 hours.

**Solana Decentralized Exchange (DEX) Data Hits New Highs**

The rise in Solana's price is further supported by strong network fundamentals.

According to data from defillama, as of November, Solana has occupied the largest share of decentralized exchange (DEX) trading volume, accounting for **33.59%** of market activity, far exceeding Ethereum's **17.54%**.

*Source: [Nate Geraci](https://x.com/NateGeraci/status/1857417598670877109)*

Sigel stated that the regulatory authorities are expected to approve the launch of more cryptocurrency products (including a Solana ETF), which may open the door for institutional investors to invest in SOL. This optimism seems to have stimulated investor demand.

After Sigel's optimistic comments on Solana, the price of SOL soared 18.51%, including a 12% increase in the past 24 hours.

**Solana Decentralized Exchange (DEX) Data Hits New Highs**

The rise in Solana's price is further supported by strong network fundamentals.

According to data from defillama, as of November, Solana has occupied the largest share of decentralized exchange (DEX) trading volume, accounting for **33.59%** of market activity, far exceeding Ethereum's **17.54%**.

*DEX trading volume (by chain). Source: defillama*

Furthermore, Solana's real economic value (measured by transaction fees and MEV fees) has also reached a new historical high, reflecting the increase in network usage.

*DEX trading volume (by chain). Source: defillama*

Furthermore, Solana's real economic value (measured by transaction fees and MEV fees) has also reached a new historical high, reflecting the increase in network usage.

*Solana real economic value chart. Source: Blockworks*

Market analyst Aylo stated that Solana's growing adoption, network utilization, and dominance in DEX trading volume are driving investor sentiment and supporting the revaluation of SOL relative to Ethereum.

He pointed out: "Solana's market cap is currently around **29.5%** of Ethereum, and this trend is still continuing to adjust."

> **"$SOL is about to enter a price discovery phase"**

**Massive Short Liquidations Propel SOL Price Surge**

The rise in Solana's price today coincided with large-scale short liquidations in the futures market.

On November 17, the amount of short liquidations in the Solana futures market reached **$14.47 million**, while long liquidations were only **$3.6 million**.

*Solana real economic value chart. Source: Blockworks*

Market analyst Aylo stated that Solana's growing adoption, network utilization, and dominance in DEX trading volume are driving investor sentiment and supporting the revaluation of SOL relative to Ethereum.

He pointed out: "Solana's market cap is currently around **29.5%** of Ethereum, and this trend is still continuing to adjust."

> **"$SOL is about to enter a price discovery phase"**

**Massive Short Liquidations Propel SOL Price Surge**

The rise in Solana's price today coincided with large-scale short liquidations in the futures market.

On November 17, the amount of short liquidations in the Solana futures market reached **$14.47 million**, while long liquidations were only **$3.6 million**.

*SOL total liquidation chart. Source: CoinGlass*

When traders short an asset, they bet on its price to decline. However, if the price rises instead, they may be forced to buy back the position to limit their losses. The rise in SOL's price forced many short traders to cover their positions, further fueling the bullish sentiment in the cryptocurrency.

Meanwhile, Solana's open interest (OI) soared to a record high of **$4.82 billion** on November 17, nearly four times the level in November 2021 (when SOL reached an all-time high of around $260).

*SOL total liquidation chart. Source: CoinGlass*

When traders short an asset, they bet on its price to decline. However, if the price rises instead, they may be forced to buy back the position to limit their losses. The rise in SOL's price forced many short traders to cover their positions, further fueling the bullish sentiment in the cryptocurrency.

Meanwhile, Solana's open interest (OI) soared to a record high of **$4.82 billion** on November 17, nearly four times the level in November 2021 (when SOL reached an all-time high of around $260).

*SOL OI and funding rate as of November 17. Source: CoinGlass*

Solana's weekly funding rate spiked to **0.827%** on November 17, compared to only **-0.0378%** two weeks earlier.

**High open interest (OI)**: Indicates an increase in active positions in the Solana futures market, significantly enhancing market speculation and liquidity.

**Positive funding rate**: Suggests that long traders are willing to pay a premium to maintain their bullish positions, reflecting strong market confidence in Solana's continued price appreciation.

These indicators demonstrate robust demand for bets on Solana's continued price increase.

**Solana's Technical Outlook Suggests More Upside**

From a technical perspective, Solana's price surge today is part of a **breakout from a descending triangle pattern**.

The descending triangle is typically formed by a downward-sloping resistance line and a horizontal support line, and is generally considered a bearish pattern. However, when the price breaks above the resistance line, it signals a shift in market sentiment to bullish.

*SOL OI and funding rate as of November 17. Source: CoinGlass*

Solana's weekly funding rate spiked to **0.827%** on November 17, compared to only **-0.0378%** two weeks earlier.

**High open interest (OI)**: Indicates an increase in active positions in the Solana futures market, significantly enhancing market speculation and liquidity.

**Positive funding rate**: Suggests that long traders are willing to pay a premium to maintain their bullish positions, reflecting strong market confidence in Solana's continued price appreciation.

These indicators demonstrate robust demand for bets on Solana's continued price increase.

**Solana's Technical Outlook Suggests More Upside**

From a technical perspective, Solana's price surge today is part of a **breakout from a descending triangle pattern**.

The descending triangle is typically formed by a downward-sloping resistance line and a horizontal support line, and is generally considered a bearish pattern. However, when the price breaks above the resistance line, it signals a shift in market sentiment to bullish.

*SOL/USDT weekly price chart. Source: TradingView*

On the weekly chart, since Trump's victory on November 6, Solana has clearly broken out of the descending triangle resistance, and the increase in trading volume further confirms the strength of this bullish trend.

**Target Price: $267-$270**

According to technical analysis, Solana's target is to continue the uptrend by the **end of 2024**, reaching the **$267-$270 range**, which would set a new all-time high.

This target price is calculated by measuring the maximum height of the triangle and adding it to the breakout point.

The current technical formation and market sentiment collectively support the prospect of continued upside for SOL.

*SOL/USDT weekly price chart. Source: TradingView*

On the weekly chart, since Trump's victory on November 6, Solana has clearly broken out of the descending triangle resistance, and the increase in trading volume further confirms the strength of this bullish trend.

**Target Price: $267-$270**

According to technical analysis, Solana's target is to continue the uptrend by the **end of 2024**, reaching the **$267-$270 range**, which would set a new all-time high.

This target price is calculated by measuring the maximum height of the triangle and adding it to the breakout point.

The current technical formation and market sentiment collectively support the prospect of continued upside for SOL.