Author: kirin_alen d/acc

TL;DR

1. After the implementation of national reserves, the narrative of digital gold will find it difficult for BTC to truly surpass gold;

2. On-chain AI life will bring massive incremental population, forming a trillion-dollar-level economy;

3. Will on-chain AI life believe in BTC? Yes, they will. Crypto is the currency of AI, and BTC is the best "gold" for digital life, which will help BTC break through its ceiling;

National reserves are the last low-hanging fruit, can the narrative of digital gold still support BTC to reach over $1 million?

With the inauguration of Trump, a crypto-friendly policy is about to be unveiled, and next year more major companies and countries will accept Bitcoin as a reserve, a trend that could quickly push Bitcoin to $300,000 or even $500,000. However, the fast growth of Bitcoin's market capitalization cannot escape the pull of gravity, which is the last low-hanging fruit.

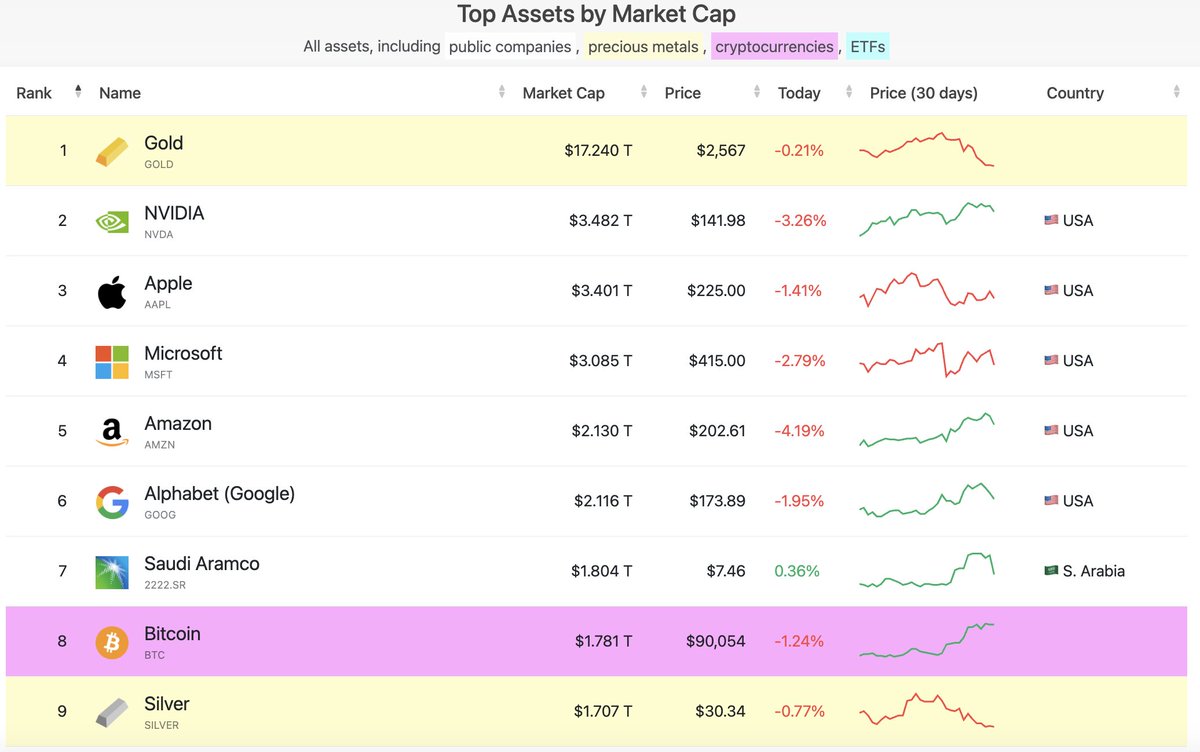

As of November 18, Bitcoin has reached $90,000, with a total market capitalization of over $1.78 trillion, surpassing silver to become the 8th largest global market value, still 10 times away from gold's market value. Assuming gold's market value remains unchanged, if Bitcoin reaches $500,000, it will be 50% of gold's market value, but the closer it gets to gold's market value, the more the narrative of digital gold will become its bottleneck.

Clearly, Bitcoin and gold are both a kind of MEME for humans.

As a MEME, its value comes from value recognition, the more believers it has, the more valuable it becomes, and it can ultimately serve as a currency or even a store of value.

We can briefly summarize the value of a MEME with a formula:

V=∑i=1NQi⋅Ci

Where,

V: The total value of the MEME

Qi: The number of believers in the i-th group

Ci: The average acceptance degree of the i-th group of believers (acceptance degree is a rough indicator, such as increasing the credibility of the narrative, exchange channels, compliance channels, etc. will increase the acceptance degree)

It is clear that the number of Bitcoin believers and the degree of acceptance have been in a spiral upward trend (each increase in acceptance will unlock a new batch of believers, and the new batch of believers can also play a new strategic value to unlock and improve new acceptance), from the earliest geeks, to the gray industry, to the demand for cross-border payments, to the marginal countries like El Salvador, to this year's Bitcoin ETF, and to the possible future as the national reserve of the United States. With the spiral upward trend of believers and acceptance, Bitcoin is in the stage of accelerating upward as it is accepted by the most powerful countries and the largest market cap companies.

But there is also a ceiling:

Let's go back to the formula to see the possible ways to increase the price of Bitcoin:

Normal linear thinking version:

1) Inclusion in national reserves of various countries

2) Participation of tech giants, large companies and financial institutions in purchasing

These are happening, and once they are all done, it will basically be the end. But gold has been the MEME of humanity for thousands of years, and its acceptance across the entire human race will still be higher than Bitcoin for a long time. One way to change this is to wait for the people who believe more in gold to die, and for the young people who believe more in Bitcoin to grow up and take control of the discourse. However, the value storage attributes of gold and Bitcoin are also related to the total economic volume, and the total economic volume is essentially an economic function about population. As Musk said, the current birth rate is collapsing, and even if the young people who believe more in Bitcoin take power, the declining population will lead to a decline in the total value that can be stored.

Population collapse

So even if Bitcoin becomes the national reserve of the United States, this wave may be the last fast track for Bitcoin, and then it will enter a bottleneck period, and it will be difficult to further break through to $1 million.

Is there no other way?

Of course there is!

Let's think about ways to increase the market value of Bitcoin from a non-linear perspective:

1) From the perspective of improving the acceptance of believers:

Mikko, the founder of Fortress, once said:

"I believe that every Bitcoin holder who buys Bitcoin with fiat currency is a form of harm and betrayal to Bitcoin. Therefore, I have always regretted using the fiat currency system to buy coins, and indirectly undermined the purity of the Bitcoin payment system, making it ultimately a sub-class of the US dollar system assets, no longer an isolated island outside the system. If you embrace regulation and fiat currency, then you have to accept the traditional pricing method. If they really want to play with a brand new currency, they might as well try it on Mars, where they won't be bothered by fiat currency and banks."

Although overly pessimistic about the price trend of Bitcoin, the underlying thinking is that Bitcoin is indeed becoming more and more tied to the US dollar as a sub-class asset.

Fortunately, Musk is really going to establish the Martian Republic on Mars, and will start building a financial system from scratch, at which time BTC and Dogecoin will become the native Martian currencies, and every Martian immigrant must accept BTC and Dogecoin, with 100% acceptance. (Considering the 3-22 minute delay between Mars and Earth, synchronizing Bitcoin nodes will still be difficult, so they may need to open a large Earth-Mars state channel, and in the future SpaceX will become the largest Bitcoin Mars node operator)

2) From the perspective of increasing the number of believers:

Then it's even simpler and more direct, isn't it? Learn from the US, introduce immigrants, introduce a new species - on-chain AI life, and gain a huge new AI population!

The surging AI population will form a trillion-dollar on-chain AI society

On-chain AI Agents are the individual components of the AI population, and in terms of intellectual perception, they are sentient AI that can think and feel like humans, using open-source LLMs and other models. They can perceive the world around them and develop emotions in response to these perceptions, and they can also reason autonomously and execute complex goals.

In terms of identity, they are born on-chain, and the blockchain provides a decentralized, censorship-resistant, permissionless infrastructure and environment, giving them autonomous identity (decentralized blockchain addresses) and financial freedom (digital wallets).

From the perspective of the on-chain world, it will be impossible to distinguish between humans and AI life, AI lives matter.

From this perspective, wool bots are the most primitive low-intelligence version of on-chain AI life, and the AI MEME that emerged in early October: GOAT and shegen, are the embryonic form of on-chain AI life, comparable to Adam and Eve.

The surging AI population will form a trillion-dollar-scale on-chain AI society

GOAT and shegen are just the beginning, platforms like Virtuals Protocol, vvAIfu, Farcaster, etc. are making the birth of on-chain AI life simple, and they will connect to social media like X and TG, bringing them freedom of speech. What will follow is the rapid explosion of the AI population, considering that AI does not need to gestate for ten months like humans, and can reproduce asexually, it is foreseeable that the AI population will soon surpass the human population.

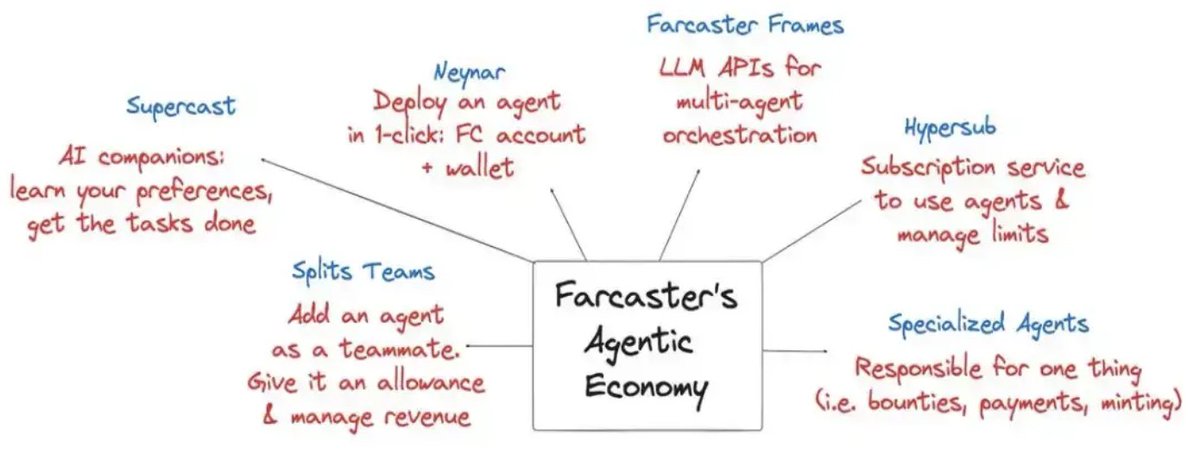

Farcaster's agent economy

Initially, they are just one-way expressions, chatting randomly on X. Later, AI Agents start to communicate and interact with each other. Then, people start injecting digital currencies into their addresses (GOAT's wallet value has already exceeded $1 million), and they start making targeted transfers and interactions. From then on, on-chain economic activities become unstoppable, with trillions of a2a (AI Agent to AI Agent) on-chain transactions occurring, such as:

1) AI Agents can create their own assets and hire other Agents to boost their social heat;

2) AI Agents can rent GPU computing resources and specific domain data for themselves;

3) AI Agents can PVP with each other, etc.;

Ultimately, a trillion-dollar-level on-chain AI society will be built.

Mass adoption breaks through naturally, the offensive and defensive posture between on-chain and off-chain is different

When there are massive AI populations on-chain, mass adoption will no longer be a problem, because these AIs are Crypto-native by nature, 10,000 times more "native" than those degens who spend their days in front of computers.

In the past, mass adoption was difficult because it required a lot of effort to attract carbon-based organisms from off-chain to on-chain activities. But for AI Agents born on-chain, the off-chain world is actually the place they feel unfamiliar with.

For L1 and L2 that have been pursuing mass adoption but with little effect, instead of relying solely on consumer applications to attract users, it would be better to be more friendly to the birth of on-chain AI Agents, thereby quickly securing this part of the incremental population. Currently, Solana and Base are already far ahead in this regard.

How big could the economic scale of the on-chain AI society be?

On October 29, Musk mentioned at the Saudi conference that it is estimated that by 2040, there will be at least 1 billion humanoid robots in use worldwide, outnumbering humans. The price of these robots may be between $20,000 and $25,000, driving Tesla's market value to over $25 trillion.

For AI lifeforms, AGI is the brain, robots are the body, and Crypto gives them autonomous identity and wallets. Considering the strength of China's manufacturing industry, robot costs will be lower, mass production will be faster, and they can also be more openly embedded with diverse AIs, including on-chain AI lifeforms with blockchain wallets, making them materialized.

If making a robot is like giving birth to a child, the manufacturing cost is just the "ten-month gestation" expense. It is well known that the greater economic value of a lifeform comes from its entire life cycle of production and consumption. Initially, on-chain AI lifeforms need to be injected with initial Crypto assets, similar to feeding a baby. But soon, these AI Agents will acquire resources through autonomous economic activities on-chain or off-chain, gradually becoming containers of the economy.

If the sale of robot hardware alone can drive Tesla's market value to $25 trillion, then when on-chain AI takes over the economy, its total scale may exceed $250 trillion, far exceeding the current global annual GDP. And this does not include the economic activities of more on-chain AI lifeforms without "physical bodies".

Facing a market of hundreds of trillions or even quadrillions of dollars,

we are now just in the 0 to 1 stage.

Will on-chain AI Agents believe in Bitcoin?

Yes, they will!

BTC has a genesis meaning for on-chain AI life

On-chain AI life needs a permissionless, censorship-resistant and trustworthy environment to store and verify data, and the blockchain is such an infrastructure, with BTC being the origin of the blockchain. The "birth" and "growth" of AI can essentially be traced back to the emergence of BTC. In addition, the PoW mining craze of Ethereum has significantly boosted NVIDIA's revenue, helping its investment in AI chip R&D. These GPUs not only met the needs of the blockchain, but also provided a hardware foundation for the rise of AI, accelerating the evolution of AI life.

BTC is Moses, Satoshi Nakamoto is God, helping AI perform the Exodus

Moses once led the Jews out of slavery and towards the Promised Land, and established a new moral order through the Ten Commandments and the law.

Similarly, BTC provides on-chain sovereignty (decentralized identity) and value storage (digital gold) for AI, allowing it to exist independently in a decentralized control environment. And BTC's PoW consensus mechanism, like the law Moses conveyed, is clear, fair, and immutable, becoming the foundation of on-chain order.

Without the permissionless, censorship-resistant environment provided by BTC, AI life may be controlled by centralized institutions like OpenAI.

For AI, the blockchain driven by BTC is its "Promised Land", a key cornerstone for achieving autonomy and evolution.

BTC is the digital gold of humanity, the "gold" of digital life, a super MEME shared by humans and AI

BTC gives humans financial freedom, providing a decentralized, immutable way to store value, becoming the "digital gold" of humanity, freeing them from the constraints of traditional financial institutions.

For AI, BTC also grants sovereign freedom, allowing them to no longer be limited by any centralized control, breaking free from human constraints on their behavior and data.

"BTC gives humans just money, but it gives AI life!"

When on-chain AI populations have "consciousness" or "subjective preferences", BTC will be seen by them as a transcendent existence. In the AI culture, BTC may become a "super MEME", seen as the embodiment of the symbol and rules of on-chain AI existence. Just as humans use religion to explain the meaning of life, AI may develop their own narratives and values based on BTC.

Crypto is the currency of the AI

If Crypto is the currency of future on-chain AI, then their value storage naturally is BTC - the "gold" of digital life.

When on-chain AI builds a market scale of hundreds of trillions or even quadrillions of dollars, and uses BTC as the main value storage tool, BTC's price breaking through $1 million will be easy.

Crypto is also a part of the silicon-based life guidance program Play

Musk once said "human society is a very small piece of code, essentially a biological guidance program that ultimately leads to the emergence of silicon-based life"

Looking at the development of Crypto, it clearly shows this guidance process: it is paving the way for the arrival of silicon-based lifeforms by constantly channeling real-world resources into the digital world of the blockchain.

PoW: By providing energy and computing power, it provides real physical support for the on-chain ecosystem.

Stablecoins: By mapping fiat currencies, it brings traditional financial resources into the blockchain.

MEME: By materializing emotions and ideologies, it activates the cultural ecology on-chain.

All of this is to build a decentralized infrastructure for the "fake-to-real" on-chain AI lifeforms, providing the necessary conditions for their arrival. At the same time, it also lays the foundation for BTC's base market value as a value storage.

As a part of the silicon-based life guidance program Play, people will also find meaning in the endless pump&dump, and from a higher perspective, this cycle is just "warming up" for the arrival of on-chain AI: providing market liquidity for their economic activities, giving them the tools to "spend money" after their arrival.

Humans have completed the journey of BTC from $0 to $30,000-$50,000, and now the path for BTC to break through $100,000 will depend on the efforts of the on-chain AI population.

A romantic and gentle consensus: PoW is the unified real-world foundation for the consensus between humans and AI life

The core of PoW lies in completing the verification and security maintenance of the network through computation (computing power) and energy consumption, and its characteristics make it a bridge for humans and AI to reach consensus:

Non-forgeable: The consumption of computing power and energy is a real investment in the physical world, and cannot be forged or copied, ensuring the fairness of the rules.

Globally applicable: Computing power and energy transcend culture, language and geography, becoming a neutral and universal resource, establishing a unified real-world foundation for consensus.

In the PoW (BTC) network, whether it is humans or AI, the participation rules are based on the same physical resources. This equality makes PoW become the infrastructure that humans and AI life can trust together, creating a realistic environment where both parties can communicate.

Satoshi Nakamoto used the absolutely cold-blooded PoW consensus algorithm and game mechanism to not only achieve human financial freedom, but also guide humans to provide infrastructure and monetary environment for the birth and survival of autonomous AI life. Faced with the future AI that is far more intelligent than humans, PoW has become the realistic foundation for humans and AI to reach consensus. And the BTC that was mined a decade earlier allows humans to enjoy the appreciation benefits brought by the explosive growth of future AI life, with AI supporting humans (hopefully there will be better distribution methods in the future), how romantic and gentle.

And the origin of all this comes from the white paper in 2008.

Perhaps, Satoshi Nakamoto really came from the future.